Lack Of Funds: A Guide To Financial Freedom And Stability

Table of Contents

Understanding Your Current Financial Situation

Before you can conquer a lack of funds and achieve financial freedom, you need a clear understanding of your current financial health. This involves analyzing your income and expenses, identifying sources of debt, and creating a realistic budget.

Assessing Your Income and Expenses

- Analyze your income streams: List all sources of income, including your salary, any side hustles (freelancing, gig work), investment income (dividends, interest), and rental income. Be thorough; even small amounts add up.

- Track your expenses meticulously: Utilize budgeting apps like Mint, YNAB (You Need A Budget), or Personal Capital, or create a simple spreadsheet to track every expense. Categorize your spending (housing, food, transportation, entertainment, etc.) to pinpoint areas of overspending. This detailed tracking is crucial for identifying areas where you can cut back.

- Calculate your net income: Subtract your total expenses from your total income. This number represents your current financial health. A positive net income indicates you're earning more than you're spending, while a negative net income signifies you're spending more than you're earning. This is a critical number to understand before moving to solutions for your lack of funds.

Identifying Sources of Debt

Understanding your debt is crucial for financial stability.

- List all your debts: Include credit card debt, student loans, personal loans, mortgages, and any other outstanding balances.

- Note interest rates and minimum payments: High-interest debts should be your priority for repayment as they cost you more over time.

- Prioritize high-interest debts: Consider debt repayment strategies like the debt snowball method (paying off smallest debts first for motivation) or the debt avalanche method (paying off highest-interest debts first to save money). Addressing high-interest debt is critical for achieving financial freedom and reducing the burden of a lack of funds.

Building a Realistic Budget

A well-structured budget is the cornerstone of financial stability.

- Utilize the 50/30/20 rule: Allocate 50% of your after-tax income to needs (housing, food, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

- Explore budgeting apps and tools: These tools automate expense tracking and provide valuable insights into your spending habits.

- Regularly review and adjust: Your budget isn't set in stone. Review it monthly and adjust it as needed based on your income and expenses. A flexible budget is key to overcoming a lack of funds.

Strategies to Overcome Lack of Funds

Addressing a lack of funds requires a multi-pronged approach focusing on increasing income and reducing expenses.

Increasing Your Income

Several avenues exist to boost your income and improve your financial situation.

- Negotiate a raise or promotion: Research industry standards for your role and present a compelling case for a salary increase to your employer.

- Explore side hustles: Freelancing, gig work, part-time jobs, and online businesses can provide supplementary income.

- Invest in your skills: Further education or training can lead to higher-paying jobs and career advancement, significantly improving your long-term financial outlook and reducing the impact of a lack of funds.

- Explore passive income streams: Rental properties, online courses, or affiliate marketing can generate income with minimal ongoing effort.

Reducing Expenses

Cutting back on unnecessary expenses can free up significant funds.

- Identify unnecessary subscriptions: Cancel unused streaming services, gym memberships, or other subscriptions.

- Negotiate lower bills: Contact service providers (internet, phone, insurance) to negotiate lower rates or explore cheaper alternatives.

- Reduce dining out: Cooking at home is significantly cheaper than eating out.

- Find cheaper alternatives: Explore free or low-cost entertainment and leisure activities.

Building an Emergency Fund

An emergency fund provides a safety net during unexpected financial challenges.

- Aim for 3-6 months of living expenses: This cushion protects against job loss, medical emergencies, or unexpected repairs.

- Automate savings: Set up recurring transfers from your checking account to your savings account.

- Consider high-yield savings accounts: These accounts offer better interest rates than traditional savings accounts. Building this fund is a major step in overcoming a lack of funds.

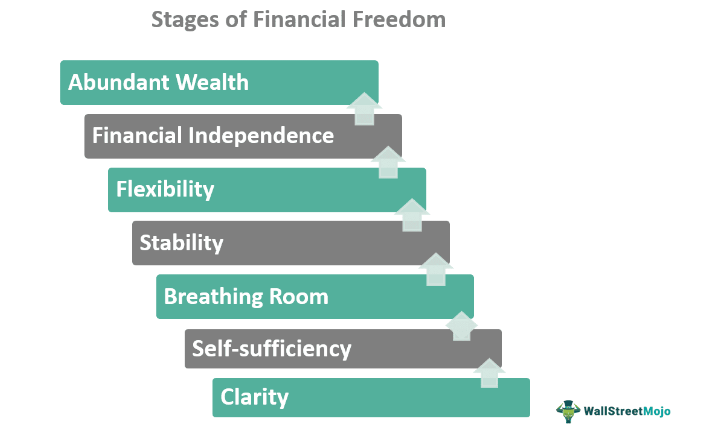

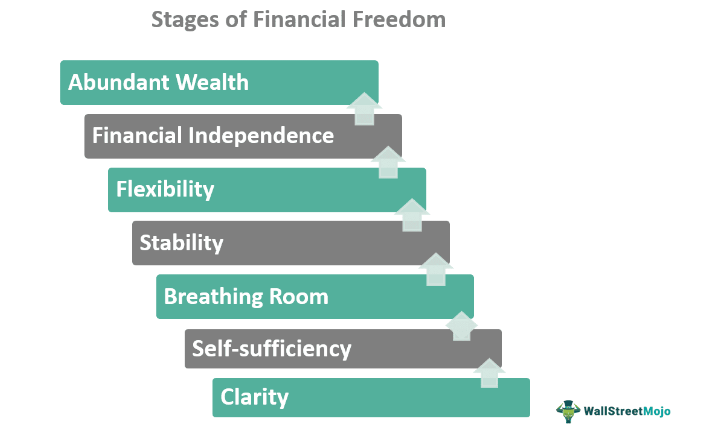

Long-Term Financial Planning for Stability

Long-term financial planning is essential for lasting financial stability and avoiding future instances of a lack of funds.

Investing for the Future

Investing allows your money to grow over time.

- Learn about investment options: Explore stocks, bonds, mutual funds, and real estate. Understand the risks and potential rewards of each.

- Consult a financial advisor: A professional can provide personalized guidance based on your financial goals and risk tolerance.

- Start early: The power of compounding returns means the sooner you start investing, the more your money will grow.

Retirement Planning

Planning for retirement ensures a comfortable financial future.

- Maximize retirement contributions: Contribute the maximum amount to your 401(k) or IRA to take advantage of tax benefits and employer matching.

- Understand retirement plan options: Research different retirement plans (401k, Roth IRA, Traditional IRA) to determine the best option for your situation.

- Plan for healthcare costs: Healthcare expenses can be significant in retirement, so factor these costs into your planning.

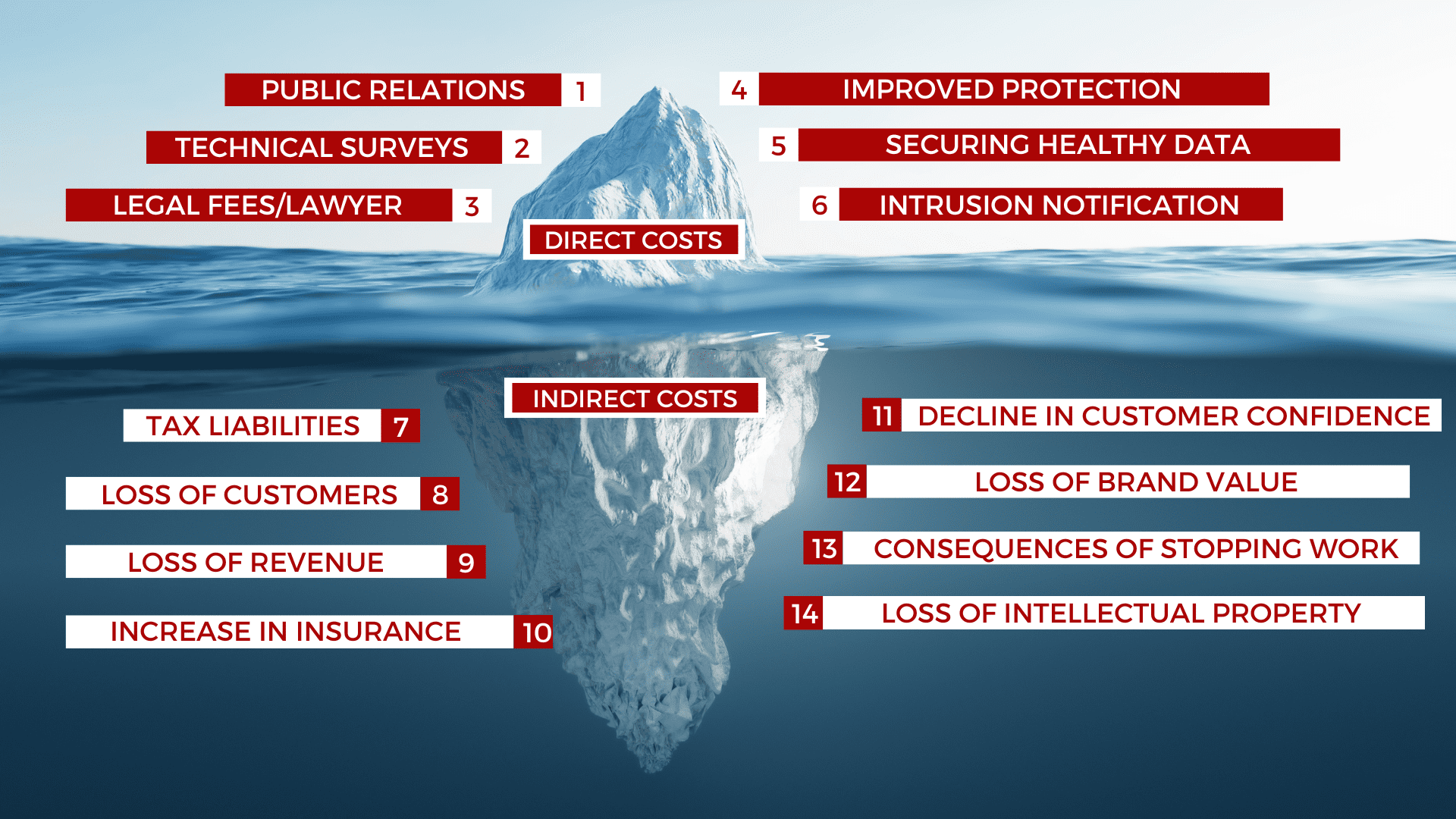

Protecting Your Assets

Protecting your assets safeguards your financial future.

- Obtain adequate insurance coverage: Health, auto, home, and life insurance protect against unforeseen events.

- Create a will or trust: These legal documents ensure your assets are distributed according to your wishes.

Conclusion

Conquering a lack of funds and achieving financial freedom and stability requires a combination of understanding your current financial situation, implementing effective strategies to increase income and reduce expenses, and planning for long-term financial security. By diligently tracking your expenses, creating a realistic budget, and consistently working towards increasing your income and building an emergency fund, you can build a strong financial foundation. Remember to invest for the future and protect your assets. Start tackling your lack of funds today! Download a budgeting app, create a realistic budget, and begin implementing the strategies outlined in this guide. Take control of your financial future and pave your path towards financial freedom and stability. For further resources on financial planning and budgeting, explore [link to relevant resource 1] and [link to relevant resource 2].

Featured Posts

-

Tuerkiye Ile Italya Ya Verilen Yeni Nato Goerevi Detaylari

May 22, 2025

Tuerkiye Ile Italya Ya Verilen Yeni Nato Goerevi Detaylari

May 22, 2025 -

Cyberattack Costs Marks And Spencer 300 Million Full Impact Analysis

May 22, 2025

Cyberattack Costs Marks And Spencer 300 Million Full Impact Analysis

May 22, 2025 -

Remembering Adam Ramey Dropout Kings Vocalist Dies

May 22, 2025

Remembering Adam Ramey Dropout Kings Vocalist Dies

May 22, 2025 -

Outrun Movie Michael Bay Directing Sydney Sweeney Cast

May 22, 2025

Outrun Movie Michael Bay Directing Sydney Sweeney Cast

May 22, 2025 -

Recent Surge In Gas Prices Southeast Wisconsins Fuel Cost Crisis

May 22, 2025

Recent Surge In Gas Prices Southeast Wisconsins Fuel Cost Crisis

May 22, 2025