Landmark Saudi Rule Change: Unlocking A Giant ABS Market

Table of Contents

Key Features of the New Saudi ABS Regulations

The new Saudi ABS regulations represent a significant departure from previous frameworks, creating a more attractive and accessible market for issuers and investors. These changes are designed to streamline the process of issuing ABS, reducing complexity and boosting investor confidence. Key features of this landmark Saudi rule change include:

-

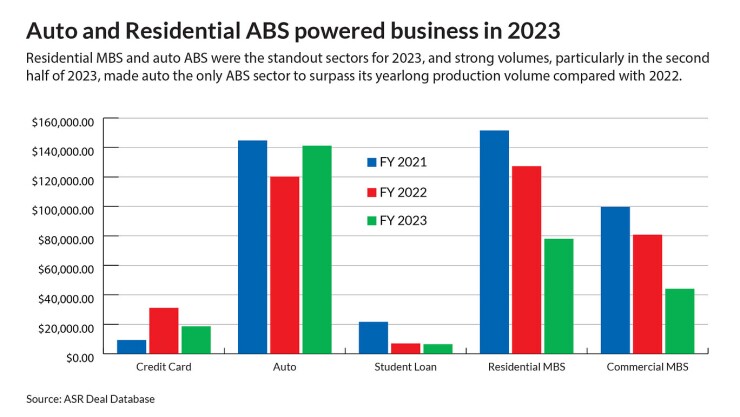

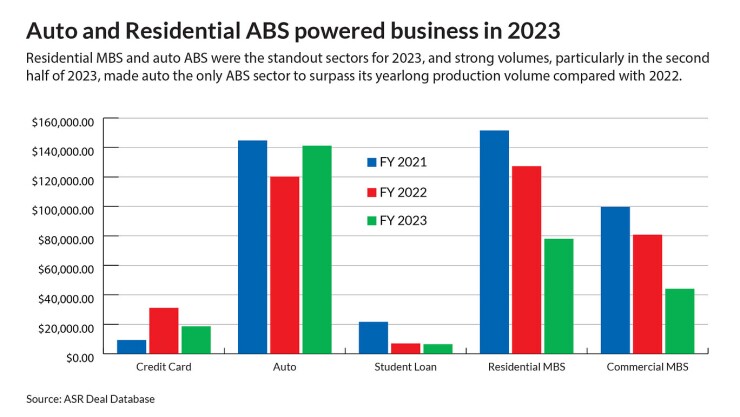

Eligibility Criteria for Underlying Assets: The expanded eligibility criteria now encompass a broader range of underlying assets, including mortgages, auto loans, credit card receivables, and other suitable financial assets. This diversification significantly expands the potential size of the Saudi ABS market.

-

Regulatory Oversight and Approvals: The regulatory framework has been modernized, simplifying the approval process for ABS issuances. This streamlining reduces bureaucratic hurdles and allows for faster issuance times.

-

Capital Requirements for Issuers: The new regulations introduce more flexible capital requirements tailored to the specific risks associated with different types of ABS. This encourages greater participation from a wider range of issuers.

-

Disclosure and Transparency Requirements: Enhanced disclosure and transparency requirements ensure greater accountability and investor protection. This increased transparency builds trust and encourages wider participation in the market.

-

Tax Implications: Favorable tax implications have been introduced to incentivize the issuance and investment in Saudi ABS, making them more competitive with other investment options.

The Potential Impact on the Saudi Economy

The unlocked Saudi ABS market holds immense potential for driving significant economic growth and diversification within the Kingdom. By facilitating increased access to financing, this landmark Saudi rule change will stimulate various sectors:

-

Increased Access to Financing for Businesses and Projects: Businesses, particularly SMEs, will gain access to a wider range of funding options, fostering entrepreneurship and driving job creation. This is crucial for Saudi Arabia's Vision 2030 diversification strategy.

-

Stimulation of Economic Growth and Diversification: The increased availability of capital will fuel infrastructure projects, real estate development, and other vital sectors, propelling economic expansion and diversification away from oil dependence. The Saudi ABS market will play a crucial role in this transformation.

-

Creation of New Investment Opportunities: The new market will attract both domestic and international investors, boosting capital inflows and fostering economic growth. This influx of investment will further fuel the growth of the Saudi ABS market.

-

Potential Job Creation: The growth of the Saudi ABS market will inevitably lead to the creation of new jobs in various sectors, including finance, law, and technology. This job creation will contribute to Saudi Arabia's overall economic development.

Opportunities for Investors in the Saudi ABS Market

The Saudi ABS market offers attractive opportunities for investors seeking diversified portfolios with potentially high returns. However, as with any investment, understanding the risks is crucial.

-

Types of ABS Available: The market offers a variety of ABS, including mortgage-backed securities, auto loan ABS, and other asset classes, providing diversification opportunities.

-

Potential Return on Investment: Depending on market conditions and the specific ABS chosen, investors can expect competitive returns compared to other asset classes.

-

Risk Factors and Diversification Strategies: While potentially lucrative, investors must carefully assess risk factors, including interest rate fluctuations and credit risk. Diversifying across different ABS issuers and asset classes is crucial for mitigating risk.

-

Due Diligence Considerations: Thorough due diligence, including independent assessments of underlying assets and issuer creditworthiness, is critical before investing in the Saudi ABS market.

Challenges and Considerations for the Growth of the Saudi ABS Market

Despite its significant potential, the growth of the Saudi ABS market faces certain challenges:

-

Robust Infrastructure and Legal Frameworks: Continued development of robust legal frameworks and supporting infrastructure is essential for building investor confidence and ensuring market stability.

-

Investor Education and Awareness: Increasing investor education and awareness about ABS products and risk management is critical for stimulating participation in the market.

-

Potential Regulatory Hurdles: Ongoing monitoring and potential adjustments to the regulatory framework may be required to address emerging challenges and ensure the market's smooth operation.

-

Transparency and Standardized Practices: Maintaining high levels of transparency and implementing standardized practices will ensure the market's long-term success and attractiveness to international investors.

Seizing the Opportunity in the Expanded Saudi ABS Market

The landmark Saudi rule change has unlocked significant potential within the Saudi ABS market. This presents a unique opportunity for investors and businesses alike. The changes introduced offer increased access to financing, stimulate economic growth, and create new avenues for investment. However, understanding the inherent risks and challenges is vital. Invest in the growing Saudi ABS market and capitalize on the opportunities presented by this landmark regulatory shift. Learn more about the landmark Saudi rule change and its impact on the Saudi Asset-Backed Securities market. Explore the potential of this burgeoning market and seize the chance to unlock the wealth of opportunities available. [Insert links to relevant resources here].

Featured Posts

-

Wsayl Alielam Alerbyt Wwaqet Mhajmt Alqaflt Alinsanyt Almtjht Ila Ghzt

May 03, 2025

Wsayl Alielam Alerbyt Wwaqet Mhajmt Alqaflt Alinsanyt Almtjht Ila Ghzt

May 03, 2025 -

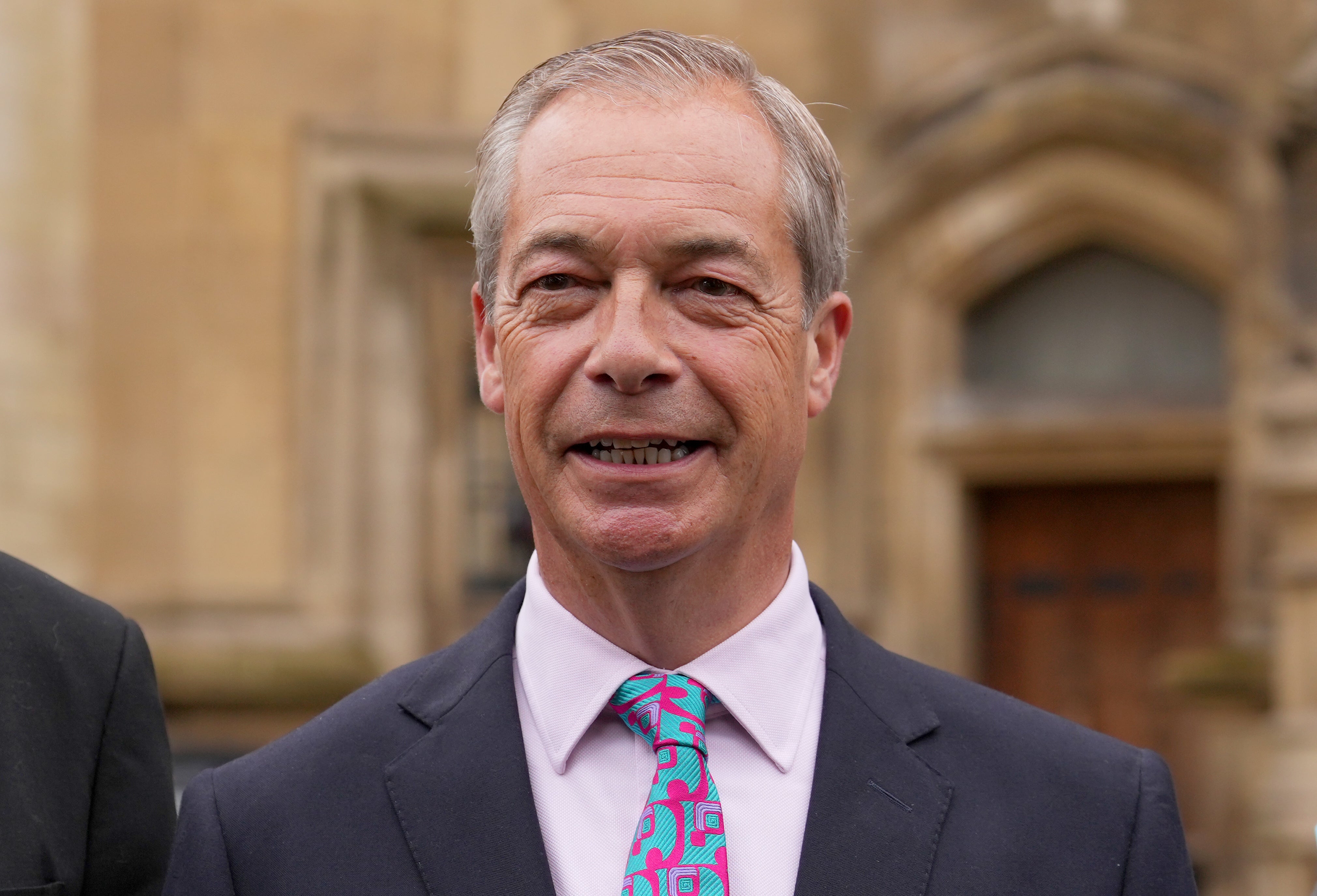

Five Potential Pitfalls For Reform Uk Analyzing Nigel Farages Party

May 03, 2025

Five Potential Pitfalls For Reform Uk Analyzing Nigel Farages Party

May 03, 2025 -

Laura Keller Em Retiro De Tantra Yoga Fotos Do Biquini

May 03, 2025

Laura Keller Em Retiro De Tantra Yoga Fotos Do Biquini

May 03, 2025 -

Ftc To Challenge Activision Blizzard Acquisition Approval

May 03, 2025

Ftc To Challenge Activision Blizzard Acquisition Approval

May 03, 2025 -

Did Christina Aguilera Go Too Far Fan Reactions To Her Latest Photoshoot

May 03, 2025

Did Christina Aguilera Go Too Far Fan Reactions To Her Latest Photoshoot

May 03, 2025

Latest Posts

-

Aedae Aljmahyr Akthr 30 Shkhsyt Ghyr Mhbwbt Fy Tarykh Krt Alqdm Mwqe Bkra

May 03, 2025

Aedae Aljmahyr Akthr 30 Shkhsyt Ghyr Mhbwbt Fy Tarykh Krt Alqdm Mwqe Bkra

May 03, 2025 -

Reform Uk A Look At The Current Internal Conflict

May 03, 2025

Reform Uk A Look At The Current Internal Conflict

May 03, 2025 -

Recent Developments And Internal Tensions Within Reform Uk

May 03, 2025

Recent Developments And Internal Tensions Within Reform Uk

May 03, 2025 -

The Ongoing Dispute Within Reform Uk An Explanation

May 03, 2025

The Ongoing Dispute Within Reform Uk An Explanation

May 03, 2025 -

Deep Divisions In Reform Uk Analysing The Current Crisis

May 03, 2025

Deep Divisions In Reform Uk Analysing The Current Crisis

May 03, 2025