Latest Oil Market News: April 24, 2024 Analysis And Insights

Table of Contents

OPEC+ Production Decisions and Their Impact

The latest OPEC+ meeting concluded with a decision that sent ripples through the oil market. Understanding the intricacies of OPEC+ production quotas is key to deciphering crude oil price movements. Keywords like oil production, oil supply, and the cartel itself are central to this discussion.

-

Summary of OPEC+ meeting outcomes: The April 24th OPEC+ meeting resulted in a surprise decision to maintain current production levels, defying expectations of an increase. This decision was largely attributed to concerns about weakening global economic growth and persistent uncertainty regarding future oil demand.

-

Analysis of production quotas for key member countries (Saudi Arabia, Russia, etc.): Saudi Arabia, a key player in OPEC+, maintained its commitment to stabilizing the market. Russia, facing ongoing sanctions, also played a significant role in the decision-making process. The allocation of production quotas among member countries remained largely unchanged from the previous meeting.

-

Assessment of the impact on Brent and WTI crude prices: The decision to maintain production levels resulted in a slight increase in both Brent and WTI crude prices in the immediate aftermath of the announcement. However, the long-term impact remains uncertain. The price volatility experienced in the preceding weeks highlights the sensitivity of the market to OPEC+ decisions.

-

Potential short-term and long-term implications for oil traders and investors: For oil traders, this decision creates opportunities for both short-term and long-term strategies, although careful risk management is crucial. Investors should closely monitor global economic indicators and geopolitical events to make informed decisions.

Global Oil Demand and Economic Outlook

Global oil demand is a critical driver of crude oil prices. The interplay between economic growth and energy consumption is a complex relationship. Keywords like oil demand, global economy, and energy consumption are vital in understanding this dynamic.

-

Review of recent economic indicators affecting oil demand: Recent economic data, including slower-than-expected GDP growth in several major economies, suggest a potential slowdown in oil demand growth in the coming months. This is particularly true for industrial activity, a key driver of petroleum consumption.

-

Discussion of potential shifts in energy consumption patterns: The ongoing transition towards renewable energy sources presents a long-term challenge to oil demand. However, the complete phasing out of fossil fuels remains a considerable time away, particularly given the reliance on petroleum for various industrial processes.

-

Assessment of the impact of economic uncertainty on oil prices: Uncertainty surrounding future economic growth and inflation remains a significant factor influencing investor sentiment in the oil market. This uncertainty contributes to oil price volatility.

-

Analysis of regional variations in oil demand: Regional variations in economic growth and energy consumption patterns create diverse impacts. For example, robust economic growth in regions like Asia continues to support strong oil demand, while economic downturns in other areas might negatively impact consumption.

Geopolitical Factors and Their Influence on Oil Prices

Geopolitical instability is a significant wildcard in the oil market. Events in oil-producing regions, sanctions, and global conflicts can significantly impact oil supply and investor sentiment. Keywords such as geopolitical risk, oil price, sanctions, and supply disruptions highlight the central themes here.

-

Identification of key geopolitical hotspots affecting oil markets: The ongoing situation in [Region] remains a key geopolitical concern, and the potential for supply disruptions from this region continues to influence oil prices.

-

Analysis of potential supply disruptions due to geopolitical tensions: Increased geopolitical tensions can lead to disruptions in oil supply chains, potentially causing significant price spikes. The impact depends greatly on the location and scale of the disruption.

-

Assessment of the impact on investor sentiment and risk premiums: Geopolitical uncertainty tends to increase risk premiums in the oil market, influencing investor decisions and ultimately impacting oil prices.

-

Discussion of potential long-term implications for oil security: Long-term oil security is impacted by geopolitical stability and the reliability of oil supply routes. Increased diversification of oil sources and enhanced energy security measures are becoming increasingly important.

Specific Geopolitical Event Analysis (Example: Impact of the situation in the Middle East)

The ongoing situation in the Middle East continues to exert pressure on global oil prices. Any escalation of tensions in this region could lead to significant supply disruptions and price increases. The reliance on this region for a significant portion of global oil production makes it a key factor impacting petroleum markets and oil trading strategies.

Oil Price Forecast and Trading Strategies

Predicting future oil prices is inherently complex. While no one can definitively predict future oil prices, the following offers a potential outlook based on the current situation. Remember: This is not financial advice.

-

Short-term price projections for Brent and WTI crude: Based on the current analysis, a short-term price range for Brent crude is projected between [price range] and for WTI crude between [price range].

-

Potential factors that could influence future price movements: Unexpected changes in OPEC+ production quotas, significant economic shifts in major consuming nations, and escalating geopolitical tensions remain primary factors impacting future oil prices.

-

Basic trading strategies for experienced investors (emphasize risk management): Experienced investors might consider hedging strategies, options trading, or other risk mitigation techniques depending on their risk tolerance and investment goals.

-

Disclaimer regarding the limitations of any forecast: This forecast is based on current information and involves inherent uncertainty. Market conditions can change rapidly, and unforeseen events can significantly influence oil prices.

Conclusion

The latest oil market news as of April 24, 2024, reflects a complex interplay of factors. OPEC+ production decisions, global oil demand influenced by economic growth and geopolitical instability, all significantly influence crude oil price movements, impacting both Brent and WTI crude. While short-term price predictions remain uncertain, understanding these key drivers is essential for navigating the ever-changing oil market.

Stay informed about the ever-changing dynamics of the oil market by regularly checking back for the latest oil market news and analysis. We provide up-to-date information to help you understand the latest trends in crude oil prices and make informed decisions. Subscribe to our newsletter for timely updates on oil market news and analysis.

Featured Posts

-

China And Canada Building A Stronger Bilateral Relationship Amidst Us Tensions

Apr 25, 2025

China And Canada Building A Stronger Bilateral Relationship Amidst Us Tensions

Apr 25, 2025 -

Cassidy Hutchinson Key Witness To January 6th Announces Memoir

Apr 25, 2025

Cassidy Hutchinson Key Witness To January 6th Announces Memoir

Apr 25, 2025 -

Meet Remember Monday Uks Eurovision 2025 Entry

Apr 25, 2025

Meet Remember Monday Uks Eurovision 2025 Entry

Apr 25, 2025 -

Jan 6th Conspiracy Theories Ray Epps Sues Fox News For Defamation

Apr 25, 2025

Jan 6th Conspiracy Theories Ray Epps Sues Fox News For Defamation

Apr 25, 2025 -

Auto Dealers Double Down On Opposition To Electric Vehicle Regulations

Apr 25, 2025

Auto Dealers Double Down On Opposition To Electric Vehicle Regulations

Apr 25, 2025

Latest Posts

-

Il Venerdi Santo Un Commento Di Feltri

Apr 30, 2025

Il Venerdi Santo Un Commento Di Feltri

Apr 30, 2025 -

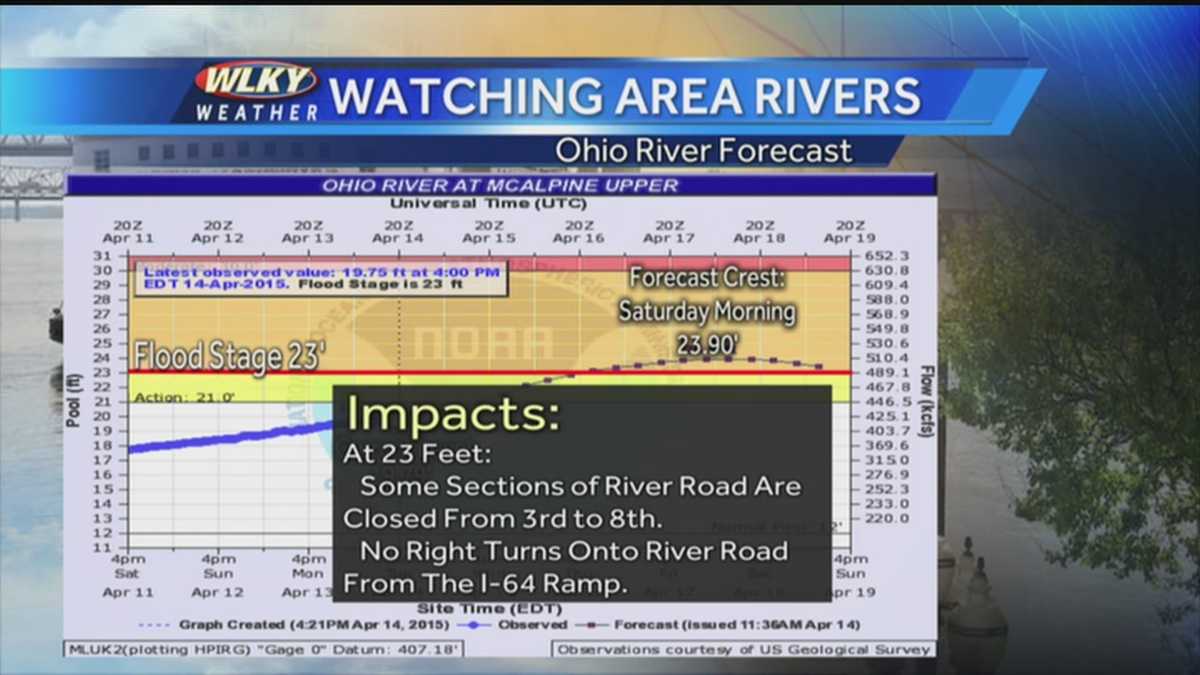

Severe Flooding Cancels Thunder Over Louisville Fireworks Show

Apr 30, 2025

Severe Flooding Cancels Thunder Over Louisville Fireworks Show

Apr 30, 2025 -

Feltri Sul Venerdi Santo Un Opinione Controversa

Apr 30, 2025

Feltri Sul Venerdi Santo Un Opinione Controversa

Apr 30, 2025 -

Kentuckys Louisville Under State Of Emergency Due To Tornado And Imminent Flooding

Apr 30, 2025

Kentuckys Louisville Under State Of Emergency Due To Tornado And Imminent Flooding

Apr 30, 2025 -

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025