Lessons Learned From The April 8th Treasury Market

Table of Contents

Understanding the April 8th Market Disruptions

The April 8th Treasury market witnessed unprecedented volatility, marked by sharp and unexpected movements in Treasury yields. This event serves as a stark reminder of the inherent risks within even the most seemingly stable financial markets.

Unprecedented Volatility in Treasury Yields

The sudden and dramatic shifts in Treasury yields across different maturities were striking. This volatility far exceeded typical daily fluctuations, signifying a significant market event.

- Specific Yield Changes: The 2-year Treasury yield saw a dramatic spike, while longer-term yields also experienced substantial increases. The specific percentage changes varied across maturities, reflecting the complex interplay of factors at play. Detailed data from reputable financial sources would be required for precise figures, which are beyond the scope of this general analysis of the event.

- Comparison to Historical Volatility: The April 8th volatility significantly surpassed the average daily volatility observed in previous years, indicating a unique and potentially destabilizing event within the bond market. Historical data clearly demonstrates this unusual level of fluctuation.

- Contributing Factors: Several factors likely contributed to the heightened volatility. Increased tax payments, which often affect market liquidity, combined with unexpected shifts in supply and demand for Treasuries, played significant roles. These factors, coupled with broader macroeconomic conditions, created a perfect storm of market uncertainty.

Liquidity Concerns and Market Functionality

The intense volatility exposed significant challenges in the efficient trading of Treasuries. The usual mechanisms for price discovery and transaction execution faced considerable strain.

- Wide Bid-Ask Spreads: The difference between the bid and ask prices for Treasuries widened significantly, making it more expensive and difficult for investors to enter or exit positions. This impaired market efficiency.

- Reduced Trading Volume: In certain sectors of the Treasury market, trading volume dropped, further exacerbating liquidity concerns and illustrating difficulties in executing trades.

- Implications for Market Stability: The reduced liquidity and difficulties in executing trades highlighted the fragility of the Treasury market and its impact on the broader financial system. Such disruptions can trigger cascading effects throughout various financial instruments.

Analyzing the Root Causes of the Volatility

Understanding the underlying causes of the April 8th Treasury market volatility is crucial for preventing similar future events.

The Role of Algorithmic Trading

The speed and scale of the price swings raise questions about the potential role of algorithmic trading and high-frequency trading (HFT) strategies.

- Exacerbated Price Swings: Algorithmic trading, with its capacity for rapid and automated responses to market signals, might have amplified the price swings. The algorithms may have reacted in a self-reinforcing manner, accelerating the decline in liquidity.

- Regulatory Oversight: This event emphasizes the need for enhanced regulatory oversight of algorithmic trading strategies and their impact on market stability. Stricter rules and increased transparency could mitigate the risk of similar future disruptions.

Macroeconomic Factors and Geopolitical Events

Broader economic conditions and geopolitical uncertainty also contributed to the heightened market sentiment and increased volatility.

- Inflation and Interest Rate Expectations: Concerns about inflation and the Federal Reserve's interest rate policy played a role in shaping investor expectations and influencing demand for Treasuries.

- Geopolitical Uncertainty: Geopolitical events can significantly impact investor sentiment and risk appetite, contributing to market instability. Uncertainty surrounding global political events further increased pressure on the bond market.

Implications for Risk Management and Investment Strategies

The April 8th events underscore the need for robust risk management and the adaptation of investment strategies to account for increased market volatility.

Strengthening Risk Management Frameworks

Investors and financial institutions must strengthen their risk management frameworks to better withstand future market shocks.

- Improved Stress Testing: More sophisticated stress tests, simulating extreme market conditions, are needed to identify vulnerabilities and assess resilience.

- Diversification Strategies: Diversifying across different asset classes and maturities helps reduce exposure to specific risks within the bond market.

- Enhanced Liquidity Planning: Maintaining sufficient liquidity buffers is crucial for navigating periods of heightened volatility and ensuring the ability to meet obligations.

Adapting Investment Strategies to Market Volatility

Investors should adapt their investment approaches to account for the increased uncertainty and potential for rapid price swings.

- Consideration of Different Asset Classes: Exploring alternative investments beyond Treasuries can help diversify risk and improve portfolio resilience.

- Hedging Strategies: Utilizing hedging techniques can help mitigate potential losses during periods of increased market volatility.

- Diversification Across Maturities: Spreading investments across a range of Treasury maturities can help reduce overall portfolio risk.

Conclusion

The April 8th Treasury market volatility served as a stark reminder of the inherent risks and potential fragility within the financial system. Understanding the root causes, including the potential role of algorithmic trading and macroeconomic factors, is crucial for improving risk management and adapting investment strategies to navigate future market disruptions. By carefully analyzing the lessons learned from this event, investors and market participants can enhance their preparedness for similar instances of increased volatility in the Treasury market. Further research into the implications of algorithmic trading, the role of market liquidity, and the impact of unexpected shifts in supply and demand is essential to mitigate potential future crises within the bond market. Learn more about mitigating risk and optimizing your strategies in the face of April 8th Treasury market volatility and similar events.

Featured Posts

-

Attorney General Issues Transgender Athlete Ban Directive To Minnesota

Apr 29, 2025

Attorney General Issues Transgender Athlete Ban Directive To Minnesota

Apr 29, 2025 -

Reagan Airport Helicopter Incident Pilot Error And Emerging Details Of The Near Collision

Apr 29, 2025

Reagan Airport Helicopter Incident Pilot Error And Emerging Details Of The Near Collision

Apr 29, 2025 -

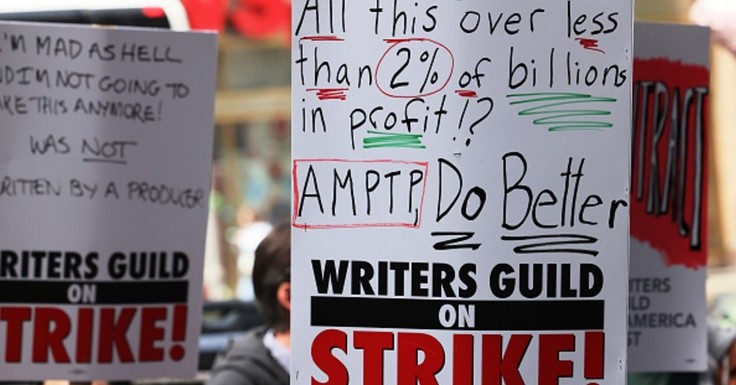

Hollywood Production Halts The Ongoing Actors And Writers Strike

Apr 29, 2025

Hollywood Production Halts The Ongoing Actors And Writers Strike

Apr 29, 2025 -

Exclusive University Group Challenges Trump Administration Policies

Apr 29, 2025

Exclusive University Group Challenges Trump Administration Policies

Apr 29, 2025 -

Debunking The Myths Exploring The True Nature Of Ai Thought Processes

Apr 29, 2025

Debunking The Myths Exploring The True Nature Of Ai Thought Processes

Apr 29, 2025

Latest Posts

-

Netflixs Sirens Trailer Supergirl Milly Alcock And Julianne Moores Cult

Apr 29, 2025

Netflixs Sirens Trailer Supergirl Milly Alcock And Julianne Moores Cult

Apr 29, 2025 -

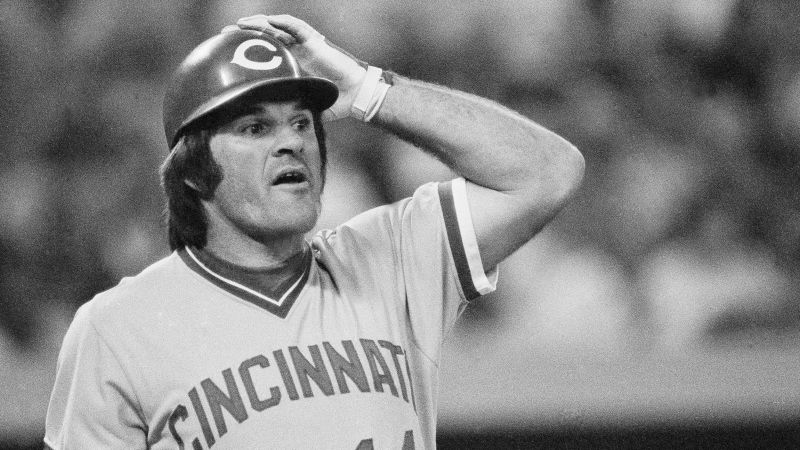

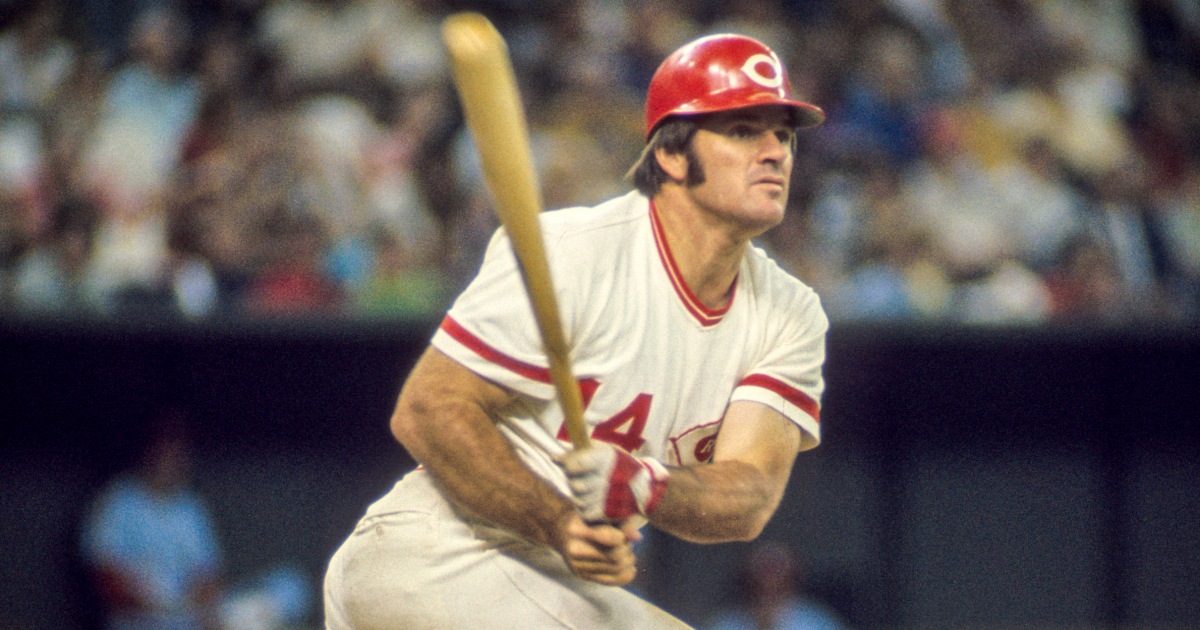

Pete Rose And A Presidential Pardon Examining The Implications Of Overturning The Mlb Ban

Apr 29, 2025

Pete Rose And A Presidential Pardon Examining The Implications Of Overturning The Mlb Ban

Apr 29, 2025 -

Milly Alcock As Supergirl In Netflixs Sirens A Look At The Cult Trailer

Apr 29, 2025

Milly Alcock As Supergirl In Netflixs Sirens A Look At The Cult Trailer

Apr 29, 2025 -

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025 -

Trumps Potential Pardon For Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025

Trumps Potential Pardon For Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025