Leveraged Semiconductor ETFs: A Pre-Surge Sell-Off Explained

Table of Contents

Understanding Leveraged Semiconductor ETFs

Leveraged exchange-traded funds (ETFs) aim to deliver a multiple of the daily performance of an underlying index or asset. In the context of semiconductors, these leveraged semiconductor ETFs seek to magnify the daily returns of a semiconductor industry benchmark. For example, SOXL is a popular choice, designed to deliver 3x the daily performance of the PHLX Semiconductor Sector Index. While TQQQ, a popular 3x leveraged ETF tracking the Nasdaq-100, has significant overlap with the semiconductor sector, it's important to remember its broader technology focus.

The concept of leverage is crucial. It means that a small movement in the underlying index results in a proportionally larger movement in the ETF's price.

- Higher potential returns during bull markets: In a rising market, leveraged ETFs can deliver significantly higher returns than their unleveraged counterparts.

- Increased losses during bear markets: Conversely, during downturns, the leveraged structure magnifies losses. The effect of compounding daily returns means that consecutive negative days can lead to substantial losses.

- Impact of daily resets: Leveraged ETFs reset their leverage daily. This means that the fund's returns are calculated daily and not over a longer period, which can impact the overall long-term performance and may not track the underlying index over extended periods.

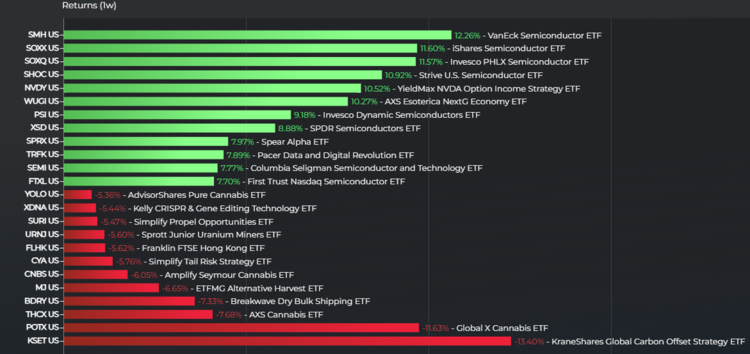

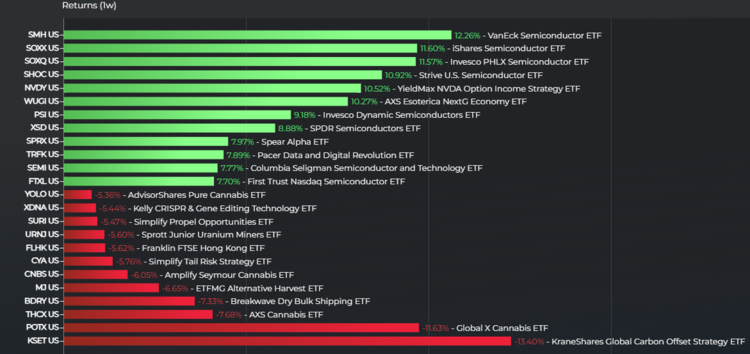

Factors Contributing to the Pre-Surge Sell-Off

Several factors contributed to the recent sell-off in leveraged semiconductor ETFs, even amidst expectations of a future sector surge.

Market Sentiment and Investor Fear

Broader market conditions played a significant role.

- Broader market corrections and their impact on technology stocks: Concerns about inflation and rising interest rates led to a general sell-off in the technology sector, impacting semiconductor stocks significantly.

- Inflationary pressures and rising interest rates: Increased interest rates make borrowing more expensive, impacting companies' profitability and investor appetite for riskier assets like technology stocks and leveraged ETFs.

- Geopolitical uncertainties and their influence on investor confidence: Global political instability and trade tensions can trigger uncertainty in the market, prompting investors to sell off riskier assets.

Sector-Specific Concerns

Within the semiconductor industry itself, specific issues further fueled the sell-off.

- Concerns about overvaluation in the semiconductor sector: Some analysts believed that semiconductor stocks were overvalued before the sell-off, leading to profit-taking.

- Inventory adjustments and potential supply chain disruptions: After a period of high demand, some companies started adjusting their inventories, potentially leading to decreased production and impacting stock prices. Supply chain concerns remain a persistent risk.

- Increased competition and the impact on profitability: Intensifying competition among semiconductor manufacturers can squeeze profit margins and negatively affect stock valuations.

The Role of Leverage in Amplifying Losses

The leveraged nature of these ETFs significantly exacerbated the sell-off.

- The effect of daily compounding on losses: Consecutive negative days lead to exponentially larger losses in a leveraged ETF compared to an unleveraged one.

- Higher volatility compared to unleveraged ETFs: Leveraged semiconductor ETFs inherently exhibit higher volatility, making them riskier investments.

- The importance of understanding the risk profile before investing: Investors must carefully assess their risk tolerance before investing in these high-risk, high-reward instruments.

Analyzing the Potential for a Future Surge

Despite the recent sell-off, several factors suggest a potential surge in semiconductor demand and prices.

Long-term growth drivers such as AI, 5G, and the Internet of Things (IoT) are expected to fuel significant demand for semiconductors. Further, government investments in domestic semiconductor manufacturing bolster the industry's future.

- Technological advancements driving demand: The continued development of advanced technologies will increase the need for more sophisticated and powerful semiconductors.

- Government support and investments in semiconductor manufacturing: Government initiatives aimed at boosting domestic semiconductor production are likely to support the industry's growth.

- Long-term growth prospects of the semiconductor industry: Despite short-term fluctuations, the long-term outlook for the semiconductor industry remains positive, driven by continuous technological innovation and global demand.

Conclusion

The recent sell-off in leveraged semiconductor ETFs was driven by a combination of factors, including broader market concerns, sector-specific issues, and the inherent risk amplification of leverage. This highlights the high-risk, high-reward nature of these investments. The potential for future surges in the semiconductor sector exists, driven by long-term technological advancements and government support. However, investors must carefully consider the risks before investing in leveraged semiconductor ETFs. Investing in leveraged semiconductor ETFs, or any leveraged investment, requires a thorough understanding of the risks involved. Before investing, conduct thorough research and consider your risk tolerance. Only invest what you can afford to lose. Remember to carefully assess the market conditions and sector-specific trends before making any investment decisions related to leveraged semiconductor ETFs.

Featured Posts

-

Luchshie Boeviki S Dzherardom Batlerom Podborka Filmov

May 13, 2025

Luchshie Boeviki S Dzherardom Batlerom Podborka Filmov

May 13, 2025 -

Ai Startup Perplexity Achieves 14 Billion Valuation Via Exclusive Investment

May 13, 2025

Ai Startup Perplexity Achieves 14 Billion Valuation Via Exclusive Investment

May 13, 2025 -

Putins Resurgent Arctic Fleet Analyzing The Implications

May 13, 2025

Putins Resurgent Arctic Fleet Analyzing The Implications

May 13, 2025 -

Gibraltars Brexit Uncertainty Negotiations At Impasse

May 13, 2025

Gibraltars Brexit Uncertainty Negotiations At Impasse

May 13, 2025 -

A Critical Analysis Of The Da Vinci Code And Its Impact

May 13, 2025

A Critical Analysis Of The Da Vinci Code And Its Impact

May 13, 2025