Lion Electric's Future Uncertain: Court-Appointed Monitor Suggests Liquidation

Table of Contents

The Court-Appointed Monitor's Report and its Recommendation

The court-appointed monitor, tasked with assessing Lion Electric's financial health and exploring potential restructuring options, has delivered a sobering report. This independent financial analysis meticulously examined the company's financial standing, revealing critical challenges that led to the recommendation of liquidation.

-

Role of the Court-Appointed Monitor: The monitor's role is to impartially assess Lion Electric's financial situation, explore all feasible restructuring alternatives, and present a recommendation to the court. They act as a neutral party to ensure fairness and transparency in the proceedings.

-

Key Findings of the Report: The report likely highlights unsustainable debt levels, persistent operating losses, and a failure to secure sufficient funding to continue operations. Specific details regarding revenue shortfalls, cost overruns, and the overall financial health of the company would be outlined in the full report.

-

Liquidation Recommendation: The core recommendation of the report is to proceed with the liquidation of Lion Electric, a drastic step signaling the severity of the company's financial predicament.

-

Rationale Behind the Recommendation: The rationale likely stems from a conclusion that Lion Electric's financial position is irreparable through restructuring. The combination of high debt, ongoing losses, and a lack of viable funding options may have rendered continued operation unsustainable.

-

Alternative Restructuring Options Considered: The monitor likely investigated various restructuring strategies, including debt renegotiation, asset sales, and potential acquisitions. However, these alternatives were likely deemed insufficient to address the company's fundamental financial issues.

Lion Electric's Financial Challenges and Contributing Factors

Lion Electric's current financial struggles are the culmination of several interconnected factors, all contributing to its precarious position. Understanding these contributing factors is crucial to grasping the gravity of the situation.

-

Lion Electric's Financial Performance: Recent financial reports likely reveal consistent losses, dwindling cash reserves, and a significant debt burden. The company's revenue generation may have fallen short of projections, impacting its ability to meet its financial obligations.

-

Impact of External Factors: Supply chain disruptions, a common challenge in the manufacturing sector, exacerbated Lion Electric's difficulties. Increased competition in the rapidly growing EV market also put pressure on margins and sales. Rising production costs and inflation further strained the company's finances.

-

Strategic Missteps and Internal Challenges: The report may also point to potential strategic missteps, operational inefficiencies, or internal challenges that hindered Lion Electric's performance and its ability to adapt to the dynamic EV market. This could include issues with production timelines, product development, or market penetration.

-

Previous Attempts at Restructuring: Lion Electric likely attempted to secure additional funding or engage in financial restructuring prior to the court appointment, but these attempts ultimately proved unsuccessful.

Potential Consequences of Liquidation for Lion Electric and the EV Industry

The potential liquidation of Lion Electric carries significant consequences for various stakeholders and the wider EV industry.

-

Impact on Employees: Liquidation would likely result in substantial job losses for Lion Electric's employees, impacting their livelihoods and families.

-

Consequences for Investors: Investors who hold Lion Electric stock or bonds would likely face significant financial losses. The value of their investments would plummet, potentially leading to substantial financial setbacks.

-

Disruption to the Electric Vehicle Supply Chain: The liquidation could disrupt the EV supply chain, affecting suppliers and potentially delaying projects for other EV manufacturers who rely on Lion Electric's components or services.

-

Implications for the EV Industry: While Lion Electric represents a single company, its failure could contribute to a perception of increased risk within the EV industry, potentially impacting investor confidence and the overall growth trajectory of the sector.

-

Impact on Customers: Existing customers with orders or ongoing projects may experience delays or cancellations, potentially harming their operations and causing significant inconvenience.

Alternatives to Liquidation: A Path to Restructuring?

Despite the grim outlook, the possibility of avoiding liquidation remains, however slim.

-

Remaining Restructuring Possibilities: While the monitor's recommendation points towards liquidation, there might still be a window for restructuring. This could involve renegotiating debt terms with creditors, attracting new investment from strategic partners, or exploring a sale of specific assets to generate much-needed capital.

-

Likelihood of Success: The chances of successful restructuring are limited, given the severity of Lion Electric's financial challenges and the monitor's assessment. However, a last-minute intervention from a significant investor or a strategic partnership could still potentially avert liquidation.

-

Potential Investors or Strategic Partners: While currently unlikely, a potential white knight – a company or investor willing to inject significant capital and provide operational expertise – could emerge, offering a lifeline to Lion Electric.

Conclusion

The court-appointed monitor's recommendation to liquidate Lion Electric underscores the considerable financial challenges facing the EV manufacturer. The report emphasizes the role of factors such as supply chain disruptions, intense market competition, and a heavy debt burden in contributing to the company's precarious financial situation. The potential consequences of liquidation are far-reaching, affecting employees, investors, and the broader EV industry. While alternative restructuring paths remain theoretically possible, their success is uncertain.

Call to Action: Stay informed about the future of Lion Electric and the dynamic landscape of the electric vehicle market. Continue to follow the developments surrounding Lion Electric's potential liquidation and the ongoing discussions regarding the future of the company. Learn more about the intricacies of Lion Electric's financial situation and the challenges faced by EV manufacturers striving for success in this rapidly evolving industry.

Featured Posts

-

The End Of John Wick 5 Analyzing Keanu Reeves Recent Statements

May 07, 2025

The End Of John Wick 5 Analyzing Keanu Reeves Recent Statements

May 07, 2025 -

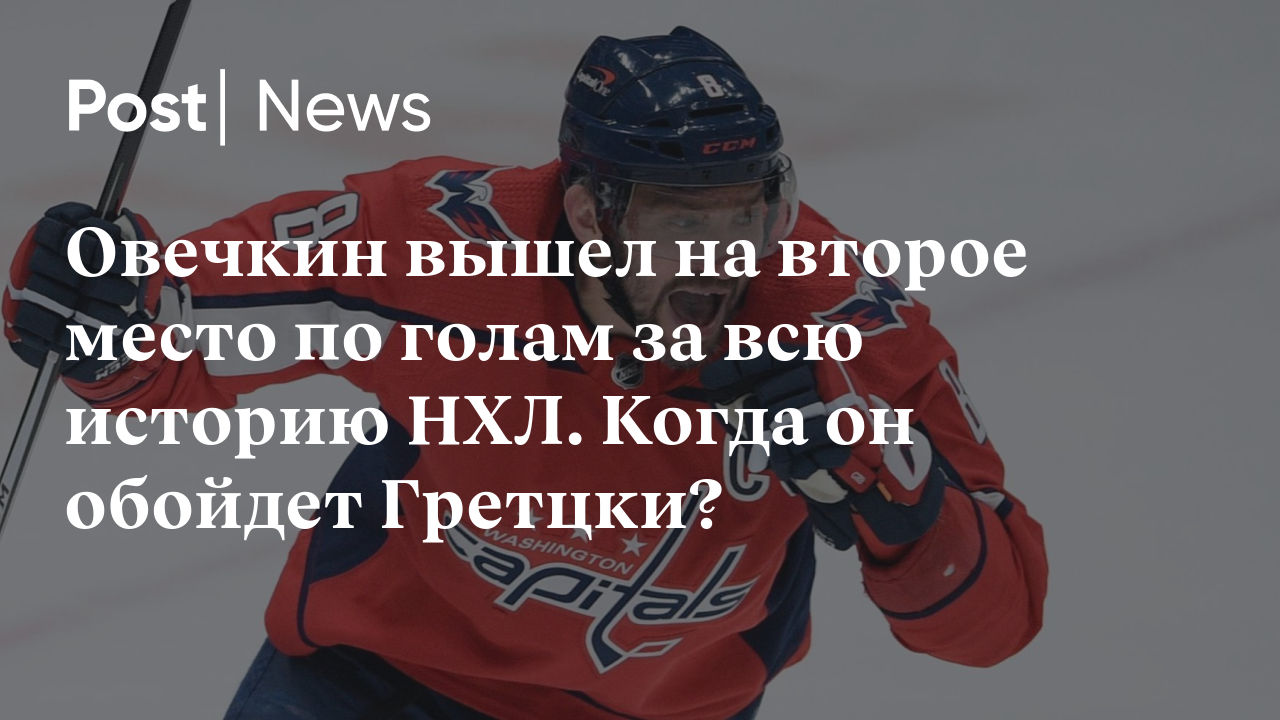

Obnovlenniy Prognoz N Kh L Kogda Ovechkin Prevzoydet Grettski

May 07, 2025

Obnovlenniy Prognoz N Kh L Kogda Ovechkin Prevzoydet Grettski

May 07, 2025 -

Cem Karaca Nin Mirasi Bati Ve Anadolu Mueziginin Birlesimi

May 07, 2025

Cem Karaca Nin Mirasi Bati Ve Anadolu Mueziginin Birlesimi

May 07, 2025 -

Carney Trump Meeting Expectations For Tuesdays White House Discussion

May 07, 2025

Carney Trump Meeting Expectations For Tuesdays White House Discussion

May 07, 2025 -

What Is A Conclave Understanding The Papal Election Process

May 07, 2025

What Is A Conclave Understanding The Papal Election Process

May 07, 2025

Latest Posts

-

Star Wars New Show 3 Strong Hints Of A Princess Leia Appearance

May 08, 2025

Star Wars New Show 3 Strong Hints Of A Princess Leia Appearance

May 08, 2025 -

Three Star Wars Andor Episodes Available Free On You Tube

May 08, 2025

Three Star Wars Andor Episodes Available Free On You Tube

May 08, 2025 -

3 Reasons A Princess Leia Cameo In The New Star Wars Show Is Likely

May 08, 2025

3 Reasons A Princess Leia Cameo In The New Star Wars Show Is Likely

May 08, 2025 -

3 Star Wars Andor Episodes Streaming Free On You Tube

May 08, 2025

3 Star Wars Andor Episodes Streaming Free On You Tube

May 08, 2025 -

Andor Season 2 The Absence Of A Trailer Sparks Intense Fan Debate

May 08, 2025

Andor Season 2 The Absence Of A Trailer Sparks Intense Fan Debate

May 08, 2025