Live Music Stock Slide To Continue Into Friday Trading

Table of Contents

Factors Contributing to the Live Music Stock Slide

Several interconnected factors are contributing to the current bearish trend in live music stocks. These range from broader macroeconomic headwinds to industry-specific challenges. Understanding these contributing elements is crucial for assessing the potential duration and severity of the slide. Keywords: Macroeconomic Factors, Inflation, Recession, Interest Rates, Operational Costs, Competition, Streaming Services.

-

Macroeconomic Headwinds: The current economic climate plays a significant role. Rising inflation, fears of a looming recession, and continued interest rate hikes are dampening investor sentiment across various sectors, including entertainment. Uncertainty about future consumer spending directly impacts ticket sales and overall industry revenue.

-

Industry-Specific Challenges: Beyond macroeconomic factors, the live music industry faces unique hurdles. The post-pandemic recovery has been uneven, with some venues struggling to regain pre-pandemic attendance levels. Simultaneously, rising operational costs – from venue rentals and artist fees to security and logistics – are squeezing profit margins.

-

Increased Competition: The rise of streaming services and other forms of entertainment poses a significant competitive threat. Consumers now have more diverse options for entertainment spending, making it harder for live music events to compete for their attention and disposable income.

Here's a summary of key contributing factors in bullet points:

- Inflationary pressures impacting ticket prices and consumer spending.

- Increased competition from streaming services and alternative entertainment.

- Supply chain issues affecting concert production and logistics.

- Potential impact of artist cancellations or delays due to illness or other unforeseen circumstances.

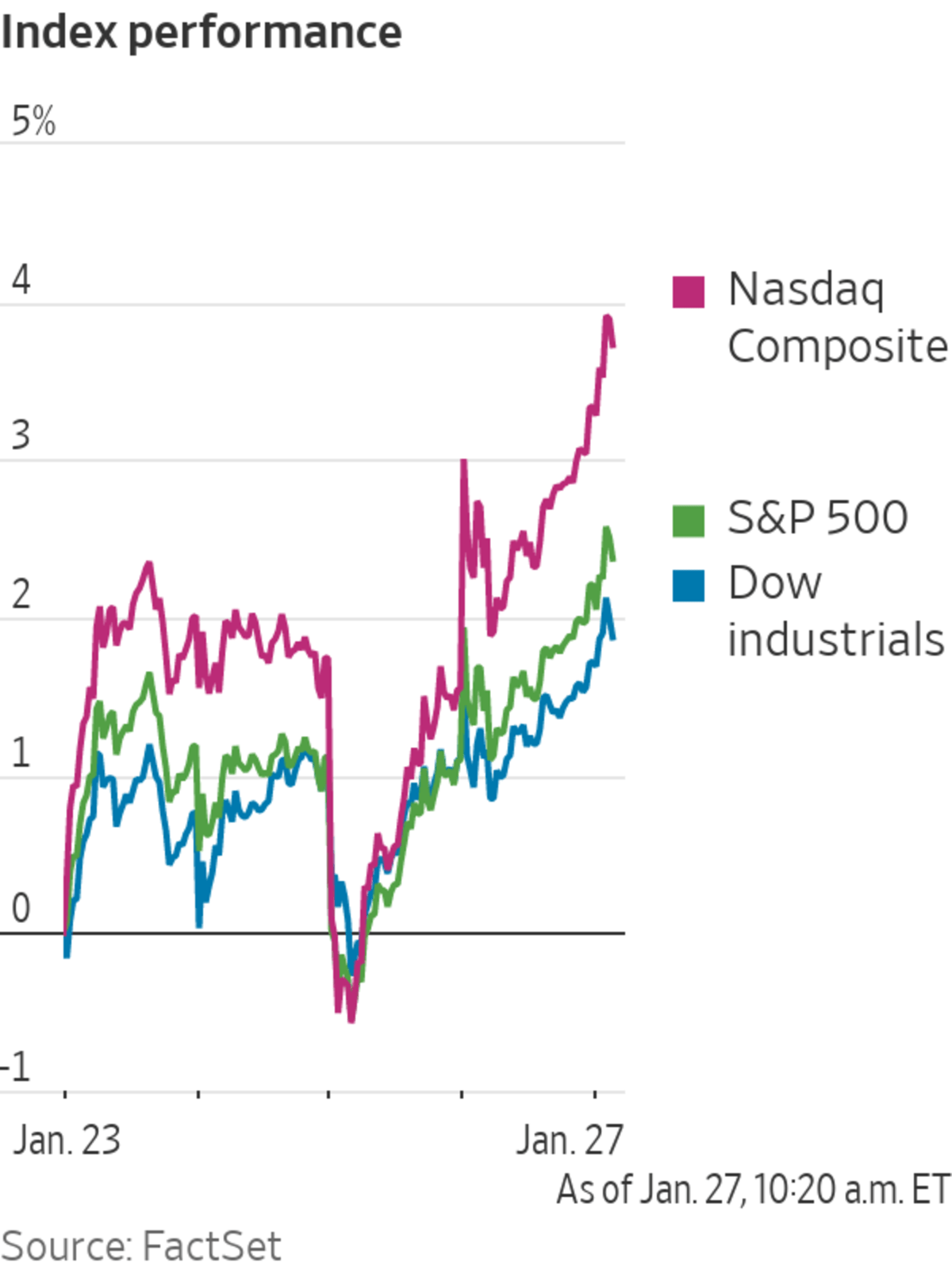

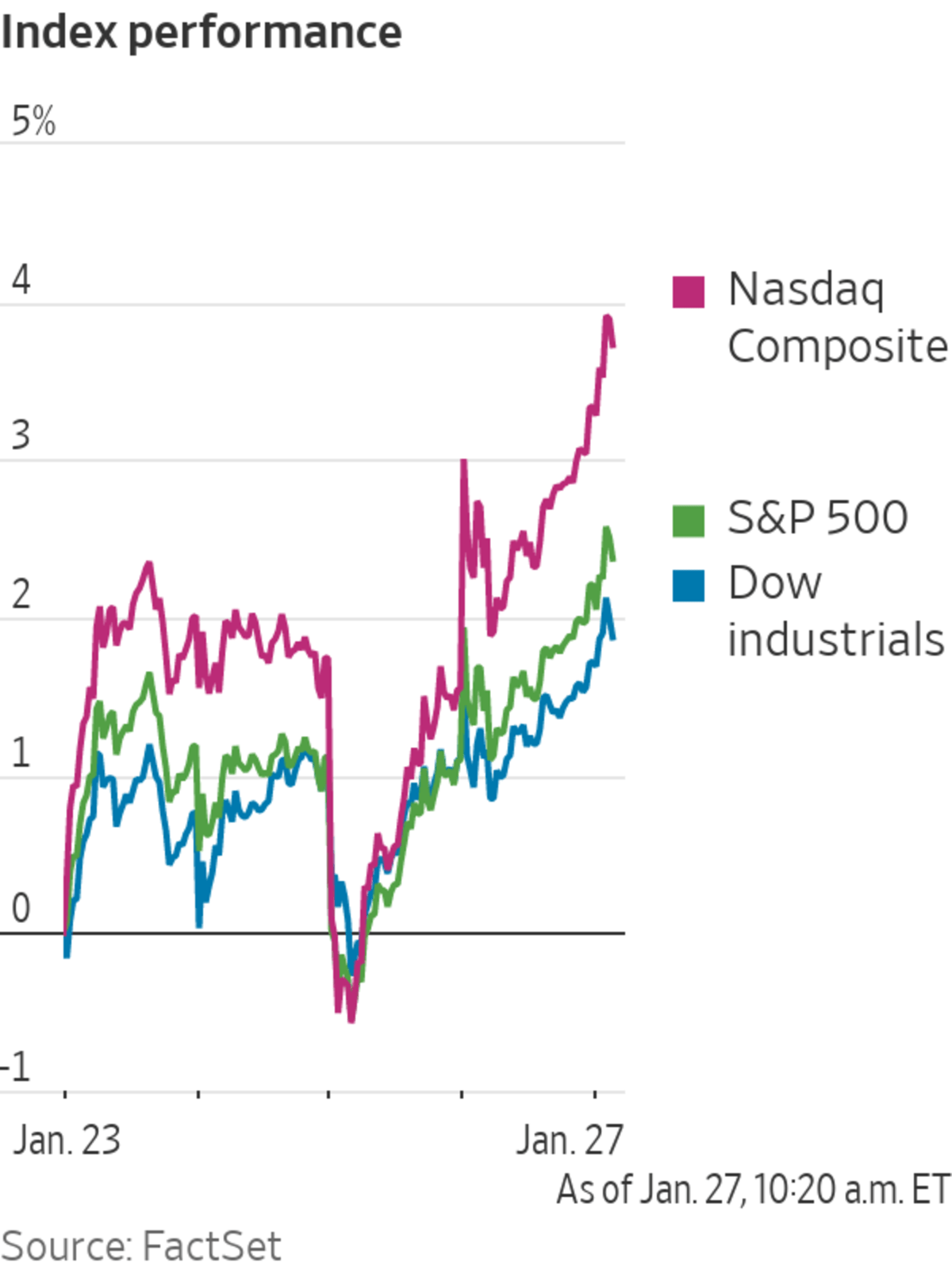

Technical Analysis Suggests Continued Decline

Technical analysis of live music stock charts points towards a continuation of the downward trend into Friday's trading. Several indicators suggest a bearish outlook. Keywords: Technical Analysis, Chart Patterns, Support Levels, Trading Volume, Bearish Trend.

While specific chart patterns and indicators vary depending on the individual stock, several common bearish signals are apparent:

-

Breakdown of Support Levels: Key support levels have been breached, indicating a weakening of the underlying price structure. This suggests further downside potential.

-

Decreasing Trading Volume: Falling trading volume alongside the price decline may indicate a lack of buying pressure and a potential weakening of the uptrend.

-

Negative Indicators: Bearish trendlines, negative RSI (Relative Strength Index) readings, and head and shoulders patterns (where applicable) all point towards a sustained decline.

(Note: This section would ideally include relevant charts and graphs illustrating these technical indicators.)

Potential Impact on Investors and the Live Music Industry

The continued slide in live music stocks carries significant implications for both investors and the live music industry itself. Keywords: Investor Impact, Portfolio Adjustments, Mergers and Acquisitions, Artist Compensation.

-

Investor Impact: Investors holding live music stocks face potential losses. Portfolio adjustments might be necessary to mitigate further risk, potentially requiring diversification into less volatile assets.

-

Industry Impact: A prolonged downturn could lead to reduced investment in new venues, impacting infrastructure development. Artist compensation might be affected, potentially leading to fewer touring opportunities or lower pay for musicians. Event cancellations or postponements due to financial constraints are also possible.

Here's a breakdown of potential impacts:

- Investment portfolio adjustments for investors.

- Potential for mergers and acquisitions within the industry to consolidate resources and market share.

- Impact on artist touring and profitability.

- Long-term implications for the live music experience, potentially leading to higher ticket prices or fewer events.

Hedging Strategies for Investors

Investors concerned about further declines in live music stocks can explore several hedging strategies to mitigate risk. Keywords: Risk Mitigation, Diversification, Stop-Loss Orders, Hedging Strategies. Diversification across different asset classes is crucial. Implementing stop-loss orders can help limit potential losses if the decline continues. Consult with a financial advisor for personalized strategies.

Conclusion: Navigating the Live Music Stock Slide

The current downturn in live music stocks is driven by a combination of macroeconomic factors and industry-specific challenges. Technical analysis suggests a continued slide into Friday's trading. The implications for investors and the live music industry are significant. Keywords: Live Music Stock Outlook, Investment Decisions, Market Trends, Financial Advice.

A cautious outlook is warranted in the near term. Closely monitor market trends and consult reputable financial news sources for updated information. Consider seeking professional financial advice to make informed investment decisions based on your risk tolerance and financial goals. Stay informed about the live music stock slide and its potential impact on your portfolio.

Featured Posts

-

Kan Anderlecht Sige Nej Til Et Godt Tilbud

May 30, 2025

Kan Anderlecht Sige Nej Til Et Godt Tilbud

May 30, 2025 -

Programma Tileoptikon Metadoseon Savvatoy 12 4

May 30, 2025

Programma Tileoptikon Metadoseon Savvatoy 12 4

May 30, 2025 -

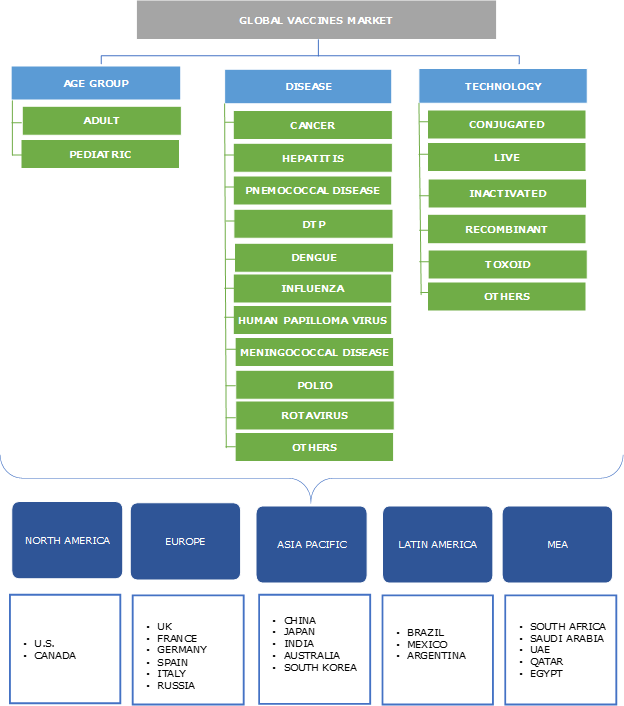

Understanding The Dynamics Of The Booming Vaccine Packaging Market

May 30, 2025

Understanding The Dynamics Of The Booming Vaccine Packaging Market

May 30, 2025 -

Alcaraz Vs Musetti A Monte Carlo Masters Showdown In 2025

May 30, 2025

Alcaraz Vs Musetti A Monte Carlo Masters Showdown In 2025

May 30, 2025 -

330 000 High Speed Rail Marketing Contract Awarded To Quebec Firm By Via Rail

May 30, 2025

330 000 High Speed Rail Marketing Contract Awarded To Quebec Firm By Via Rail

May 30, 2025