Live Now, Pay Later: Benefits, Risks, And How To Use It Responsibly

Table of Contents

Benefits of Live Now, Pay Later

Live Now, Pay Later schemes offer several potential advantages, but it's crucial to weigh them against the risks. Let's explore the potential upsides:

Increased Purchasing Power

LNPL allows you to purchase items you might otherwise postpone, significantly boosting your immediate spending capacity.

- Access to larger purchases without the immediate financial strain: Need a new appliance or furniture? LNPL can help you spread the cost over several months.

- Facilitates purchases during unexpected expenses or emergencies: Unexpected car repairs or medical bills can be easier to manage with the help of LNPL.

- Useful for budgeting smaller purchases across multiple pay periods: Instead of a large lump sum, you can break down the cost of smaller purchases (like groceries or clothes) into manageable payments.

Improved Budgeting and Cash Flow Management (Potentially)

Breaking down payments can make large purchases more manageable and potentially improve your budgeting.

- Helps spread the cost over time, potentially easing financial burden: Instead of a single, large payment impacting your monthly budget, you can spread it out.

- Avoids putting large amounts on credit cards with potentially higher interest rates: If used responsibly, LNPL can be a lower-cost alternative to high-interest credit card debt. (Note: this is only true if used responsibly – see Risks section).

Building Credit (Potentially)

Responsible use of LNPL services can positively impact your credit score.

- On-time payments demonstrate financial responsibility to credit bureaus: Consistent, timely payments show lenders you're a reliable borrower.

- Some LNPL providers report payment history to credit agencies: Check the terms and conditions of your chosen provider to see if they report to credit bureaus like Experian, Equifax, and TransUnion. (Note: This isn't always the case).

Risks of Live Now, Pay Later

While LNPL offers conveniences, several risks need careful consideration.

High Interest Rates and Fees

Late or missed payments can result in steep penalties and accumulating interest, making the final cost significantly higher than the original purchase price.

- Hidden fees and charges can significantly increase the final cost: Carefully review the terms and conditions to understand all associated fees before committing to a purchase.

- Understand the APR and all associated fees before committing: The Annual Percentage Rate (APR) reveals the true cost of borrowing. Don't just focus on the monthly payment.

Debt Accumulation

Overusing LNPL services can lead to unmanageable debt if not carefully monitored.

- Tracking all LNPL repayments is vital to avoid exceeding your budget: Use budgeting apps or spreadsheets to keep track of all your repayments and ensure you're not overspending.

- Multiple LNPL accounts can quickly become overwhelming: Stick to one or two providers to avoid losing track of your repayments.

Negative Impact on Credit Score

Missed payments can severely damage your credit rating, making future borrowing more difficult and expensive.

- Late payments are reported to credit bureaus, impacting loan applications and interest rates: A damaged credit score can make it harder to get loans or mortgages, and you'll likely face higher interest rates.

- A damaged credit score can make future borrowing significantly more expensive: This can impact everything from car loans to mortgages.

How to Use Live Now, Pay Later Responsibly

To avoid the pitfalls of LNPL, responsible usage is key.

Budget Carefully

Plan your purchases and ensure you can comfortably afford the repayments.

- Track your spending and repayment schedules meticulously: Use budgeting apps or spreadsheets to monitor your finances.

- Prioritize essential expenses over non-essential items: Only use LNPL for necessary purchases, not impulse buys.

Choose Reputable Providers

Research and compare different LNPL services to find the one with the most favorable terms and conditions.

- Read reviews and compare APRs and fees: Look for providers with transparent fees and positive customer reviews.

- Look for transparent and trustworthy companies: Avoid companies with hidden fees or unclear terms and conditions.

Pay on Time, Every Time

Make repayments on schedule to avoid late fees and damage your credit score.

- Set reminders and automate payments if possible: Set up calendar reminders or automatic payments to ensure you never miss a deadline.

- Consider setting up automatic payments to prevent missed deadlines: This is the easiest way to ensure on-time payments.

Limit Your Usage

Avoid using LNPL for multiple purchases simultaneously to prevent debt overload.

- Use LNPL sparingly for necessary purchases, not impulse buys: Only use it for items you truly need and can afford.

- Avoid exceeding your available credit across all LNPL and credit accounts: Keep track of your total credit utilization to avoid overextending yourself.

Conclusion

Live Now, Pay Later offers potential benefits, but understanding the inherent risks is vital. Used responsibly, LNPL can be a helpful tool for managing finances, but irresponsible use can quickly lead to debt and a damaged credit score. By carefully budgeting, choosing reputable providers, paying on time, and limiting your usage, you can harness the advantages of LNPL while mitigating the risks. Remember to always prioritize responsible spending habits when considering Live Now, Pay Later options. Make informed decisions and choose your LNPL provider wisely.

Featured Posts

-

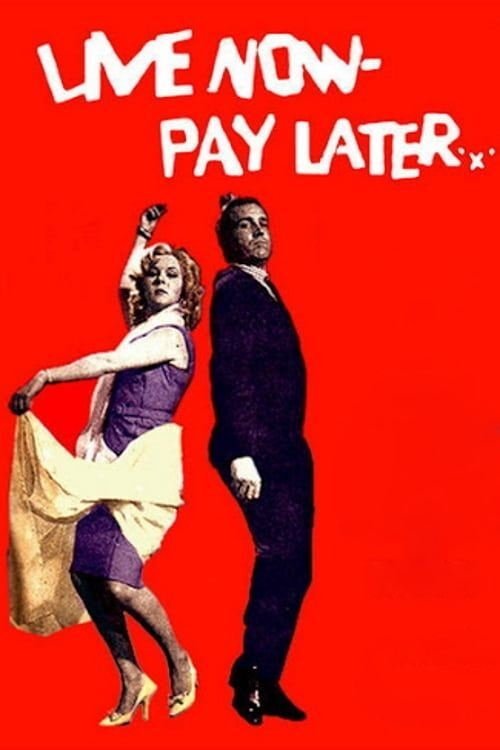

Izrail Preduprezhdenie Mada Ob Opasnykh Pogodnykh Usloviyakh

May 30, 2025

Izrail Preduprezhdenie Mada Ob Opasnykh Pogodnykh Usloviyakh

May 30, 2025 -

Age De Depart A La Retraite Negociations Secretes Entre Le Rn Et La Gauche

May 30, 2025

Age De Depart A La Retraite Negociations Secretes Entre Le Rn Et La Gauche

May 30, 2025 -

Amorim Afasta Possibilidade De Bruno Fernandes Deixar O Manchester United

May 30, 2025

Amorim Afasta Possibilidade De Bruno Fernandes Deixar O Manchester United

May 30, 2025 -

Arcelor Mittal Et La Guerre En Ukraine Decryptage Du 9 Mai 2025 Avec Laurent Jacobelli

May 30, 2025

Arcelor Mittal Et La Guerre En Ukraine Decryptage Du 9 Mai 2025 Avec Laurent Jacobelli

May 30, 2025 -

Ticketmaster Y Virtual Venue Una Nueva Era En La Compra De Entradas

May 30, 2025

Ticketmaster Y Virtual Venue Una Nueva Era En La Compra De Entradas

May 30, 2025

Latest Posts

-

Creating Your Good Life A Roadmap To Wellbeing

May 31, 2025

Creating Your Good Life A Roadmap To Wellbeing

May 31, 2025 -

The Good Life Finding Fulfillment And Purpose

May 31, 2025

The Good Life Finding Fulfillment And Purpose

May 31, 2025 -

Measuring The Good Life Tracking Your Progress And Adjustments

May 31, 2025

Measuring The Good Life Tracking Your Progress And Adjustments

May 31, 2025 -

How To Achieve The Good Life Simple Steps For Lasting Happiness

May 31, 2025

How To Achieve The Good Life Simple Steps For Lasting Happiness

May 31, 2025 -

The Evolving Good Life Adapting To Change And Growth

May 31, 2025

The Evolving Good Life Adapting To Change And Growth

May 31, 2025