Live Now, Pay Later: Your Guide To Smart Spending

Table of Contents

Understanding Live Now, Pay Later Services

How LNPL Works

Live now, pay later services allow you to purchase goods and services and defer payment to a later date. The specifics vary, but generally, you'll make a purchase and agree to a repayment schedule, often interest-free for a limited time. This "interest-free period" is a crucial detail – missed payments or exceeding the grace period can quickly lead to significant interest charges and fees. These services can be integrated directly at the checkout of many online retailers and even some physical stores.

Different Types of LNPL

Several types of LNPL options exist:

- Point-of-sale financing: Offered directly by retailers at the time of purchase. Think of the financing options offered when buying a new appliance or furniture.

- Buy now, pay later (BNPL) apps: Standalone apps like Affirm, Klarna, and Afterpay that work with numerous online merchants. These often offer a virtual credit card linked to your account.

- Store credit cards: Similar to BNPL apps but specific to a single retailer. These often have interest rates and other fees.

Bullet Points:

- Interest-free vs. Interest-bearing: Interest-free options are appealing, but always confirm the terms and conditions. Interest-bearing options can accumulate debt rapidly if not managed carefully.

- Payment Schedules and Due Dates: Understand your repayment schedule and set reminders to avoid late fees and negative impacts on your credit. Missed payments can have serious consequences.

- Credit Score Impact: While responsible use of LNPL can sometimes improve credit scores by demonstrating on-time payments, missed payments can significantly damage your creditworthiness.

Smart Strategies for Using Live Now, Pay Later

Budgeting and Financial Planning

Before considering LNPL, create a detailed budget. Track your income and expenses to identify areas where you can cut back. Using budgeting apps can significantly help with this process. Ensure you can comfortably afford the repayment plan before committing to the purchase.

Prioritizing Needs vs. Wants

Distinguish between essential purchases (necessities) and non-essential purchases (wants). Avoid using LNPL for non-essential items unless you have sufficient funds readily available to cover the payments without affecting other financial obligations. Impulse purchases are a major pitfall of LNPL.

Setting Realistic Repayment Goals

Develop a realistic repayment plan that fits your budget. Factor in all your financial commitments, including rent, bills, and other debts. Avoid spreading yourself too thin by using multiple LNPL services simultaneously.

Bullet Points:

- Budgeting Apps: Mint, YNAB (You Need A Budget), and Personal Capital can help track your spending and create a budget.

- Realistic Repayment Plan: Ensure the monthly payments are manageable without creating financial stress.

- Avoid Overextending Yourself: Using LNPL for multiple purchases at once can easily lead to debt overload.

Avoiding the Pitfalls of Live Now, Pay Later

The Danger of Overspending

LNPL's ease of access can tempt overspending. Remember that you’re still incurring debt. Avoid using LNPL as a substitute for saving or budgeting. The "buy now" aspect makes it easier to ignore the "pay later" part.

Managing Multiple LNPL Accounts

Juggling multiple LNPL accounts increases the risk of missed payments. Stick to one or two providers to avoid confusion and maintain better control over your finances. Track all your due dates diligently.

Understanding Fees and Interest

Some LNPL services have hidden fees or high interest rates that apply if payments are missed or the interest-free period expires. Thoroughly read the terms and conditions before using any service.

Bullet Points:

- Debt Accumulation: Missed payments rapidly lead to debt accumulation and damage your credit score.

- Negative Credit Impact: Late payments remain on your credit report for years, making it harder to secure loans or credit cards in the future.

- Debt Consolidation: If you’re struggling to manage multiple LNPL debts, consider consolidating them into a single, more manageable loan.

Conclusion

Live now, pay later services offer a convenient way to finance purchases, but responsible use is key. By understanding how these services work, creating a budget, prioritizing needs, and setting realistic repayment goals, you can leverage the benefits of LNPL without falling into the trap of debt. Remember, “live now, pay later” should enhance your financial well-being, not jeopardize it. Use live now, pay later wisely and responsibly to maintain your long-term financial health.

Featured Posts

-

Kawasaki W175 Atau Honda St 125 Dax Panduan Memilih Motor Sesuai Kebutuhan

May 30, 2025

Kawasaki W175 Atau Honda St 125 Dax Panduan Memilih Motor Sesuai Kebutuhan

May 30, 2025 -

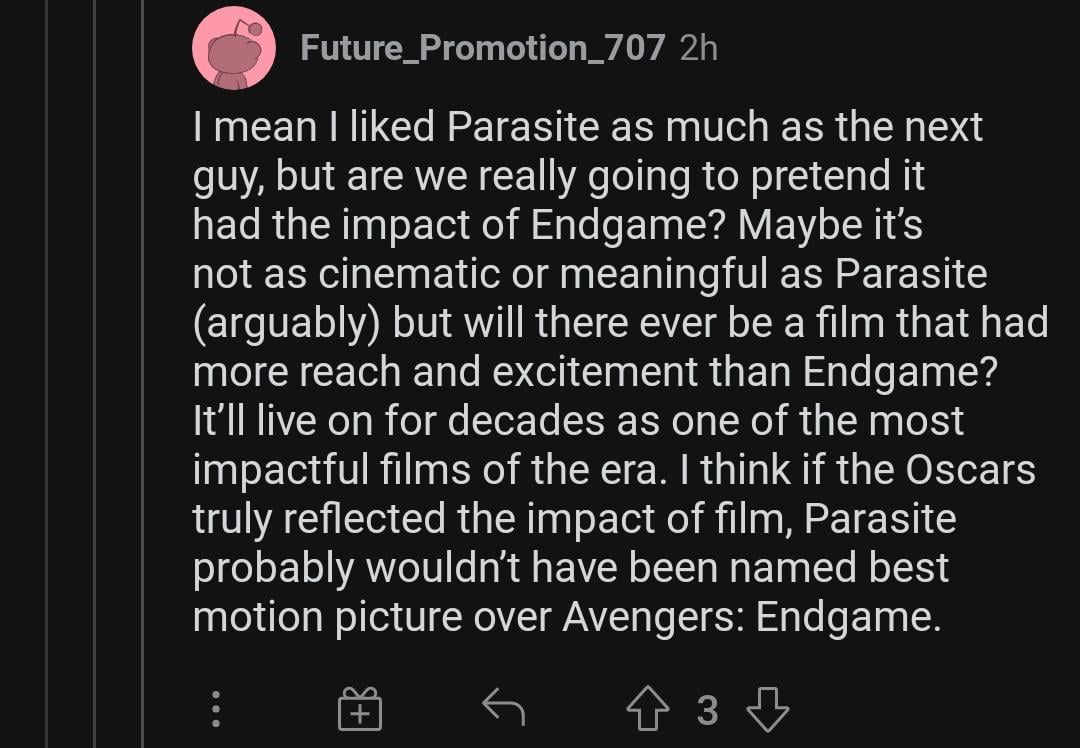

Fan Favorite Avenger Snubbed No Endgame Sequel Invite

May 30, 2025

Fan Favorite Avenger Snubbed No Endgame Sequel Invite

May 30, 2025 -

Augsburg Ontslaat Thorup De Race Naar De Nieuwe Trainer Is Begonnen

May 30, 2025

Augsburg Ontslaat Thorup De Race Naar De Nieuwe Trainer Is Begonnen

May 30, 2025 -

The French Opens Dark Side How Home Advantage Turns Against Visiting Players

May 30, 2025

The French Opens Dark Side How Home Advantage Turns Against Visiting Players

May 30, 2025 -

Jon Jones Vs Nate Diaz Ufc Legend Chooses Diaz Over Aspinall

May 30, 2025

Jon Jones Vs Nate Diaz Ufc Legend Chooses Diaz Over Aspinall

May 30, 2025