Los Angeles Wildfires: A Growing Market For Speculative Betting?

Table of Contents

The Rise of Wildfire Prediction Markets

The ability to accurately predict wildfire risk is crucial, not only for emergency response but also for the burgeoning market of wildfire speculation. This market hinges on data-driven predictions, attempting to forecast the likelihood, severity, and location of future wildfires.

Data-Driven Predictions and their Accuracy

Predictive modeling uses a variety of data sources to forecast wildfire risk. This includes:

- Meteorological Data: Temperature, humidity, wind speed, and precipitation data from sources like the National Oceanic and Atmospheric Administration (NOAA) are crucial inputs.

- Historical Wildfire Patterns: Analyzing past wildfire occurrences, their spread, and contributing factors helps identify high-risk areas.

- Fuel Load Assessments: Mapping vegetation density and dryness provides crucial information about the potential intensity of a wildfire.

- Cal Fire Data: Data from the California Department of Forestry and Fire Protection (Cal Fire) offers valuable insights into past incidents and current fire activity.

However, limitations exist. Predictive models are not perfect; their accuracy depends on the quality and completeness of the data, as well as the complexity of the underlying ecological and meteorological factors. While accuracy rates vary, these predictions provide a basis for speculative betting markets, albeit with inherent uncertainties. This data, while imperfect, is precisely what fuels the potential for speculative betting on Los Angeles wildfires.

The Role of Insurance Companies

Insurance companies play a significant role in assessing wildfire risk. Their analyses influence:

- Insurance Premiums: Higher wildfire risk in specific areas translates to increased premiums for homeowners and businesses.

- Policy Availability: In high-risk zones, insurance coverage might become limited or even unavailable.

- Reinsurance Markets: Reinsurance companies manage the risk for primary insurers, and their assessment of wildfire risk influences the overall insurance market stability.

The data collected and analyzed by insurance companies, though primarily focused on risk mitigation and financial stability, indirectly informs the speculative betting markets by providing another layer of information about perceived risk.

Ethical Concerns and Regulatory Challenges

The emergence of speculative betting on Los Angeles wildfires raises several significant ethical concerns.

Moral Hazard and the Impact on Prevention Efforts

The existence of such markets could create a moral hazard. If individuals or entities profit from wildfires, there's a potential disincentive to invest in wildfire prevention and mitigation efforts.

- Argument for Regulation: Proponents of regulation argue that it's necessary to prevent the exploitation of a natural disaster and protect vulnerable communities.

- Argument Against Regulation: Opponents suggest that free markets should be allowed to operate, and that regulation could stifle innovation and limit access to risk management tools.

The potential for increased risk-taking, fueled by the existence of betting markets, further complicates the situation.

The Vulnerability of Affected Communities

Profiting from the devastation caused by wildfires raises serious ethical questions, particularly concerning vulnerable communities disproportionately affected by these disasters.

- Ethical Considerations: Exploiting the suffering of those who have lost their homes and livelihoods is morally reprehensible.

- Potential for Exploitation: The lack of regulation and oversight creates an opportunity for exploitation.

- Social Responsibility: It is crucial to consider the social responsibility associated with such markets.

The Economic Landscape of Wildfire Speculation

Understanding the mechanics and potential economic consequences of wildfire speculation is vital.

The Mechanics of Wildfire Betting Markets

While currently largely hypothetical, the potential mechanics of wildfire betting markets could involve:

- Platforms: Dedicated online platforms could allow users to place bets on various aspects of wildfires, such as the severity, location, or duration of an event.

- Types of Bets: Bets could range from simple binary options (wildfire/no wildfire) to more complex predictions involving the extent of damage or the number of structures affected.

- Potential Return on Investment: The potential payouts would depend on the accuracy of the predictions and the odds offered by the platform.

The potential growth and profitability of such markets are significant, mirroring similar speculative markets in other areas of risk and uncertainty.

Economic Impact on Los Angeles

The economic impact of a thriving wildfire betting market on Los Angeles is complex and potentially significant.

- Potential for Economic Growth: The market could generate revenue and create new jobs within the financial sector.

- Potential for Exploitation and Instability: Unregulated markets could lead to exploitation and exacerbate existing economic inequalities.

- Broader Economic Impact: The overall effect on the city's economy would depend on the market's regulation and management.

Conclusion

The potential for speculative betting on Los Angeles wildfires presents a complex landscape of opportunity and risk. While the possibility of data-driven prediction markets offers potential economic benefits, the ethical concerns surrounding profiting from natural disasters and the vulnerability of affected communities cannot be ignored. The lack of regulation highlights the urgent need for responsible discussion and potential legislative action to address the ethical and economic implications of this emerging market. We urge readers to research the topic further, investigating organizations involved in wildfire risk assessment and exploring legislative efforts related to speculative betting on natural disasters, including researching "Los Angeles wildfire prediction markets," "speculative betting on California wildfires," and the "future of wildfire risk assessment and financial markets." Only through informed discussion can we navigate the complex challenges and opportunities presented by this developing trend.

Featured Posts

-

Crazy Rich Asians A New Series In Development At Hbo Max

May 11, 2025

Crazy Rich Asians A New Series In Development At Hbo Max

May 11, 2025 -

Scenes De Menages Gerard Hernandez Revele Ses Difficultes Avec Chantal Ladesou

May 11, 2025

Scenes De Menages Gerard Hernandez Revele Ses Difficultes Avec Chantal Ladesou

May 11, 2025 -

Zhang Weili Vs Valentina Shevchenko The Ufc 315 Superfight We Need

May 11, 2025

Zhang Weili Vs Valentina Shevchenko The Ufc 315 Superfight We Need

May 11, 2025 -

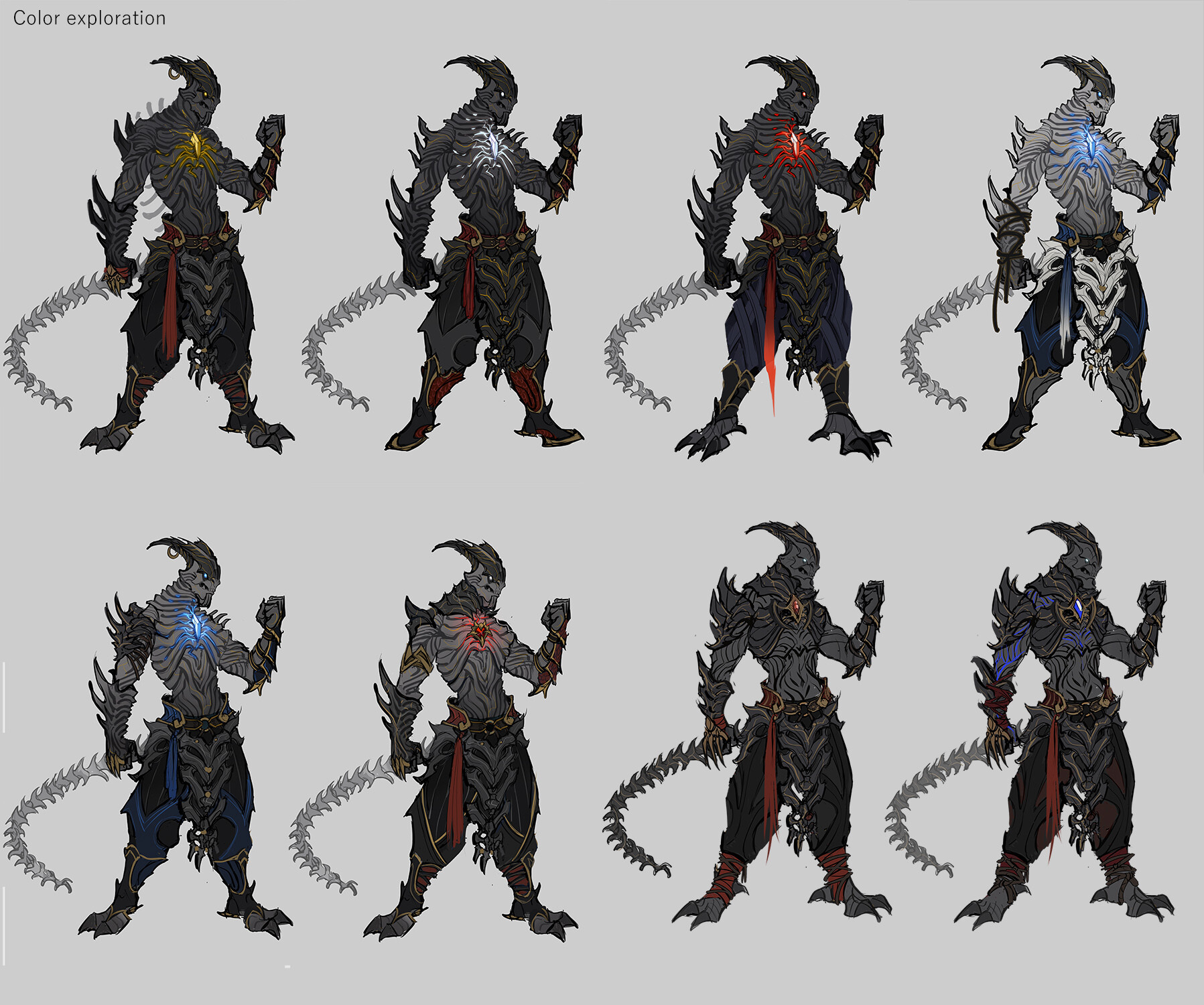

Ufcs Shevchenko Debuts Custom Dragon Themed Fighting Gear

May 11, 2025

Ufcs Shevchenko Debuts Custom Dragon Themed Fighting Gear

May 11, 2025 -

Plei Of Nba Imerominies Agonon And Analysi Ton Zeygarion

May 11, 2025

Plei Of Nba Imerominies Agonon And Analysi Ton Zeygarion

May 11, 2025

Latest Posts

-

Oregon Womens Basketball Graves International Recruitment Success

May 13, 2025

Oregon Womens Basketball Graves International Recruitment Success

May 13, 2025 -

Local Protest Highlights Resistance To Trumps State Of The Union Message

May 13, 2025

Local Protest Highlights Resistance To Trumps State Of The Union Message

May 13, 2025 -

Kelly Graves Adds Australian Player To Oregon Ducks Roster

May 13, 2025

Kelly Graves Adds Australian Player To Oregon Ducks Roster

May 13, 2025 -

Local Opposition To Trumps State Of The Union A Protest Erupts

May 13, 2025

Local Opposition To Trumps State Of The Union A Protest Erupts

May 13, 2025 -

Obituaries A Tribute To Recently Deceased Local Residents

May 13, 2025

Obituaries A Tribute To Recently Deceased Local Residents

May 13, 2025