Los Angeles Wildfires And The Growing Market For Disaster Bets

Table of Contents

The Mechanics of Disaster Bets

Disaster bets, a relatively new area of financial speculation, encompass various instruments used to wager on the likelihood and severity of catastrophic events like wildfires. Understanding the mechanics is crucial to grasping the risks and potential rewards involved.

Types of Disaster Bets

-

Insurance Derivatives: These financial contracts derive their value from insurance policies. Investors can buy or sell these derivatives, effectively betting on the total payout an insurer will make for wildfire claims. A large wildfire season would increase the value of these derivatives, yielding profits for those who bet correctly. The risk lies in misjudging the extent of the damage.

-

Prediction Markets: Platforms like PredictIt (now defunct) or other similar markets allow individuals to bet on the likelihood and severity of wildfires. For example, users might bet on the total acreage burned in a given fire season or whether a specific region will exceed a certain damage threshold. These markets often aggregate collective wisdom, potentially providing a more accurate forecast than individual predictions.

-

Traditional Sports Betting Parallels: While seemingly unrelated, the principles behind betting on sports events share similarities with disaster bets. Just as one might bet on a team's performance, individuals can bet on the extent of wildfire damage, mirroring the prediction of an outcome based on various factors. The key difference is the devastating real-world consequences associated with wildfire devastation.

-

Complexities, Returns, and Risks:

- Complexity: Understanding the underlying mechanisms of each bet type requires specialized knowledge and analysis.

- High Returns: The potential for significant returns is a major draw for investors willing to take on substantial risk.

- Inherent Risks: Inaccurate predictions, unforeseen circumstances, and market volatility can lead to substantial losses.

Regulatory Landscape of Disaster Betting

The regulatory landscape surrounding disaster bets remains largely undefined, particularly concerning wildfires.

-

Legal Status in California and the US: Currently, the legality of disaster bets varies depending on the specific instrument and jurisdiction. While some forms of insurance derivatives are regulated, prediction markets often fall into legal gray areas.

-

Ethical Considerations: Profiting from natural disasters raises significant ethical concerns. Critics argue that such markets trivialize human suffering and potentially incentivize inaction in disaster preparedness.

-

Government Oversight: The lack of clear regulation and oversight is a significant concern, leaving the market vulnerable to manipulation and exploitation. The need for stronger government intervention and ethical guidelines is increasingly apparent.

-

Need for Stronger Oversight:

- Lack of Transparency: Many aspects of these markets lack transparency, making it difficult to assess risks accurately.

- Potential for Manipulation: The lack of regulation increases the potential for market manipulation and price distortion.

- Consumer Protection: Without proper regulation, investors are at risk of significant losses without adequate safeguards.

The Impact of Climate Change on Wildfire Risk and Betting Markets

Climate change is a major driver of increased wildfire risk in Los Angeles and across California. This heightened risk directly impacts the disaster bet market.

Increased Frequency and Severity of Wildfires

-

Climate Change Connection: Rising temperatures, prolonged droughts, and changes in vegetation patterns due to climate change are creating conditions that fuel more frequent and intense wildfires.

-

Scientific Evidence: Numerous scientific studies demonstrate a clear link between climate change and the increased severity of wildfires in California. Data shows a consistent upward trend in both the frequency and intensity of these events.

-

Wildfire Damage Costs: The economic cost of wildfires in Los Angeles and California has skyrocketed in recent years, adding fuel to the disaster bet market's growth. Billions of dollars in property damage and economic disruption are now commonplace.

-

Increased Risk and Market Impact:

- Higher Stakes: The increasing frequency and severity of wildfires translate to higher stakes in the disaster bet market.

- Increased Volatility: The unpredictability of wildfire behavior adds volatility and risk to these bets.

- Greater Investor Interest: The escalating risk profile attracts investors seeking higher potential returns, despite the increased uncertainty.

Predictive Modeling and Disaster Bets

Sophisticated predictive modeling plays a crucial role in the disaster bet market.

-

Climate Models and Data: Climate models and historical wildfire data are used to assess risk and inform betting strategies. These models consider factors such as temperature, humidity, wind patterns, and fuel load.

-

Accuracy and Limitations: While these models provide valuable insights, they are not perfect. Unpredictable weather patterns and unforeseen circumstances can significantly impact the accuracy of predictions.

-

Technology and AI: The use of advanced technologies like artificial intelligence is improving the accuracy of predictive models, further fueling the growth of the disaster bet market.

-

Scientific Prediction and Financial Speculation:

- Data-Driven Decisions: The market relies heavily on data-driven predictions, creating a complex interplay between scientific research and financial speculation.

- Uncertainty and Risk: The inherent limitations of predictive models introduce significant uncertainty and risk into the market.

- Potential for Misinterpretation: The complexity of these models can lead to misinterpretations and potentially flawed investment strategies.

The Social and Economic Implications of Disaster Bets

The rise of disaster bets carries significant social and economic consequences.

Impact on Insurance Premiums

-

Correlation with Rising Premiums: The increased risk of wildfires, coupled with speculation in the disaster bet market, can lead to higher insurance premiums for homeowners and businesses.

-

Speculation and Premiums: Investors’ bets on wildfire severity can influence insurers' risk assessments, potentially driving up premiums even further.

-

Implications for Homeowners and Businesses: Higher insurance costs place a disproportionate burden on communities already vulnerable to wildfire damage. Many may face unaffordable premiums, leading to underinsurance and increased financial vulnerability.

-

Burden on Communities:

- Financial Strain: Rising insurance premiums create a significant financial strain on individuals and businesses.

- Displacement: Unaffordable premiums may force residents to relocate, impacting community stability.

- Need for Equitable Solutions: Addressing this issue requires exploring equitable and affordable insurance solutions.

Community Resilience and Disaster Preparedness

-

Funding Disaster Relief: While some argue that disaster bets could potentially fund disaster relief efforts, the reality is far more complex. The direct link between profits from these bets and disaster aid remains tenuous.

-

Philanthropic Initiatives: Some philanthropic initiatives might incorporate strategies linked to these markets, aiming to incentivize mitigation and preparedness. However, these remain nascent and relatively small-scale efforts.

-

Potential Benefits vs. Negative Aspects: The potential for positive outcomes needs to be weighed carefully against the negative aspects of speculation and the ethical concerns raised.

-

Ethical Considerations and Responsible Investment:

- Profiting from Suffering: The ethical implications of profiting from the misfortune of others need to be carefully considered.

- Responsible Investment Strategies: Promoting responsible investment strategies that prioritize community resilience and disaster preparedness is paramount.

- Transparency and Accountability: Greater transparency and accountability within the disaster bet market are essential to ensure its ethical application.

Conclusion

The increasing frequency and severity of Los Angeles wildfires are driving a complex and rapidly evolving market for disaster bets. While offering potential investment opportunities, this market raises significant ethical and regulatory concerns. Understanding the intricacies of disaster bets, including the risks and the ethical considerations surrounding them, is crucial for both investors and policymakers. Further research into responsible investment strategies concerning Los Angeles wildfires and the broader disaster bet market is vital. Learn more about the growing market for disaster bets related to Los Angeles wildfires and how to navigate this complex landscape responsibly.

Featured Posts

-

Bbcs Four Year Partnership With The Ecb Confirmed

May 23, 2025

Bbcs Four Year Partnership With The Ecb Confirmed

May 23, 2025 -

Memorial Day Travel Gas Prices At Their Lowest

May 23, 2025

Memorial Day Travel Gas Prices At Their Lowest

May 23, 2025 -

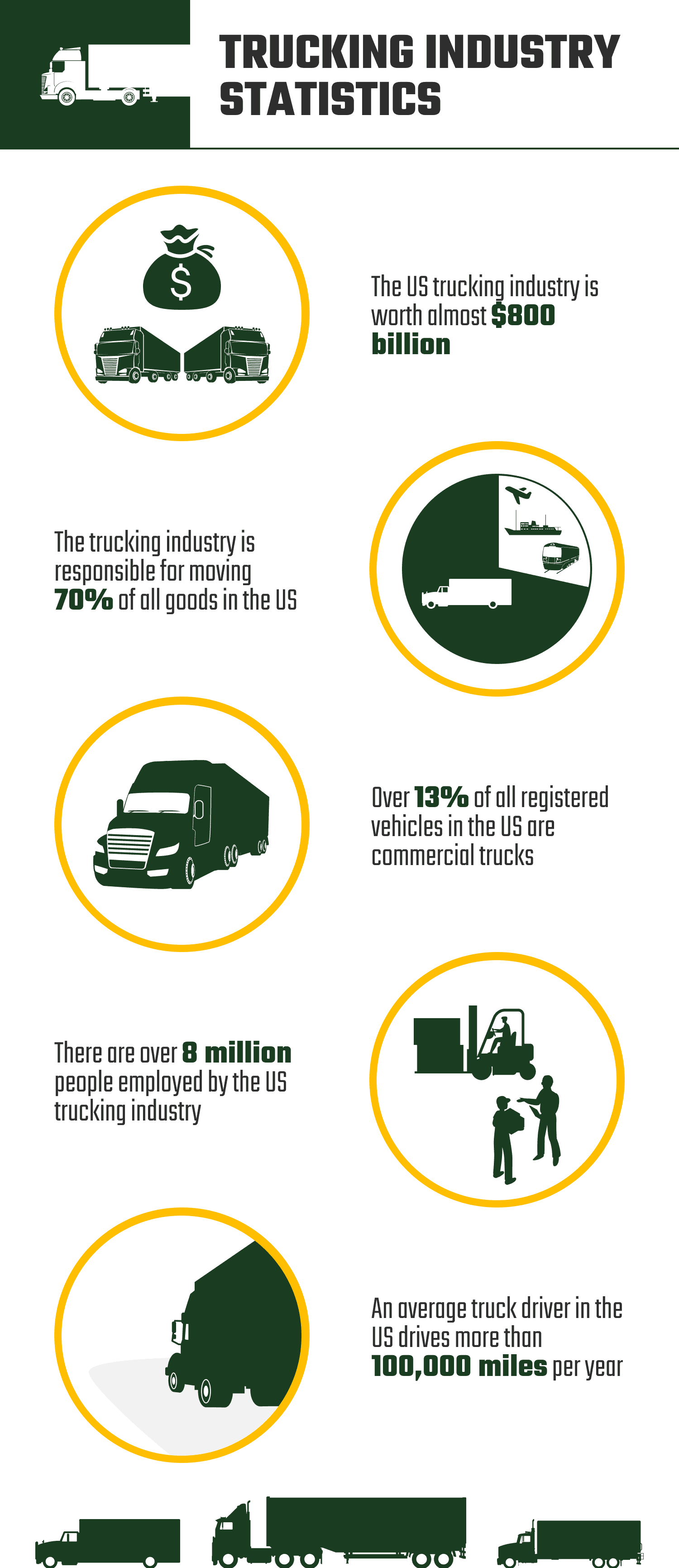

Big Rig Rock Report 3 12 On Rock 106 1 Trucking Industry Update

May 23, 2025

Big Rig Rock Report 3 12 On Rock 106 1 Trucking Industry Update

May 23, 2025 -

Joe Jonas A Couples Fight And His Measured Response

May 23, 2025

Joe Jonas A Couples Fight And His Measured Response

May 23, 2025 -

Nisan 2024 Zengin Olmaya Hazirlanan Burclar

May 23, 2025

Nisan 2024 Zengin Olmaya Hazirlanan Burclar

May 23, 2025

Latest Posts

-

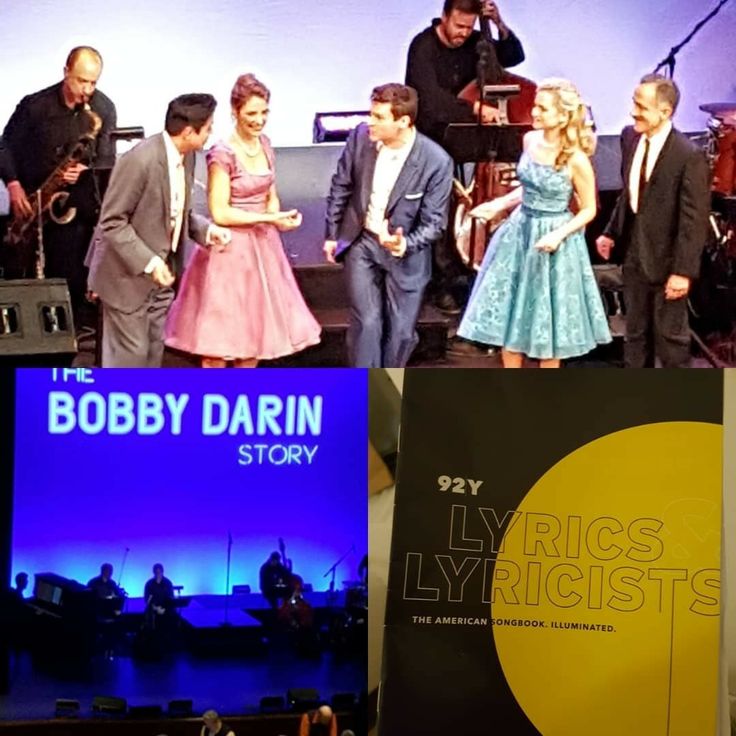

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Actor Jonathan Groff Opens Up About His Experience With Asexuality

May 23, 2025

Actor Jonathan Groff Opens Up About His Experience With Asexuality

May 23, 2025 -

Jonathan Groff On Bobby Darin The Just In Time Performance And His Raw Talent

May 23, 2025

Jonathan Groff On Bobby Darin The Just In Time Performance And His Raw Talent

May 23, 2025 -

Jonathan Groff Discusses His Past And Asexuality

May 23, 2025

Jonathan Groff Discusses His Past And Asexuality

May 23, 2025 -

Jonathan Groffs Just In Time Primal Performance And The Bobby Darin Influence

May 23, 2025

Jonathan Groffs Just In Time Primal Performance And The Bobby Darin Influence

May 23, 2025