Low Inflation: Your Financial Advantage (Podcast)

Table of Contents

Low Inflation and Increased Purchasing Power

Low inflation means prices for goods and services rise slowly or remain relatively stable. This directly translates to increased purchasing power; your money buys more. Keywords: Purchasing power, inflation rate, consumer spending, price stability, affordability.

-

Less erosion of your savings and income: With low inflation, the value of your money isn't significantly diminished over time. Your savings retain their buying power, allowing you to maintain your lifestyle and achieve your financial goals more effectively.

-

Ability to buy more goods and services with the same amount of money: A stable price environment means your budget stretches further. You can afford more groceries, entertainment, and other necessities without sacrificing your savings goals.

-

Enhanced consumer confidence leading to increased spending: When prices are stable and predictable, consumers feel more confident about their financial future, leading to increased spending and boosting economic activity.

-

Easier budgeting and financial planning due to predictable price changes: Predictable price increases make budgeting and financial planning significantly easier. You can accurately forecast expenses and set realistic financial goals. This predictability is a major financial advantage.

Low Inflation’s Positive Impact on Savings and Investments

When inflation is low, your savings retain their value better, and your investment returns aren't eroded as quickly. Low inflation can also lead to lower interest rates, making borrowing cheaper but potentially impacting returns on some savings vehicles. Keywords: Savings accounts, investment returns, interest rates, risk-free rate, long-term investment, fixed income.

-

Higher real returns on investments (nominal return minus inflation): The real return on your investments – the return after accounting for inflation – is higher during periods of low inflation. This means your investments grow at a faster rate in real terms.

-

Greater potential for capital appreciation in assets: With low inflation, asset prices are less likely to be driven up solely by inflationary pressures. This can lead to greater potential for capital appreciation (growth in the value of your assets).

-

More attractive interest rates on savings accounts (though potentially lower than during inflationary periods): While interest rates might be lower during low inflation, the real return on your savings is likely to be higher due to the lower inflation rate.

-

Reduced risk associated with inflation-linked investments: Inflation-linked investments, such as TIPS (Treasury Inflation-Protected Securities), become less attractive during low inflation periods. This reduces the need for complex strategies to protect against inflation erosion.

Low Inflation and Economic Growth

While high inflation can stifle economic growth, a period of low and stable inflation can foster a healthier economic climate. This is because predictable prices encourage business investment and consumer spending, leading to job creation and sustained expansion. Keywords: Economic growth, GDP, consumer confidence, business investment, employment, sustainable growth.

-

Increased business investment due to lower uncertainty: Businesses are more likely to invest when they can accurately predict future costs and prices. Low inflation creates this predictability, leading to increased capital expenditure and job growth.

-

Stimulated consumer spending and increased demand: Consumer confidence rises when inflation is low, leading to increased spending and higher demand for goods and services. This further stimulates economic growth.

-

Stronger economic growth leading to better job opportunities: The combination of increased investment and consumer spending results in stronger economic growth and more job creation opportunities.

-

A more stable and predictable economic environment: Low inflation contributes to a more stable and predictable economic environment, reducing uncertainty for both businesses and consumers.

Navigating Low Inflation: Strategies for Financial Success

Even during periods of low inflation, smart financial planning is crucial. This section outlines strategies to maximize your financial advantage in this environment. Keywords: Financial planning, budgeting, investment strategy, diversification, debt management, retirement planning.

-

Diversify your investment portfolio to mitigate risk: Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce your overall risk.

-

Develop a comprehensive budget to track expenses and savings: A well-structured budget is essential to track your income and expenses and ensure you're saving enough to meet your financial goals.

-

Prioritize paying down high-interest debt: High-interest debt can significantly impact your financial well-being. Prioritize paying it down to free up cash flow and improve your financial position.

-

Plan for retirement effectively by taking advantage of long-term growth potential: Low inflation provides a favorable environment for long-term investments. Take advantage of this by contributing regularly to your retirement accounts.

-

Regularly review your financial plan and adjust as needed: Your financial circumstances and goals may change over time. Regularly review and adjust your financial plan accordingly.

Conclusion

Low inflation presents a considerable financial advantage, offering increased purchasing power, better investment returns, and a more stable economic environment. By understanding its implications and adopting appropriate financial strategies, you can significantly improve your financial well-being. Our podcast episode provides a deeper dive into these topics and offers practical advice.

Call to Action: Learn more about maximizing your financial advantage during low inflation. Listen to our podcast now and start making informed decisions about your savings and investments! #LowInflation #FinancialPlanning #FinancialAdvantage

Featured Posts

-

Le Congres Du Ps Debat Sur La Rupture Avec Melenchon Selon Bouamrane

May 27, 2025

Le Congres Du Ps Debat Sur La Rupture Avec Melenchon Selon Bouamrane

May 27, 2025 -

The Dangers Of Synthetic Hair Braids For Black Womens Health

May 27, 2025

The Dangers Of Synthetic Hair Braids For Black Womens Health

May 27, 2025 -

Sex Lives Of College Girls Cancelled What Happened And Whats Next

May 27, 2025

Sex Lives Of College Girls Cancelled What Happened And Whats Next

May 27, 2025 -

Nigerian Food And Football Osimhens Transfer Speculation

May 27, 2025

Nigerian Food And Football Osimhens Transfer Speculation

May 27, 2025 -

Lagarde Dan Enflasyon Ve Kueresel Ticaret Sikintilarina Iliskin Aciklamalar

May 27, 2025

Lagarde Dan Enflasyon Ve Kueresel Ticaret Sikintilarina Iliskin Aciklamalar

May 27, 2025

Latest Posts

-

Teenagers Arrested For Attack On 16 Year Old Hate Crime Allegations

May 29, 2025

Teenagers Arrested For Attack On 16 Year Old Hate Crime Allegations

May 29, 2025 -

Dodelijke Aanrijding A67 Bij Grashoek Man Uit Venlo Overleden

May 29, 2025

Dodelijke Aanrijding A67 Bij Grashoek Man Uit Venlo Overleden

May 29, 2025 -

Five Teenagers Arrested In Gay Bashing Of 16 Year Old

May 29, 2025

Five Teenagers Arrested In Gay Bashing Of 16 Year Old

May 29, 2025 -

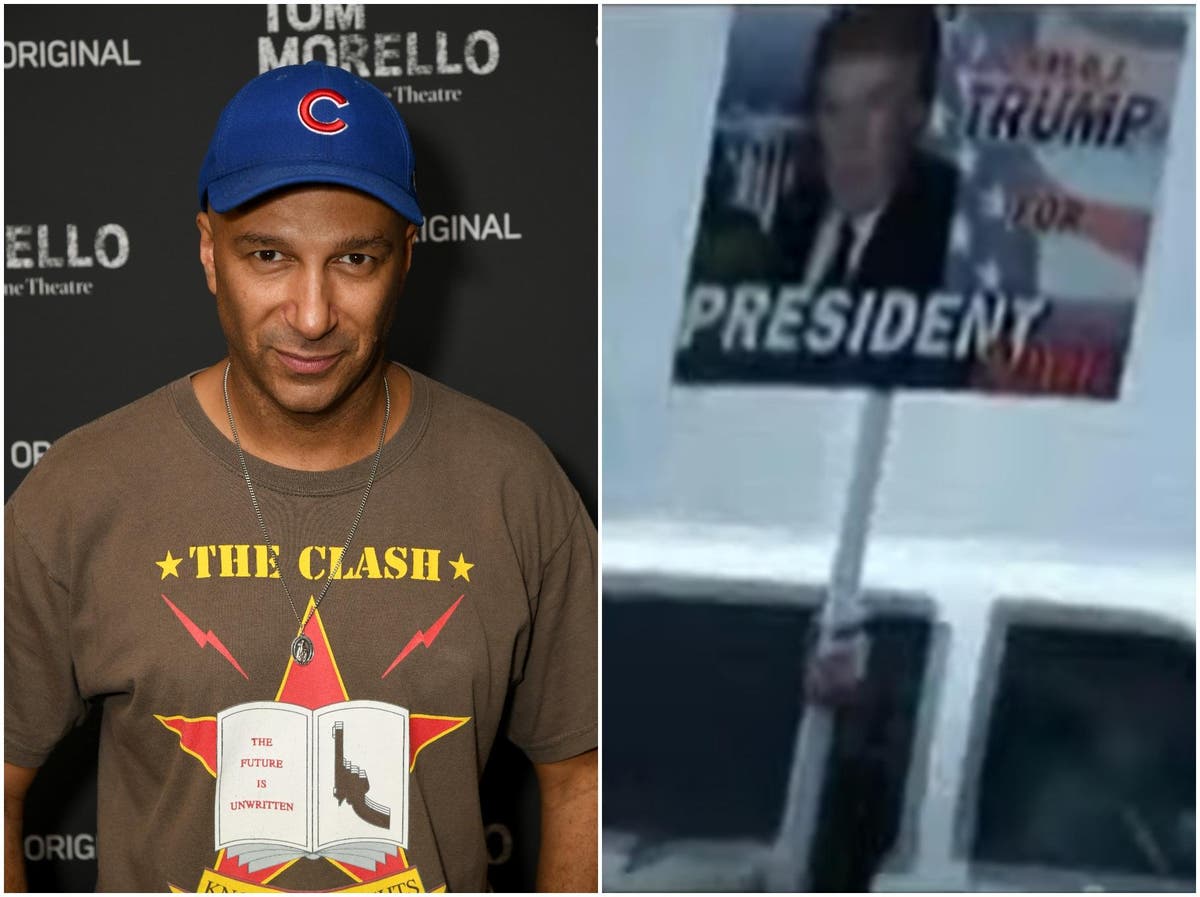

Rage Against The Machine O Morello Xtypaei Ton Tramp Kai Sygkrinei Ton Springsteen

May 29, 2025

Rage Against The Machine O Morello Xtypaei Ton Tramp Kai Sygkrinei Ton Springsteen

May 29, 2025 -

O Tom Morello Kai I Sfodri Kritiki Toy Gia Ton Donald Trump

May 29, 2025

O Tom Morello Kai I Sfodri Kritiki Toy Gia Ton Donald Trump

May 29, 2025