Lower Inflation, Higher Pound: Traders Adjust BOE Rate Cut Expectations

Table of Contents

Falling Inflation Fuels Pound Strength

Impact of Lower-Than-Expected Inflation

Lower-than-anticipated inflation figures have dramatically influenced market sentiment. The decreased inflationary pressure reduces the urgency for the BOE to implement aggressive interest rate hikes. This positive economic news boosts investor confidence in the UK economy, leading to increased demand for the British Pound. Consequently, the Pound has strengthened against other major currencies, such as the US dollar (USD) and the Euro (EUR).

- Decreased inflationary pressure: The recent CPI (Consumer Price Index) and RPI (Retail Price Index) figures showed a more significant drop in inflation than many economists predicted, easing concerns about a sustained period of high inflation.

- Increased investor confidence: Lower inflation signals a healthier economic outlook, attracting foreign investment and driving up demand for the Pound.

- Stronger Pound against other major currencies: GBP/USD and GBP/EUR exchange rates have shown notable increases, reflecting the improved market sentiment.

Technical Analysis of GBP/USD and GBP/EUR

Technical indicators support the observation of Pound strengthening. Chart patterns show a clear upward momentum for the Pound against both the USD and EUR.

- Upward momentum: GBP/USD and GBP/EUR charts display clear bullish trends, with prices breaking through key resistance levels.

- Support and resistance levels: Previous resistance levels have become new support levels, indicating a sustained upward trend.

- Trading volume increases: Higher trading volumes accompany the price increases, suggesting strong conviction behind the Pound's appreciation.

- Technical indicators: RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) indicators also point towards a strong bullish trend for the Pound.

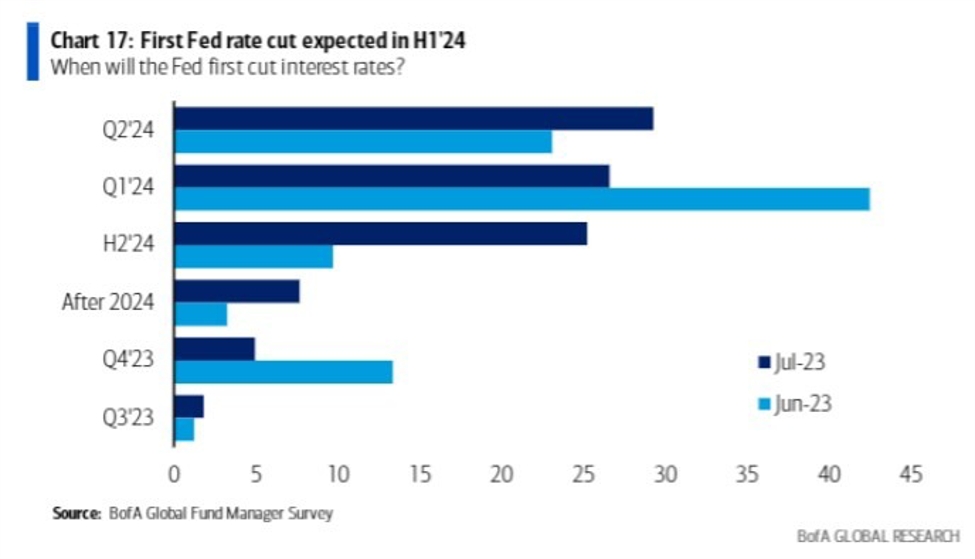

Revised BOE Rate Cut Expectations

Shift in Market Sentiment

The decline in inflation has significantly altered trader sentiment regarding potential BOE rate cuts. The probability of further rate cuts has diminished considerably.

- Reduced probability of further rate cuts: Many market analysts now believe the BOE is less likely to continue its cycle of interest rate cuts.

- Potential for a pause in rate adjustments: A pause in interest rate adjustments is now considered a more probable scenario than further cuts.

- Market speculation on future rate hikes: Some market participants are even speculating about the possibility of future interest rate hikes should inflation rebound.

- Analyst predictions and market consensus: Major financial institutions and market analysts have revised their forecasts to reflect the changed outlook.

Factors Influencing the BOE's Decision-Making

While inflation is a key factor, the BOE's decision-making process considers other economic indicators.

- Wage growth data: Sustained wage growth could put upward pressure on inflation, influencing the BOE's decision.

- Unemployment figures: Low unemployment rates could also contribute to inflationary pressures.

- Global economic conditions: Global economic uncertainty and geopolitical events can significantly impact the UK economy and influence the BOE's policy decisions.

- Geopolitical factors: Brexit-related uncertainties and global political instability continue to play a role in the BOE's considerations.

Impact on UK Economy and Financial Markets

Implications for Borrowing Costs

The shift in BOE rate cut expectations has significant implications for borrowing costs.

- Lower borrowing costs for businesses: Reduced expectations of further rate cuts could translate to lower borrowing costs for businesses, potentially stimulating investment and economic growth.

- Impact on mortgage rates: Lower interest rates generally lead to lower mortgage rates, benefiting homeowners and potentially boosting the housing market.

- Effect on consumer spending: Lower borrowing costs can encourage consumer spending, further contributing to economic growth.

Wider Market Implications

The changing outlook on BOE rate cuts has broader implications for UK financial markets.

- Stock market performance (FTSE 100): The FTSE 100 index has generally reacted positively to the improved economic outlook.

- Bond yields: Government bond yields may adjust in response to the changed expectations regarding interest rates.

- Impact on the UK housing market: Lower mortgage rates could lead to increased demand and potentially higher house prices.

Conclusion

The recent decline in inflation has significantly altered market expectations surrounding the Bank of England's interest rate policy. This has led to a strengthening of the Pound and a reassessment of the likelihood of future rate cuts. Traders are now pricing in a lower probability of further rate reductions, reflecting a more optimistic outlook for the UK economy. Understanding the evolving BOE rate cut expectations and their impact on the Pound is crucial for making sound investment decisions.

Call to Action: Stay informed on the evolving BOE rate cut expectations and their impact on the Pound. Monitor inflation data releases, wage growth figures, and unemployment statistics. Follow expert analysis to effectively navigate the changing economic landscape and make informed investment decisions regarding the BOE rate cut expectations. Understanding the interplay between inflation, the Pound, and the BOE's actions is crucial for successful trading and investment strategies.

Featured Posts

-

La Rental Market Exploits Price Gouging Following Recent Fires

May 22, 2025

La Rental Market Exploits Price Gouging Following Recent Fires

May 22, 2025 -

Chi Varto Putinu Rizikuvati Obman Trampa Ta Yogo Potentsiyni Naslidki

May 22, 2025

Chi Varto Putinu Rizikuvati Obman Trampa Ta Yogo Potentsiyni Naslidki

May 22, 2025 -

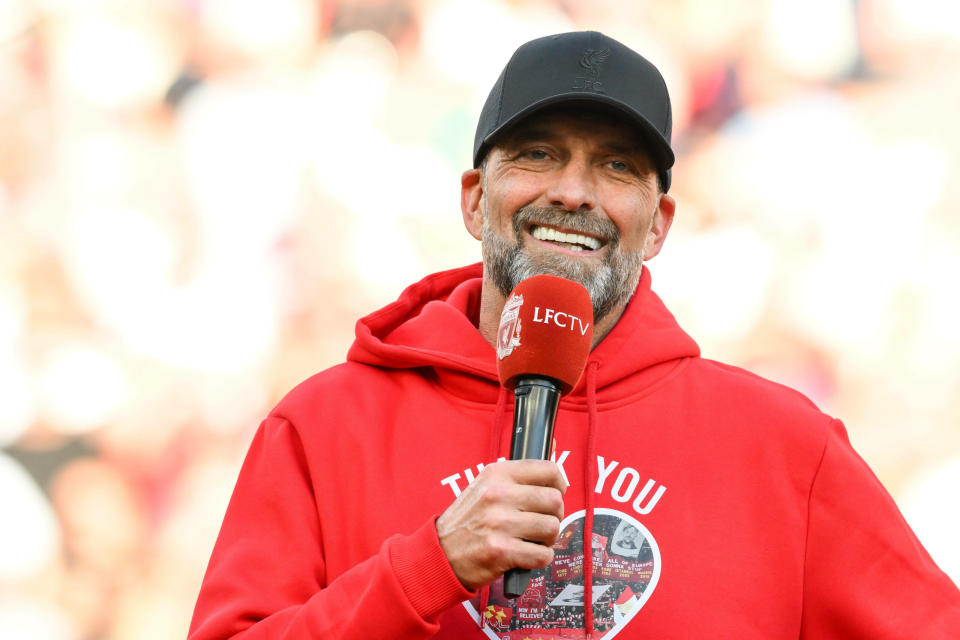

Klopps Liverpool Transforming Doubters Into Believers A Journey Through Success

May 22, 2025

Klopps Liverpool Transforming Doubters Into Believers A Journey Through Success

May 22, 2025 -

Naslidki Vidmovi Ukrayini U Chlenstvi Nato Posilennya Rosiyskoyi Agresiyi

May 22, 2025

Naslidki Vidmovi Ukrayini U Chlenstvi Nato Posilennya Rosiyskoyi Agresiyi

May 22, 2025 -

Solve Wordle 363 March 13th Hints Clues And Answer

May 22, 2025

Solve Wordle 363 March 13th Hints Clues And Answer

May 22, 2025