March 6th: QNB Corp Investor Presentation At Virtual Banking Conference

Table of Contents

QNB Corp's Financial Performance Review (Q4 2023 & Full Year)

QNB Corp's financial performance review for Q4 2023 and the full year showcased strong results, exceeding expectations in several key areas. The presentation provided a comprehensive overview of the bank's financial health, highlighting robust growth and profitability.

Key Financial Metrics:

- Net Profit: QNB Corp reported a significant increase in net profit for Q4 2023 compared to the same period last year, demonstrating strong profitability and efficient operations. Specific figures were presented, showing a [insert percentage]% year-over-year growth.

- Revenue Growth: Revenue growth also showed impressive gains, driven by [mention key drivers, e.g., strong loan growth, increased fee income]. The year-over-year growth was reported as [insert percentage]%.

- Assets Under Management (AUM): AUM experienced substantial growth, reaching [insert figure], reflecting increased client trust and the bank's success in attracting and retaining assets.

- Return on Equity (ROE): The ROE remained strong at [insert figure]%, indicating efficient use of shareholder equity and a healthy return on investment.

- Non-Performing Loans (NPLs): The NPL ratio remained low at [insert figure]%, showcasing the bank's robust credit risk management and lending practices.

These positive financial results demonstrate QNB Corp's resilience and its ability to navigate the challenging global economic environment. The management highlighted the positive trends observed in these key performance indicators as evidence of their successful strategies.

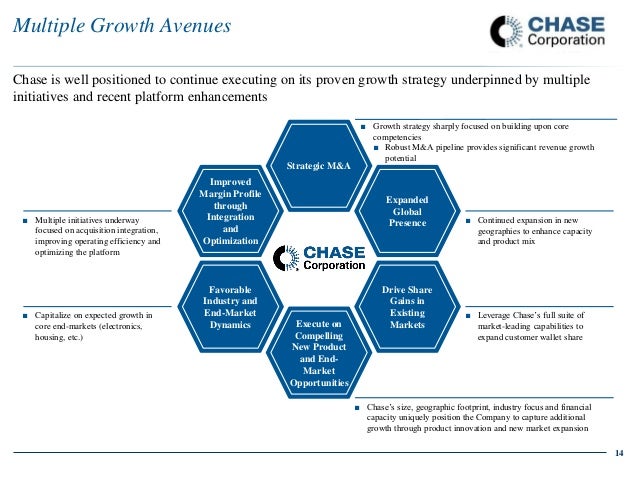

QNB Corp's Strategic Outlook and Future Growth Plans

QNB Corp outlined its ambitious strategic outlook and future growth plans, focusing on several key initiatives designed to drive sustainable growth and enhance shareholder value.

Growth Strategies and Initiatives:

- Geographic Expansion: QNB Corp highlighted plans to expand its geographical footprint into [mention specific regions/countries], capitalizing on emerging market opportunities.

- Digital Transformation: Significant investments in digital technologies are aimed at enhancing customer experience, improving operational efficiency, and expanding the bank's digital product offerings. This includes plans to launch [mention specific digital initiatives, e.g., new mobile banking app, enhanced online platform].

- Sustainability Initiatives: QNB Corp reaffirmed its commitment to sustainable banking practices, outlining initiatives to reduce its environmental footprint and support environmentally friendly projects.

- Strategic Partnerships: The presentation also touched upon strategic partnerships aimed at expanding the bank's product offerings and market reach. [Mention specific examples of planned partnerships if disclosed].

These initiatives demonstrate QNB Corp's forward-looking approach and commitment to innovation and sustainable growth. The management emphasized the importance of digital transformation and strategic partnerships in achieving its long-term goals.

Key Announcements and Investor Q&A

The investor presentation included several key announcements and a robust question-and-answer session with investors.

Significant Announcements:

- New Product Launch: QNB Corp announced the launch of [mention new product/service] designed to cater to [target customer segment]. This is expected to contribute significantly to revenue growth in [mention timeframe].

- New Partnership: A strategic partnership with [mention partner company] will expand the bank's reach in [mention market segment].

Investor Q&A Highlights:

Investors' questions focused primarily on the bank's growth strategy, risk management, and future outlook. Management addressed concerns regarding [mention key concerns] and provided detailed responses, reassuring investors about the bank's long-term prospects. The management's confident and transparent communication was well-received by the attendees.

Conclusion: Investing in QNB Corp After the Virtual Banking Conference Presentation

The March 6th QNB Corp investor presentation painted a positive picture of the bank's financial health and future growth prospects. Strong financial results, coupled with ambitious strategic initiatives, indicate a promising outlook for QNB Corp. The key takeaways include robust profitability, impressive revenue growth, a strong strategic focus on digital transformation and sustainable growth, and clear communication with investors. This makes QNB Corp an attractive prospect for those seeking exposure to the growth potential within the banking sector. Learn more about QNB Corp's investment opportunities by visiting their investor relations website or contacting your financial advisor. Explore investment opportunities with QNB Corp and be a part of its exciting future. The future of QNB Corp looks bright, and this presentation reaffirmed its position as a strong player in the financial market.

Featured Posts

-

Our Farm Next Door Amanda Clive And The Kids Farming Life

Apr 30, 2025

Our Farm Next Door Amanda Clive And The Kids Farming Life

Apr 30, 2025 -

New Hurdles For Amanda Owen And Family At Ravenseat Farm

Apr 30, 2025

New Hurdles For Amanda Owen And Family At Ravenseat Farm

Apr 30, 2025 -

Disney Cuts Nearly 200 Jobs Impacting Abc News

Apr 30, 2025

Disney Cuts Nearly 200 Jobs Impacting Abc News

Apr 30, 2025 -

Drag Race Live Hits 1 000 Shows A Live Broadcast Event

Apr 30, 2025

Drag Race Live Hits 1 000 Shows A Live Broadcast Event

Apr 30, 2025 -

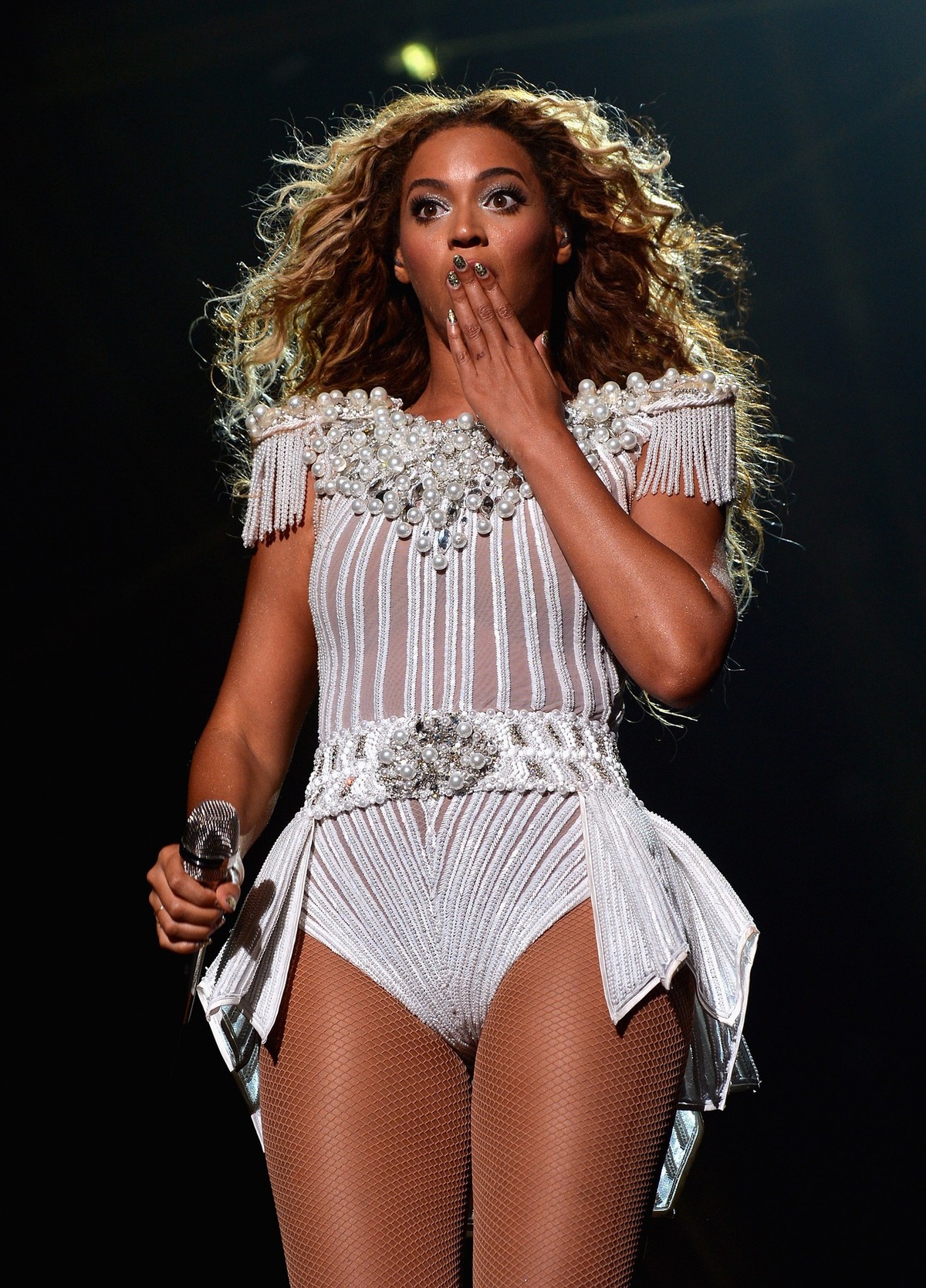

Understanding Beyonce And Jay Zs Decision To Keep Sir Carter Private

Apr 30, 2025

Understanding Beyonce And Jay Zs Decision To Keep Sir Carter Private

Apr 30, 2025

Latest Posts

-

Mat Beyonse Boretsya S Rakom

Apr 30, 2025

Mat Beyonse Boretsya S Rakom

Apr 30, 2025 -

Novoe O Sostoyanii Zdorovya Materi Beyonse

Apr 30, 2025

Novoe O Sostoyanii Zdorovya Materi Beyonse

Apr 30, 2025 -

Rak U Materi Beyonse Podrobnosti O Ee Sostoyanii

Apr 30, 2025

Rak U Materi Beyonse Podrobnosti O Ee Sostoyanii

Apr 30, 2025 -

Zdorove Materi Beyonse Poslednie Soobscheniya

Apr 30, 2025

Zdorove Materi Beyonse Poslednie Soobscheniya

Apr 30, 2025 -

Semya Beyonse Borba S Rakom

Apr 30, 2025

Semya Beyonse Borba S Rakom

Apr 30, 2025