Market Analysis: Dow Futures, China's Economic Policies, And Today's Stock Market Performance

Table of Contents

Dow Futures: A Leading Indicator of Market Sentiment

Understanding Dow Futures Contracts

Dow Futures are derivative contracts that track the future value of the Dow Jones Industrial Average (DJIA), a widely followed index of 30 large, publicly-owned companies in the US. These contracts allow investors to speculate on the future direction of the DJIA or to hedge against potential losses in their stock portfolios.

- Dow Jones Industrial Average (DJIA): A price-weighted average of 30 significant US stocks, considered a barometer of the overall US economy.

- Futures Contracts: Agreements to buy or sell an asset at a specific price on a future date. Dow Futures allow traders to bet on whether the DJIA will rise or fall.

- Hedging and Speculation: Investors use Dow Futures to mitigate risk (hedging) or to profit from anticipated price movements (speculation).

As of [insert current date and time], the Dow Futures contract is trading at [insert current price] representing a [insert percentage change] change compared to the previous day's close.

Analyzing Recent Dow Futures Trends

Recent Dow Futures trends reveal [describe recent trends - e.g., a period of consolidation followed by a sharp upward movement]. This fluctuation reflects the market's response to various factors, including [mention specific influencing news, e.g., corporate earnings reports, geopolitical events].

- Significant Price Movements: [Describe significant upward or downward movements in Dow Futures, mentioning specific dates and price levels].

- Support and Resistance Levels: Potential support levels are currently around [mention price levels], while resistance seems to be around [mention price levels]. These are crucial levels to watch for potential breakouts or reversals.

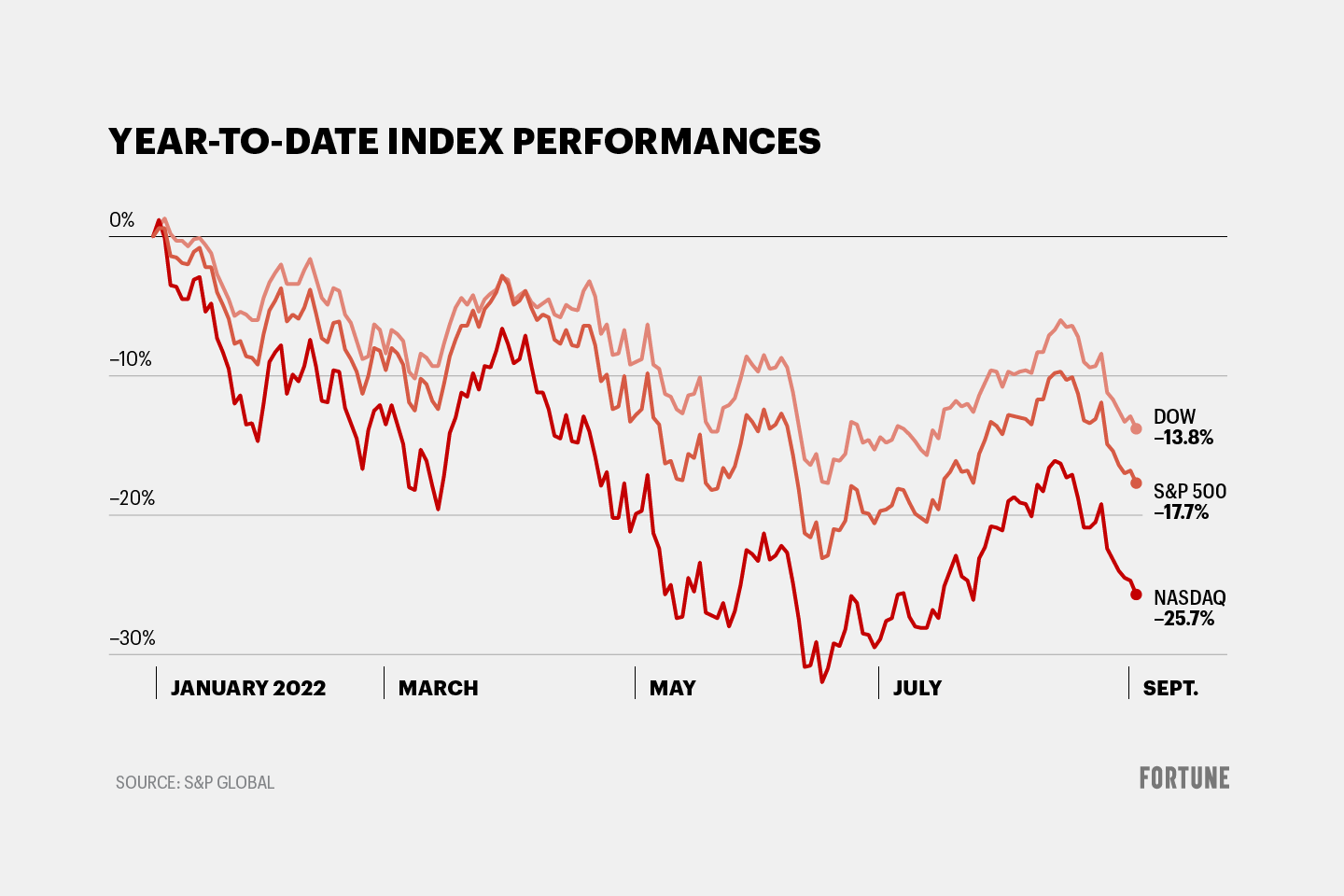

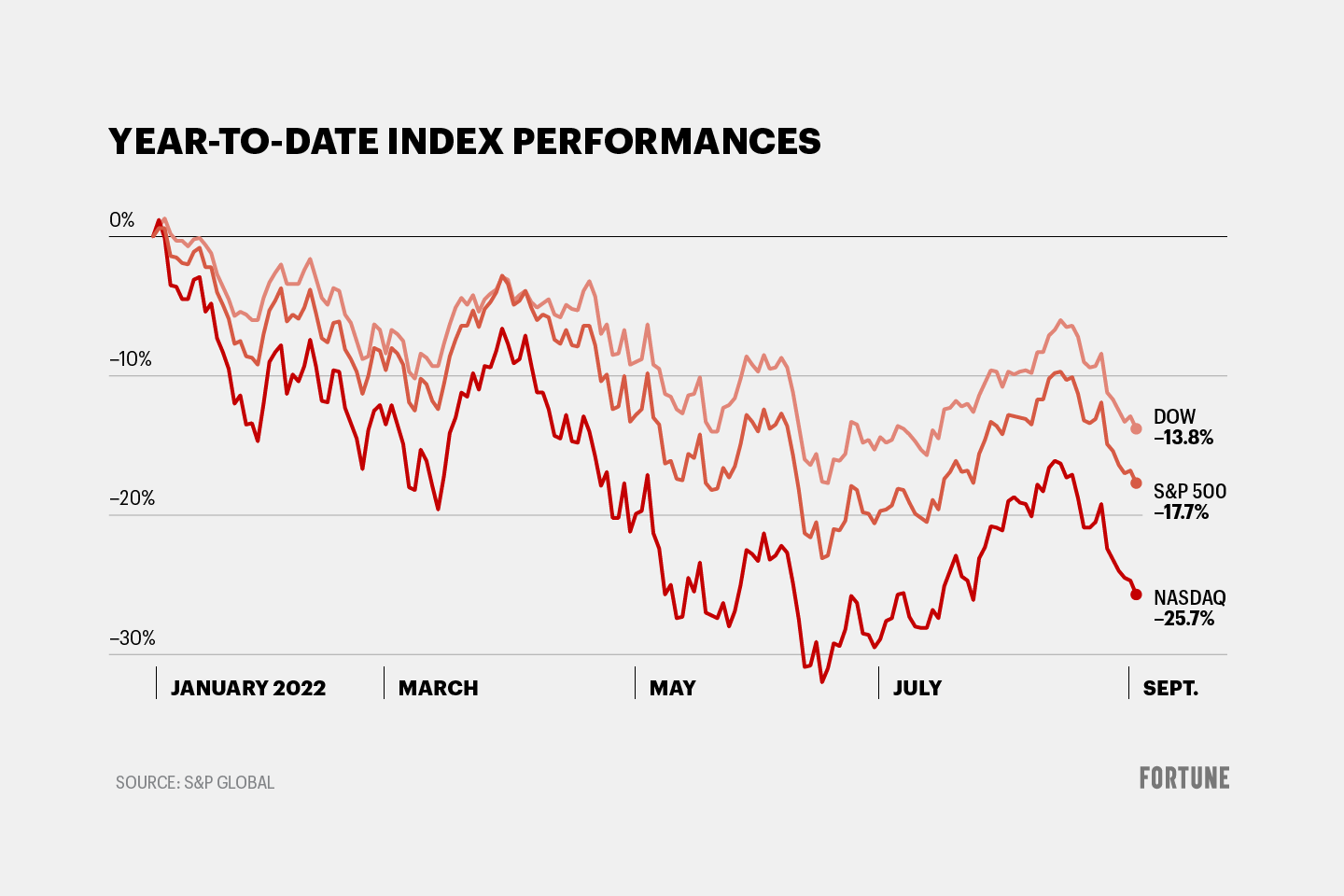

- Influencing News Events: [Cite specific news events such as interest rate hikes, inflation reports, or geopolitical tensions that significantly impacted Dow Futures]. [Insert chart/graph visualizing recent Dow Futures trends here].

China's Economic Policies and Their Global Impact

Recent Economic Announcements from China

China's recent economic policy announcements have sent ripples through global markets. Key announcements include [list recent announcements, e.g., adjustments to interest rates, new infrastructure spending programs, or changes in trade policies].

- Interest Rate Adjustments: [Explain the impact of any recent interest rate changes on Chinese economic activity and global markets].

- Stimulus Packages: [Detail any recent stimulus packages announced by the Chinese government, and their intended impact on the economy].

- Trade Policies: [Discuss any recent changes in Chinese trade policies and their effect on global trade and investment].

These policies are reported by reputable sources such as [cite sources like the Financial Times, Bloomberg, etc.].

China's Influence on Global Markets

China's economic policies exert a significant influence on global stock markets due to its role as a major player in global trade and investment.

- Interconnectedness of Global Markets: The close links between the Chinese and US economies mean that significant developments in China directly impact the performance of US stocks.

- Impact on Global Commodities: Chinese demand for raw materials heavily influences prices of commodities like oil and metals, affecting companies across multiple sectors.

- Influence on Global Companies: Many multinational companies have significant operations in China, making them susceptible to changes in Chinese economic policies. For example, [mention specific companies and how they've been impacted].

Today's Stock Market Performance: A Synthesis of Factors

Correlation between Dow Futures and Actual Stock Market Performance

The correlation between Dow Futures movements and actual stock market performance is generally strong, but not always perfect. Today, the Dow Futures predicted [predicted movement], while the actual opening of the DJIA shows [actual opening movement].

- Predicted vs. Actual Movement: [Quantify the difference between predicted and actual movements. Discuss the factors that might explain the divergence].

- Reasons for Discrepancies: Discrepancies can arise due to unforeseen events, unexpected news releases, or a general shift in market sentiment during trading hours.

Impact of Other Economic Indicators

Beyond Dow Futures and China's policies, other economic indicators also impact today's stock market performance.

- Inflation Rates: High inflation can lead to tighter monetary policies, potentially slowing economic growth and impacting stock valuations.

- Unemployment Data: Strong employment numbers generally boost market confidence, while high unemployment rates can trigger a negative reaction.

- Geopolitical Events: Global political instability can introduce uncertainty into the market, causing volatility and impacting investor sentiment.

These factors, considered alongside Dow Futures and China’s economic policies, create a complex picture influencing today's stock market performance.

Conclusion

Our market analysis highlights the complex interplay between Dow Futures, China's economic policies, and the current stock market performance. Dow Futures serve as a leading indicator of market sentiment, while China’s economic decisions significantly impact global markets due to its economic size and influence. Other economic factors further complicate the picture.

Key Takeaways:

- Dow Futures provide a valuable forecast of potential market movements.

- China’s economic policies are a major driver of global market volatility.

- A multifaceted analysis incorporating diverse economic indicators is essential for understanding market dynamics.

Stay ahead of the curve by regularly monitoring Dow Futures, keeping abreast of China's economic policies, and consistently analyzing today's stock market performance. Understanding these crucial elements is key to effective investment decision-making. [Include a link to a relevant financial news source or investment platform here].

Featured Posts

-

Trumps Tariffs Ceo Concerns And Consumer Anxiety

Apr 26, 2025

Trumps Tariffs Ceo Concerns And Consumer Anxiety

Apr 26, 2025 -

Sinners Cinematographer Captures The Mississippi Deltas Vastness

Apr 26, 2025

Sinners Cinematographer Captures The Mississippi Deltas Vastness

Apr 26, 2025 -

Open Ais Chat Gpt The Ftc Launches An Investigation

Apr 26, 2025

Open Ais Chat Gpt The Ftc Launches An Investigation

Apr 26, 2025 -

Mission Impossible Dead Reckoning Tom Cruises Stunts Will Amaze

Apr 26, 2025

Mission Impossible Dead Reckoning Tom Cruises Stunts Will Amaze

Apr 26, 2025 -

Guillaume Scheer Ouvre Son Restaurant A Strasbourg Le 13 Juin

Apr 26, 2025

Guillaume Scheer Ouvre Son Restaurant A Strasbourg Le 13 Juin

Apr 26, 2025

Latest Posts

-

Understanding The Professional Help Behind Ariana Grandes Drastic Style Change

Apr 27, 2025

Understanding The Professional Help Behind Ariana Grandes Drastic Style Change

Apr 27, 2025 -

New Hair New Ink The Professionals Behind Ariana Grandes Style Evolution

Apr 27, 2025

New Hair New Ink The Professionals Behind Ariana Grandes Style Evolution

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Transformation The Professionals Who Made It Happen

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation The Professionals Who Made It Happen

Apr 27, 2025 -

The Team Behind Ariana Grandes Latest Transformation Hair Tattoos And Professional Help

Apr 27, 2025

The Team Behind Ariana Grandes Latest Transformation Hair Tattoos And Professional Help

Apr 27, 2025 -

How Ariana Grande Achieved Her Stunning New Hair And Tattoos Professional Expertise Revealed

Apr 27, 2025

How Ariana Grande Achieved Her Stunning New Hair And Tattoos Professional Expertise Revealed

Apr 27, 2025