Market Chaos And The Freeze On IPO Activity: A Deep Dive

Table of Contents

Main Points: Deconstructing the IPO Freeze

2.1 The Impact of Geopolitical Instability on IPO Markets

Geopolitical instability significantly impacts investor sentiment and, consequently, IPO activity. War, political tensions, and international trade disputes inject uncertainty into the market, making it difficult to accurately predict future performance. This uncertainty translates directly into investor hesitancy. Investors become more risk-averse, preferring safer, established assets over the perceived volatility of new offerings.

For example, the ongoing conflict in Ukraine has dramatically increased market volatility, causing investors to pull back from riskier investments, including IPOs. The ripple effect of such events extends far beyond the immediate conflict zone, impacting global markets and chilling IPO activity worldwide.

- Increased market volatility makes accurate valuations difficult. Pricing IPOs becomes a challenge when market fluctuations are extreme.

- Investor risk aversion leads to reduced demand for new offerings. Investors seek stability, leading to a lower appetite for riskier IPO investments.

- Uncertainty surrounding future regulatory changes creates hesitation. Geopolitical events can trigger changes in regulations, creating further uncertainty for potential investors.

2.2 Inflationary Pressures and Rising Interest Rates: A Double Whammy for IPOs

The current inflationary environment, fueled by rising interest rates, poses a significant challenge for IPOs. Higher interest rates make alternative investments, such as bonds, more attractive compared to the perceived risk of equities. This shift in investor preference reduces the demand for IPOs.

Furthermore, inflation erodes purchasing power and increases the cost of borrowing for companies seeking to go public. These increased costs, coupled with the need to justify high valuations in a period of economic uncertainty, make the IPO process significantly more challenging.

- Increased borrowing costs make IPOs more expensive for companies. Higher interest rates increase the cost of capital, making it more expensive for companies to finance their IPOs.

- Investors demand higher returns in an inflationary environment. To compensate for inflation, investors require higher returns, putting pressure on IPO valuations.

- Reduced consumer spending impacts the potential profitability of new companies. Inflation can lead to decreased consumer spending, affecting the projected profitability of companies seeking IPOs.

2.3 The Role of Market Sentiment and Investor Confidence

Market sentiment plays a crucial role in driving IPO activity. Negative news cycles, amplified by social media and traditional media outlets, can create a climate of fear and uncertainty, leading to a "wait-and-see" approach by potential investors. This negativity can quickly snowball, further suppressing IPO activity.

Investor confidence, closely tied to broader economic expectations, is another key factor. A lack of confidence in future economic growth discourages investment in new ventures, including IPOs. This makes it more difficult for companies to attract investors and secure the necessary funding for their public offerings.

- Fear of losses drives investors towards safer investments. Negative market sentiment pushes investors towards less volatile assets.

- Negative news cycles amplify market anxieties and suppress IPO activity. Fear and uncertainty are contagious, leading to reduced IPO participation.

- Lack of confidence in future economic growth discourages investment in new ventures. Pessimism about the future inhibits investment in riskier ventures.

2.4 Regulatory Scrutiny and Increased Compliance Costs

Increased regulatory scrutiny and higher compliance costs significantly impact the feasibility and attractiveness of IPOs. Stricter regulations, while intended to protect investors, add complexities and costs to the process. This includes higher legal and accounting fees, as well as lengthier approval processes. These factors can deter some companies from pursuing IPOs altogether, particularly smaller companies with limited resources.

- Higher legal and accounting fees increase IPO costs for companies. The increased complexity of regulatory compliance translates directly to higher expenses.

- Lengthier regulatory approval processes delay IPOs. The time it takes to navigate regulatory hurdles can significantly delay a company's ability to go public.

- Increased compliance burdens can deter some companies from pursuing IPOs. The sheer cost and complexity of compliance can make IPOs unfeasible for some.

Conclusion: A Look Ahead: Recovering from the IPO Freeze

The current freeze on IPO activity is a multifaceted problem, stemming from geopolitical instability, inflationary pressures, weak investor sentiment, and increased regulatory burdens. Recovering from this slowdown will require a combination of factors: stabilized global markets, reduced inflation, increased investor confidence, and potentially a reassessment of regulatory frameworks.

Monitoring market conditions and accurately assessing risk tolerance is crucial for both investors and companies considering an IPO. Understanding the complexities of "Market Chaos and the Freeze on IPO Activity" is essential for navigating this challenging environment and making informed investment decisions related to IPOs. Stay informed about evolving market conditions to make the best decisions regarding your portfolio and potential IPO investments. Understand the risks and potential rewards before investing in initial public offerings during periods of market uncertainty.

Featured Posts

-

Consumer Alert Walmart Recalls Baby Products Due To Safety Concerns

May 14, 2025

Consumer Alert Walmart Recalls Baby Products Due To Safety Concerns

May 14, 2025 -

14 Great Value Brand Recalls From Walmart A Comprehensive List

May 14, 2025

14 Great Value Brand Recalls From Walmart A Comprehensive List

May 14, 2025 -

Selin Dion Onovlennya Pro Yiyi Zdorov Ya Osobiste Zhittya Ta Kar Yeru

May 14, 2025

Selin Dion Onovlennya Pro Yiyi Zdorov Ya Osobiste Zhittya Ta Kar Yeru

May 14, 2025 -

Ct Nepustila Novinare Deniku N A Seznam Zprav Informace O Brifinku Zamlceny

May 14, 2025

Ct Nepustila Novinare Deniku N A Seznam Zprav Informace O Brifinku Zamlceny

May 14, 2025 -

Analyzing The Impact Of Cross National Artists On Eurovision

May 14, 2025

Analyzing The Impact Of Cross National Artists On Eurovision

May 14, 2025

Latest Posts

-

Alkaras Inspiracija Za Decu Poput Nadala I Federera

May 14, 2025

Alkaras Inspiracija Za Decu Poput Nadala I Federera

May 14, 2025 -

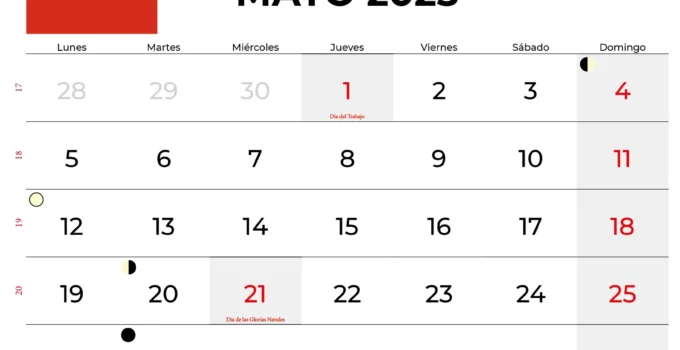

Sevilla Planifica Tu Dia Miercoles 7 De Mayo De 2025

May 14, 2025

Sevilla Planifica Tu Dia Miercoles 7 De Mayo De 2025

May 14, 2025 -

Miercoles 7 De Mayo De 2025 Guia De Actividades En Sevilla

May 14, 2025

Miercoles 7 De Mayo De 2025 Guia De Actividades En Sevilla

May 14, 2025 -

Analiza Dokovicevih Rekorda Prevazilazenje Federerove Ere

May 14, 2025

Analiza Dokovicevih Rekorda Prevazilazenje Federerove Ere

May 14, 2025 -

Cosas Que Hacer En Sevilla Este Miercoles 7 De Mayo De 2025

May 14, 2025

Cosas Que Hacer En Sevilla Este Miercoles 7 De Mayo De 2025

May 14, 2025