Market Crash: Seven Leading Stocks Shed $2.5 Trillion In Value

Table of Contents

The Seven Leading Stocks Affected

The $2.5 trillion loss was distributed across several key players in the global economy. The seven leading stocks most significantly impacted include:

- Apple (AAPL): [Link to relevant financial news source about AAPL losses] (Percentage Loss: [Insert Percentage])

- Microsoft (MSFT): [Link to relevant financial news source about MSFT losses] (Percentage Loss: [Insert Percentage])

- Amazon (AMZN): [Link to relevant financial news source about AMZN losses] (Percentage Loss: [Insert Percentage])

- Tesla (TSLA): [Link to relevant financial news source about TSLA losses] (Percentage Loss: [Insert Percentage])

- Alphabet (GOOGL): [Link to relevant financial news source about GOOGL losses] (Percentage Loss: [Insert Percentage])

- Meta (META): [Link to relevant financial news source about META losses] (Percentage Loss: [Insert Percentage])

- NVIDIA (NVDA): [Link to relevant financial news source about NVDA losses] (Percentage Loss: [Insert Percentage])

The losses weren't evenly distributed. For example, while [Insert Company Name] experienced a significant percentage drop, its overall market capitalization meant its contribution to the total $2.5 trillion loss was proportionally less than that of [Insert Company Name], which saw a smaller percentage drop but started from a larger market cap. The tech sector, in particular, was disproportionately affected, highlighting the concentration of risk within certain industries.

Underlying Causes of the Market Crash

Several intertwined factors contributed to this sharp stock market downturn.

Rising Interest Rates and Inflation

The Federal Reserve's aggressive interest rate hikes, aimed at combating persistent inflation, played a crucial role.

- Higher borrowing costs: Increased interest rates make it more expensive for companies to borrow money, impacting their profitability and investment plans.

- Investor sentiment: Higher rates also make bonds more attractive, diverting investment away from equities and causing a stock market downturn.

- Inflationary pressures: Persistent inflation erodes purchasing power and increases uncertainty, leading to investor anxiety and sell-offs. The current inflation rate stands at [Insert Current Inflation Rate], significantly impacting consumer confidence and stock valuations.

Geopolitical Instability

Geopolitical uncertainties significantly contributed to market volatility and triggered sell-offs.

- The war in Ukraine: The ongoing conflict created significant uncertainty in energy markets and supply chains, impacting global economic growth and investor confidence. [Link to relevant news source].

- US-China trade tensions: Lingering trade disputes between the US and China created further market instability and uncertainty. [Link to relevant news source].

- Other geopolitical risks: Other global events, such as [mention other relevant geopolitical factors], further contributed to the negative investor sentiment.

Tech Sector Correction

The technology sector, which had experienced a period of rapid growth and high valuations, underwent a significant correction.

- Overvaluation: Many tech stocks were considered overvalued, leading to a sharp decline as investors reassessed their worth.

- Slowing growth: The tech sector's growth slowed down, impacting investor expectations and causing sell-offs.

- Increased competition: Intensified competition within the tech sector further added pressure on company valuations.

- Shifts in consumer spending: Changes in consumer spending habits away from discretionary technology purchases also affected the sector's performance.

Impact on Investors and the Broader Economy

The market crash had a significant impact on both individual investors and the broader economy.

- Individual investors: Many individual investors suffered significant losses in their retirement accounts and investment portfolios, impacting their financial security and future plans.

- Reduced consumer confidence: The market downturn eroded consumer confidence, leading to decreased spending and a potential slowdown in economic growth.

- Business investment: Uncertainty in the market led businesses to postpone or reduce investment plans, further impacting economic activity.

- Potential for recession: The severity of the market crash increases the risk of a recession, as reduced consumer and business spending can trigger a downward economic spiral. Government intervention, such as stimulus packages or other economic measures, might become necessary to mitigate the effects.

Strategies for Navigating Market Volatility

Navigating market volatility requires a proactive and informed approach.

- Diversification: Diversifying your investment portfolio across different asset classes reduces risk.

- Long-term investment strategy: Focusing on long-term investment goals helps weather short-term market fluctuations.

- Risk tolerance: Understanding your own risk tolerance and adjusting your investment strategy accordingly is crucial.

- Rebalancing your portfolio: Regularly rebalancing your portfolio to maintain your desired asset allocation is essential.

- Avoid panic selling: Resist the urge to sell assets during a market crash. Panic selling often leads to greater losses.

- Seek professional advice: Consulting a financial advisor can provide personalized guidance and support.

Conclusion

This market crash, resulting in a $2.5 trillion loss across seven leading stocks, highlights the significant risks inherent in investing. The confluence of rising interest rates, persistent inflation, geopolitical instability, and a tech sector correction created a perfect storm. This event had a considerable impact on individual investors and the broader economy, potentially leading to reduced consumer confidence and a risk of recession. Understanding these factors and adopting strategies like diversification, a long-term investment horizon, and professional financial guidance are crucial for navigating market volatility effectively. Don't let the next market crash catch you unprepared. Learn how to protect your investments and navigate market volatility effectively. Start planning your investment strategy today!

Featured Posts

-

Huaweis Exclusive Ai Chip Specifications And Implications

Apr 29, 2025

Huaweis Exclusive Ai Chip Specifications And Implications

Apr 29, 2025 -

Mlb 160km

Apr 29, 2025

Mlb 160km

Apr 29, 2025 -

The Los Angeles Wildfires A Reflection Of Our Times Through The Lens Of Disaster Betting

Apr 29, 2025

The Los Angeles Wildfires A Reflection Of Our Times Through The Lens Of Disaster Betting

Apr 29, 2025 -

Is Made In The Usa Really Worth The Effort

Apr 29, 2025

Is Made In The Usa Really Worth The Effort

Apr 29, 2025 -

Beyond Quinoa Introducing The Latest Superfood Sensation

Apr 29, 2025

Beyond Quinoa Introducing The Latest Superfood Sensation

Apr 29, 2025

Latest Posts

-

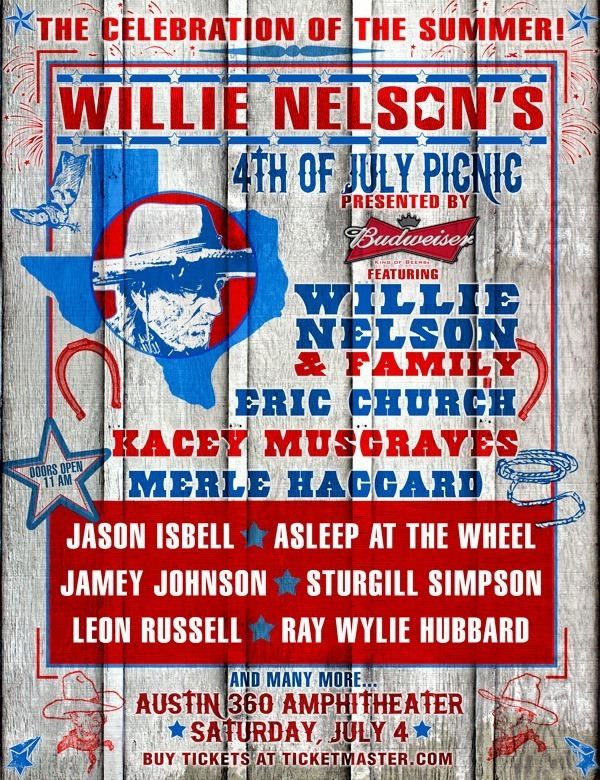

Willie Nelsons 4th Of July Picnic Texas Comeback

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Texas Comeback

Apr 29, 2025 -

New Documentary Willie Nelson Celebrates Legendary Roadie

Apr 29, 2025

New Documentary Willie Nelson Celebrates Legendary Roadie

Apr 29, 2025 -

Get To Know Willie Nelson A Collection Of Fast Facts

Apr 29, 2025

Get To Know Willie Nelson A Collection Of Fast Facts

Apr 29, 2025 -

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025 -

Willie Nelson Pays Tribute To His King Of The Road Crew In New Documentary

Apr 29, 2025

Willie Nelson Pays Tribute To His King Of The Road Crew In New Documentary

Apr 29, 2025