Market Reaction: Why CoreWeave Inc. (CRWV) Stock Fell On Tuesday

Table of Contents

Broader Market Downturn and Tech Sector Weakness

Tuesday's market performance was generally negative, impacting various sectors, including technology. A broad sell-off contributed to the decline in CRWV stock price, reflecting a wider trend of investor apprehension. High-growth technology companies, like CoreWeave, are often more vulnerable during periods of market uncertainty. Their valuations are often heavily reliant on future growth projections, making them susceptible to shifts in investor sentiment.

- Market Indices Performance: The Nasdaq Composite and the S&P 500 both experienced significant drops on Tuesday, indicating a general negative market trend. Specific percentage drops for these indices should be inserted here once the specific date is known.

- Negative Tech News: Reports of slowing growth in certain segments of the technology sector, coupled with concerns about rising interest rates, contributed to the overall negative sentiment affecting tech stocks. Details on relevant negative news affecting the tech sector should be inserted here.

Lack of Positive Catalysts for CRWV Stock

The absence of positive news or catalysts for CRWV contributed significantly to the stock price decline. Without any supportive factors to counter the negative market sentiment, the stock price became more susceptible to downward pressure. Investor expectations weren't met, further fueling the decline.

- Missed Expectations: Any anticipated earnings reports, strategic partnerships, or product launches that didn't materialize or fell short of expectations would have negatively impacted investor confidence, leading to selling pressure. Specific examples should be added here if available.

- Analyst Reports: Negative or even neutral analyst reports released before or on Tuesday could have also contributed to the sell-off. Details on any such reports should be added here if available.

Profit-Taking and Investor Sentiment

The sharp rise in CRWV stock price prior to Tuesday may have prompted some investors to take profits, contributing to the sell-off. Profit-taking often occurs after a period of significant gains, leading to increased selling pressure as investors secure their profits. Furthermore, a shift in investor sentiment towards CoreWeave's long-term prospects likely played a role.

- Trading Volume: High trading volume on Tuesday would suggest significant activity, potentially including profit-taking. Data on trading volume should be included here.

- Analyst Downgrades: Any downgrades in analyst ratings or changes in outlook regarding CoreWeave's future performance would have likely contributed to negative sentiment and selling pressure. Specific information on analyst actions should be added here if available.

- Social Media Sentiment: Analysis of social media sentiment toward CRWV around the time of the drop could provide further insights into the market reaction.

Specific News Affecting CoreWeave (CRWV)

While broader market conditions and general investor sentiment played a role, any specific negative news directly related to CoreWeave would have significantly amplified the stock price drop. This section should explore any such news.

- Regulatory Concerns: Any potential regulatory scrutiny or investigations targeting CoreWeave would negatively impact investor confidence.

- Competitive Pressures: News of increased competition or market share losses to competitors could have triggered selling.

- Financial News: Negative financial news, such as unexpected losses or a disappointing outlook, could explain the market reaction. Specific details of any such news should be inserted here if available.

Conclusion: Assessing the Future of CRWV Stock After Tuesday's Decline

CoreWeave Inc.'s (CRWV) stock price drop on Tuesday resulted from a combination of factors, including broader market weakness in the tech sector, a lack of positive catalysts, profit-taking by some investors, and potentially specific negative news related to the company itself (details of which should be added if available). The short-term implications of this decline may include further volatility, while the long-term outlook depends on CoreWeave's ability to address any underlying issues and capitalize on future growth opportunities in the cloud computing and AI infrastructure markets. It is important to maintain a balanced perspective, acknowledging the negative while considering the potential for future growth. To stay updated on CRWV and make informed investment decisions, continue monitoring the CRWV stock price, research CRWV investment opportunities, and conduct your own thorough due diligence before investing. Stay updated on CRWV and monitor CoreWeave stock performance closely.

Featured Posts

-

Duong 4 Lan Xe Xuyen Rung Ma Da Kien Nghi Moi Tu Dong Nai Den Binh Phuoc

May 22, 2025

Duong 4 Lan Xe Xuyen Rung Ma Da Kien Nghi Moi Tu Dong Nai Den Binh Phuoc

May 22, 2025 -

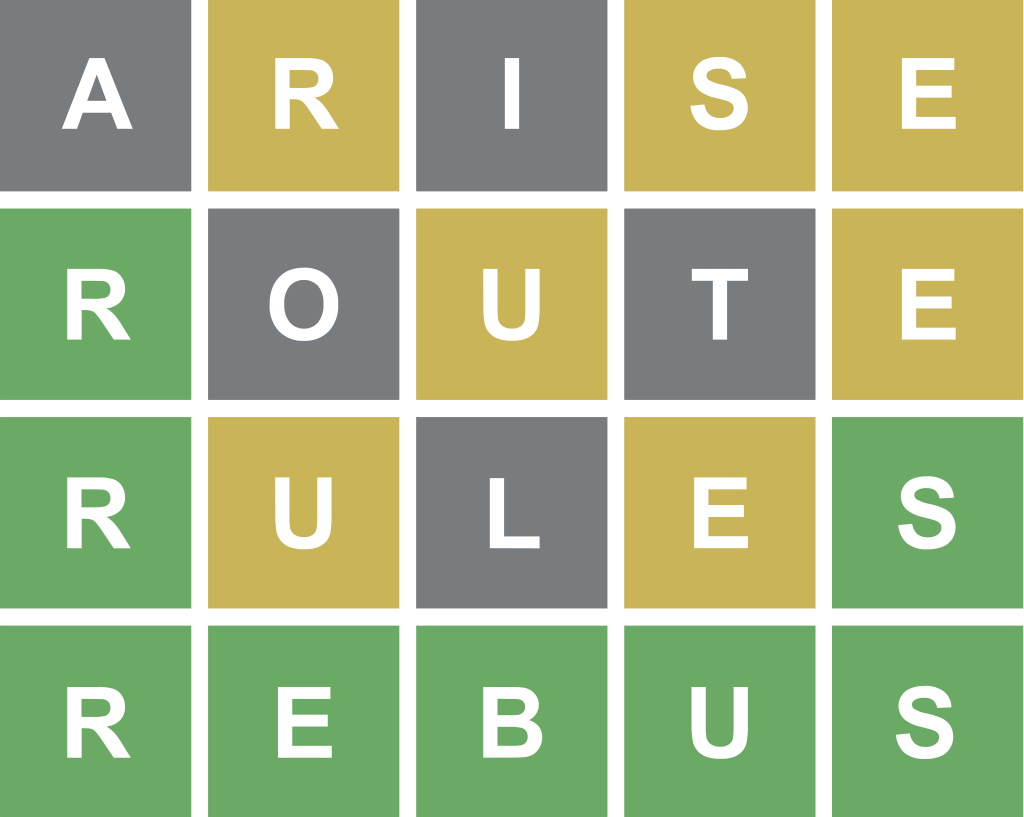

Wordle 363 Get The Answer For Thursday March 13th

May 22, 2025

Wordle 363 Get The Answer For Thursday March 13th

May 22, 2025 -

The Ultimate Sandylands U Tv Guide For Uk Viewers

May 22, 2025

The Ultimate Sandylands U Tv Guide For Uk Viewers

May 22, 2025 -

Espns Insight Crucial Elements Of The Bruins Transformative Offseason

May 22, 2025

Espns Insight Crucial Elements Of The Bruins Transformative Offseason

May 22, 2025 -

Peppa Pigs Sibling Arrives The Name Secret Finally Out

May 22, 2025

Peppa Pigs Sibling Arrives The Name Secret Finally Out

May 22, 2025