Market Swings: Professional Selling And The Individual Investor Response

Table of Contents

Understanding Professional Selling Strategies During Market Swings

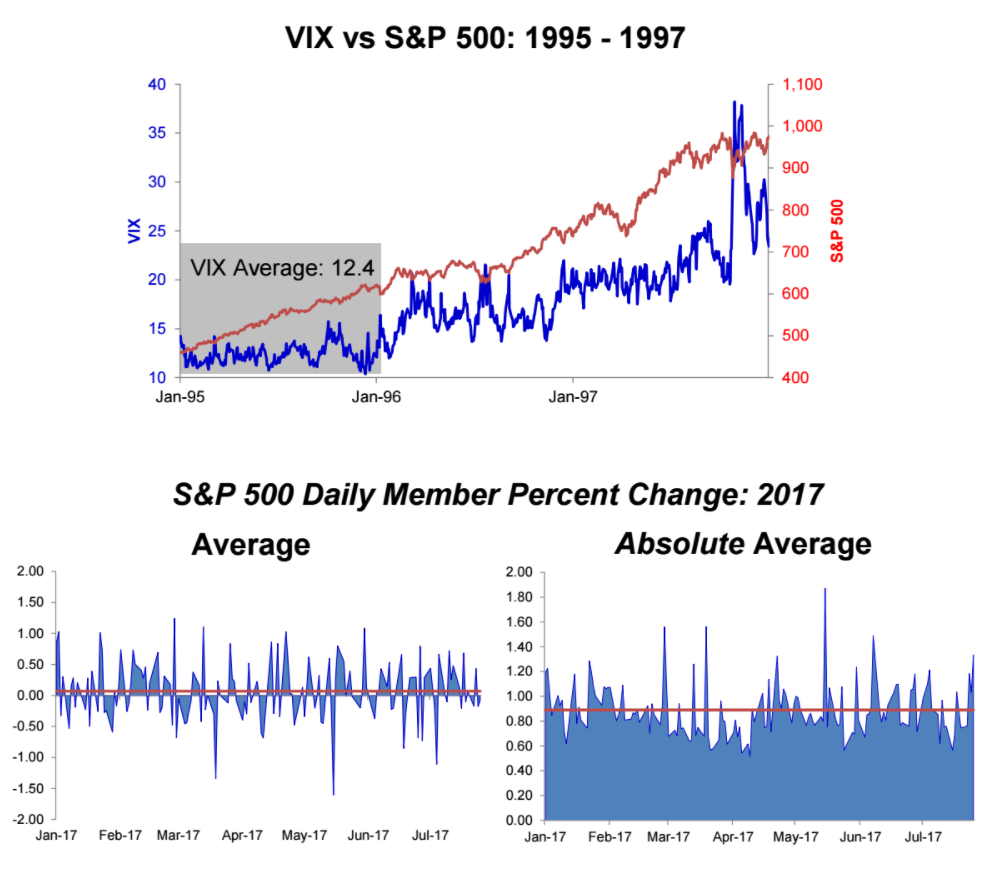

Professional investors, including hedge funds and institutional investors, employ various strategies to manage risk and capitalize on opportunities during market swings. These strategies often involve significant selling activity, which can influence the overall market.

-

Hedge funds and institutional investors often engage in hedging strategies to protect against losses during market volatility. This can involve selling assets or using derivatives to offset potential declines in their portfolio value. Effective hedging requires sophisticated understanding of market dynamics and risk management tools. This activity often contributes to increased selling pressure during periods of uncertainty. Understanding the impact of hedging strategies on market liquidity is also important for individual investors.

-

Portfolio rebalancing involves adjusting asset allocations to maintain a desired risk profile. If a particular asset class has outperformed others, rebalancing may necessitate selling some of those assets to reallocate funds to underperforming areas, bringing the portfolio back to its target allocation. This is a proactive strategy to maintain a consistent risk level, regardless of short-term market swings. For example, an investor might sell some stocks after a strong rally to buy bonds, thus reducing their overall equity exposure.

-

Profit-taking is the act of selling assets that have appreciated significantly. This is a common strategy during market rallies, allowing investors to secure profits and potentially reduce risk exposure before a potential downturn. While seemingly simple, effective profit-taking requires an understanding of market cycles and the ability to identify potential turning points. This activity, though often rational, can trigger a sell-off as multiple investors simultaneously secure their gains.

Identifying Indicators of Professional Selling

Identifying when professional selling is occurring can provide valuable insight for individual investors. While pinpointing the exact timing is impossible, certain indicators can suggest increased selling pressure.

-

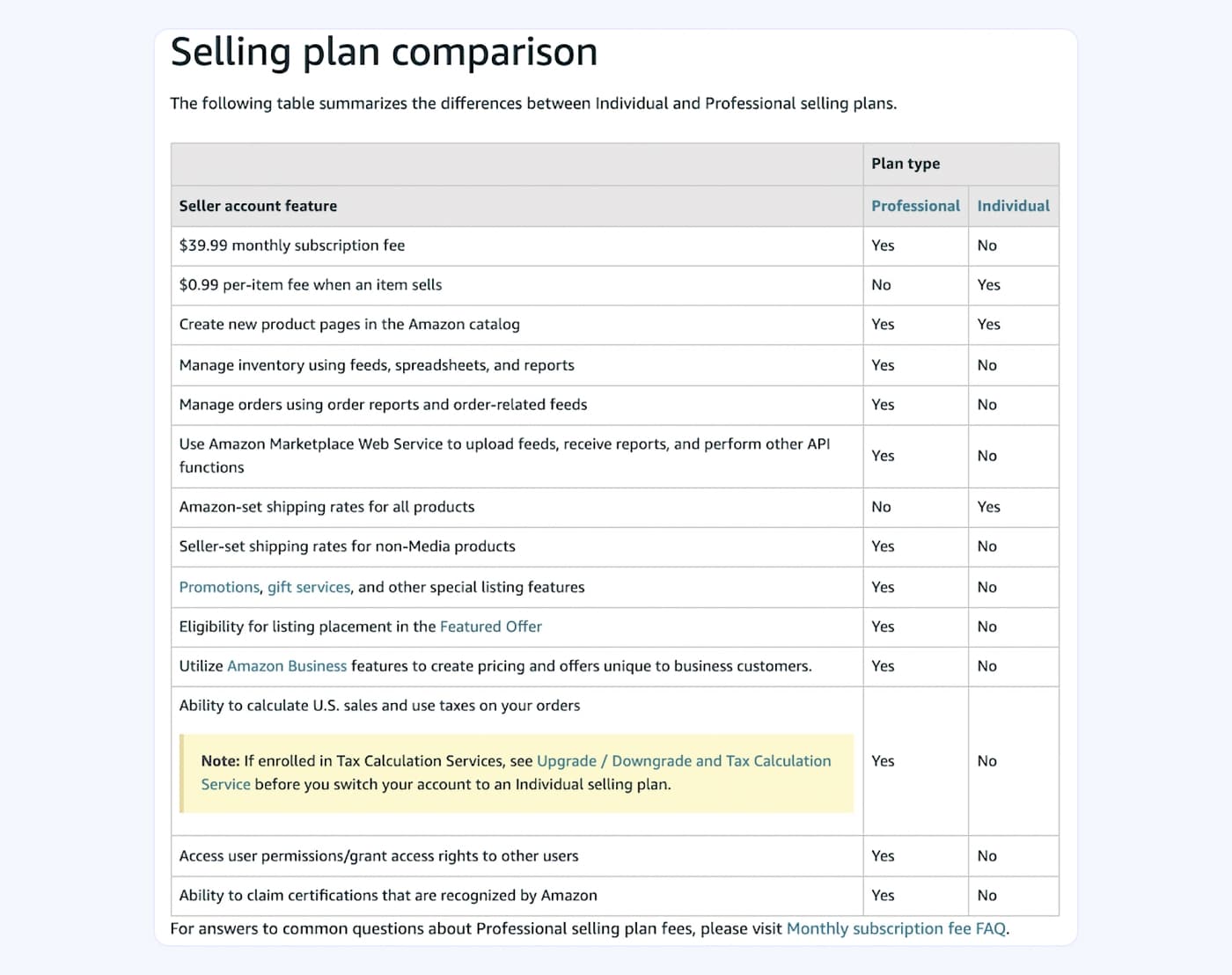

High-volume trading coupled with significant price drops. A sudden surge in trading volume accompanied by a sharp decline in prices often signals large-scale selling by institutional investors. This is often seen during sharp market corrections.

-

Unusual activity in options markets (e.g., increased put option buying). A significant increase in the purchase of put options, which provide the right to sell an asset at a specific price, indicates that some investors anticipate a price decline and are hedging their positions. This can be a leading indicator of broader selling pressure.

-

Negative shifts in investor sentiment reflected in surveys and media coverage. A pessimistic outlook among professional investors, reflected in surveys and market commentary, can signal an increased likelihood of selling pressure. Monitoring financial news and investor sentiment indices can help gauge overall market confidence.

Common Individual Investor Responses to Market Swings

Individual investors often react emotionally to market swings, leading to decisions that can negatively impact their portfolios. Understanding these behavioral biases is crucial for making rational investment choices.

-

Panic selling: During market declines, fear often leads to investors selling assets at a loss, exacerbating the downturn. Panic selling is driven by emotion rather than rational analysis and often results in poor investment outcomes.

-

FOMO (Fear Of Missing Out): Conversely, during market rallies, FOMO can prompt investors to chase rising prices, potentially buying high and selling low. This reactive behavior often leads to regret later on as prices correct.

-

Analysis Paralysis: The uncertainty during market swings can lead to inaction, causing investors to delay important decisions. This can be particularly detrimental if the delay results in missing opportunities or failing to protect against losses.

Strategies for Individual Investors to Navigate Market Swings

Navigating market swings effectively requires a disciplined approach and a long-term perspective. The following strategies can help individual investors protect their portfolios and potentially profit during periods of volatility.

-

Develop a long-term investment strategy and stick to it. A well-defined plan that outlines investment goals, risk tolerance, and asset allocation helps navigate emotional responses to market fluctuations.

-

Diversify your portfolio to reduce risk. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) helps mitigate losses during market downturns.

-

Avoid emotional decision-making. Base decisions on your investment strategy and market fundamentals, not on fear or speculation. Maintain a disciplined approach even during volatile periods.

-

Consider dollar-cost averaging to reduce the impact of market timing. Investing a fixed amount of money at regular intervals, regardless of market price, helps mitigate the risk of buying high and selling low.

-

Regularly review and rebalance your portfolio. Periodically reviewing your portfolio's performance and adjusting asset allocation as needed ensures your investments remain aligned with your goals and risk tolerance.

Conclusion

Market swings are an inherent part of investing. While professional selling activity can significantly influence market movements, individual investors can mitigate risk and potentially benefit by understanding these dynamics and adopting a well-defined, long-term investment strategy. By recognizing common investor responses and implementing the strategies outlined above, you can navigate market swings more effectively and make informed decisions to protect and grow your wealth. Don’t let fear dictate your investment choices; master the art of navigating market swings for better long-term investment success. Start building your resilient investment strategy today!

Featured Posts

-

Open Ais Chat Gpt The Ftc Investigation And Its Future

Apr 28, 2025

Open Ais Chat Gpt The Ftc Investigation And Its Future

Apr 28, 2025 -

The Trump Era And Its Legacy On College Campuses Across America

Apr 28, 2025

The Trump Era And Its Legacy On College Campuses Across America

Apr 28, 2025 -

Understanding The Volatility Of Gpu Prices

Apr 28, 2025

Understanding The Volatility Of Gpu Prices

Apr 28, 2025 -

The Post Roe Landscape Examining The Role Of Otc Birth Control

Apr 28, 2025

The Post Roe Landscape Examining The Role Of Otc Birth Control

Apr 28, 2025 -

Watch Blue Jays Vs Yankees Mlb Spring Training Game Online Free Live Stream And Tv Channel

Apr 28, 2025

Watch Blue Jays Vs Yankees Mlb Spring Training Game Online Free Live Stream And Tv Channel

Apr 28, 2025

Latest Posts

-

Yankees 12 3 Win Frieds Debut Highlights Offensive Powerhouse Against Pirates

Apr 28, 2025

Yankees 12 3 Win Frieds Debut Highlights Offensive Powerhouse Against Pirates

Apr 28, 2025 -

Frieds First Game As A Yankee Offensive Explosion Secures 12 3 Win Vs Pirates

Apr 28, 2025

Frieds First Game As A Yankee Offensive Explosion Secures 12 3 Win Vs Pirates

Apr 28, 2025 -

Max Frieds Impressive Yankees Debut 12 3 Rout Of Pirates

Apr 28, 2025

Max Frieds Impressive Yankees Debut 12 3 Rout Of Pirates

Apr 28, 2025 -

Yankees Max Fried Dominant Debut In 12 3 Victory Against Pirates

Apr 28, 2025

Yankees Max Fried Dominant Debut In 12 3 Victory Against Pirates

Apr 28, 2025 -

Max Frieds Yankee Debut 12 3 Win Over Pirates Fueled By Strong Offense

Apr 28, 2025

Max Frieds Yankee Debut 12 3 Win Over Pirates Fueled By Strong Offense

Apr 28, 2025