Market Volatility And Gold: How Trump's Actions Impact Prices

Table of Contents

Trump's Trade Policies and Their Effect on Gold Prices

Trump's presidency was marked by a significant shift in global trade relations. His administration implemented protectionist policies, directly impacting market stability and driving investor interest in gold.

Impact of Tariffs: The imposition of tariffs on imported goods created considerable market uncertainty. This uncertainty pushed investors towards gold, a traditional safe-haven asset, to protect their portfolios.

- Examples: Tariffs on steel and aluminum from China and the European Union, as well as tariffs on various goods from Mexico and Canada, all contributed to market volatility.

- Data Points: Studies indicate that periods of heightened tariff implementation were often correlated with increases in gold prices. For example, the announcement of tariffs on steel and aluminum in March 2018 saw a noticeable spike in gold prices.

- Expert Opinion: Many financial analysts, such as [cite a relevant financial analyst and their quote on tariffs and gold], noted the direct correlation between increased trade protectionism and heightened gold demand.

Trade Wars and Global Economic Slowdown: Trump's initiation of trade disputes with multiple countries fueled concerns about a global economic slowdown. This fueled further demand for gold as a safe-haven asset.

- Examples: The trade war with China, involving escalating tariffs and retaliatory measures, significantly impacted global market sentiment.

- Data Points: Charts clearly illustrate the relationship between escalated trade tensions and the upward trajectory of gold prices. Data from [cite a reliable source, e.g., World Gold Council] can be used to support this.

- Expert Opinion: Economists widely predicted that prolonged trade wars would negatively impact global growth, increasing investor appetite for gold as a hedge against economic downturn.

Trump's Fiscal Policies and their Influence on Gold

Trump's fiscal policies also played a role in shaping gold prices. His actions impacted inflation expectations and investor confidence, both of which influence gold investment decisions.

Government Spending and Inflation: Increased government spending, a key component of Trump's economic agenda, had the potential to fuel inflation. Gold, historically a hedge against inflation, benefited from this potential.

- Examples: Significant increases in military spending and infrastructure investments could have contributed to inflationary pressures.

- Data Points: Comparing inflation rates during Trump's presidency with gold price movements can illustrate this potential correlation. Data from the Bureau of Labor Statistics (BLS) would be helpful here.

- Expert Opinion: Experts on monetary policy frequently highlighted the potential for increased government spending to lead to inflation, making gold a more attractive investment.

Tax Cuts and their Impact on Market Sentiment: Trump's tax cuts aimed to stimulate economic growth, but their effect on market sentiment and subsequent gold investment was complex.

- Bullet Points: The tax cuts, while potentially boosting short-term economic activity, also raised concerns about long-term debt levels and fiscal sustainability.

- Data Points: Analyzing investor sentiment indices around the time of the tax cuts, alongside gold price movements, would reveal a more nuanced relationship.

- Expert Opinion: Financial experts offered differing perspectives on the tax cuts' impact on gold, with some arguing for a positive correlation and others highlighting the complexities of the situation.

Geopolitical Uncertainty and Gold's Response During Trump's Presidency

Trump's often unpredictable foreign policy decisions significantly increased global geopolitical uncertainty, further enhancing gold's appeal as a safe-haven asset.

International Relations and Gold as a Safe Haven: Trump's unconventional approach to international relations created substantial uncertainty in global markets.

- Examples: The withdrawal from the Iran nuclear deal, the shifting relationships with NATO allies, and heightened tensions with North Korea all added to market volatility.

- Data Points: Examining gold price fluctuations during periods of heightened geopolitical tension resulting from Trump's actions reinforces the safe-haven demand for gold.

- Expert Opinion: Geopolitical analysts frequently pointed to the increased uncertainty as a major factor driving investment in gold.

Conclusion

Trump's presidency witnessed significant shifts in trade, fiscal, and geopolitical landscapes. These changes, characterized by volatility and uncertainty, significantly impacted gold prices. His trade policies, particularly the imposition of tariffs and the initiation of trade wars, increased market uncertainty, driving investors towards gold. His fiscal policies, including increased government spending and tax cuts, influenced inflation expectations and investor sentiment, impacting gold's appeal. Finally, his foreign policy decisions created substantial geopolitical uncertainty, further solidifying gold's role as a safe haven asset. Understanding the complex interplay between market volatility and gold is crucial for investors. Understanding how market volatility and gold interact is crucial for navigating uncertain economic times. Learn more about protecting your investments during times of market uncertainty by understanding the relationship between gold prices and political events.

Featured Posts

-

Prodazhi Vinilovikh Plativok Teylor Svift Lidiruye Ostanni 10 Rokiv

May 27, 2025

Prodazhi Vinilovikh Plativok Teylor Svift Lidiruye Ostanni 10 Rokiv

May 27, 2025 -

Stream Tom Hiddleston And Brie Larsons Monster Verse Film For Free Next Month

May 27, 2025

Stream Tom Hiddleston And Brie Larsons Monster Verse Film For Free Next Month

May 27, 2025 -

Ukrayina Nato Nimetskiy Vnesok U Yevroatlantichnu Integratsiyu

May 27, 2025

Ukrayina Nato Nimetskiy Vnesok U Yevroatlantichnu Integratsiyu

May 27, 2025 -

The Future Of Yellowstone Will Taylor Sheridans Retirement Impact The Show

May 27, 2025

The Future Of Yellowstone Will Taylor Sheridans Retirement Impact The Show

May 27, 2025 -

Gucci 838949 Faev 58460 Re Web Gradient Blue Gg Supreme Handbag Details And Release Date

May 27, 2025

Gucci 838949 Faev 58460 Re Web Gradient Blue Gg Supreme Handbag Details And Release Date

May 27, 2025

Latest Posts

-

Houston Faces Unprecedented Crisis Drug Addicted Rat Infestation

May 31, 2025

Houston Faces Unprecedented Crisis Drug Addicted Rat Infestation

May 31, 2025 -

Drug Addicted Rats Plague Houston Understanding The Unusual Crisis

May 31, 2025

Drug Addicted Rats Plague Houston Understanding The Unusual Crisis

May 31, 2025 -

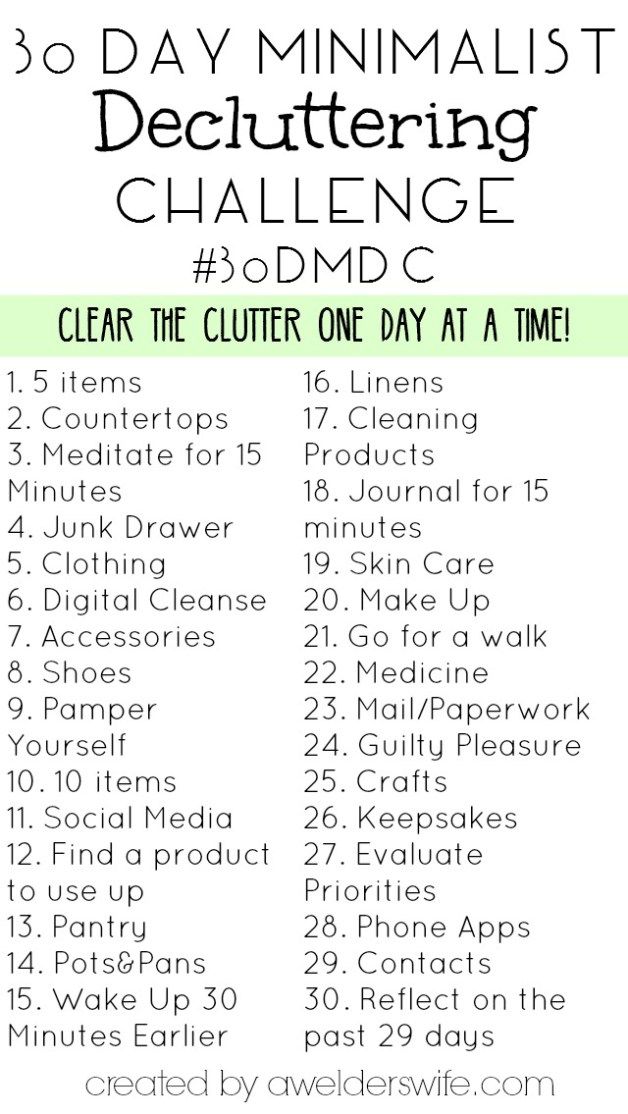

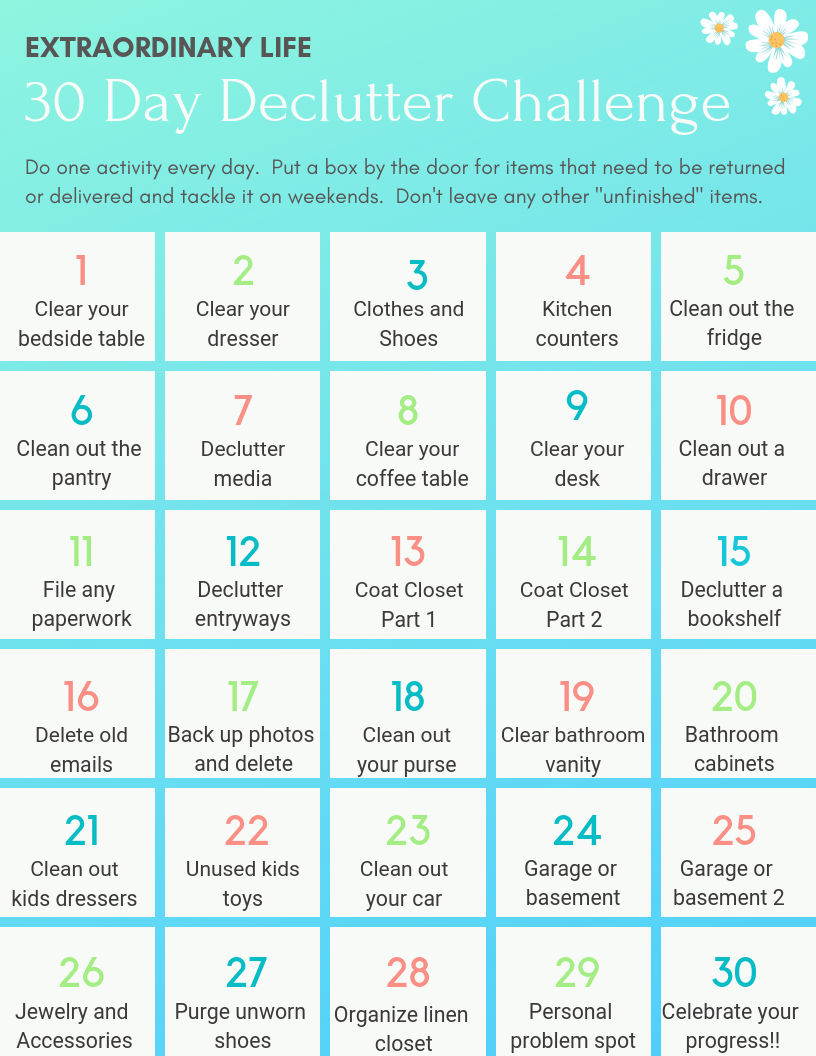

30 Days To Minimalism A Practical Guide To Decluttering

May 31, 2025

30 Days To Minimalism A Practical Guide To Decluttering

May 31, 2025 -

Simplify Your Life In 30 Days A Minimalist Approach

May 31, 2025

Simplify Your Life In 30 Days A Minimalist Approach

May 31, 2025 -

Declutter Your Life The 30 Day Minimalist Experiment

May 31, 2025

Declutter Your Life The 30 Day Minimalist Experiment

May 31, 2025