Market Volatility And Investor Behavior: A Case Study Of Recent Trends

Table of Contents

Recent Market Volatility: A Deep Dive

Market volatility in 2023 has been significantly influenced by several interconnected factors, creating a challenging environment for investors. Understanding these drivers of global market volatility is crucial for informed decision-making. Recent market trends demonstrate the interplay of economic uncertainty and geopolitical risks.

-

The Impact of Inflation on Investor Sentiment: Soaring inflation rates in many countries have eroded purchasing power and fueled concerns about future economic growth. This has led to increased market uncertainty and impacted investor confidence, resulting in increased market volatility. High inflation often necessitates interest rate hikes, further impacting market sentiment.

-

Interest Rate Changes and Market Volatility: Central banks around the world have responded to inflation by raising interest rates. While intended to curb inflation, these hikes can negatively impact stock prices and increase market volatility. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and reducing corporate profitability. This correlation between interest rate changes and market volatility is a key factor to consider.

-

Geopolitical Risks and Market Uncertainty: Geopolitical events, such as the ongoing conflict in Ukraine and rising tensions in other regions, contribute significantly to global market volatility. These events introduce uncertainty, impacting supply chains, energy prices, and overall economic stability. Analyzing these geopolitical risks is crucial for assessing market volatility and its potential impact.

-

Illustrating Volatility: The Volatility Index (VIX), often referred to as the "fear gauge," provides a quantifiable measure of market expectations of near-term volatility. [Insert relevant chart or graph of the VIX here, showing recent spikes in volatility]. This visual representation helps illustrate the periods of heightened uncertainty.

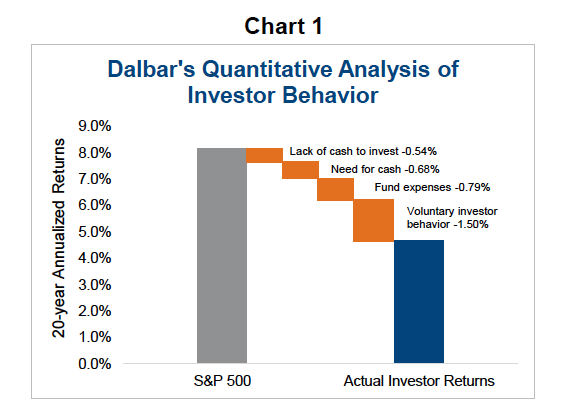

The Psychology of Investor Behavior During Volatility

Behavioral finance highlights the significant role of investor psychology in driving market reactions to volatility. Fear and greed are powerful emotions that can lead to irrational investment decisions. Understanding these psychological factors is key to mitigating their negative impact.

-

Loss Aversion and Investment Choices: Loss aversion, the tendency to feel the pain of a loss more strongly than the pleasure of an equivalent gain, can lead investors to hold onto losing investments for too long or sell winning investments too early. This emotional response contributes to poor investment outcomes during volatile periods.

-

Herd Mentality and Irrational Decisions: Herd behavior, where investors mimic the actions of others, can amplify market fluctuations. During periods of high volatility, this can lead to panic selling, exacerbating market downturns. Independent analysis is crucial to avoid falling prey to herd mentality.

-

Cognitive Biases and Market Volatility: Cognitive biases, such as confirmation bias (favoring information that confirms existing beliefs) and overconfidence bias, can distort judgment and lead to poor investment decisions. Recognizing and mitigating these biases is essential for rational investing.

-

Emotional Intelligence in Investment Decisions: Emotional intelligence, the ability to understand and manage one's own emotions and those of others, is crucial for successful investing during volatile periods. Investors with high emotional intelligence are better equipped to make rational decisions despite market fluctuations.

Effective Strategies for Managing Volatility

Effectively managing market volatility requires a proactive approach incorporating several key strategies. These strategies help mitigate risk and improve the chances of long-term investment success.

-

Diversification: A Cornerstone of Risk Management: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces the impact of any single investment's poor performance. This spreads risk and helps cushion against market downturns.

-

Asset Allocation Strategies: Tailoring to Risk Tolerance: Asset allocation involves determining the optimal mix of assets in your portfolio based on your risk tolerance, investment goals, and time horizon. This strategy helps balance risk and reward.

-

Dollar-Cost Averaging: A Disciplined Approach: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy reduces the risk of investing a lump sum at a market peak.

-

Long-Term Investing: Riding Out the Waves: Maintaining a long-term investment horizon allows you to ride out short-term market volatility. This approach is crucial for achieving long-term financial goals.

-

Risk Mitigation Tools: Stop-Loss Orders and More: Utilizing stop-loss orders can help limit potential losses by automatically selling an investment when it reaches a predetermined price. Other risk management tools, such as hedging strategies, can also be employed to protect your portfolio.

Case Studies: Examining Investor Reactions to Specific Events

Analyzing specific market events and investor reactions provides valuable insights into the psychology of investing during volatility and the effectiveness of different strategies.

-

Case Study 1: The [Insert Specific Event, e.g., early 2022 tech stock sell-off]: This event saw a sharp decline in technology stocks, leading to widespread panic selling among some investors. However, investors with a long-term perspective and diversified portfolios were better able to weather the storm.

-

Case Study 2: The [Insert Specific Event, e.g., post-pandemic market rebound]: This period of rapid market growth saw both exuberant buying and cautious approaches. The case study would highlight the contrasting strategies and their respective outcomes.

Conclusion

Market volatility significantly impacts investor behavior, often leading to emotional and irrational decisions. Understanding the psychology of investing during turbulent times, coupled with implementing effective risk management strategies, is crucial for long-term investment success. By diversifying your portfolio, employing dollar-cost averaging, and adopting a long-term perspective, you can mitigate the impact of market volatility and achieve your financial goals. Learn more about effective strategies for managing market volatility and protecting your investments – your financial future depends on it.

Featured Posts

-

9 Revelations From Times Trump Interview Annexing Canada Xi Jinping And The Presidency

Apr 28, 2025

9 Revelations From Times Trump Interview Annexing Canada Xi Jinping And The Presidency

Apr 28, 2025 -

The Current Gpu Price Situation Causes And Predictions

Apr 28, 2025

The Current Gpu Price Situation Causes And Predictions

Apr 28, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Automakers

Apr 28, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Automakers

Apr 28, 2025 -

Is Kuxius Solid State Power Bank Worth The Price Longevity Vs Cost

Apr 28, 2025

Is Kuxius Solid State Power Bank Worth The Price Longevity Vs Cost

Apr 28, 2025 -

Metro Vancouver Housing Rent Increase Slowdown But Costs Still Climbing

Apr 28, 2025

Metro Vancouver Housing Rent Increase Slowdown But Costs Still Climbing

Apr 28, 2025

Latest Posts

-

Yankees Suffer Setback Devin Williams Implosion Leads To Loss Against Blue Jays

Apr 28, 2025

Yankees Suffer Setback Devin Williams Implosion Leads To Loss Against Blue Jays

Apr 28, 2025 -

Yankees Loss To Blue Jays Devin Williams Another Collapse

Apr 28, 2025

Yankees Loss To Blue Jays Devin Williams Another Collapse

Apr 28, 2025 -

Devin Williams Implosion Dooms Yankees In Loss To Blue Jays

Apr 28, 2025

Devin Williams Implosion Dooms Yankees In Loss To Blue Jays

Apr 28, 2025 -

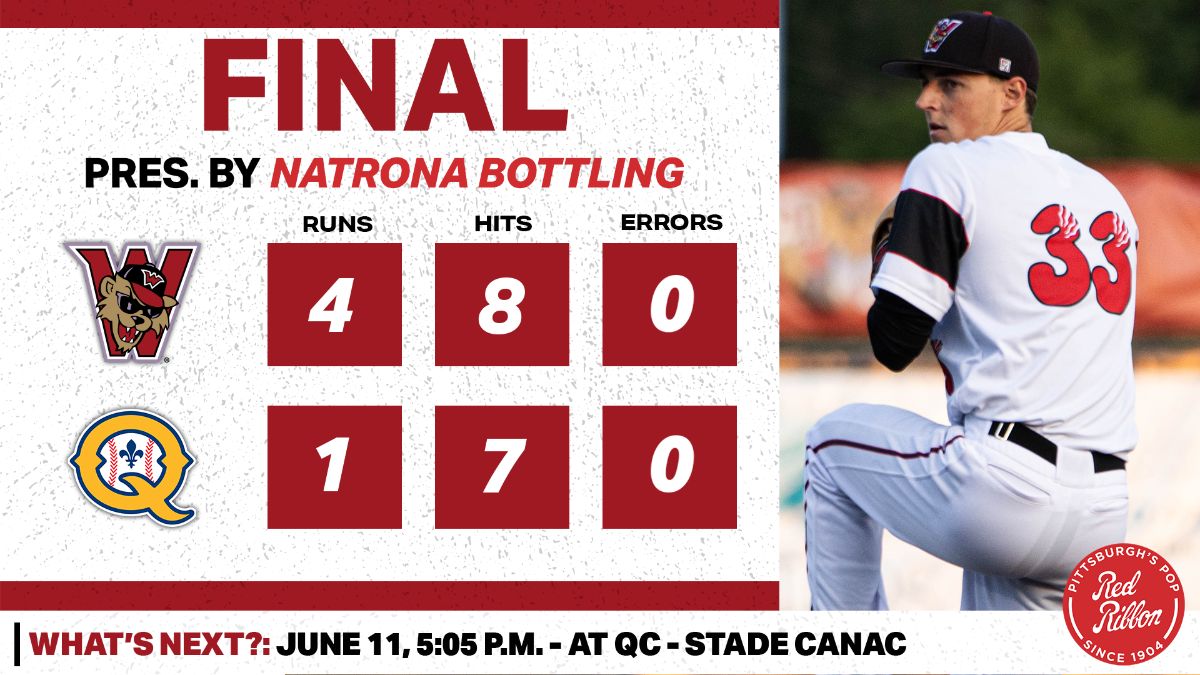

Yankees Stave Off Sweep Rodons Pitching Early Offense Key To Victory

Apr 28, 2025

Yankees Stave Off Sweep Rodons Pitching Early Offense Key To Victory

Apr 28, 2025 -

Rodons Strong Performance Yankees Offense Secure Win Against Astros

Apr 28, 2025

Rodons Strong Performance Yankees Offense Secure Win Against Astros

Apr 28, 2025