Market Volatility: US Fiscal Concerns Fuel Stock Market Decline

Table of Contents

The Debt Ceiling Debate and its Impact on Market Confidence

The ongoing debate surrounding the US debt ceiling is a major contributor to current market volatility. The debt ceiling represents the legal limit on the amount of debt the US government can accumulate. Reaching this limit without raising it could lead to a series of severe economic consequences, triggering widespread uncertainty and impacting investor confidence.

-

Potential government shutdown scenarios and their market effects: Failure to raise the debt ceiling could force a government shutdown, halting essential government services and potentially disrupting the economy. This uncertainty can lead to immediate market drops as investors react to the risk.

-

Impact on investor confidence and risk appetite: The very real possibility of a US default on its debt significantly erodes investor confidence. This leads to risk aversion, as investors pull back from the market, seeking safer investments.

-

Credit rating downgrades and their consequences: If the US defaults, credit rating agencies could downgrade the country's credit rating. This would increase borrowing costs for the government and businesses, further exacerbating economic woes and negatively impacting market performance.

-

Increased borrowing costs for the government and businesses: Higher borrowing costs make it more expensive for the government to fund its operations and for businesses to invest and expand. This dampens economic activity and contributes to market instability.

-

Uncertainty surrounding future fiscal policy: The ongoing political wrangling surrounding the debt ceiling highlights deeper concerns about the long-term sustainability of US fiscal policy. This uncertainty creates a climate of fear and instability in the markets.

Inflationary Pressures and the Federal Reserve's Response

Persistent inflationary pressures are another significant driver of market volatility. High inflation erodes purchasing power and increases the cost of living, impacting consumer spending and business investment. The Federal Reserve (Fed), tasked with controlling inflation, has responded with aggressive interest rate hikes.

-

Impact of interest rate hikes on market valuations: Raising interest rates increases borrowing costs for businesses and consumers, slowing economic growth and impacting corporate profits. This often leads to lower valuations for stocks.

-

Potential for a recession due to aggressive monetary policy: The Fed's aggressive approach to tackling inflation raises the risk of a recession. The fear of an economic downturn is a major contributor to market volatility.

-

Inflation's effect on consumer spending and business investment: High inflation reduces consumer spending as people have less disposable income. Businesses, facing higher input costs and reduced demand, may postpone investment plans.

-

The Fed's balancing act between inflation control and economic growth: The Fed is walking a tightrope, trying to control inflation without triggering a recession. This delicate balancing act contributes to the market's uncertainty.

-

Uncertainty about the future path of interest rates: Investors are keenly watching the Fed's actions and statements for clues about future interest rate movements. Uncertainty about the future path of interest rates fuels market volatility.

Geopolitical Risks and their Contribution to Market Volatility

Geopolitical events significantly contribute to the current market uncertainty. The ongoing war in Ukraine, tensions with China, and other global conflicts create instability that impacts markets worldwide.

-

The impact of the war in Ukraine on global energy prices and supply chains: The war has disrupted global energy markets, leading to higher energy prices and impacting supply chains. This adds to inflationary pressures and market uncertainty.

-

Tensions with China and their effect on trade and investment: Escalating tensions between the US and China, particularly regarding trade and technology, create uncertainty for businesses operating in global markets, leading to market volatility.

-

Other geopolitical factors contributing to market instability: Other geopolitical factors, such as political instability in various regions, can also contribute to increased market volatility.

-

Increased market volatility due to global uncertainty: The cumulative effect of these geopolitical risks is a heightened sense of global uncertainty, leading to increased market volatility.

-

The influence of geopolitical risks on investor sentiment: Geopolitical risks negatively impact investor sentiment, leading to risk aversion and market declines.

How to Navigate Market Volatility

Navigating periods of high market volatility requires a well-defined strategy. Investors can employ several techniques to mitigate risk and protect their portfolios.

-

Diversify your investment portfolio: A diversified portfolio, spreading investments across different asset classes and geographies, can help reduce risk during periods of market volatility.

-

Maintain a long-term investment strategy: A long-term investment strategy focuses on long-term goals, rather than reacting to short-term market fluctuations.

-

Consider hedging strategies to mitigate risk: Hedging strategies, such as using derivatives, can help protect against potential losses during market downturns.

-

Stay informed about market developments: Keeping up-to-date on market news and economic data is crucial for making informed investment decisions.

-

Consult with a financial advisor: A financial advisor can help you develop a personalized investment strategy that aligns with your risk tolerance and financial goals.

Conclusion

The current market volatility is a complex issue driven by a confluence of factors, including the US debt ceiling debate, persistent inflationary pressures, and ongoing geopolitical risks. Understanding these interconnected forces is vital for investors. While the short-term outlook remains uncertain, maintaining a well-diversified portfolio, adhering to a long-term investment strategy, and staying informed are crucial for navigating periods of high market volatility. Don't let the current market volatility deter you – a well-informed approach to investing can help you weather the storm. Learn more about managing your investments during periods of high market volatility and develop a robust strategy to protect your portfolio.

Featured Posts

-

Poznat Izgledot Na Sheshirite Makedoni A Gi Dozna Mozhnite Rivali Vo Ligata Na Natsii

May 23, 2025

Poznat Izgledot Na Sheshirite Makedoni A Gi Dozna Mozhnite Rivali Vo Ligata Na Natsii

May 23, 2025 -

James Wiltshire Reflecting On A Decade Of Photography At The Border Mail

May 23, 2025

James Wiltshire Reflecting On A Decade Of Photography At The Border Mail

May 23, 2025 -

The Kieran Culkin Michael Jackson Connection Fact Or Fiction

May 23, 2025

The Kieran Culkin Michael Jackson Connection Fact Or Fiction

May 23, 2025 -

Sam Cook Englands New Test Bowler For Zimbabwe Series

May 23, 2025

Sam Cook Englands New Test Bowler For Zimbabwe Series

May 23, 2025 -

Zimbabwe Ends Away Test Win Drought With Sylhet Victory

May 23, 2025

Zimbabwe Ends Away Test Win Drought With Sylhet Victory

May 23, 2025

Latest Posts

-

Srkht Alhryt Lflstyn Thlyl Lrdwd Alfel Ela Emlyt Washntn Wtsryhat Rwdryghyz

May 23, 2025

Srkht Alhryt Lflstyn Thlyl Lrdwd Alfel Ela Emlyt Washntn Wtsryhat Rwdryghyz

May 23, 2025 -

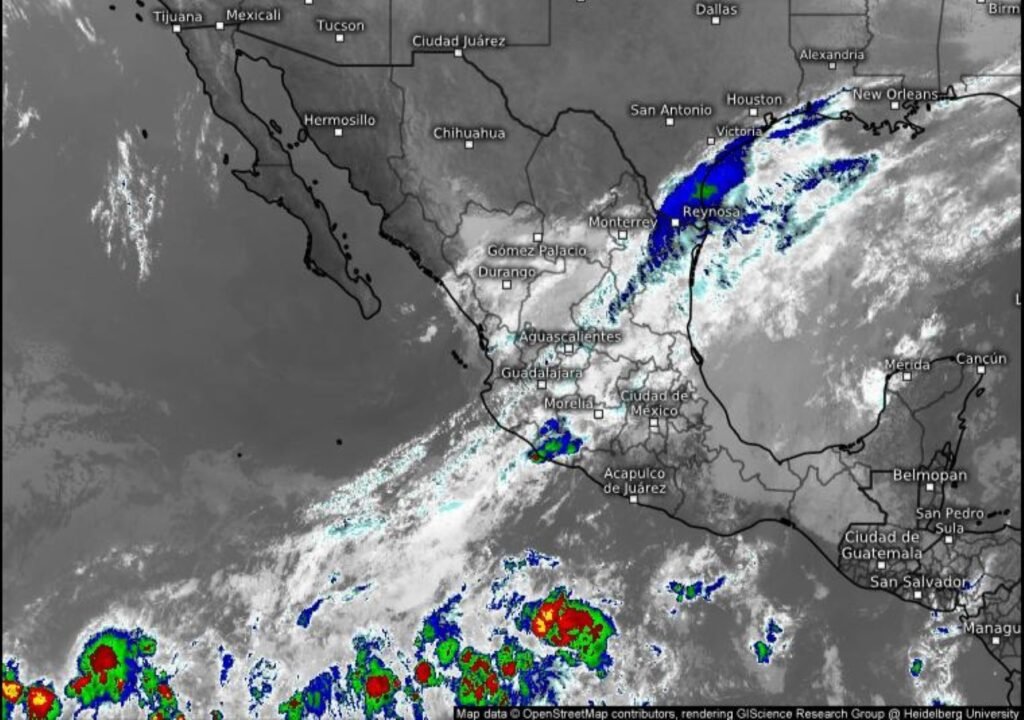

Alerta Meteorologica Se Esperan Lluvias Moderadas

May 23, 2025

Alerta Meteorologica Se Esperan Lluvias Moderadas

May 23, 2025 -

Ten Hag From Manchester United To Leverkusen A Realistic Possibility

May 23, 2025

Ten Hag From Manchester United To Leverkusen A Realistic Possibility

May 23, 2025 -

Jesse Eisenbergs Relaxed Approach To Casting Kieran Culkin In A Real Pain

May 23, 2025

Jesse Eisenbergs Relaxed Approach To Casting Kieran Culkin In A Real Pain

May 23, 2025 -

La Libertad Excongresista Rodriguez Acusa A App De Venganza Politica

May 23, 2025

La Libertad Excongresista Rodriguez Acusa A App De Venganza Politica

May 23, 2025