Market Wrap: Sensex Up 200, Nifty Above 18,600 - Key Movers

Table of Contents

Sensex Gains and Key Contributors

The Sensex's impressive 200-point gain was driven by strong performances across various sectors. Analyzing the sectoral performance provides a deeper understanding of the market rally.

Sector-wise Performance:

The banking and IT sectors were key contributors to the Sensex's rise, exhibiting robust growth. FMCG and auto sectors also showed positive momentum, though at a slightly more moderate pace. This broad-based strength indicates a healthy and optimistic market outlook. The surge in these sectors reflects investor confidence in the long-term economic prospects of India.

-

Top 5 Sensex Gainers:

- Reliance Industries (+3.2%)

- HDFC Bank (+2.8%)

- Infosys (+2.5%)

- ICICI Bank (+2.2%)

- TCS (+1.9%) (Percentage increases are illustrative)

-

Strong Q2 earnings reports from several banking and IT companies boosted investor sentiment and fuelled trading volume.

-

The high trading volume in leading stocks suggests significant investor participation in the market rally.

Nifty's Ascent Above 18,600

The Nifty 50 index also experienced a significant surge, comfortably surpassing the 18,600 mark, mirroring the positive trend observed in the Sensex. Understanding the technical indicators and outlook is crucial for short-term and long-term investment strategies.

Technical Analysis & Outlook:

The Nifty's upward trajectory suggests a bullish market sentiment. Technical indicators, such as the Relative Strength Index (RSI) and moving averages, point towards further potential upside. However, investors should remain cautious and monitor key economic indicators.

- Key Support and Resistance Levels: The immediate support level for the Nifty is around 18,500, while resistance is expected around 18,750. (These are illustrative figures)

- Upcoming inflation data releases will significantly influence market sentiment in the coming days.

- Experts predict sustained growth for the Nifty in the short term, with some suggesting potential for further gains based on current macroeconomic factors and global market stability.

Key Movers and Market Volatility

While the overall market trend was positive, certain stocks experienced significant price swings, highlighting the inherent volatility of the stock market. Understanding these fluctuations is critical for informed investment decisions.

Significant Stock Movements:

The market showed instances of both significant positive and negative movements, reflecting the dynamic nature of stock trading.

- Significant Positive Movers: Apart from the top Sensex gainers, [mention specific stocks and reasons].

- Significant Negative Movers: [Mention specific stocks and reasons for negative movements. Examples could include negative earnings reports or regulatory concerns].

- Today's market volatility was relatively low compared to the previous week, suggesting a degree of market stability despite the sharp movements in specific stocks.

Global Market Influences

Global market trends play a significant role in influencing the Indian stock market. Examining these correlations provides a broader perspective on the market's performance.

International Market Trends:

Positive trends in major global indices, such as the Dow Jones and Nasdaq, contributed to the overall optimistic sentiment in the Indian market.

- Positive economic data from the US and Europe bolstered global investor sentiment, impacting positively on the Indian market.

- The correlation between global and Indian markets was particularly strong today, indicating a high degree of interconnectedness.

- Any significant geopolitical events or global economic shifts could influence the direction of the Indian stock market in the coming days.

Conclusion

Today's market wrap highlights the impressive gains witnessed in the Sensex and Nifty indices, closing up 200 and surpassing 18,600 respectively. Strong performances across key sectors, particularly banking and IT, were major contributors. While the overall market exhibited positive momentum, individual stock movements highlighted inherent volatility. Global market trends also played a crucial role in shaping today's market dynamics. Stay informed about the daily fluctuations of the Sensex and Nifty with our regular Market Wrap updates. Follow [Publication Name] for insightful stock market analysis and stay ahead in the game!

Featured Posts

-

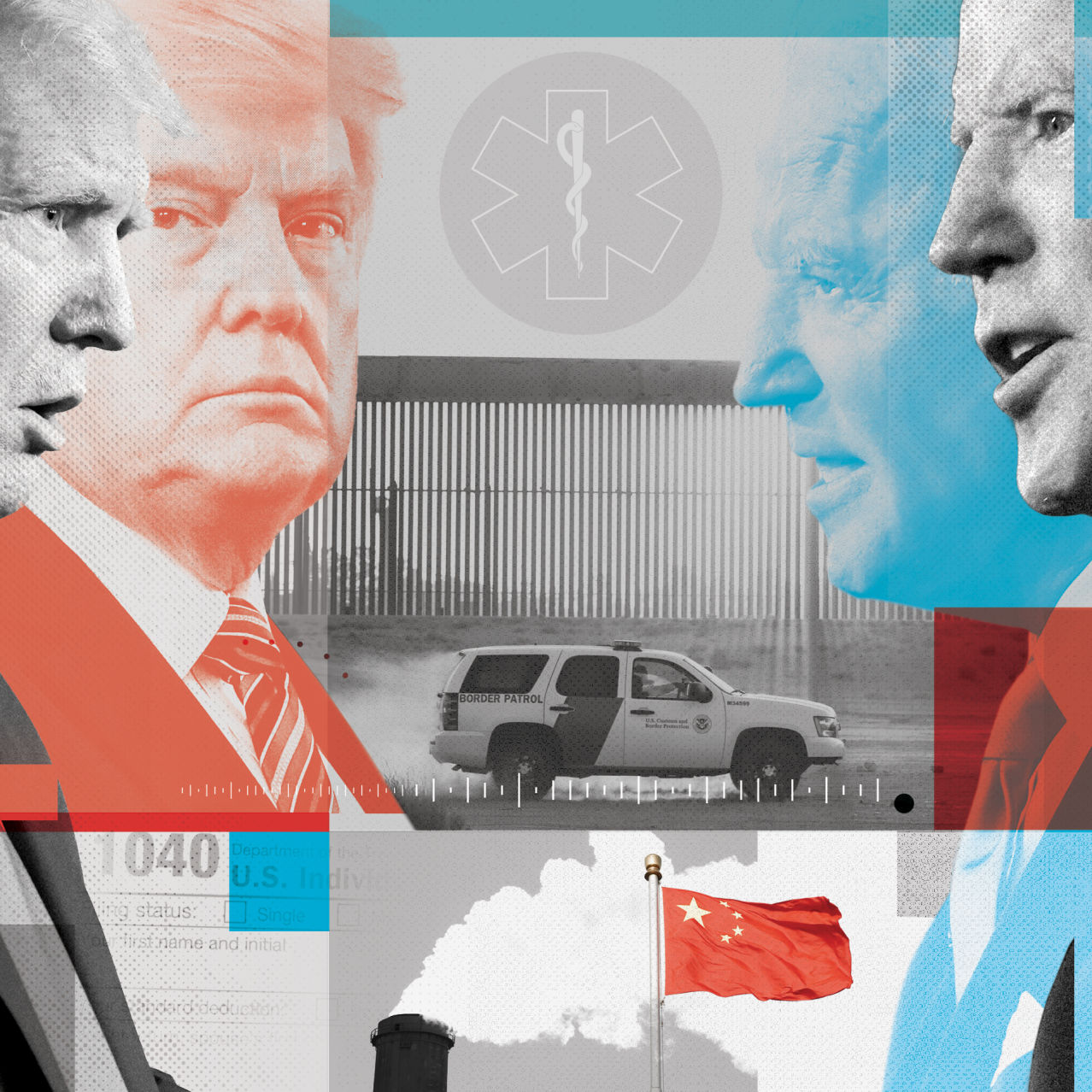

Survey Transgender Perspectives On Trump Administration Policies

May 10, 2025

Survey Transgender Perspectives On Trump Administration Policies

May 10, 2025 -

Understanding Figmas Ai Driven Competitive Edge

May 10, 2025

Understanding Figmas Ai Driven Competitive Edge

May 10, 2025 -

Crack The Nyt Spelling Bee April 4 2025 Clues And Solutions

May 10, 2025

Crack The Nyt Spelling Bee April 4 2025 Clues And Solutions

May 10, 2025 -

Sharing Your Story The Impact Of Trumps Executive Orders On Transgender Lives

May 10, 2025

Sharing Your Story The Impact Of Trumps Executive Orders On Transgender Lives

May 10, 2025 -

El Bolso Hereu De Dakota Johnson Un Icono De Estilo Para It Girls

May 10, 2025

El Bolso Hereu De Dakota Johnson Un Icono De Estilo Para It Girls

May 10, 2025