Markets To Decide If Words Are Enough: Assessing The US-China Trade Talks

Table of Contents

The Current State of US-China Trade Negotiations

The US-China trade negotiations have been characterized by a series of ups and downs, marked by periods of apparent progress followed by setbacks. Key sticking points remain, including intellectual property rights protection, forced technology transfer, and the persistent trade imbalance. While both sides have expressed a desire for a resolution, significant disagreements persist.

- Concessions and Disagreements: Recent negotiations have seen some concessions on agricultural purchases from China, but substantial disagreements remain on issues such as market access for US companies and the enforcement of intellectual property rights. China has also pushed for the removal of existing tariffs.

- Deadlines and Upcoming Events: Although specific deadlines are rarely publicly announced, the ongoing negotiations are often punctuated by important meetings and events, including high-level diplomatic discussions and ministerial-level talks. The timing and outcome of these events significantly influence market sentiment.

- Key Figures: The negotiations involve key figures from both sides, including high-ranking officials from the US Trade Representative's office and the Chinese Ministry of Commerce. The personal dynamics and negotiating styles of these individuals can also influence the trajectory of the talks.

Assessing the Economic Impact of the Talks

The economic implications of the US-China trade talks are far-reaching and multifaceted. Different outcomes will have vastly different impacts on both economies, and indeed, the global economy.

- Sector-Specific Impacts: The agricultural sector in the US is particularly sensitive to the outcome of these talks, as is the technology sector, given concerns about data security and intellectual property theft. Manufacturing industries in both countries are also significantly affected by tariffs and trade restrictions.

- Global Supply Chain Disruptions: The US-China trade relationship is deeply intertwined with global supply chains. Continued trade tensions could lead to further disruptions, increasing costs and potentially slowing economic growth.

- Tariffs and Sanctions: The imposition and potential removal of tariffs and sanctions have a direct impact on the pricing of goods and the profitability of businesses. These measures can significantly influence inflation rates and consumer spending.

- Economic Growth vs. Recession: A successful resolution to the trade talks could boost economic growth for both countries and globally. Conversely, a prolonged stalemate or further escalation could lead to decreased investment and a potential global recession.

Market Reactions and Investor Sentiment

The US-China trade talks have significantly impacted global markets, causing considerable volatility. Investor sentiment shifts dramatically based on news and developments.

- Market Volatility: Announcements related to the US-China trade talks have consistently been associated with increased market volatility, particularly in the equity markets. Positive news generally leads to rallies, while negative news can trigger sharp declines.

- Investor Confidence and Risk Appetite: Investor confidence has been closely tied to the progress of the negotiations. Periods of optimism lead to increased risk appetite, while periods of uncertainty result in a flight to safety.

- Stock Index Performance: Major stock indices such as the S&P 500 and the Shanghai Composite have shown strong correlations with the progress or lack thereof in the US-China trade talks. These indices often experience significant swings based on the news flow.

- Media Influence: The media plays a considerable role in shaping market sentiment. Positive or negative media coverage of the talks can significantly influence investor behavior and market reactions.

Geopolitical Implications Beyond Trade

The US-China trade relationship extends far beyond pure economics, influencing global power dynamics and international relations.

- Global Power Dynamics: The trade dispute is viewed by many as a reflection of a broader struggle for global influence between the two superpowers.

- Alliances and International Relations: The trade war has tested existing alliances and created new fault lines in international relations. Countries are increasingly forced to choose sides, potentially leading to geopolitical realignments.

- Related Geopolitical Tensions: The trade conflict is intertwined with other geopolitical tensions, including disputes over Taiwan, the South China Sea, and cybersecurity.

The Role of Technology in the US-China Trade War

Technological competition between the US and China is a central aspect of the trade conflict.

- 5G Technology: The race to dominate 5G technology is a key battleground, with both countries seeking to establish technological leadership and secure strategic advantages.

- Tech Companies' Involvement: Major technology companies from both countries are directly impacted by the trade tensions, facing restrictions on access to markets and technology sharing.

- Technological Sanctions: The US has imposed various technological sanctions on Chinese companies, restricting their access to key technologies and components.

Conclusion: Markets to Decide if Words Are Enough: A Final Assessment of the US-China Trade Talks

The US-China trade talks remain a critical factor shaping global markets. The economic and geopolitical ramifications are profound, impacting various sectors and influencing investor sentiment. Market reactions will ultimately be the arbiter of whether the words exchanged in these negotiations translate into tangible improvements in the trade relationship. Continued market observation is crucial to assessing the long-term effects of any agreements reached. To make informed investment decisions, stay updated on the US-China trade talks; monitor the impact of US-China trade negotiations closely; and follow the developments in US-China trade relations carefully. The ongoing uncertainty underscores the crucial role that markets will play in determining the ultimate success or failure of these complex negotiations.

Featured Posts

-

Semana Santa O Semana De Turismo La Particularidad Uruguaya

May 12, 2025

Semana Santa O Semana De Turismo La Particularidad Uruguaya

May 12, 2025 -

Tom Cruise And Ana De Armas A New Romance Blossoming In England

May 12, 2025

Tom Cruise And Ana De Armas A New Romance Blossoming In England

May 12, 2025 -

Exploring The World Of Hotel Transylvania A Fans Guide

May 12, 2025

Exploring The World Of Hotel Transylvania A Fans Guide

May 12, 2025 -

2025 Indy Car Season What To Expect From Rahal Letterman Lanigan Racing

May 12, 2025

2025 Indy Car Season What To Expect From Rahal Letterman Lanigan Racing

May 12, 2025 -

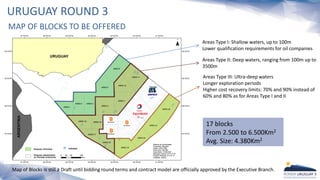

Black Gold Prospects The Future Of Offshore Drilling In Uruguay

May 12, 2025

Black Gold Prospects The Future Of Offshore Drilling In Uruguay

May 12, 2025

Latest Posts

-

Doom Games Chronological Order A Complete Guide

May 13, 2025

Doom Games Chronological Order A Complete Guide

May 13, 2025 -

Exploring Doom The Dark Ages Gameplay Story And More

May 13, 2025

Exploring Doom The Dark Ages Gameplay Story And More

May 13, 2025 -

Doom The Dark Ages Everything You Need To Know

May 13, 2025

Doom The Dark Ages Everything You Need To Know

May 13, 2025 -

Doom The Dark Ages A Comprehensive Guide

May 13, 2025

Doom The Dark Ages A Comprehensive Guide

May 13, 2025 -

The Dark Ages Of Gaming Dooms Continued Relevance In Modern Development

May 13, 2025

The Dark Ages Of Gaming Dooms Continued Relevance In Modern Development

May 13, 2025