Master The Bargain Hunt: Strategies For Smart Spending

Table of Contents

Planning Your Purchases: The Foundation of Smart Spending

Smart spending starts with a plan. Before you even think about browsing sales, you need a solid foundation built on budgeting and prioritization.

Creating a Budget and Sticking to It

Effective budgeting is the cornerstone of mastering the bargain hunt. It provides a clear picture of your finances, allowing you to allocate funds strategically.

- Utilize budgeting apps: Mint, YNAB (You Need A Budget), and Personal Capital offer features to track expenses, categorize spending, and set financial goals.

- Track expenses: Monitor where your money goes for at least a month to identify spending patterns and areas for improvement.

- Categorize spending: Divide your expenses into needs (housing, food, transportation) and wants (entertainment, dining out, subscriptions).

- Set realistic goals: Don't try to overhaul your spending overnight. Start with small, achievable goals and gradually work towards larger ones.

- Allocate funds for wants vs. needs: Assign a specific amount for wants each month, preventing overspending.

Different budgeting methods cater to various needs. The 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Zero-based budgeting, on the other hand, requires you to allocate every dollar of your income to a specific expense category. Choose the method that best suits your lifestyle and financial goals. [Link to budgeting resource].

Prioritizing Needs vs. Wants

Differentiating between needs and wants is crucial for effective bargain hunting. Needs are essential for survival and well-being, while wants are desires that improve your quality of life but aren't strictly necessary.

- Differentiate between essential and non-essential purchases: Analyze your spending habits to distinguish between needs and wants.

- Create a "wants" list and prioritize: Instead of impulsive buying, create a list and prioritize items based on their importance and value.

- Delay gratification for non-essential items: Give yourself time to consider a purchase before making it. This helps prevent impulse buys.

Impulse buying often stems from emotional triggers like stress or boredom. Strategies to overcome it include mindful shopping, avoiding stores when stressed, and unsubscribing from tempting email newsletters. For example, needing new winter boots is a need, while buying the latest designer handbag is a want.

Utilizing Shopping Lists and Meal Planning

Shopping lists and meal planning are powerful tools for saving money and reducing waste.

- Create detailed shopping lists: Plan your meals for the week and create a detailed shopping list based on the ingredients needed.

- Plan meals for the week: This helps avoid impulse buys at the grocery store and reduces food waste.

- Avoid impulse buys at the grocery store: Stick to your shopping list and avoid browsing aisles that tempt you.

- Compare unit prices: Check the unit price (price per ounce, pound, etc.) to ensure you're getting the best value for your money.

Meal planning dramatically reduces grocery bills by preventing unnecessary purchases and minimizing food waste. Utilize grocery store apps for coupons and digital shopping lists to streamline your process.

Mastering the Art of the Sale: Finding the Best Deals

Finding the best deals requires understanding sales cycles and utilizing various strategies.

Understanding Sales Cycles and Promotional Periods

Retailers follow predictable sales cycles throughout the year. Learning these patterns can help you snag incredible bargains.

- Learn seasonal sales patterns: Familiarize yourself with the typical sales periods for different products (back-to-school, holiday season, end-of-season clearances).

- Identify peak shopping times for specific items: Research when the best deals on specific items typically occur.

- Utilize price comparison websites: Websites like Google Shopping, PriceGrabber, and CamelCamelCamel help you compare prices across different retailers.

Various sales exist: clearance sales (end-of-season discounts), flash sales (short-term, limited-quantity offers), and early bird discounts (rewards for early purchases). Always ensure a sale genuinely offers a good deal by comparing prices and considering the item’s original value.

Utilizing Coupons and Discount Codes

Coupons and discount codes are valuable tools for saving money.

- Sign up for email newsletters: Many retailers offer exclusive discounts to email subscribers.

- Use coupon websites and apps: Websites like RetailMeNot and Groupon offer a wide range of coupons and deals.

- Look for in-store coupons and rebates: Check your local newspaper, store flyers, and websites for coupons and rebates.

- Stack coupons where allowed: Combine manufacturer coupons and store coupons to maximize savings (check store policies).

Manufacturer coupons are offered by the product's manufacturer, while store coupons are issued by the retailer. Understanding the different types and how to stack them can significantly impact your savings.

Negotiating Prices and Leveraging Loyalty Programs

Don't be afraid to negotiate, especially for larger purchases, and leverage loyalty programs.

- Don't be afraid to negotiate: Politely inquire about discounts, particularly for larger purchases like furniture or appliances.

- Utilize loyalty programs and rewards points: Sign up for loyalty programs to earn points or cashback on purchases.

- Ask about price matching: Many retailers will match a competitor's price if you show them proof of a lower price.

Negotiating requires confidence and politeness. Clearly state your desired price and be prepared to walk away if the seller isn't willing to compromise. Loyalty programs offer significant long-term savings; make sure to utilize them fully.

Smart Shopping Habits for Long-Term Savings

Cultivating smart shopping habits leads to substantial long-term savings.

Comparing Prices Across Retailers

Before making a purchase, always compare prices across multiple retailers.

- Use price comparison websites: Leverage websites and apps designed to compare prices across multiple retailers.

- Check online reviews: Read reviews to ensure the product meets your expectations and is from a reputable seller.

- Consider shipping costs and taxes: Factor in shipping costs, sales taxes, and any other associated fees.

Failing to compare prices can lead to overspending. Utilize price comparison tools effectively to identify the best value.

Buying Used or Refurbished Items

Consider buying used or refurbished items to save money.

- Explore secondhand markets: Websites and apps like eBay, Craigslist, Facebook Marketplace, and OfferUp offer a wide selection of used and refurbished goods.

- Consider buying certified refurbished electronics: Certified refurbished electronics often come with warranties and are a cost-effective alternative to new products.

- Check for warranties: Ensure any used or refurbished item comes with a warranty to protect your purchase.

Buying used items can significantly reduce your spending while still allowing you to acquire quality products. Always inspect used goods carefully before purchasing.

Avoiding Impulse Purchases and Practicing Delayed Gratification

Resist impulse buys by employing effective strategies.

- Wait 24 hours before making a non-essential purchase: This allows time for rational consideration.

- Unsubscribe from tempting email newsletters: Reduce exposure to tempting sales and promotions.

- Use shopping cart abandonment strategies: Many retailers send reminders about items left in your shopping cart, giving you a chance to reconsider the purchase.

Impulse purchases drain your budget. Developing delayed gratification helps prevent these unnecessary expenses.

Conclusion: Become a Master of the Bargain Hunt

Mastering the bargain hunt involves strategic planning, skillful deal-finding, and the adoption of smart shopping habits. By creating a budget, prioritizing needs, utilizing sales, and employing savvy shopping techniques, you can significantly reduce spending and make informed purchasing decisions. Ready to master the bargain hunt and transform your spending habits? Start implementing these strategies today and unlock significant savings! [Link to budgeting worksheet]

Featured Posts

-

Bruno Fernandes Almost Joined Spurs A Look Back At The Transfer Saga

May 30, 2025

Bruno Fernandes Almost Joined Spurs A Look Back At The Transfer Saga

May 30, 2025 -

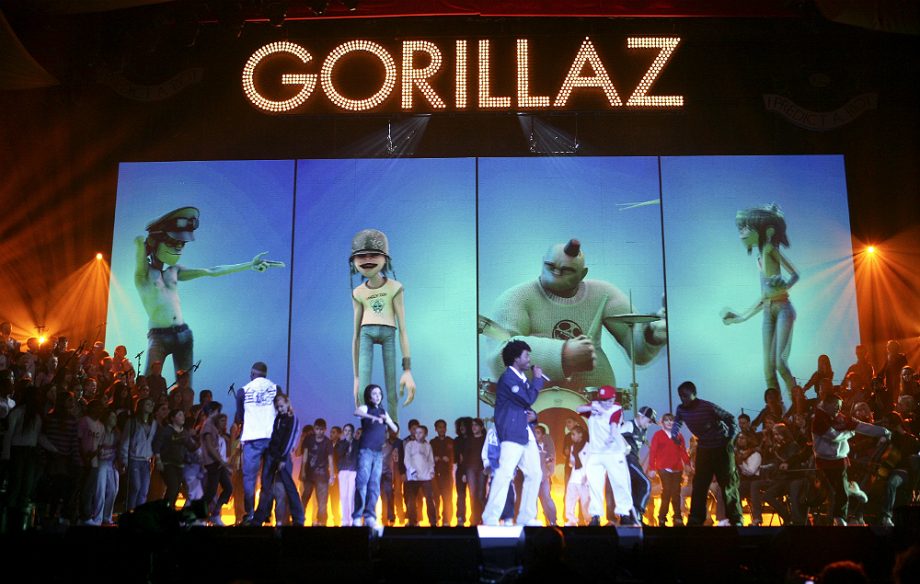

Gorillaz Announce Four Special September Live Shows

May 30, 2025

Gorillaz Announce Four Special September Live Shows

May 30, 2025 -

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025 -

Madden Nfl Rob Manfreds Mlb Ownership Crisis

May 30, 2025

Madden Nfl Rob Manfreds Mlb Ownership Crisis

May 30, 2025 -

Alcaraz Claims Sixth Masters 1000 Crown Defeats Injured Musetti In Monte Carlo

May 30, 2025

Alcaraz Claims Sixth Masters 1000 Crown Defeats Injured Musetti In Monte Carlo

May 30, 2025