Maximize Dividend Income: Simplicity As A Key To Success

Table of Contents

Understanding Dividend Investing Basics

Before diving into strategies to maximize dividend income, let's establish a solid foundation.

Defining Dividends and Dividend Yield

- Dividend: A dividend is a payment made by a company to its shareholders, usually from its profits. It represents a share of the company's earnings distributed to those who own its stock.

- Dividend Yield: This crucial metric calculates the annual dividend per share relative to the stock's current market price. The formula is: (Annual Dividend per Share / Stock Price) x 100%. A higher dividend yield indicates a potentially higher return on investment, but it's crucial to consider the underlying factors.

- Payout Ratio: This is the percentage of a company's earnings paid out as dividends. A sustainable payout ratio generally falls between 30% and 70%. A ratio exceeding 70% might signal potential future dividend cuts, as the company is distributing a disproportionate amount of its profits. Understanding payout ratios is key to assessing the sustainability of a dividend.

Types of Dividend Stocks

The dividend investing landscape offers diverse options. Let's explore some common types:

- Blue-Chip Stocks: These are large, well-established companies with a long history of consistent dividend payments and strong financial performance (e.g., Coca-Cola, Johnson & Johnson). They generally offer lower yields but higher stability.

- High-Yield Stocks: These stocks offer significantly higher dividend yields than average, but often carry higher risk due to potential financial instability or unsustainable payout ratios. Thorough due diligence is crucial before investing.

- Dividend Aristocrats: These are companies that have increased their dividends annually for at least 25 consecutive years, demonstrating a strong commitment to returning value to shareholders (e.g., companies within the S&P 500 Dividend Aristocrats index).

- REITs (Real Estate Investment Trusts): These companies own or finance income-producing real estate. They are required by law to distribute a significant portion of their income as dividends, making them attractive for dividend-focused investors.

Diversification for Risk Management

Diversification is paramount in dividend investing. Spreading your investments across various sectors, industries, and geographies significantly reduces risk.

- Sector Diversification: Don't put all your eggs in one basket. Invest in companies from different sectors (e.g., technology, healthcare, consumer staples) to mitigate the impact of sector-specific downturns.

- Industry Diversification: Even within sectors, diversify across different industries to further reduce your risk profile.

- Geographic Diversification: Consider investing in companies from different countries to lessen the impact of economic or political events in a single region. This requires additional research into international investing regulations and tax implications.

Building a Simple, High-Yield Dividend Portfolio

Now, let’s discuss how to construct a simple yet effective dividend portfolio that helps maximize dividend income.

Focus on Quality over Quantity

Prioritize companies with a proven track record of consistent dividend payments and strong financial fundamentals rather than chasing exceptionally high yields from unstable companies.

- Strong Balance Sheet: Look for low debt-to-equity ratios and ample cash reserves.

- Consistent Earnings Growth: Analyze historical earnings to ensure the company has a history of profitability and sustainable growth.

- Low Debt: High debt levels can strain a company's ability to maintain dividend payments during economic downturns.

- Examples: Research companies known for their stable dividends and robust financials.

The Power of DRIPs (Dividend Reinvestment Plans)

Dividend Reinvestment Plans (DRIPs) allow you to automatically reinvest your dividends to purchase more shares, accelerating your wealth-building through compounding.

- Definition: A DRIP is a plan offered by some companies that allows shareholders to reinvest their dividends to buy additional shares of the company's stock without brokerage fees.

- Benefits: Compounded growth, increased returns over time.

- Enrollment: Many brokerages offer easy enrollment in DRIPs; check with your broker for details.

Regular Portfolio Reviews (but not too often!)

Regular reviews are important, but avoid over-trading based on short-term market fluctuations.

- Review Frequency: Aim for quarterly or semi-annual reviews to assess the performance of your portfolio and make necessary adjustments.

- Key Metrics: Monitor your dividend yield, payout ratios, and overall portfolio performance.

- Avoid Impulsive Trading: Stick to your long-term investment strategy and avoid making emotional decisions based on short-term market volatility.

Avoiding Common Dividend Investing Mistakes

Understanding common pitfalls can help you maximize dividend income and avoid unnecessary losses.

Chasing High Yields without Due Diligence

High dividend yields can be tempting, but don't prioritize yield above fundamental analysis. High yields sometimes signal underlying financial problems.

- Red Flags: Declining earnings, increasing debt, negative cash flow, frequent management changes.

- Fundamental Analysis: Thoroughly research the company's financial statements, business model, and competitive landscape.

Ignoring Dividend Cuts and Suspensions

Companies may reduce or suspend dividends due to financial difficulties. Staying informed is critical.

- Stay Informed: Regularly check company news releases and financial reports.

- Managing Dividend Cuts: Diversification helps mitigate the impact of dividend cuts from individual companies.

Overlooking Taxes on Dividend Income

Dividend income is taxable. Plan accordingly to minimize your tax burden.

- Tax Rates: Dividend tax rates vary depending on your income bracket and the type of dividend (qualified vs. non-qualified).

- Tax Optimization: Consult a tax professional to explore strategies for minimizing your tax liability on dividend income.

Conclusion

Maximizing dividend income is achievable with a simple yet effective strategy. By focusing on quality companies, diversifying your portfolio, utilizing DRIPs, and avoiding common pitfalls, you can build a robust and sustainable source of passive income. Start maximizing your dividend income today! Begin your journey to financial freedom with a simplified dividend investment strategy. Learn more about maximizing your dividend income and achieving long-term financial success. [Link to relevant resources, if applicable]

Featured Posts

-

Bayern Munichs Triumph Mullers Farewell And Championship Celebration

May 12, 2025

Bayern Munichs Triumph Mullers Farewell And Championship Celebration

May 12, 2025 -

Henry Cavills Superman Exit James Gunn On Past Dc Management

May 12, 2025

Henry Cavills Superman Exit James Gunn On Past Dc Management

May 12, 2025 -

Princess Beatrice Discusses The Impact Of Her Parents Separation

May 12, 2025

Princess Beatrice Discusses The Impact Of Her Parents Separation

May 12, 2025 -

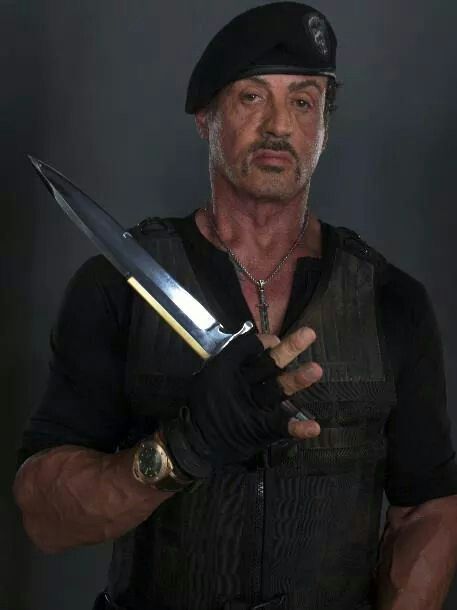

Free Streaming Watch Sylvester Stallones Action Thriller Armor This Month

May 12, 2025

Free Streaming Watch Sylvester Stallones Action Thriller Armor This Month

May 12, 2025 -

Upcoming Mntn Ipo What To Expect From Ryan Reynolds Company

May 12, 2025

Upcoming Mntn Ipo What To Expect From Ryan Reynolds Company

May 12, 2025

Latest Posts

-

Sylvester Stallone Reveals His Favorite Rocky Film An Emotional Rollercoaster

May 12, 2025

Sylvester Stallone Reveals His Favorite Rocky Film An Emotional Rollercoaster

May 12, 2025 -

Which Rocky Movie Touches Sylvester Stallone The Most Exploring The Franchises Emotional Core

May 12, 2025

Which Rocky Movie Touches Sylvester Stallone The Most Exploring The Franchises Emotional Core

May 12, 2025 -

The Most Emotional Rocky Movie According To Sylvester Stallone A Critical Analysis

May 12, 2025

The Most Emotional Rocky Movie According To Sylvester Stallone A Critical Analysis

May 12, 2025 -

Sylvester Stallone Picks His Top Rocky Film Why This One Is So Emotional

May 12, 2025

Sylvester Stallone Picks His Top Rocky Film Why This One Is So Emotional

May 12, 2025 -

Exploring Sylvester Stallones Only Non Starring Directorial Effort

May 12, 2025

Exploring Sylvester Stallones Only Non Starring Directorial Effort

May 12, 2025