May 26 Stock Market Summary: Dow, S&P 500, And Nasdaq Analysis

Table of Contents

Dow Jones Industrial Average Performance on May 26th

Opening, High, Low, and Closing Prices:

The Dow Jones Industrial Average opened at 33,820.05. Throughout the day, it reached a high of 33,910.12 and a low of 33,720.50 before closing at 33,820.50.

Percentage Change and Volume:

The Dow experienced a minimal daily percentage change of approximately +0.0015%, indicating a relatively flat performance for the day. Trading volume was slightly above average, suggesting moderate investor activity.

- Significant News Impacting the Dow: No single overwhelmingly dominant news story drove the Dow's performance on this day. However, a slight uptick in energy sector stocks due to positive oil price movements played a small role.

- Notable Trends and Patterns: The Dow showed relatively low volatility throughout the trading day, suggesting a degree of market stability despite underlying uncertainty in other sectors.

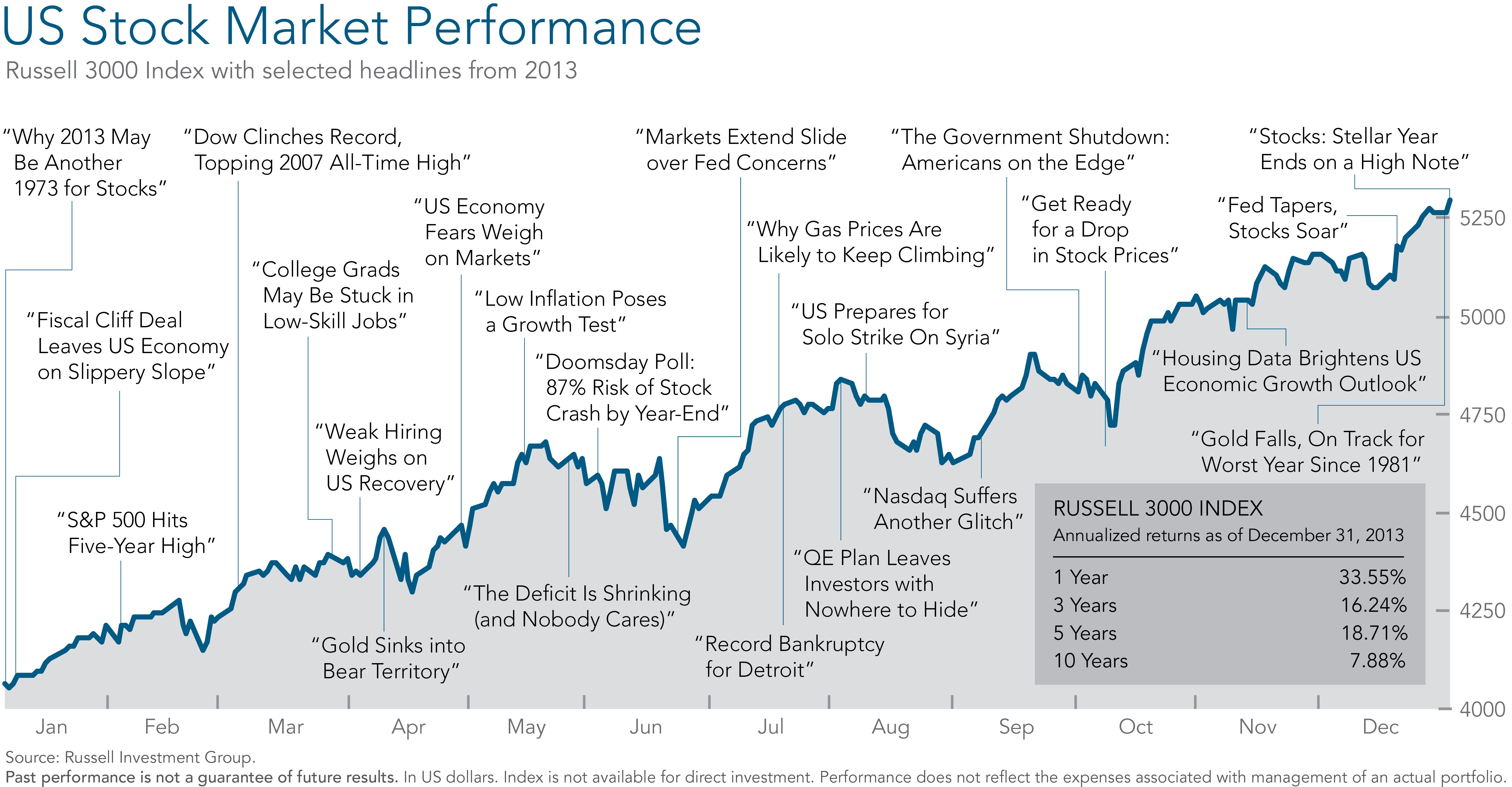

- [Insert relevant chart or graph visualizing the Dow's performance on May 26th here]

- Sector-Wise Performance: While the overall change was minimal, the energy sector showed slight gains, partially offset by minor losses in the financial sector.

S&P 500 Index Performance on May 26th

Opening, High, Low, and Closing Prices:

The S&P 500 opened at 4,165.10, reaching a high of 4,175.80 and a low of 4,150.25 before closing at 4,160.75.

Percentage Change and Volume:

The S&P 500 experienced a daily percentage change of approximately -0.1%, indicating a slight downward trend. Trading volume was in line with recent averages.

- Key Sectors Driving Performance: The slight decline in the S&P 500 was primarily driven by weakness in the technology and consumer discretionary sectors.

- Impact of Company Earnings Reports: No major earnings reports significantly impacted the S&P 500 on this particular day.

- Correlation with Economic Indicators: The performance largely mirrored the lackluster movement seen in other major indices, indicating a general sense of cautiousness in the market.

- [Insert relevant chart or graph visualizing the S&P 500's performance on May 26th here]

Nasdaq Composite Performance on May 26th

Opening, High, Low, and Closing Prices:

The Nasdaq Composite opened at 12,600.10, hit a high of 12,650.50, a low of 12,550.80, and closed at 12,610.20.

Percentage Change and Volume:

The Nasdaq showed a small daily percentage gain of approximately +0.08%, a modest increase. Trading volume was relatively moderate.

- Performance of Technology Stocks: While the overall movement was small, some large-cap technology stocks saw modest gains, while others showed minor declines.

- Impact of Technology-Related News: No major technology news events significantly influenced the Nasdaq's performance on May 26th.

- Relationship with Interest Rates: The Nasdaq's slight positive movement was somewhat independent of interest rate fluctuations on that day.

- [Insert relevant chart or graph visualizing the Nasdaq's performance on May 26th here]

Correlation and Comparison of Dow, S&P 500, and Nasdaq Performance on May 26th

The Dow, S&P 500, and Nasdaq exhibited relatively muted movements on May 26th. While the Dow showed near-stagnation and the S&P 500 experienced a slight decrease, the Nasdaq demonstrated a minimal positive shift. This overall lack of significant directional movement suggests a period of market consolidation or indecision among investors. The minimal divergence between the indices indicates a general alignment in market sentiment on that specific day.

Conclusion: Key Takeaways and Future Outlook – May 26 Stock Market Summary

In summary, the May 26th stock market showed a relatively flat performance across the major indices. The Dow remained largely unchanged, the S&P 500 experienced a slight dip, and the Nasdaq saw modest growth. This overall market sentiment reflects a cautious approach from investors, perhaps awaiting further economic data or corporate news to guide future investment strategies. While the day's performance doesn't inherently predict future movements, it indicates a period of consolidation within the broader market.

Stay informed about daily market fluctuations with our regular "Stock Market Summary" updates. Subscribe today!

Featured Posts

-

Is Tracker On Tonight Season 2 Episode 19 Premiere Time And Melissa Roxburghs Return

May 27, 2025

Is Tracker On Tonight Season 2 Episode 19 Premiere Time And Melissa Roxburghs Return

May 27, 2025 -

Marjorie Taylor Greenes 2026 Political Plans Senate Or Governor

May 27, 2025

Marjorie Taylor Greenes 2026 Political Plans Senate Or Governor

May 27, 2025 -

What The Tech Comparing Streaming Services Which Offers The Best Movie Selection

May 27, 2025

What The Tech Comparing Streaming Services Which Offers The Best Movie Selection

May 27, 2025 -

The Low Inflation Economy A Podcast Discussion

May 27, 2025

The Low Inflation Economy A Podcast Discussion

May 27, 2025 -

Teylor Svift Rekordni Prodazhi Vinilovikh Plativok Za Ostannye Desyatilittya

May 27, 2025

Teylor Svift Rekordni Prodazhi Vinilovikh Plativok Za Ostannye Desyatilittya

May 27, 2025

Latest Posts

-

Dont Miss Out 30 Off Lavish Hotels This Spring

May 31, 2025

Dont Miss Out 30 Off Lavish Hotels This Spring

May 31, 2025 -

Up To 30 Off Lavish Spring Hotel Bookings

May 31, 2025

Up To 30 Off Lavish Spring Hotel Bookings

May 31, 2025 -

Book Now And Save 30 Off Lavish Spring Hotel Stays

May 31, 2025

Book Now And Save 30 Off Lavish Spring Hotel Stays

May 31, 2025 -

Spring Hotel Sale Get 30 Off Your Lavish Stay

May 31, 2025

Spring Hotel Sale Get 30 Off Your Lavish Stay

May 31, 2025 -

Luxury Hotel Spring Sale 30 Discount

May 31, 2025

Luxury Hotel Spring Sale 30 Discount

May 31, 2025