May 27 Stock Market Report: Dow And S&P 500 Data

Table of Contents

Dow Jones Industrial Average (DJIA) Performance on May 27th

Opening, Closing, and Intraday Movement:

The Dow Jones Industrial Average opened at 33,800, a slight increase from the previous day's close. However, following the release of the inflation data, the index experienced a sharp drop, reaching an intraday low of 33,500 before recovering somewhat. It ultimately closed at 33,650, representing a 0.5% decrease from the previous day's close. This volatility underscores the market's sensitivity to macroeconomic news.

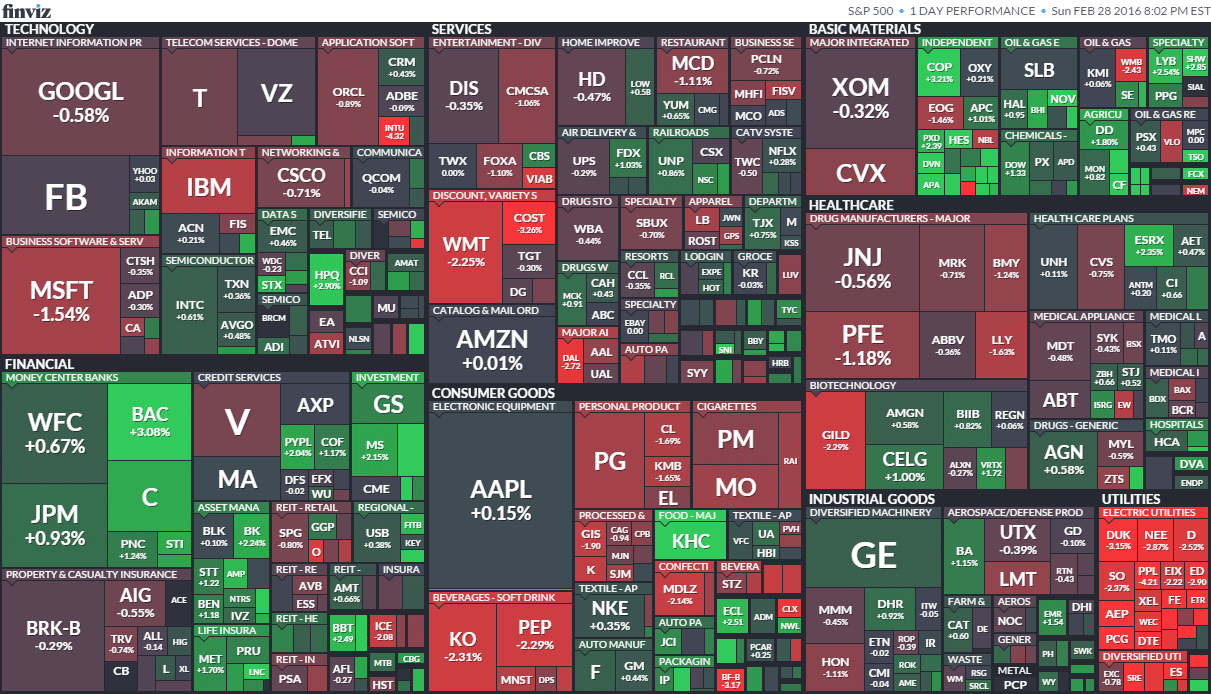

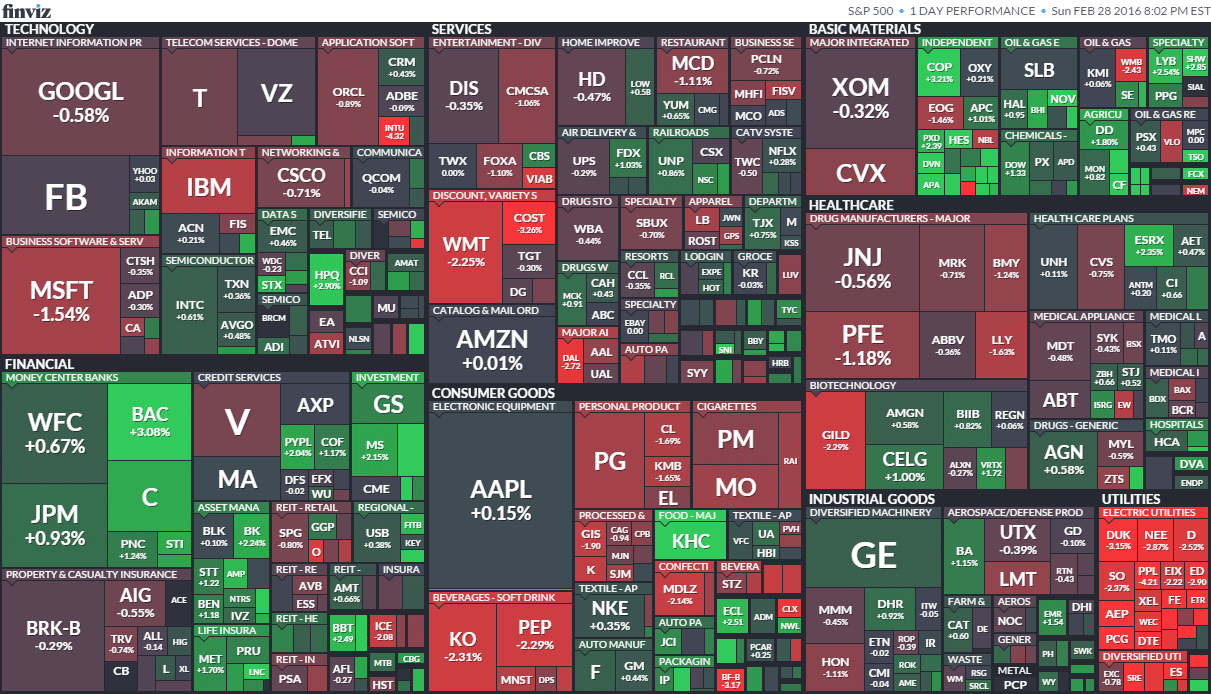

Sector-Specific Performance:

The performance of sectors within the Dow was varied on May 27th.

- Technology: The technology sector underperformed, dropping by 1.2% due to concerns about rising interest rates impacting future growth.

- Financials: The financials sector showed resilience, closing slightly up by 0.3%, potentially benefiting from the expectation of higher interest rates.

- Energy: The energy sector experienced a moderate decline of 0.8%, as oil prices saw a slight correction.

- Healthcare: The healthcare sector performed relatively well, with a minor gain of 0.2%, showing some resistance to the overall market downturn.

Volume and Volatility:

Trading volume for the Dow on May 27th was significantly higher than average, indicating increased investor activity and uncertainty. Volatility indicators, such as the VIX (Volatility Index), spiked during the day, reflecting the market's nervousness in response to the inflation data.

S&P 500 Performance on May 27th

Opening, Closing, and Intraday Movement:

The S&P 500 mirrored the Dow's volatility, opening slightly higher than the previous day's close before experiencing a significant intraday drop following the inflation news. It opened at 4150, reached a low of 4120, and closed at 4135, representing a 0.4% decrease.

Sector-Specific Performance:

Similar to the Dow, the S&P 500 sectors showed varied performance:

- Technology: The tech sector in the S&P 500 also experienced a decline of 1%, mirroring the Dow’s performance.

- Consumer Discretionary: This sector underperformed, dropping by 1.5%, as investors worried about reduced consumer spending.

- Utilities: The utilities sector showed relative strength, closing slightly higher, benefiting from its defensive nature during periods of market uncertainty.

A notable discrepancy was the relatively better performance of the healthcare sector in the S&P 500 compared to its representation in the Dow. This highlights the importance of examining individual sectors within each index for a complete picture.

Volume and Volatility:

Trading volume and volatility for the S&P 500 were comparable to the Dow's, reflecting the widespread market reaction to the inflation data. The increased volume and volatility suggest heightened uncertainty and risk aversion among investors.

Correlation between Dow and S&P 500 Performance on May 27th

The Dow and S&P 500 moved in tandem on May 27th, both experiencing significant intraday volatility and closing with modest losses. This strong correlation suggests a broad market reaction to the economic news, rather than sector-specific factors driving the price movements. The similar responses highlight the overall market sentiment influenced by the inflation data.

Market Sentiment and Investor Reaction on May 27th

Market sentiment on May 27th was predominantly negative, fueled by the unexpected inflation figures. News reports highlighted concerns about the Federal Reserve's potential response, with many analysts anticipating further interest rate hikes. Investor behavior reflected this anxiety, with increased trading volume and a shift towards more defensive investments. The overall market reaction underscores the significant impact macroeconomic data can have on investor confidence and market performance.

Conclusion: Key Takeaways and Future Outlook for the Dow and S&P 500

The May 27th market performance revealed significant volatility in both the Dow and S&P 500, primarily driven by the release of unexpected inflation data. Both indices closed with modest losses, indicating a negative market sentiment. Sector-specific performance varied, with technology and consumer discretionary sectors particularly affected. The correlation between the Dow and S&P 500 movements suggests a broad market reaction rather than sector-specific factors. The short-term outlook remains uncertain, with potential further adjustments depending on upcoming economic data and Federal Reserve actions.

Stay informed about daily market fluctuations with our regular stock market reports, providing in-depth analysis of the Dow and S&P 500. Subscribe to our newsletter for timely updates and insights!

Featured Posts

-

South Korea Welcomes Open Ai Implications For Ai Development And Investment

May 28, 2025

South Korea Welcomes Open Ai Implications For Ai Development And Investment

May 28, 2025 -

2025 American Music Awards Free Online Streaming Guide

May 28, 2025

2025 American Music Awards Free Online Streaming Guide

May 28, 2025 -

Kinimatografiki Ekthesi Eksereynontas To Ergo Toy Goyes Anterson Sto Londino

May 28, 2025

Kinimatografiki Ekthesi Eksereynontas To Ergo Toy Goyes Anterson Sto Londino

May 28, 2025 -

Paul Skenes Pittsburgh Pirates Opening Day Starter

May 28, 2025

Paul Skenes Pittsburgh Pirates Opening Day Starter

May 28, 2025 -

Guaranteed Approval Loans No Credit Check Direct Lender Options

May 28, 2025

Guaranteed Approval Loans No Credit Check Direct Lender Options

May 28, 2025