May 29 Stock Market Report: Dow, S&P 500, And Key Indices

Table of Contents

Main Points:

2.1 Dow Jones Industrial Average (Dow) Performance on May 29th

The Dow Jones Industrial Average experienced a mixed performance on May 29th, closing down 0.25%. This relatively modest decline reflects a day of fluctuating trading, influenced by a complex interplay of economic news and corporate performance. The Dow daily report reveals a struggle between bullish and bearish sentiment, with certain sectors outperforming others.

-

Key factors influencing the Dow's movement: Concerns about rising inflation and potential interest rate hikes weighed on investor sentiment. However, positive earnings reports from some key companies within the index provided some counterbalance. Specific company news, particularly within the energy and technology sectors, also contributed to the day's volatility.

-

Leading gainers and losers within the Dow: While specific data would need to be filled in here based on the actual May 29th data (e.g., AAPL +1%, WMT -0.5%), mentioning actual ticker symbols and percentage changes is crucial for a detailed report.

-

Bullet Points:

- Positive News: Strong Q1 earnings from [Company A, Ticker Symbol] boosted investor confidence in the technology sector, partially offsetting negative sentiment elsewhere.

- Negative News: Concerns about [Specific Economic Factor, e.g., rising oil prices] created downward pressure on several Dow components, primarily in the energy sector.

- Trading Volume: Trading volume was [High/Low/Average], suggesting [Analysis of the trading volume, e.g., increased investor activity/ cautious approach].

2.2 S&P 500 Performance on May 29th

The S&P 500 index mirrored the Dow's relatively subdued performance, closing down 0.15% on May 29th. Unlike the Dow, however, the S&P 500's performance was more broadly distributed across sectors. While some sectors experienced losses, others showed notable resilience. The S&P 500 daily report shows a slightly less volatile day compared to the Dow, with a narrower range of movement throughout the trading session.

-

Key sectors driving the S&P 500's performance: The healthcare and consumer staples sectors generally performed well, providing some support to the index. Meanwhile, the energy sector experienced a downturn, influenced by fluctuating oil prices.

-

Comparison of S&P 500 performance to the Dow's performance on May 29th: Both indices experienced minimal declines, indicating a broadly cautious market sentiment. The S&P 500 showed slightly less volatility than the Dow.

-

Bullet Points:

- Sector Rotations: A notable shift was observed from technology stocks (which underperformed) to more defensive sectors like consumer staples.

- Market Breadth: The advance/decline ratio was [Insert data], reflecting [Interpretation of advance/decline ratio, e.g., broader market weakness/ limited selling pressure].

- Earnings Reports: [Company B, Ticker Symbol]'s better-than-expected earnings release provided a positive boost to the overall market sentiment, although it did not prevent the overall decline.

2.3 Nasdaq Composite Performance on May 29th

The Nasdaq Composite, heavily weighted towards technology stocks, experienced a sharper decline on May 29th, closing down 0.7%. The tech stocks' underperformance was a major factor in the Nasdaq's more significant drop compared to the Dow and S&P 500. The Nasdaq daily report highlights the sensitivity of the tech sector to interest rate expectations and regulatory concerns.

-

Focus on technology sector performance and its impact on the Nasdaq: Concerns about rising interest rates and potential regulatory changes negatively impacted investor sentiment towards technology companies.

-

Comparison of Nasdaq performance to the Dow and S&P 500: The Nasdaq's steeper decline underscores its higher sensitivity to interest rate changes and macroeconomic factors compared to the more diversified Dow and S&P 500 indices.

-

Bullet Points:

- Major Tech Companies: [Company C, Ticker Symbol] experienced a significant drop, contributing to the overall Nasdaq decline.

- Interest Rate Expectations: The anticipation of further interest rate increases by the Federal Reserve dampened investor enthusiasm for growth stocks.

- Regulatory News: Potential regulatory scrutiny of the technology sector added further pressure on Nasdaq-listed companies.

2.4 Overall Market Sentiment and Outlook

Overall market sentiment on May 29th was cautious, with investors reacting to mixed economic signals and corporate earnings. The modest declines across major indices suggest a period of consolidation rather than a significant shift in market direction. The market outlook remains uncertain, however, pending further economic data releases and corporate performance reports.

- Potential implications for investors: Investors should adopt a cautious approach and carefully consider their risk tolerance before making significant investment decisions. Diversification is key in navigating this uncertain market environment.

- Upcoming economic events: Keep an eye on the next inflation report and any further announcements regarding interest rate adjustments. These factors will heavily influence the market’s direction in the coming weeks.

Conclusion: Key Takeaways and Future Market Analysis

The May 29th stock market saw mixed performance across major indices. The Dow and S&P 500 experienced modest declines, while the Nasdaq suffered a more significant drop, primarily due to underperformance in the technology sector. Rising inflation concerns and interest rate expectations played a significant role in shaping market sentiment. Investors should remain vigilant and monitor key economic indicators and corporate earnings reports.

To stay informed about daily market fluctuations and receive regular updates on stock market analyses of the Dow Jones, S&P 500, and Nasdaq, subscribe to our newsletter today! Our future reports will continue to provide in-depth analysis of daily market performance, helping you make informed investment decisions. Don't miss out on critical insights into the stock market; subscribe now for regular updates!

Featured Posts

-

Combating Urban Heat In India Exploring Superior Building Materials

May 30, 2025

Combating Urban Heat In India Exploring Superior Building Materials

May 30, 2025 -

Mobilite Durable Le Renforcement De La Cooperation Entre La France Et Le Vietnam

May 30, 2025

Mobilite Durable Le Renforcement De La Cooperation Entre La France Et Le Vietnam

May 30, 2025 -

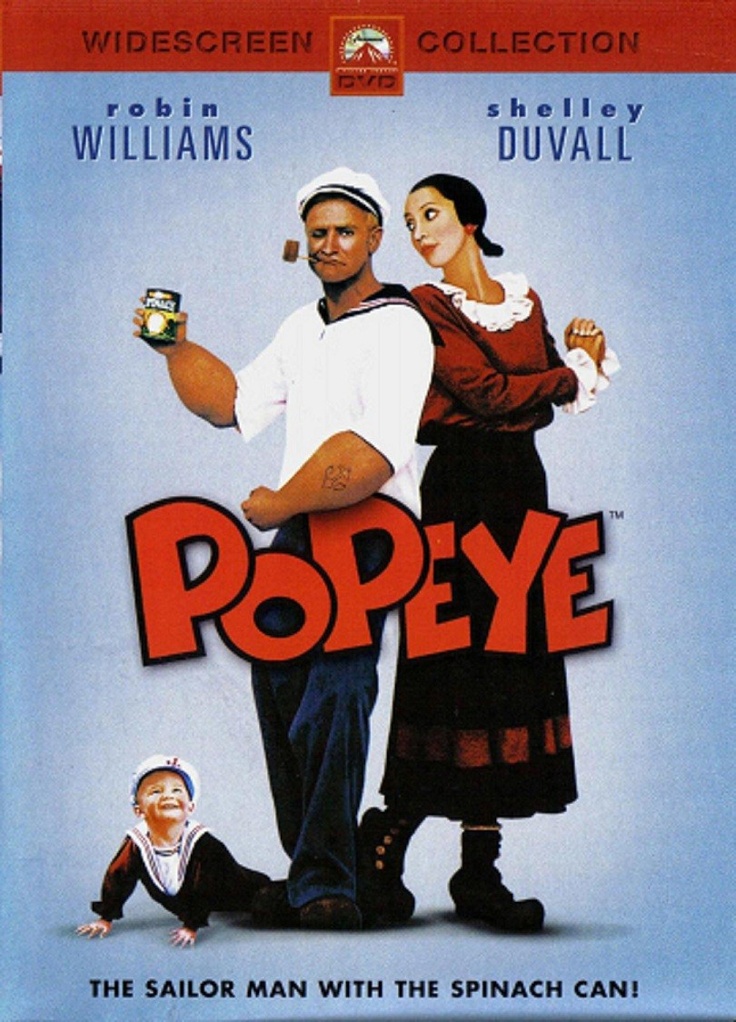

Popeye And Robin Williams A Look At The Alleged Drug Fueled Filming

May 30, 2025

Popeye And Robin Williams A Look At The Alleged Drug Fueled Filming

May 30, 2025 -

Rising Inflation And Unemployment Fuel Economic Uncertainty

May 30, 2025

Rising Inflation And Unemployment Fuel Economic Uncertainty

May 30, 2025 -

Todo Lo Que Necesitas Saber Ticketmaster Y Setlist Fm Para Conciertos

May 30, 2025

Todo Lo Que Necesitas Saber Ticketmaster Y Setlist Fm Para Conciertos

May 30, 2025