Meet The Stealthy Wealthy: Building Quiet Fortunes The Traditional Way

Table of Contents

H2: The Power of Patient, Long-Term Investing

Building quiet fortunes isn't a sprint; it's a marathon. The cornerstone of this approach is patient, long-term investing. This strategy eschews get-rich-quick schemes in favor of steady, consistent growth over time.

H3: Diversification and Risk Management

A diversified investment portfolio is crucial for mitigating risk. Don't put all your eggs in one basket! Instead, spread your investments across various asset classes:

- Stocks: Equities offer potential for high growth but also carry higher risk. Diversify across different sectors and market caps.

- Bonds: Bonds are generally less risky than stocks and provide a steady income stream. Consider government bonds, corporate bonds, and municipal bonds.

- Real Estate: Real estate can offer both rental income and long-term appreciation. Consider diversifying across different property types and locations.

- Alternative Investments: These could include commodities, precious metals, or private equity, each with varying risk profiles.

Employing strategies like dollar-cost averaging (investing a fixed amount at regular intervals) and portfolio rebalancing (adjusting your asset allocation to maintain your target percentages) can help manage risk and optimize returns. [Link to credible source on dollar-cost averaging] [Link to credible source on portfolio rebalancing]

H3: The Value of Compound Interest

Compound interest is the eighth wonder of the world. It's the magic of earning interest on your initial investment and on the accumulated interest. The longer your money is invested, the more powerful this effect becomes.

- Example: Investing $10,000 annually for 30 years at a 7% annual return results in a significantly larger sum than investing the same amount over a shorter period. [Include a simple calculation or link to a compound interest calculator]

Starting early is crucial to harness the power of compounding. Even small, consistent contributions made early in life can accumulate to a substantial amount over time.

H3: Avoiding Get-Rich-Quick Schemes

Beware of get-rich-quick schemes! These often promise high returns with minimal risk, which is rarely the case. They are frequently scams designed to separate you from your money.

- Examples to avoid: Pump-and-dump schemes, high-yield investment programs (HYIPs), and unsolicited investment opportunities. Always conduct thorough due diligence before investing in anything unfamiliar.

H2: Living Below Your Means and Strategic Saving

Building quiet fortunes requires financial discipline. This means living below your means and strategically saving a significant portion of your income.

H3: Budgeting and Financial Discipline

Create a realistic budget that tracks your income and expenses. Identify areas where you can cut back and redirect those funds towards savings and investments.

- Tips: Utilize budgeting apps, the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), and automate your savings.

H3: Debt Management and Elimination

High-interest debt can significantly hinder your wealth-building efforts. Prioritize paying down high-interest debt aggressively, whether through the debt snowball or debt avalanche method.

- Debt Snowball: Pay off the smallest debt first for motivation, then roll that payment into the next smallest, and so on.

- Debt Avalanche: Prioritize paying off the debt with the highest interest rate first to minimize total interest paid.

H3: Delayed Gratification and Long-Term Goals

Building quiet fortunes requires patience and delayed gratification. Prioritize long-term financial goals over immediate pleasures.

- Example: Instead of buying a new car every few years, consider keeping your current car longer and investing the difference.

H2: The Role of Continuous Learning and Skill Development

Continuous learning is vital for long-term financial success. Invest in your education and professional development to enhance your earning potential.

H3: Investing in Education and Self-Improvement

Financial literacy is paramount. Read books, take courses, attend seminars, and stay updated on financial news and trends.

- Resources: [Link to reputable financial education websites and books]

H3: Building a Strong Professional Network

Networking can open doors to new opportunities and collaborations. Attend industry events, join professional organizations, and build relationships with people in your field.

- Networking tips: Be proactive, listen more than you talk, and offer value to others.

H3: Adaptability and Resilience in the Face of Market Fluctuations

Markets fluctuate. Develop the ability to adapt to changing economic conditions and remain resilient during market downturns.

- Strategies: Maintain a diversified portfolio, have an emergency fund, and avoid panic selling during market corrections.

Conclusion:

Building quiet fortunes is a journey that requires patience, discipline, and a long-term perspective. By consistently applying the strategies outlined above – patient investing, disciplined saving, continuous learning, and avoiding get-rich-quick schemes – you can embark on your own path towards achieving lasting financial security. Start building your quiet fortune today. Embrace the traditional path to lasting wealth and discover the power of building quiet fortunes the right way.

Featured Posts

-

Dijital Veri Tabani Isguecue Piyasasi Rehberi Carsamba Ledra Pal Da

May 19, 2025

Dijital Veri Tabani Isguecue Piyasasi Rehberi Carsamba Ledra Pal Da

May 19, 2025 -

Youtuber Jyoti Malhotra Puris Srimandir Visit Footage Emerges Amid Espionage Probe

May 19, 2025

Youtuber Jyoti Malhotra Puris Srimandir Visit Footage Emerges Amid Espionage Probe

May 19, 2025 -

Nyt Mini Crossword Solution March 12 2025

May 19, 2025

Nyt Mini Crossword Solution March 12 2025

May 19, 2025 -

Quienes Son Los Aspirantes A Diputados Del Movimiento Nueva Corriente

May 19, 2025

Quienes Son Los Aspirantes A Diputados Del Movimiento Nueva Corriente

May 19, 2025 -

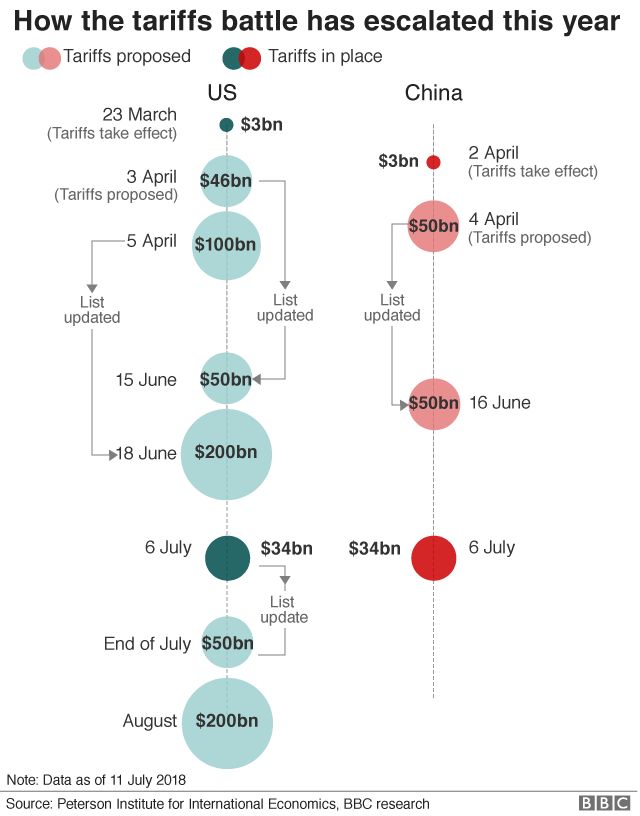

Trumps 30 China Tariffs Extended Until Late 2025

May 19, 2025

Trumps 30 China Tariffs Extended Until Late 2025

May 19, 2025