Meeting Between Finance Minister And Deutsche Bank: Implications For The Economy

Table of Contents

Potential Discussions at the Meeting:

Financial Stability of Deutsche Bank:

The primary focus of the meeting likely revolved around Deutsche Bank's financial stability. Discussions undoubtedly centered on several key areas:

- Capital Adequacy Ratio: Assessing whether Deutsche Bank meets the required capital adequacy ratios and if further capital injections are needed to bolster its financial strength.

- Non-Performing Loans: Examining the level of non-performing loans on Deutsche Bank's balance sheet and the strategies in place to address them.

- Regulatory Compliance: Reviewing the bank's adherence to current regulations and identifying any potential areas of non-compliance.

- Systemic Risk: Evaluating the potential systemic risk posed by Deutsche Bank's financial health to the broader German and European banking systems.

Deutsche Bank has faced significant challenges in recent years, including hefty fines related to regulatory breaches and struggles with profitability. News reports have highlighted concerns about its capital reserves and the potential need for further restructuring. The Finance Minister's meeting was likely aimed at gaining a clear understanding of the bank's current financial health and identifying potential solutions to mitigate future risks. Any weakness in Deutsche Bank's financial position could lead to a contagion effect, threatening the stability of the entire German banking sector.

Government Support and Bailouts:

Another crucial aspect of the meeting likely involved exploring the possibility of government support or a bailout. This discussion would have encompassed several considerations:

- Government Intervention: The extent to which the government might intervene to stabilize Deutsche Bank, considering the potential costs and political implications.

- State Aid: Determining the legality and feasibility of providing state aid, navigating the complexities of EU regulations on state aid.

- Public Perception of Bailouts: Assessing the public's reaction to a potential bailout, considering the potential for negative sentiment and political backlash.

- Legal and Political Hurdles: Identifying and addressing any legal or political obstacles to government intervention.

Providing state aid or a bailout raises complex issues. While such measures could prevent a systemic crisis, they might also be viewed negatively by taxpayers and could face significant political resistance. The precedent of past bailouts, both successful and unsuccessful, would certainly have informed these discussions.

Impact on the German Banking Sector:

The outcome of the meeting will have a significant ripple effect across the German banking sector.

- Contagion Effect: A failure to address Deutsche Bank's challenges effectively could trigger a contagion effect, eroding confidence in other German banks and potentially leading to a wider financial crisis.

- Confidence in the Banking System: The meeting's outcome will significantly impact investor and public confidence in the stability and resilience of the German banking system.

- Market Volatility: Uncertainty surrounding Deutsche Bank's future could lead to increased market volatility, affecting investment decisions and economic activity.

Any perceived weakness or instability in Deutsche Bank could trigger a run on the bank or a broader loss of confidence in the German financial system, leading to potentially catastrophic economic consequences.

Broader Economic Implications:

Impact on Investment and Growth:

The uncertainty surrounding Deutsche Bank's future could significantly impact Germany's economic growth trajectory:

- Uncertainty's Impact on Business Investment: Businesses may delay investment decisions due to the uncertainty surrounding the financial stability of the banking sector.

- Consumer Spending Patterns: Consumer confidence might decline, leading to reduced consumer spending.

- GDP Growth Forecasts: The overall economic outlook for Germany will likely be revised downward if Deutsche Bank's problems are not adequately addressed.

The potential for reduced investment and consumer spending directly translates to slower GDP growth, potentially impacting job creation and overall economic prosperity.

International Market Reactions:

The meeting's outcome will likely have significant repercussions on international markets:

- Impact on the Euro: Uncertainty could lead to fluctuations in the value of the Euro against other major currencies.

- Global Financial Market Responses: International financial markets will closely watch the situation, potentially leading to broader market volatility.

- Potential for International Spillover Effects: Problems in the German banking sector could have spillover effects on other European economies and potentially the global financial system.

The Eurozone's stability is intrinsically linked to the health of its largest economies, and a significant disruption in Germany could trigger a chain reaction throughout the European Union and beyond.

Conclusion:

The meeting between the German Finance Minister and Deutsche Bank holds significant weight for Germany's economic future. The potential outcomes, ranging from renewed financial stability to wider market instability, will greatly influence investment, growth, and international market confidence. The discussions surrounding financial stability, government support, and the impact on the broader banking sector are all critical considerations. The potential for contagion and the impact on investor confidence cannot be overstated.

Call to Action: Stay informed about further developments surrounding the Finance Minister's meeting with Deutsche Bank. Monitoring the ongoing situation and its implications for the German economy and international markets is essential. Understanding the complexities of this crucial meeting and its potential economic consequences is vital for navigating the financial landscape. Further analysis of the Finance Minister's Deutsche Bank meeting and its impact is crucial.

Featured Posts

-

Navigating The Hostile Atmosphere Challenges Faced By Non French Players At The French Open

May 30, 2025

Navigating The Hostile Atmosphere Challenges Faced By Non French Players At The French Open

May 30, 2025 -

Cts Eventim Strong Start To The Year With Significant Growth

May 30, 2025

Cts Eventim Strong Start To The Year With Significant Growth

May 30, 2025 -

Ticketmaster Setlist Fm La Combinacion Ganadora Para Fans De Musica

May 30, 2025

Ticketmaster Setlist Fm La Combinacion Ganadora Para Fans De Musica

May 30, 2025 -

Todo Lo Que Necesitas Saber Ticketmaster Y Setlist Fm Para Conciertos

May 30, 2025

Todo Lo Que Necesitas Saber Ticketmaster Y Setlist Fm Para Conciertos

May 30, 2025 -

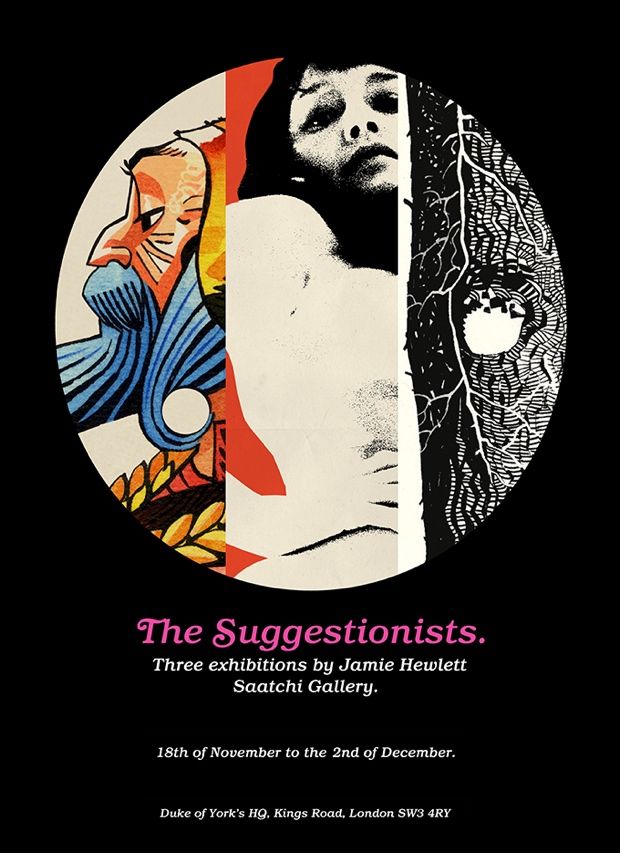

House Of Kong The Gorillaz Exhibition Lands In London This Summer

May 30, 2025

House Of Kong The Gorillaz Exhibition Lands In London This Summer

May 30, 2025