Meta Monopoly Trial: FTC's Defense Strategy Takes Center Stage

Table of Contents

The FTC's Core Arguments Against Meta's Anti-Competitive Behavior:

The FTC's case against Meta rests on two primary pillars: Meta's acquisition strategy and its exploitation of network effects and data monopolies. These arguments aim to demonstrate that Meta's actions have stifled competition and harmed consumers.

Acquisition Strategy as a Means of Stifling Competition:

The FTC will likely argue that Meta's acquisitions of Instagram and WhatsApp weren't driven by innovation but by a strategic desire to eliminate potential competitors. The argument hinges on the idea that these acquisitions prevented these platforms from growing into significant rivals and thus reduced consumer choice within the digital social media marketplace.

- Market share data: The FTC will present evidence showcasing Meta's market share before and after the acquisitions, emphasizing the significant increase in its dominance.

- Lack of viable alternatives: The argument will highlight the absence of robust alternatives to Meta's platforms post-acquisition, showcasing how consumers now have limited choices.

- Suppression of competing platforms: The FTC will attempt to demonstrate how Meta's actions actively suppressed the growth and potential of competing platforms through various means. This might involve evidence suggesting deliberate efforts to limit interoperability or to acquire promising startups before they could pose a serious threat.

Exploitation of Network Effects and Data Monopolies:

A central component of the FTC's case revolves around Meta's exploitation of network effects and its vast data monopoly. The argument is that Meta's massive user base and the resulting network effects, coupled with its unparalleled data collection capabilities, create insurmountable barriers to entry for new competitors in the social media and digital advertising markets.

- Data advantages in targeted advertising: The FTC will show how Meta uses its collected data to power its highly targeted advertising business, providing an unfair advantage over smaller competitors.

- Difficulty for smaller firms to compete: The case will illustrate the immense challenges faced by smaller firms trying to compete with Meta's scale and resources, especially regarding data-driven advertising.

- Stifling innovation: The FTC will argue that Meta's dominance stifles innovation by discouraging investment in and development of competitive alternatives.

Key Elements of the FTC's Defense Strategy:

The FTC's strategy relies heavily on two key elements: robust economic modeling and compelling witness testimony, backed by internal Meta documents.

Economic Modeling and Market Analysis:

The FTC will employ sophisticated economic models to demonstrate the negative impact of Meta's actions on competition and consumer welfare. These models will attempt to quantify the harm caused by reduced choice and potentially higher prices resulting from Meta's dominance.

- Counterfactual scenarios: The FTC will likely present models illustrating what the market would look like without Meta's acquisitions, showing a potential landscape with greater competition and consumer benefits.

- Analysis of price and innovation levels: The economic analysis will compare price and innovation levels in the current market with those predicted in a more competitive environment without Meta's dominant position.

- Econometric data: The FTC will leverage econometric data to support its claims of anti-competitive behavior, strengthening the quantitative aspects of their case.

Witness Testimony and Internal Documents:

The FTC's case will also rely heavily on compelling witness testimony and incriminating internal Meta documents.

- Testimony from former employees: Former Meta employees will provide firsthand accounts of internal discussions and decision-making processes surrounding acquisitions and competitive strategies.

- Leaked documents: Internal Meta documents revealing strategic decisions aimed at suppressing competition will be crucial evidence.

- Expert testimony: Experts in various fields, including antitrust law and economics, will provide testimony supporting the FTC's claims.

Potential Outcomes and Implications of the Meta Monopoly Trial:

The potential outcomes of the Meta Monopoly trial are significant and far-reaching.

- Restructuring of Meta: A ruling in favor of the FTC could result in the forced divestiture of Instagram or WhatsApp, fundamentally altering Meta's structure and market position.

- Precedent for future antitrust cases: The outcome will set a significant precedent for future antitrust cases against other large technology companies, impacting how such cases are approached and decided.

- Implications for digital market regulation: The trial's outcome will significantly influence the future of digital market regulation and competition policy, shaping the regulatory landscape for years to come.

Conclusion:

The Meta Monopoly trial is a watershed moment for antitrust enforcement in the digital age. The FTC’s comprehensive defense strategy, using economic modeling, witness testimony, and internal documents, seeks to demonstrate that Meta's actions have stifled competition, resulting in harm to consumers and reduced innovation. The outcome will dramatically impact the digital landscape, shaping future antitrust enforcement and the balance of power within the tech industry. Stay informed on the developments in this crucial Meta Monopoly trial to understand its broader implications for the future of digital competition. Follow this case closely to fully grasp the intricacies of the ongoing Meta Monopoly trial and its lasting impact on the competitive dynamics of the digital market.

Featured Posts

-

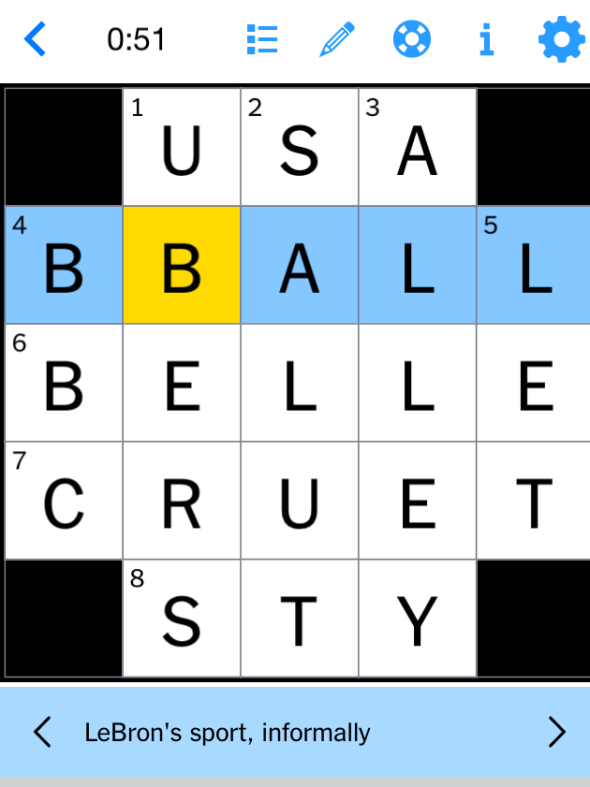

March 26 2025 Nyt Mini Crossword Solutions And Clues

May 21, 2025

March 26 2025 Nyt Mini Crossword Solutions And Clues

May 21, 2025 -

Backstage News Whats Next For Aj Styles And His Wwe Contract

May 21, 2025

Backstage News Whats Next For Aj Styles And His Wwe Contract

May 21, 2025 -

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

May 21, 2025

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

May 21, 2025 -

Historic Night New Womens Tag Team Champions On Wwe Raw

May 21, 2025

Historic Night New Womens Tag Team Champions On Wwe Raw

May 21, 2025 -

Ftv Lives Hell Of A Run Examining Its Legacy In Television News

May 21, 2025

Ftv Lives Hell Of A Run Examining Its Legacy In Television News

May 21, 2025