MicroStrategy Stock And Bitcoin: A Comparative Investment Analysis For 2025

Table of Contents

The volatile world of cryptocurrency and traditional stocks presents exciting, yet risky, opportunities. Bitcoin's meteoric rise and fall, coupled with MicroStrategy's bold bet on the digital asset, have created a fascinating intersection for investors. The increasing correlation between MicroStrategy stock and Bitcoin's price makes a comparative investment analysis crucial for anyone considering exposure to either asset. This article aims to provide a comprehensive comparison of MicroStrategy stock and Bitcoin as investment options, focusing on their potential trajectory in 2025 and beyond. We'll explore the intricacies of each investment, offering insights into their risk profiles and potential returns to help inform your investment decisions.

2. Main Points:

2.1 MicroStrategy's Business Model and Bitcoin Holdings:

H3: Understanding MicroStrategy's Core Business:

MicroStrategy is primarily known for its business intelligence software, providing enterprise analytics and mobility solutions. However, since 2020, the company has dramatically shifted its strategy, becoming one of the largest corporate holders of Bitcoin. This bold move has fundamentally altered its risk profile and made its stock price significantly correlated with Bitcoin's performance.

- Revenue Streams and Profitability: While MicroStrategy continues to generate revenue from its software business, a significant portion of its financial performance now hinges on the value of its Bitcoin holdings. This creates both substantial upside potential and significant downside risk.

- Risks of Bitcoin Reliance: The company's heavy reliance on Bitcoin exposes it to extreme price volatility. A sharp decline in Bitcoin's price could severely impact MicroStrategy's balance sheet and its stock valuation.

- Recent Developments: MicroStrategy has actively continued to accumulate Bitcoin, demonstrating a long-term commitment to the cryptocurrency. Tracking their acquisition strategy and any changes in their approach is vital for assessing future performance.

H3: Analyzing MicroStrategy's Bitcoin Investment Strategy:

MicroStrategy's Bitcoin acquisition strategy has been aggressive and consistent, signaling a belief in Bitcoin's long-term value as a store of value and a hedge against inflation.

- Timing and Rationale: Understanding the timing of their purchases – whether during periods of high or low Bitcoin prices – provides valuable insight into their overall strategy and risk tolerance.

- Impact on Financial Statements: Bitcoin's price fluctuations directly impact MicroStrategy's reported earnings and net asset value, creating accounting complexities and influencing investor sentiment.

- Long-Term Implications for Shareholders: The success of MicroStrategy's strategy is intrinsically linked to Bitcoin's future price. Shareholders must carefully weigh the potential for substantial gains against the risks of significant losses.

2.2 Bitcoin's Market Dynamics and Future Predictions:

H3: Bitcoin's Price Volatility and Market Sentiment:

Bitcoin is notoriously volatile, experiencing significant price swings driven by a multitude of factors.

- Regulatory Changes: Government regulations, both supportive and restrictive, can significantly influence Bitcoin's price. Upcoming regulatory clarity (or lack thereof) is a major uncertainty.

- Technological Advancements: Innovations within the Bitcoin ecosystem, such as the Lightning Network, could impact its scalability and adoption rate, affecting its price.

- Macroeconomic Factors: Global economic conditions, inflation rates, and the performance of traditional asset classes all play a role in Bitcoin's price movements. Predictions for 2025 vary widely based on different macroeconomic scenarios.

H3: Bitcoin's Role in a Diversified Portfolio:

Bitcoin's unique characteristics warrant careful consideration when constructing a diversified investment portfolio.

- Correlation with Traditional Assets: Bitcoin's correlation with traditional assets is low, making it a potential diversifier for portfolios dominated by stocks and bonds. However, this correlation can fluctuate.

- Benefits and Risks of Allocation: Allocating a portion of your portfolio to Bitcoin can offer potential for high returns but carries substantial risk due to its volatility. Risk tolerance is paramount.

- Successful Investment Strategies: Dollar-cost averaging (DCA) is a common strategy to mitigate risk, involving regular purchases of Bitcoin regardless of price fluctuations.

2.3 Comparative Analysis: MicroStrategy Stock vs. Bitcoin Investment:

H3: Risk vs. Reward: A Direct Comparison:

Investing in MicroStrategy stock offers exposure to both its software business and its Bitcoin holdings, creating a complex risk profile. Investing directly in Bitcoin offers more concentrated exposure to cryptocurrency markets.

- Historical Price Performance: Analyzing past price performance data for both assets is essential, keeping in mind past performance is not indicative of future results.

- Liquidity and Transaction Costs: Bitcoin trades 24/7, offering high liquidity. MicroStrategy stock trades during regular market hours. Transaction costs vary for both.

- Correlation Analysis: The strong positive correlation between MicroStrategy's stock price and Bitcoin's price suggests that investing in both might not offer significant diversification benefits.

H3: Investment Strategies and Portfolio Allocation:

Incorporating both MicroStrategy stock and Bitcoin into a portfolio requires careful consideration of your risk tolerance and investment goals.

- Dollar-Cost Averaging: DCA can help mitigate risk for both investments by spreading out purchases over time.

- Hedging Strategies: Advanced strategies, such as using derivatives, could offer potential hedging against price volatility, but carry their own risks.

- Portfolio Allocation Models: The optimal allocation will depend on your individual circumstances and risk profile. Consulting with a financial advisor is highly recommended.

3. Conclusion: Making Informed Investment Decisions on MicroStrategy Stock and Bitcoin

This comparative analysis highlights the potential and risks associated with investing in MicroStrategy stock and Bitcoin. While MicroStrategy's Bitcoin holdings offer significant upside potential, they also introduce substantial volatility. Direct Bitcoin investment carries similar risks but offers potentially higher returns. The strong correlation between the two means diversification benefits are limited when investing in both. Thorough due diligence is essential before making any investment decisions. Remember to consider your individual financial goals, risk tolerance, and seek professional advice before allocating capital to either MicroStrategy stock or Bitcoin. Further research into both the MicroStrategy stock market and the Bitcoin market, including analysis of financial reports and market trends, is highly recommended before making any investment decisions.

Featured Posts

-

Arsenal Psg Semi Final Why Its A Bigger Challenge Than Real Madrid

May 08, 2025

Arsenal Psg Semi Final Why Its A Bigger Challenge Than Real Madrid

May 08, 2025 -

Angels Farm System Receives Scathing Review From Mlb Insiders

May 08, 2025

Angels Farm System Receives Scathing Review From Mlb Insiders

May 08, 2025 -

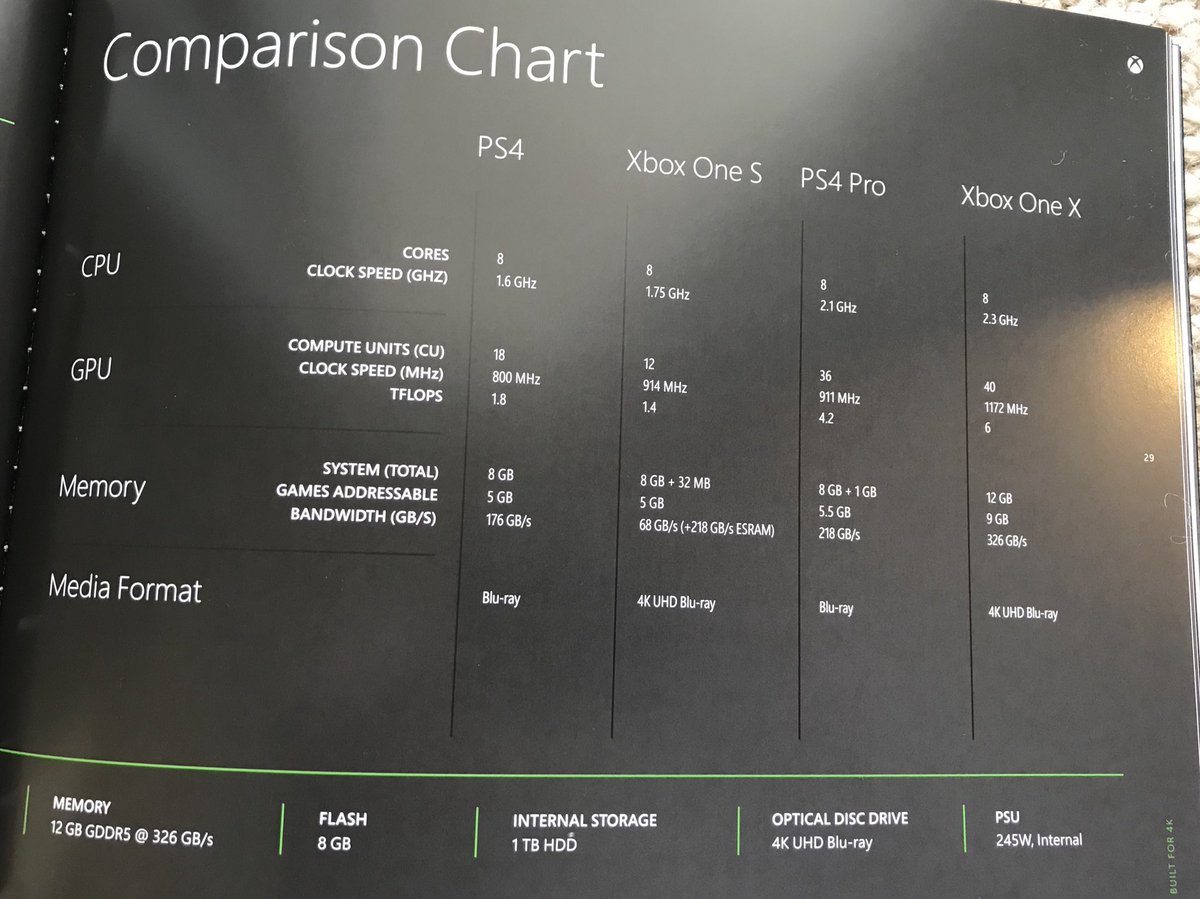

Ps 5 Pro Vs Ps 4 Pro A Sales Performance Comparison

May 08, 2025

Ps 5 Pro Vs Ps 4 Pro A Sales Performance Comparison

May 08, 2025 -

How Andor Season 2 Will Differ From Other Star Wars A Rogue One Actors Perspective

May 08, 2025

How Andor Season 2 Will Differ From Other Star Wars A Rogue One Actors Perspective

May 08, 2025 -

X Men Rogues Costume Evolution Beyond The Skimpy Suit

May 08, 2025

X Men Rogues Costume Evolution Beyond The Skimpy Suit

May 08, 2025

Latest Posts

-

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Isverenler Ve Calisanlar Icin Rehber

May 08, 2025

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Isverenler Ve Calisanlar Icin Rehber

May 08, 2025 -

Brezilya Da Bitcoin Maas Oedemeleri Yasal Oluyor

May 08, 2025

Brezilya Da Bitcoin Maas Oedemeleri Yasal Oluyor

May 08, 2025 -

Kripto Para Yatirimlarinda Duesues Riskler Ve Oenlemler

May 08, 2025

Kripto Para Yatirimlarinda Duesues Riskler Ve Oenlemler

May 08, 2025 -

Yatirimcilarin Kripto Paralardan Cekilmesinin Nedenleri Ve Sonuclari

May 08, 2025

Yatirimcilarin Kripto Paralardan Cekilmesinin Nedenleri Ve Sonuclari

May 08, 2025 -

Kripto Piyasasi Coekuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025

Kripto Piyasasi Coekuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025