MicroStrategy Vs. Bitcoin: Predicting Investment Returns For 2025

Table of Contents

MicroStrategy's Bitcoin Strategy: A Deep Dive

MicroStrategy's aggressive Bitcoin acquisition strategy has made it a prominent player in the cryptocurrency market. Understanding their approach is crucial to assessing the potential returns of investing either directly in Bitcoin or through MicroStrategy stock.

Understanding MicroStrategy's Bitcoin Holdings

MicroStrategy, a business intelligence company, began accumulating Bitcoin in August 2020. Their strategy is largely driven by CEO Michael Saylor's belief in Bitcoin as a long-term store of value and inflation hedge.

- Total Bitcoin owned: As of [Insert latest data - find the most up-to-date figure from a reliable source], MicroStrategy holds approximately [Insert number] Bitcoin.

- Average purchase price: Their average cost basis per Bitcoin is approximately [Insert average price - find the most up-to-date figure from a reliable source].

- Key dates of significant purchases: Significant purchases have been made throughout [mention important periods of purchases].

- Michael Saylor's influence: Michael Saylor's strong advocacy for Bitcoin has significantly shaped the company's strategy and attracted attention from both investors and critics.

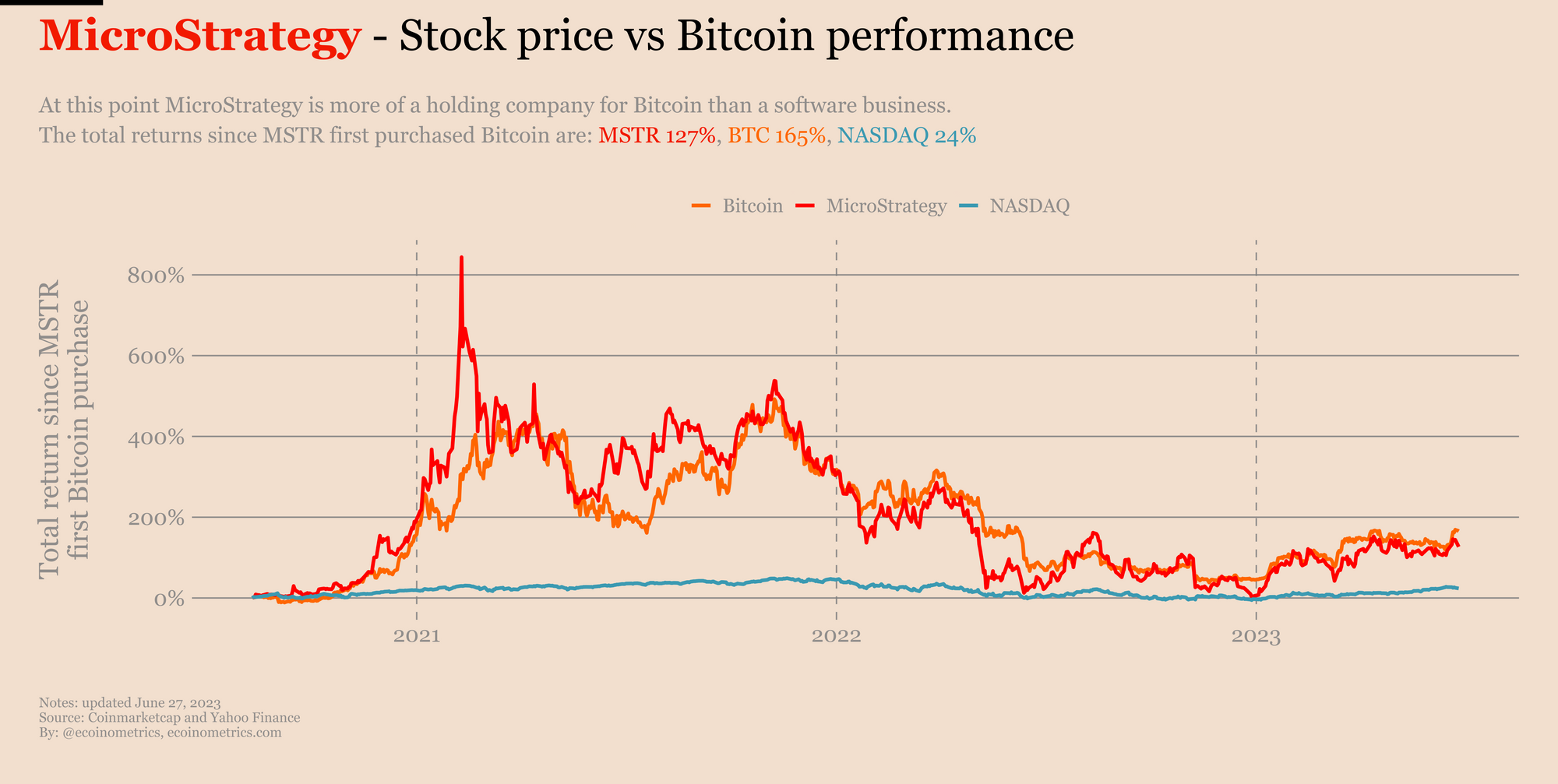

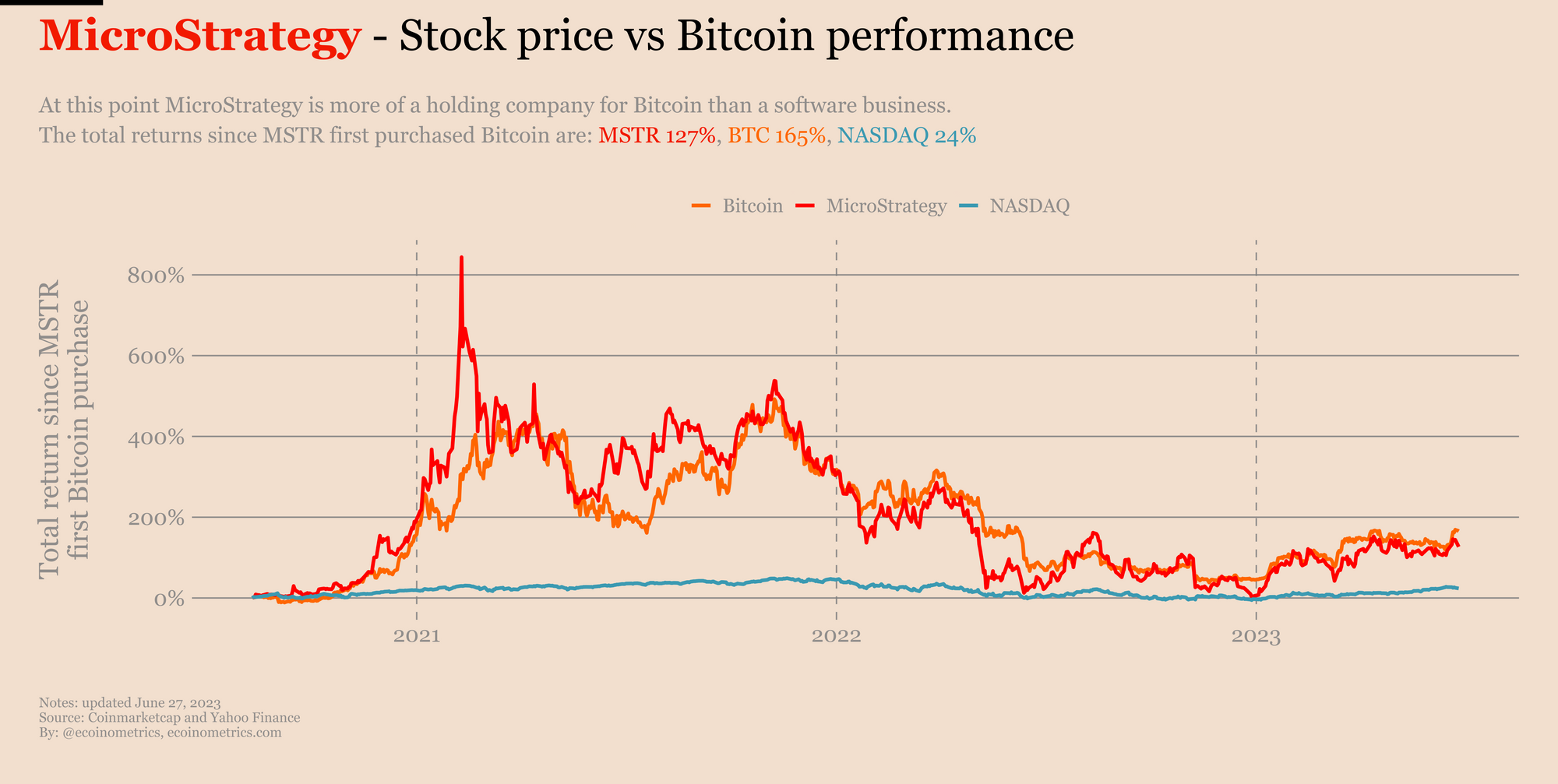

Analyzing MicroStrategy's Stock Performance Linked to Bitcoin

MicroStrategy's stock price is heavily correlated with the price of Bitcoin. When Bitcoin's price rises, MicroStrategy's stock tends to follow suit, and vice-versa. This highlights the inherent risk and reward tied to the company's Bitcoin-centric approach.

- Historical stock price data correlated with Bitcoin price: Historical data clearly shows a strong positive correlation between MicroStrategy's stock price and Bitcoin's price. [Include a chart or graph if possible, citing the source].

- Analysis of market reactions to Bitcoin price fluctuations: Market reactions to Bitcoin price swings often lead to amplified volatility in MicroStrategy's stock.

- Impact of regulatory changes on the stock price: Regulatory developments concerning Bitcoin directly impact MicroStrategy's stock price, demonstrating the company's vulnerability to regulatory uncertainty.

Risks Associated with MicroStrategy's Bitcoin Strategy

Investing in MicroStrategy, given its heavy reliance on Bitcoin, carries substantial risks.

- Volatility risk: Bitcoin's price is notoriously volatile. Sharp price drops can significantly impact both MicroStrategy's balance sheet and its stock price.

- Regulatory risk: Regulatory scrutiny of Bitcoin and cryptocurrency markets poses a significant threat. SEC investigations and potential future regulations could negatively affect MicroStrategy's holdings and overall value.

- Security risks associated with holding Bitcoin: The security of MicroStrategy's Bitcoin holdings is a key concern. Hacking and theft are ever-present risks in the cryptocurrency space.

- Counterparty risk: Risks associated with the exchanges and custodians used to manage MicroStrategy's Bitcoin holdings also need to be considered.

Bitcoin's Price Prediction for 2025: Factors to Consider

Predicting Bitcoin's price is inherently speculative, but analyzing key factors can provide valuable insights.

Halving Events and their Impact

Bitcoin's halving events, which reduce the rate of new Bitcoin creation, have historically led to price increases.

- Dates of past halving events: Previous halving events occurred in [list dates].

- Price movements following each halving: Following each halving, Bitcoin’s price generally experienced a period of growth. [Include data or chart if possible].

- Projected impact of the next halving: The next halving is expected to [state the date] and could potentially [explain the expected impact on price].

Adoption Rate and Institutional Investment

Growing institutional adoption and increased mainstream awareness are bullish factors for Bitcoin's price.

- Growth of institutional adoption: More and more institutional investors are allocating capital to Bitcoin, signifying increased confidence in its long-term potential.

- Impact of regulatory clarity or uncertainty: Clearer regulatory frameworks could boost institutional adoption, while regulatory uncertainty might dampen it.

- Macroeconomic factors affecting Bitcoin's price: Global economic uncertainty, inflation, and the performance of traditional financial markets can influence Bitcoin's price.

Technological Advancements and Competition

Technological advancements and competition within the cryptocurrency landscape also affect Bitcoin's price.

- Impact of Layer-2 solutions: Layer-2 scaling solutions aim to improve Bitcoin's transaction speed and reduce fees, potentially boosting adoption.

- Competition from other cryptocurrencies (Ethereum, etc.): The emergence of competing cryptocurrencies could divert investment away from Bitcoin.

- Technological advancements within the Bitcoin network: Upgrades and improvements to the Bitcoin network can enhance its efficiency and security, potentially increasing its value.

Comparing Potential Returns: MicroStrategy Stock vs. Bitcoin

Comparing the potential returns of MicroStrategy stock and Bitcoin requires analyzing different scenarios.

Scenario Analysis

Let's consider three scenarios for Bitcoin's price by 2025:

- Bullish Scenario: Bitcoin reaches [price], resulting in [MicroStrategy stock projection] and [Bitcoin ROI].

- Bearish Scenario: Bitcoin falls to [price], resulting in [MicroStrategy stock projection] and [Bitcoin ROI].

- Neutral Scenario: Bitcoin remains around [price], resulting in [MicroStrategy stock projection] and [Bitcoin ROI]. [Remember to clearly state your assumptions for each scenario]

Risk Tolerance and Investment Strategy

Your risk tolerance and investment goals should guide your decision.

- High-risk, high-reward vs. lower-risk, lower-reward strategies: Direct Bitcoin investment is inherently higher risk than a diversified portfolio including MicroStrategy stock.

- Diversification considerations: Diversification is crucial to mitigate risk. Don't put all your eggs in one basket.

Conclusion

Predicting the future of Bitcoin and MicroStrategy's investment strategy is challenging. MicroStrategy's bold bet on Bitcoin presents both significant upside and considerable risk. By considering Bitcoin halving events, adoption rates, and macroeconomic conditions, alongside a thorough understanding of MicroStrategy's business model and the inherent risks associated with Bitcoin investment, you can make a more informed decision. Remember to conduct thorough research and consult a financial advisor before making any investment decisions related to Bitcoin or MicroStrategy. Understanding the nuances of MicroStrategy vs. Bitcoin is key to navigating this dynamic market.

Featured Posts

-

Is Your Investment A Real Safe Bet A Critical Assessment

May 09, 2025

Is Your Investment A Real Safe Bet A Critical Assessment

May 09, 2025 -

Yemen Shipping Outlook Uncertain Following Trumps Houthi Truce

May 09, 2025

Yemen Shipping Outlook Uncertain Following Trumps Houthi Truce

May 09, 2025 -

Imf Review Of Pakistans 1 3 Billion Package Tensions With India And Other News

May 09, 2025

Imf Review Of Pakistans 1 3 Billion Package Tensions With India And Other News

May 09, 2025 -

Knights Edge Wild In Overtime Barbashev Scores Game Winner

May 09, 2025

Knights Edge Wild In Overtime Barbashev Scores Game Winner

May 09, 2025 -

Barys San Jyrman Hl Yktb Altarykh Fy Dwry Abtal Awrwba

May 09, 2025

Barys San Jyrman Hl Yktb Altarykh Fy Dwry Abtal Awrwba

May 09, 2025