MicroStrategy's Competitor: A Deep Dive Into The Latest SPAC Investment Frenzy

Table of Contents

The SPAC Phenomenon and its Impact on the Business Intelligence Market

SPACs, or blank-check companies, raise capital through an initial public offering (IPO) with the sole purpose of acquiring a private company. This mechanism has become a popular route for businesses, especially in the tech sector, to go public, bypassing the traditional IPO process. The influx of capital into the business intelligence sector via SPACs is significant. This has led to a surge in competition, attracting both established players and innovative startups aiming to challenge established leaders like MicroStrategy.

Advantages of SPACs:

- Faster Capital Access: SPACs offer a quicker path to funding compared to traditional IPOs.

- Lower Regulatory Hurdles: The process is often perceived as less stringent than a traditional IPO.

- Potentially Higher Valuation: SPAC mergers can sometimes result in higher valuations for the acquired company.

Disadvantages of SPACs:

- Dilution of Existing Shareholder Stakes: Existing shareholders may see their ownership diluted.

- Potential for Overvaluation: The SPAC process can lead to inflated valuations, creating risks for investors.

- Increased Scrutiny: SPACs have faced increased regulatory scrutiny in recent years.

Examples of SPAC mergers in the BI sector include [Insert examples of successful and unsuccessful SPAC mergers in the BI sector, citing sources]. These examples highlight both the opportunities and risks associated with this financing method for BI companies aiming to compete with MicroStrategy.

Identifying Key Competitors Emerging from SPAC Mergers

Several companies directly competing with MicroStrategy have leveraged SPACs to enter the public market. Let's examine a few key players:

Company A: [Insert Name of Company A - e.g., "DataWeave"]

DataWeave, a leading provider of AI-powered data intelligence, went public via a SPAC merger in [Year]. Its business model centers on providing real-time insights from unstructured data, focusing on [mention specific industries or applications].

- Key Offerings: Real-time data analytics, predictive modeling, customizable dashboards.

- Competitive Advantages vs. MicroStrategy: Focus on AI and machine learning, a strong presence in specific niche markets.

- Competitive Disadvantages vs. MicroStrategy: Smaller market capitalization, potentially less established brand recognition.

- Market Capitalization and Investor Sentiment: [Insert data and analysis, citing sources].

- Recent News and Developments: [Mention recent company news, partnerships, or product launches].

Company B: [Insert Name of Company B - e.g., "Synapse"]

Synapse, another significant player in the BI market, completed its SPAC merger in [Year]. Their focus is on [mention specific technologies or target markets, e.g., cloud-based analytics solutions for large enterprises].

- Key Offerings: Cloud-based BI platform, advanced data visualization tools, robust data integration capabilities.

- Competitive Advantages vs. MicroStrategy: Scalability, cost-effectiveness of cloud solutions, strong partnerships with cloud providers.

- Competitive Disadvantages vs. MicroStrategy: Dependence on cloud infrastructure, potential security concerns.

- Market Capitalization and Investor Sentiment: [Insert data and analysis, citing sources].

- Recent News and Developments: [Mention recent company news, partnerships, or product launches].

Competitive Landscape Analysis: MicroStrategy vs. SPAC-Backed Competitors

MicroStrategy's strengths lie in its established brand reputation, extensive customer base, and comprehensive suite of BI tools. However, SPAC-backed competitors are challenging its dominance by focusing on specific niches, leveraging AI/ML, and offering cloud-based solutions.

- Market Share: [Insert market share data for MicroStrategy and its competitors, citing sources].

- Growth Potential: [Analyze the growth potential of each player based on market trends and competitive advantages].

- Strategic Partnerships/Acquisitions: The BI market is likely to see further consolidation. Both MicroStrategy and its SPAC-backed competitors may pursue strategic partnerships or acquisitions to expand their reach and capabilities.

- Long-Term Implications: The emergence of strong SPAC-backed competitors will likely intensify competition, forcing MicroStrategy to innovate and adapt to maintain its market leadership.

Future Trends and Predictions in the Business Intelligence Market

Several key trends will shape the future of the BI market:

- Cloud Adoption: The shift towards cloud-based BI solutions will continue, impacting both MicroStrategy and its competitors.

- AI Integration: The integration of AI and machine learning capabilities into BI platforms will become increasingly crucial.

- Data Security: Data security and privacy will remain paramount concerns, requiring robust security measures.

These trends suggest a future of increased competition and innovation. Further consolidation through mergers and acquisitions is highly probable. Predicting precise market share is challenging, but we can anticipate a more fragmented market with MicroStrategy facing stronger competition from agile, well-funded SPAC-backed rivals.

Conclusion

The emergence of numerous strong MicroStrategy's competitors, many fueled by the SPAC investment frenzy, has created a dynamic and competitive landscape in the business intelligence market. Our analysis highlights both the opportunities and challenges facing MicroStrategy as it navigates this new environment. The future likely involves a period of intense competition, innovation, and potential consolidation. Staying informed about the latest developments in the SPAC market and the ongoing evolution of MicroStrategy's competitors is crucial for understanding the future of the BI industry. Stay updated on the latest news and analysis by subscribing to our newsletter to learn more about the impact of the SPAC market on finding a strong MicroStrategy's competitor.

Featured Posts

-

Black Rock Etf Billionaire Investment Signals Potential 110 Surge In 2025

May 08, 2025

Black Rock Etf Billionaire Investment Signals Potential 110 Surge In 2025

May 08, 2025 -

Colin Cowherd And Jayson Tatum An Ongoing Disagreement And Its Implications

May 08, 2025

Colin Cowherd And Jayson Tatum An Ongoing Disagreement And Its Implications

May 08, 2025 -

Here Are The Lotto Results For Saturday April 12th

May 08, 2025

Here Are The Lotto Results For Saturday April 12th

May 08, 2025 -

Thunders Game 1 Win Alex Caruso Makes Nba Playoff History

May 08, 2025

Thunders Game 1 Win Alex Caruso Makes Nba Playoff History

May 08, 2025 -

Bitcoin In Son Durumu Ne Guencel Degeri Ve Analizi

May 08, 2025

Bitcoin In Son Durumu Ne Guencel Degeri Ve Analizi

May 08, 2025

Latest Posts

-

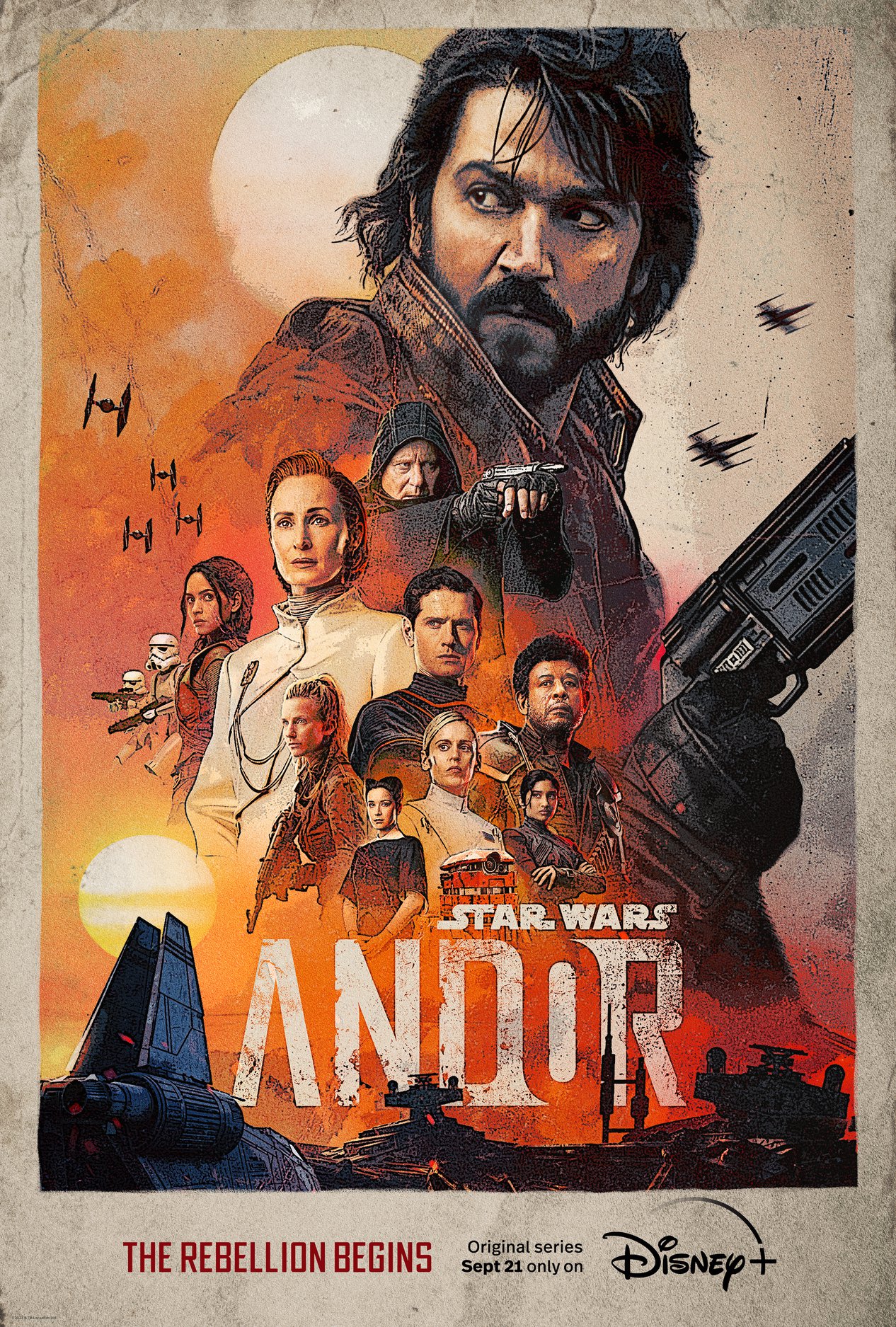

Andor Season 2 The Absence Of A Trailer Sparks Intense Fan Debate

May 08, 2025

Andor Season 2 The Absence Of A Trailer Sparks Intense Fan Debate

May 08, 2025 -

Fan Anxiety Mounts As Andor Season 2 Trailer Remains Elusive

May 08, 2025

Fan Anxiety Mounts As Andor Season 2 Trailer Remains Elusive

May 08, 2025 -

Andor Season 1 Episodes 1 3 Where To Stream Online Hulu And You Tube

May 08, 2025

Andor Season 1 Episodes 1 3 Where To Stream Online Hulu And You Tube

May 08, 2025 -

Andor Season 2 Delayed Trailer Ignites Fan Speculation And Anxiety

May 08, 2025

Andor Season 2 Delayed Trailer Ignites Fan Speculation And Anxiety

May 08, 2025 -

Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Streaming Options

May 08, 2025

Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Streaming Options

May 08, 2025