Microsoft Activision Blizzard Deal Faces FTC Appeal

Table of Contents

The FTC's Case Against the Microsoft Activision Blizzard Merger

The FTC's lawsuit against the Microsoft Activision Blizzard merger centers on concerns about anti-competitive practices and market dominance. The agency argued that the acquisition would give Microsoft undue control over the video game market, harming competition and potentially consumers.

-

Anti-competitive Practices: The FTC argued that the merger would allow Microsoft to stifle competition by making key Activision Blizzard franchises, particularly Call of Duty, exclusive to its Xbox ecosystem. This could harm players who use other consoles or PC platforms, limiting their access to popular games. The argument hinges on the potential for Microsoft to leverage its market power to disadvantage competitors.

-

Market Dominance: The FTC highlighted Microsoft's already significant presence in the gaming market, including its Xbox consoles, Game Pass subscription service, and extensive game development studios. Acquiring Activision Blizzard, a major player with titles like Call of Duty, World of Warcraft, and Candy Crush, would further consolidate Microsoft's power, potentially creating an insurmountable barrier for competitors.

-

Harm to Consumers: The FTC contended that the merger would ultimately harm consumers through higher prices, fewer choices, and reduced innovation in the gaming industry. By controlling key franchises, Microsoft could potentially raise prices or limit features on rival platforms.

-

The Initial Ruling: A federal judge initially dismissed the FTC's lawsuit, finding the agency had not presented enough evidence to prove the merger would substantially lessen competition. This decision, however, did not end the matter, paving the way for the FTC's current appeal.

The FTC's Appeal and its Potential Impact

The FTC's appeal represents a significant challenge to the initial ruling and throws the future of the Microsoft Activision Blizzard deal into question. The appeal process involves detailed legal arguments and reviews of evidence, potentially leading to several outcomes.

-

The Appeal Process: The FTC will present its case before a higher court, arguing that the original judge's decision was incorrect and that the merger should be blocked based on antitrust laws. The appeal will focus on strengthening the evidence concerning anti-competitive practices and the potential harm to consumers.

-

Potential Outcomes: The appellate court could uphold the original ruling, dismissing the FTC's appeal and allowing the merger to proceed. Conversely, the court could reverse the lower court's decision, blocking the acquisition. A third possibility is that the court could send the case back to the lower court for further review and consideration of additional evidence.

-

Impact on Timeline: The FTC appeal significantly impacts the deal's timeline. The appellate process can be lengthy, potentially delaying the acquisition by months, or even longer, depending on the court's schedule and any further legal challenges.

-

Investor Confidence and Market Impact: The uncertainty surrounding the appeal affects investor confidence in both Microsoft and Activision Blizzard. The ongoing legal battle creates market volatility, impacting stock prices and the overall sentiment in the gaming industry.

International Regulatory Scrutiny

The regulatory hurdles for the Microsoft Activision Blizzard merger extend beyond the US. The deal faces scrutiny from competition authorities worldwide, adding further complexity to the acquisition process.

-

EU Competition: The European Union's competition authorities have also conducted their own investigation into the merger, raising similar concerns about anti-competitive practices and market dominance. Their decision will be crucial in determining whether the deal can proceed globally.

-

CMA Investigation: The UK's Competition and Markets Authority (CMA) also expressed significant concerns and initially blocked the deal. While Microsoft has appealed the CMA's decision, the outcome remains uncertain.

-

Global Regulatory Landscape: The varying approaches of different jurisdictions towards mergers and acquisitions create a complex international regulatory landscape. The success or failure of the deal will heavily depend on navigating these diverse regulatory requirements.

The Future of the Microsoft Activision Blizzard Deal

The future of the Microsoft Activision Blizzard deal remains uncertain, with several possible scenarios unfolding.

-

Possible Scenarios: The deal could ultimately be approved, either through the successful appeal by Microsoft or concessions made to regulatory bodies. Alternatively, the deal could be blocked entirely, either by the US courts or international regulatory authorities. A compromise, involving the divestment of certain assets by Activision Blizzard, might also be a potential outcome.

-

Potential Compromises: To appease regulatory concerns, Microsoft might offer concessions, such as agreeing to keep Call of Duty available on competing platforms for a set period or licensing certain Activision Blizzard titles to other companies. The nature of any such concessions would depend on the specific concerns raised by the regulatory bodies.

-

Broader Implications: Regardless of the outcome, this merger has broader implications for the gaming industry and the future of large-scale acquisitions in the tech sector. It highlights the increasing scrutiny faced by major tech companies seeking to consolidate their power and the important role of regulatory bodies in maintaining fair competition.

Conclusion

The FTC's appeal against the Microsoft Activision Blizzard deal marks a critical juncture. The outcome will significantly impact the gaming landscape, influencing the competitive dynamics and potentially setting precedents for future large-scale mergers in the tech industry. The uncertainty surrounding the deal's future underscores the complex regulatory challenges faced by major technology acquisitions. The interplay of antitrust laws, international regulatory bodies, and the business strategies of major tech players will determine the ultimate fate of this landmark acquisition.

Call to Action: Stay tuned for further updates on the Microsoft Activision Blizzard deal and its ongoing legal battles. Continue to follow this story to understand the impact of this landmark FTC appeal on the future of the gaming industry and the ever-evolving landscape of tech mergers and acquisitions. Understanding the implications of the Microsoft Activision Blizzard merger is crucial for anyone following the gaming industry and the complexities of modern antitrust regulations.

Featured Posts

-

The White Lotus Season 3 Unmasking The Voice Of Tims Coworker Kenny

May 07, 2025

The White Lotus Season 3 Unmasking The Voice Of Tims Coworker Kenny

May 07, 2025 -

One Le Chateau Christophe Mali Clot La Saison Musicale

May 07, 2025

One Le Chateau Christophe Mali Clot La Saison Musicale

May 07, 2025 -

Arozarena And Mariners 10 Inning Victory Over Reds

May 07, 2025

Arozarena And Mariners 10 Inning Victory Over Reds

May 07, 2025 -

Fatal Street Race Results In Eight Year Sentence For Driver

May 07, 2025

Fatal Street Race Results In Eight Year Sentence For Driver

May 07, 2025 -

Learning From The Celtics A Cavaliers Stars Perspective

May 07, 2025

Learning From The Celtics A Cavaliers Stars Perspective

May 07, 2025

Latest Posts

-

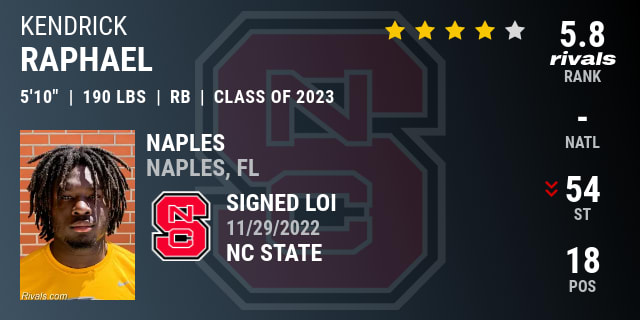

Nc State Recruiting Setback Loss Of Running Back Kendrick Raphael

May 08, 2025

Nc State Recruiting Setback Loss Of Running Back Kendrick Raphael

May 08, 2025 -

De Andre Hopkins Joins Baltimore Ravens Contract Breakdown And Impact

May 08, 2025

De Andre Hopkins Joins Baltimore Ravens Contract Breakdown And Impact

May 08, 2025 -

Nc State Loses Kendrick Raphael Rising Junior Running Back Decommits

May 08, 2025

Nc State Loses Kendrick Raphael Rising Junior Running Back Decommits

May 08, 2025 -

Nfl News Browns Sign Experienced Wide Receiver And Return Specialist

May 08, 2025

Nfl News Browns Sign Experienced Wide Receiver And Return Specialist

May 08, 2025 -

Jokic I Dzordan Tradicija Tri Poljupca I Uloga Bobija Marjanovica

May 08, 2025

Jokic I Dzordan Tradicija Tri Poljupca I Uloga Bobija Marjanovica

May 08, 2025