Microsoft-Activision Deal: FTC's Appeal And Its Implications

Table of Contents

The FTC's Arguments Against the Microsoft-Activision Merger

The FTC's opposition to the Microsoft-Activision merger centers on two key concerns: market domination and allegations of anti-competitive practices.

Concerns about Market Domination

The FTC argues that Microsoft's acquisition of Activision Blizzard would grant it undue control over the video game market. This concern primarily focuses on the immensely popular Call of Duty franchise. The FTC fears that Microsoft could leverage its ownership of Activision Blizzard to stifle competition and harm consumers.

- Reduced competition leading to higher prices for gamers: By controlling a major gaming franchise, Microsoft could potentially raise prices for Call of Duty and other Activision Blizzard titles, reducing consumer choice and affordability.

- Limited choices for consumers regarding gaming platforms and subscription services: The FTC worries that Microsoft might make Call of Duty exclusive to Xbox consoles or its Xbox Game Pass subscription service, limiting consumer access to the game on PlayStation, Nintendo Switch, or PC platforms. This exclusivity could significantly hinder competition in the console and subscription services markets.

- Potential stifling of innovation within the gaming industry: The FTC argues that a lack of competition could lead to reduced innovation in game development, graphics, and overall gaming experiences, ultimately harming consumers. The fear is that Microsoft, with its dominant position, might not be incentivized to push boundaries as aggressively as it would in a more competitive environment.

Anti-Competitive Practices Allegations

Beyond market domination, the FTC alleges that Microsoft could engage in anti-competitive practices following the merger.

- Making Call of Duty exclusive to Xbox platforms or its Game Pass service: This is the most significant anti-competitive concern. Restricting access to Call of Duty, a hugely popular title, to a single ecosystem would give Xbox a significant advantage over its competitors.

- Limiting access to Activision Blizzard games on rival consoles or PC platforms: This would extend beyond Call of Duty, affecting other popular Activision Blizzard games and potentially harming the broader gaming ecosystem.

- Imposing unfair licensing terms on competitors: Microsoft could leverage its position to negotiate unfavorable licensing terms with other game developers and publishers, further hindering competition.

The Judge's Initial Ruling and the FTC's Appeal

The Initial Decision

A US District Judge initially ruled in favor of Microsoft, allowing the merger to proceed. The judge's decision found the FTC's arguments unconvincing, suggesting that the evidence presented wasn't sufficient to demonstrate a substantial lessening of competition.

- The judge's reasoning and key findings regarding market competition: The judge focused on the existing competitive landscape of the gaming industry, highlighting the presence of other major players like Sony and Nintendo.

- Analysis of the evidence presented by both sides in the case: The judge considered the evidence presented by both Microsoft and the FTC, weighing the potential benefits of the merger against the risks of reduced competition.

The FTC's Appeal and its Basis

Unsatisfied with the initial ruling, the FTC appealed the decision. The FTC argued that the court misinterpreted key aspects of antitrust law and failed to adequately consider the potential harm to competition, especially in the long term.

- Detailed explanation of the FTC's grounds for the appeal: The appeal highlights the potential for anti-competitive behavior by Microsoft post-merger, focusing on the potential for exclusive access to key franchises.

- Legal precedents cited by the FTC in its appeal: The FTC referenced various antitrust cases to support its arguments, attempting to establish a legal framework for its concerns.

- The potential impact of the appeal on future merger approvals: The FTC's appeal could set a precedent for how future large-scale mergers in the tech industry are evaluated, particularly within the gaming sector.

Potential Outcomes and Implications of the Appeal

Scenarios Following the Appeal

Several scenarios could unfold following the FTC's appeal:

-

Reversal of the original ruling: The appellate court could overturn the initial decision, blocking the merger.

-

Confirmation of the original ruling: The appellate court could uphold the initial decision, allowing the merger to proceed.

-

Negotiated settlement: Microsoft and the FTC could reach a negotiated settlement involving concessions from Microsoft to address the FTC's concerns.

-

Potential outcomes and their implications for the gaming industry: Each outcome carries significant implications for the gaming industry, from game pricing and availability to the development of new platforms and technologies.

-

Analysis of the likelihood of each outcome: Predicting the outcome is difficult, dependent on the appellate court's interpretation of antitrust law and the weight given to the evidence presented.

Impact on the Gaming Industry

Regardless of the outcome, the Microsoft-Activision deal sets a crucial precedent for future mergers and acquisitions in the gaming industry.

- Effect on game pricing and availability: The decision will significantly affect the price and availability of Activision Blizzard games across different platforms.

- Influence on the development of new gaming technologies and platforms: The merger's success or failure could influence the pace of innovation and development within the gaming industry.

- Changes in the competitive landscape of the video game market: The outcome will undoubtedly reshape the competitive dynamics of the video game market, impacting both established players and emerging competitors.

Conclusion

The FTC's appeal of the Microsoft-Activision deal highlights the complexities and significant consequences of large-scale mergers within the tech industry. The outcome will profoundly impact the future of gaming, competition, and regulatory oversight. This case serves as a critical reminder of the importance of thoroughly scrutinizing such deals to ensure a fair and competitive marketplace. Stay informed about further developments in the Microsoft-Activision deal and its implications for the future of gaming. Understanding the nuances of this significant merger is crucial for anyone invested in or interested in the gaming industry.

Featured Posts

-

Luxury Suv Pricing Analyzing The 230 000 Lotus Eletre

Apr 25, 2025

Luxury Suv Pricing Analyzing The 230 000 Lotus Eletre

Apr 25, 2025 -

Could Ashton Jeanty Be The Key To The Denver Broncos Super Bowl Hopes

Apr 25, 2025

Could Ashton Jeanty Be The Key To The Denver Broncos Super Bowl Hopes

Apr 25, 2025 -

Guilty Plea Lab Owner Admits To Fraudulent Covid 19 Testing

Apr 25, 2025

Guilty Plea Lab Owner Admits To Fraudulent Covid 19 Testing

Apr 25, 2025 -

Would Perplexity Buy Chrome Analyzing A Potential Google Divestiture

Apr 25, 2025

Would Perplexity Buy Chrome Analyzing A Potential Google Divestiture

Apr 25, 2025 -

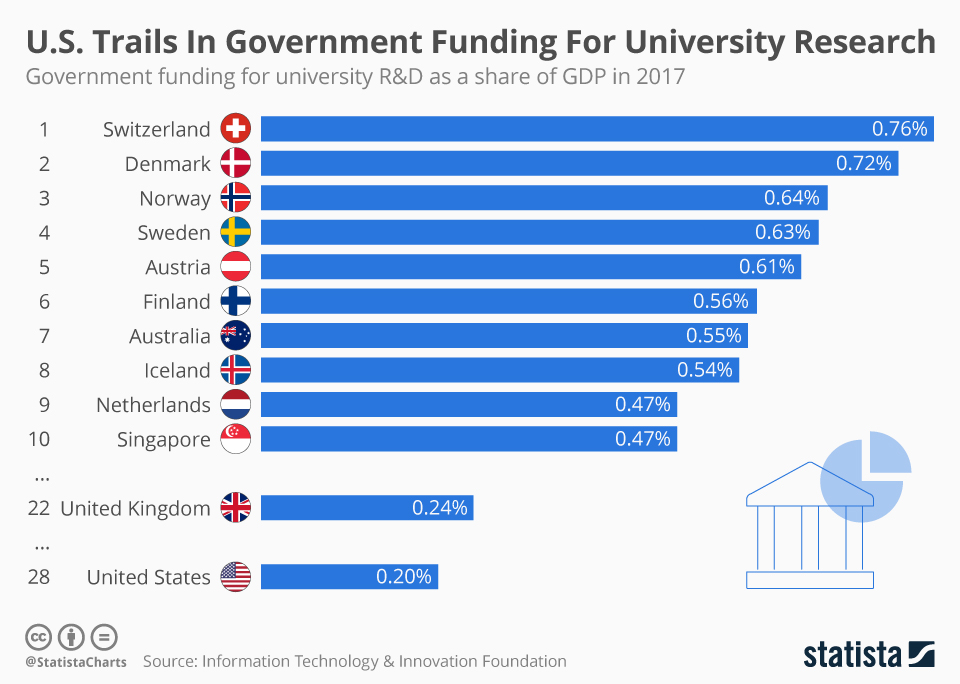

The Harvard Case A Deeper Dive Into Trumps Scrutiny Of Foreign University Funding

Apr 25, 2025

The Harvard Case A Deeper Dive Into Trumps Scrutiny Of Foreign University Funding

Apr 25, 2025

Latest Posts

-

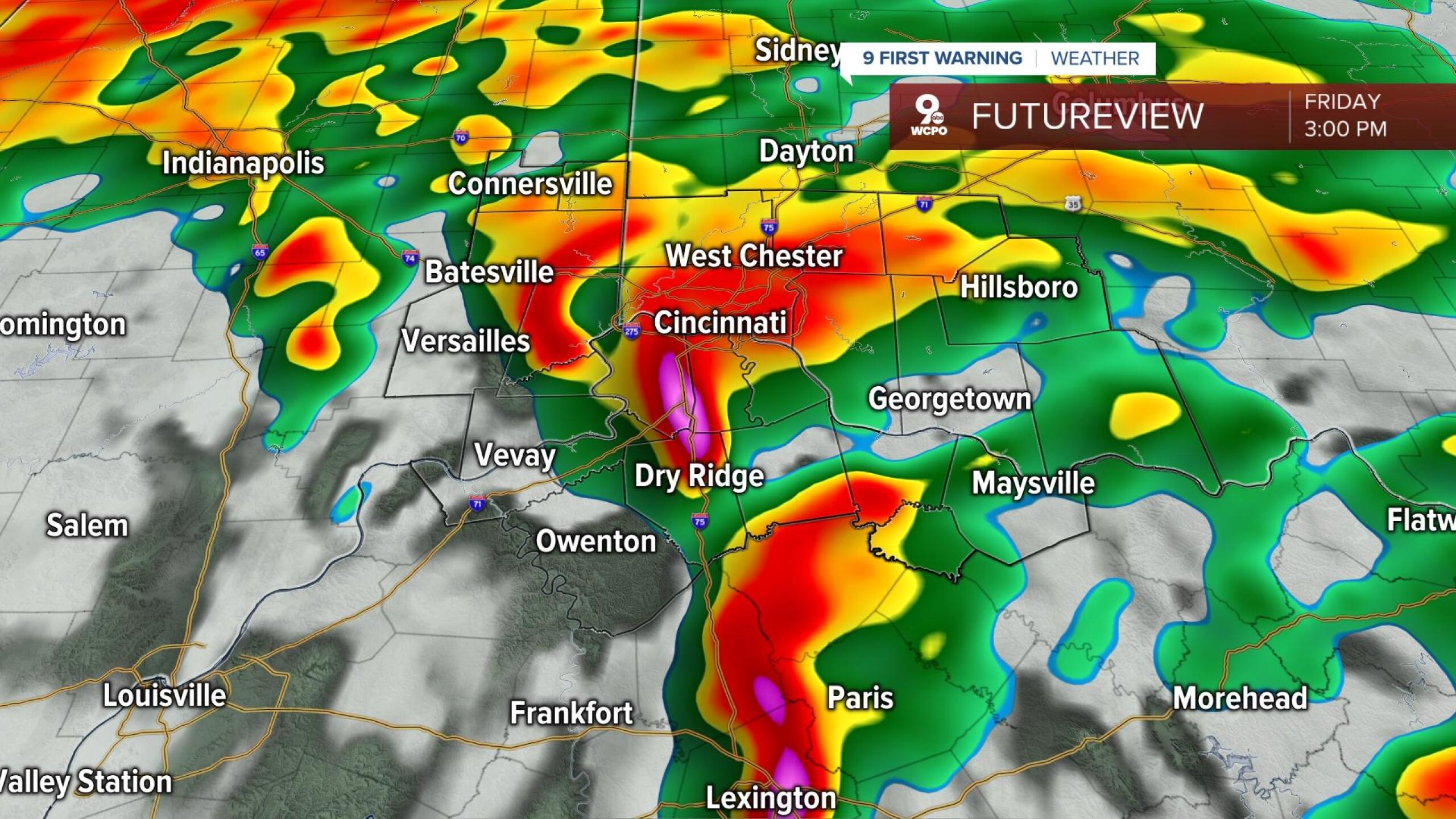

Heavy Rain And Flooding Prompt State Of Emergency Declaration In Kentucky

Apr 30, 2025

Heavy Rain And Flooding Prompt State Of Emergency Declaration In Kentucky

Apr 30, 2025 -

Louisville Mail Delivery Issues Unions Positive Outlook

Apr 30, 2025

Louisville Mail Delivery Issues Unions Positive Outlook

Apr 30, 2025 -

Understanding The Delays In Kentuckys Post Storm Damage Assessments

Apr 30, 2025

Understanding The Delays In Kentuckys Post Storm Damage Assessments

Apr 30, 2025 -

Relief In Sight Louisville Mail Delays Nearing Resolution

Apr 30, 2025

Relief In Sight Louisville Mail Delays Nearing Resolution

Apr 30, 2025 -

Kentucky Facing Storm Damage Assessment Backlog Causes And Solutions

Apr 30, 2025

Kentucky Facing Storm Damage Assessment Backlog Causes And Solutions

Apr 30, 2025