Microsoft Software Stock: A Safe Harbor During Tariff Uncertainty

Table of Contents

Microsoft's Diversified Revenue Streams Mitigate Tariff Risks

Microsoft's success isn't solely reliant on any single product or market segment. This diversification significantly reduces its vulnerability to the disruptive effects of tariffs.

Cloud Computing Dominance (Azure)

Microsoft Azure, the company's cloud computing platform, is a key driver of growth and a significant factor in its resilience to tariff impacts. Its global reach and rapid expansion minimize the impact of localized trade disputes.

- Market Leader: Azure holds a substantial share of the rapidly growing cloud computing market, competing directly with Amazon Web Services (AWS) and Google Cloud.

- High Growth Rate: Azure's revenue growth consistently outpaces the overall cloud market, demonstrating strong demand and market penetration.

- Global Reach: Azure's infrastructure spans numerous countries, reducing dependence on any single geographic region and mitigating the effects of tariffs imposed on specific nations.

- Diverse Client Base: Azure serves a vast array of industries and clients, further diversifying its revenue streams and reducing risk.

Productivity and Business Processes (Office 365, Dynamics 365)

Microsoft's subscription-based models for Office 365 and Dynamics 365 provide predictable and recurring revenue, shielding the company from the volatility associated with hardware sales dependent on fluctuating demand and import/export tariffs.

- Widespread Adoption: Office 365 is the dominant productivity suite globally, used by individuals, businesses, and institutions.

- Recurring Revenue: The subscription model ensures a steady stream of income, regardless of short-term economic fluctuations.

- Enterprise Solutions: Dynamics 365 caters to enterprise needs, offering robust business process management solutions with recurring revenue streams.

- Global Reach: Both Office 365 and Dynamics 365 are used globally, lessening reliance on specific markets.

Gaming (Xbox)

While a smaller portion of overall revenue, the gaming sector, particularly through Xbox, adds another layer of diversification. The gaming market tends to be relatively resilient even during economic downturns.

- Resilient Market: The video game industry demonstrates consistent growth, proving its relative resilience during economic uncertainty.

- Strong Brand Recognition: Xbox is a well-established brand with a loyal following, ensuring consistent demand for its products and services.

- Subscription Services: Xbox Game Pass provides another recurring revenue stream similar to Office 365, enhancing stability.

Strong Balance Sheet and Cash Flow as a Buffer Against Economic Downturns

Microsoft boasts a remarkably strong financial position, providing a buffer against economic headwinds and investor uncertainty.

Financial Stability and Dividend Payments

Microsoft's robust financial health is evident in its substantial cash reserves and consistent dividend payments, providing confidence to investors during times of market volatility.

- High Cash Reserves: Microsoft maintains significant cash on hand, providing ample resources for strategic investments and weathering economic storms.

- Low Debt Levels: Its low debt levels minimize financial risk and enhance its ability to navigate economic uncertainty.

- Consistent Dividend Payouts: Regular dividend payments provide a steady income stream for investors, reducing reliance on capital appreciation alone.

Strategic Acquisitions and Investments

Microsoft's ability to make strategic acquisitions and investments, even during economic downturns, positions it for continued growth.

- Acquisitions: Past successful acquisitions have broadened Microsoft’s product portfolio and expanded its market reach, demonstrating its capability for strategic growth.

- R&D Investments: Significant investment in research and development ensures Microsoft remains at the forefront of technological innovation, driving future growth.

- Long-Term Vision: Microsoft's commitment to long-term growth strategies allows it to navigate short-term economic challenges with greater resilience.

Microsoft Stock as a Defensive Investment Strategy

Including Microsoft stock in a well-diversified portfolio can be a valuable defensive strategy during times of market uncertainty.

Reducing Portfolio Volatility

Microsoft stock often exhibits lower correlation with other asset classes, meaning its price movements don't always align with broader market trends. This makes it a valuable tool for reducing overall portfolio volatility.

- Portfolio Diversification: Adding Microsoft stock helps to spread risk across different asset classes.

- Lower Correlation: MSFT stock often demonstrates relatively low correlation with other market sectors, acting as a hedge against broader market downturns.

- Risk Mitigation: Microsoft’s resilience helps cushion the impact of market fluctuations on your overall investment portfolio.

Long-Term Growth Potential

Microsoft's ongoing innovation and expansion into new markets, especially in areas like Artificial Intelligence (AI), cloud computing, and gaming, ensures long-term growth potential even amidst short-term economic headwinds.

- AI Leadership: Microsoft is a leader in Artificial Intelligence, a technology poised for exponential growth and offering substantial future opportunities.

- Cloud Computing Expansion: The ongoing expansion of Azure further solidifies Microsoft's position in a rapidly growing market.

- Innovation Pipeline: Microsoft's commitment to research and development ensures a continuous pipeline of innovative products and services, driving future growth.

Conclusion

Microsoft software stock presents a compelling case as a safe harbor investment during periods of tariff uncertainty and broader economic volatility. Its diversified revenue streams, robust financial position, and long-term growth potential make it a strong candidate for portfolio inclusion. The company's strong balance sheet and consistent dividend payments further enhance its appeal as a defensive investment.

Invest in Microsoft stock today to mitigate risks associated with tariff uncertainty and economic volatility. Explore Microsoft as a safe haven investment and protect your portfolio with Microsoft software stock. Remember to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Vont Weekend At 104 5 The Cat April 4 6 2025 Photo Gallery

May 15, 2025

Vont Weekend At 104 5 The Cat April 4 6 2025 Photo Gallery

May 15, 2025 -

Jury Finds Man Guilty In 2023 Warner Robins Killing

May 15, 2025

Jury Finds Man Guilty In 2023 Warner Robins Killing

May 15, 2025 -

Honda Delays 15 Billion Ontario Ev Plant Amid Market Slowdown

May 15, 2025

Honda Delays 15 Billion Ontario Ev Plant Amid Market Slowdown

May 15, 2025 -

Jalen Brunsons Return Knicks Pistons Playoff Push

May 15, 2025

Jalen Brunsons Return Knicks Pistons Playoff Push

May 15, 2025 -

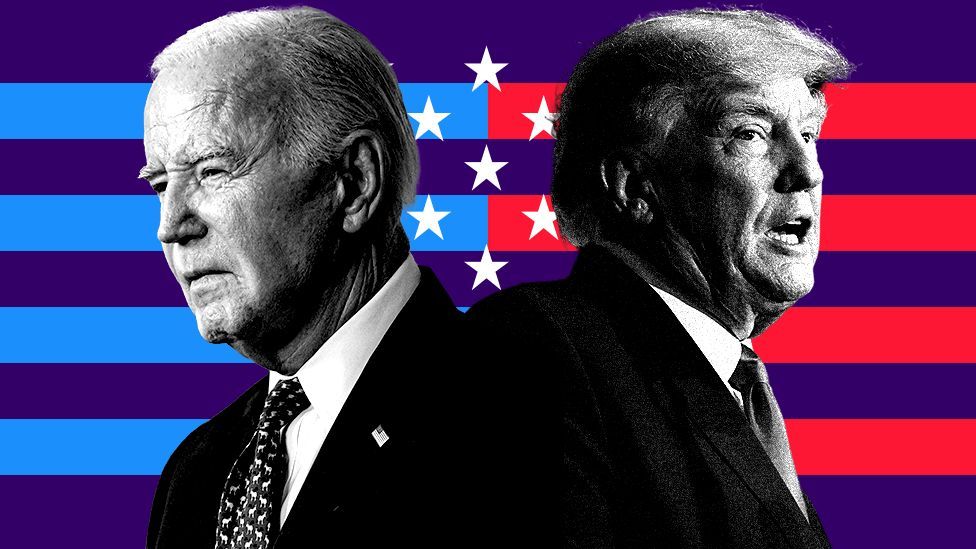

Bidens Response To Trumps Russia Ukraine Actions Vances Critique

May 15, 2025

Bidens Response To Trumps Russia Ukraine Actions Vances Critique

May 15, 2025