Minority Government: Will It Weaken The Canadian Dollar?

Table of Contents

<p>A minority government in Canada raises crucial questions about the country's economic stability and its impact on the Canadian dollar (CAD). Political uncertainty often leads to market volatility, making investors hesitant. This article explores the potential effects of a minority government on the Canadian dollar's exchange rate and what it means for businesses and individuals. We will examine the increased political risk, its impact on investor confidence, and the role of the Bank of Canada in navigating these challenging times.</p>

<h2>Increased Political Uncertainty and its Impact on the CAD</h2>

<h3>Difficulty in Passing Legislation</h3>

<p>A minority government frequently struggles to pass key legislation, resulting in policy gridlock and delayed economic reforms. This uncertainty can deter foreign investment, reducing demand for the CAD and weakening its value. Consider the challenges faced by previous minority governments in enacting crucial economic policies, such as tax reforms or infrastructure investments. These delays create a climate of instability that negatively impacts business confidence.</p>

<ul> <li><strong>Delayed economic reforms:</strong> Projects vital to economic growth may face significant delays or even cancellation.</li> <li><strong>Reduced foreign investment:</strong> Uncertainty makes foreign investors hesitant to commit capital.</li> <li><strong>Decreased business confidence:</strong> Businesses postpone expansion plans, hiring, and investment due to unpredictability.</li> <li><strong>Example:</strong> The difficulties in passing certain budget measures in [insert year of a past minority government] led to a period of market uncertainty and impacted the CAD.</li> </ul>

<h3>Frequent Elections and Their Economic Fallout</h3>

<p>The ever-present threat of snap elections contributes significantly to ongoing economic instability. Election campaigns inherently disrupt normal business operations and long-term investment planning. The market often reacts negatively to this uncertainty, causing increased volatility in the CAD exchange rate. </p>

<ul> <li><strong>Disrupted business operations:</strong> Businesses may postpone decisions during election periods, leading to slower growth.</li> <li><strong>Increased market volatility:</strong> Uncertainty around election outcomes leads to fluctuations in currency markets.</li> <li><strong>Impact on investment decisions:</strong> Investors delay or cancel investments until the political landscape becomes clearer.</li> <li><strong>Analysis:</strong> Historical data shows a correlation between election cycles and CAD exchange rate fluctuations. [Insert relevant data or citation here].</li> </ul>

<h2>Impact on Investor Confidence and Foreign Direct Investment (FDI)</h2>

<h3>Risk Perception and Capital Flight</h3>

<p>Investors are more likely to withdraw their funds from a country perceived as politically unstable. Reduced Foreign Direct Investment (FDI) negatively impacts economic growth and weakens the Canadian dollar. This "capital flight" can trigger a downward spiral, further eroding investor confidence and depressing the CAD.</p>

<ul> <li><strong>Reduced FDI:</strong> A decline in FDI reduces investment in Canadian businesses and infrastructure.</li> <li><strong>Negative impact on economic growth:</strong> Less investment means fewer jobs and slower economic expansion.</li> <li><strong>Currency depreciation:</strong> Reduced demand for the CAD leads to a decrease in its value against other currencies.</li> <li><strong>International examples:</strong> [Insert examples of countries where political instability led to currency depreciation].</li> </ul>

<h3>Government Spending and Budgetary Challenges</h3>

<p>Minority governments may face significant challenges in passing budgets, leading to instability in government spending programs. Reduced government spending can negatively affect economic growth, potentially triggering inflation and impacting the CAD's value. The ability to implement effective fiscal policy is crucial for maintaining economic stability.</p>

<ul> <li><strong>Budgetary uncertainty:</strong> Difficulty in passing budgets can lead to delays in crucial government projects.</li> <li><strong>Reduced government spending:</strong> Cuts in government programs can negatively impact economic growth.</li> <li><strong>Potential for inflation:</strong> Uncertainty about government spending can fuel inflationary pressures.</li> <li><strong>Fiscal policy impact:</strong> Effective fiscal policy is crucial for mitigating the negative impacts of political instability on the CAD.</li> </ul>

<h3>The Role of the Bank of Canada and Monetary Policy</h3>

<p>The Bank of Canada plays a vital role in responding to economic instability under a minority government. It utilizes monetary policy tools, primarily interest rate adjustments, to influence the CAD exchange rate and maintain price stability. However, the Bank's effectiveness is influenced by the overall level of political and economic uncertainty.</p>

<ul> <li><strong>Interest rate adjustments:</strong> The Bank of Canada may raise or lower interest rates to manage inflation and influence the CAD.</li> <li><strong>Inflationary pressures:</strong> Political uncertainty can contribute to increased inflation, requiring intervention from the Bank of Canada.</li> <li><strong>Historical analysis:</strong> Examination of the Bank of Canada's actions during past periods of political uncertainty provides valuable insights.</li> <li><strong>Challenges:</strong> The Bank of Canada faces the challenge of balancing economic growth and price stability in an uncertain political environment.</li> </ul>

<h2>Conclusion</h2>

<p>The potential impact of a minority government on the Canadian dollar is multifaceted. While not a guaranteed weakening of the CAD, the increased political uncertainty, potential for legislative gridlock, and challenges in attracting foreign investment all contribute to a heightened risk environment. This uncertainty can negatively impact investor confidence, potentially leading to fluctuations in the CAD's exchange rate. Understanding these potential implications is crucial for businesses and individuals making financial decisions. Staying informed about the political climate and its potential effects on the Canadian economy is vital for navigating the complexities of a minority government and its influence on the Canadian dollar. Monitor the Canadian political landscape and economic indicators closely to manage your CAD investments effectively.</p>

Featured Posts

-

Nieuw Duurzaam Schoolgebouw Kampen Aansluiting Op Stroomnet Onmogelijk

May 01, 2025

Nieuw Duurzaam Schoolgebouw Kampen Aansluiting Op Stroomnet Onmogelijk

May 01, 2025 -

Rechtszaak Kampen Enexis Gevecht Om Stroomnetaansluiting

May 01, 2025

Rechtszaak Kampen Enexis Gevecht Om Stroomnetaansluiting

May 01, 2025 -

Argamanis Urgent Call For Hostage Release At Time Magazine Event

May 01, 2025

Argamanis Urgent Call For Hostage Release At Time Magazine Event

May 01, 2025 -

Frances Rugby Dominance A Six Nations 2025 Preview

May 01, 2025

Frances Rugby Dominance A Six Nations 2025 Preview

May 01, 2025 -

Alteawn Khtt Mtynt Ltezyz Slslt Alintaj Dd Almnafst Alshbabyt

May 01, 2025

Alteawn Khtt Mtynt Ltezyz Slslt Alintaj Dd Almnafst Alshbabyt

May 01, 2025

Latest Posts

-

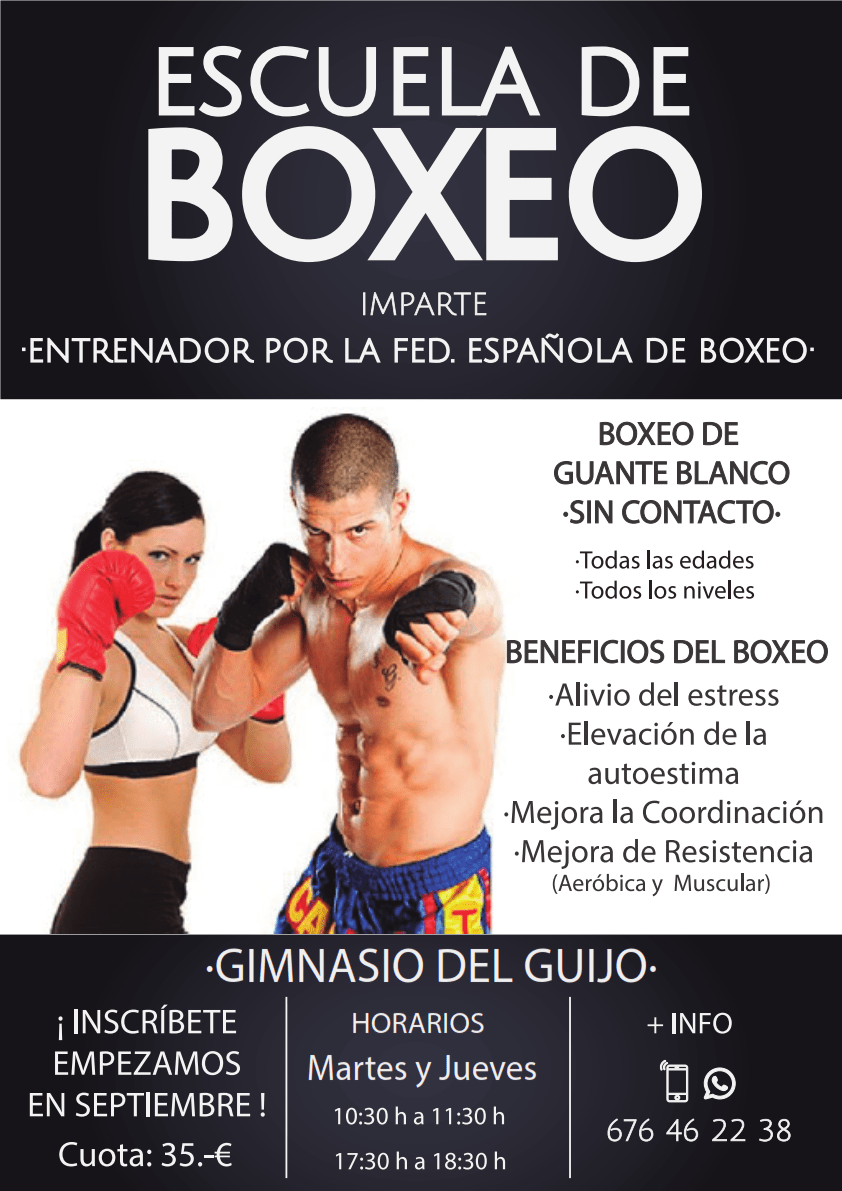

Clases De Boxeo En Edomex Inscripcion Cierra En 3 Dias

May 01, 2025

Clases De Boxeo En Edomex Inscripcion Cierra En 3 Dias

May 01, 2025 -

Ultima Oportunidad Clases De Boxeo En Edomex 3 Dias

May 01, 2025

Ultima Oportunidad Clases De Boxeo En Edomex 3 Dias

May 01, 2025 -

No Te Lo Pierdas Clases De Boxeo En Edomex 3 Dias

May 01, 2025

No Te Lo Pierdas Clases De Boxeo En Edomex 3 Dias

May 01, 2025 -

Reserva Tu Lugar Clases De Boxeo Edomex 3 Dias Restantes

May 01, 2025

Reserva Tu Lugar Clases De Boxeo Edomex 3 Dias Restantes

May 01, 2025 -

Aprovecha 3 Dias Para Clases De Boxeo En Edomex

May 01, 2025

Aprovecha 3 Dias Para Clases De Boxeo En Edomex

May 01, 2025