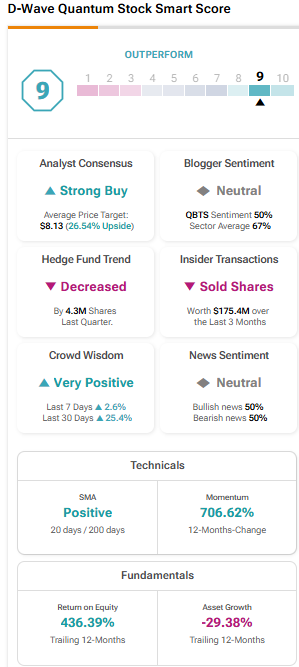

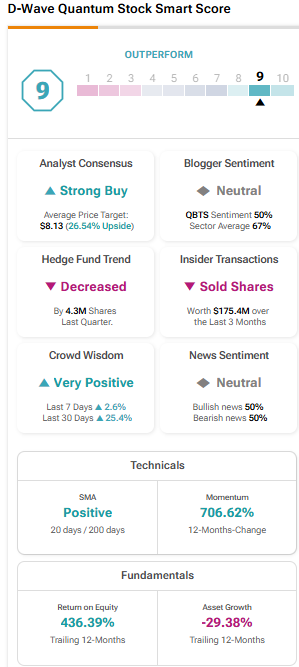

Monday's D-Wave Quantum (QBTS) Stock Dip: A Comprehensive Look

Table of Contents

Potential Causes Behind the D-Wave Quantum (QBTS) Stock Dip

Several factors likely contributed to Monday's D-Wave Quantum (QBTS) stock dip. Analyzing these factors offers insight into the complexities of investing in this emerging technology sector.

Market-Wide Factors

The broader market context is crucial when assessing the QBTS market performance. Monday's downturn wasn't isolated to D-Wave Quantum.

- Negative Market Sentiment: The overall market sentiment on Monday was [Insert description of market sentiment – e.g., negative, cautious, risk-averse]. This general negativity likely impacted even promising tech stocks like QBTS.

- Tech Sector Volatility: The technology sector, known for its volatility, experienced [Insert data on tech sector performance – e.g., a significant drop in the Nasdaq Composite Index]. This broader tech stock volatility undoubtedly influenced QBTS's price.

- Impact of Macroeconomic Factors: [Mention any macroeconomic factors such as interest rate hikes, inflation concerns, or geopolitical events that may have contributed to the overall market downturn and subsequently affected QBTS.]

Company-Specific News

While market-wide factors played a role, it's essential to consider whether any company-specific news triggered the sell-off.

- Absence of Positive News: The lack of significant positive news or announcements from D-Wave Quantum might have contributed to investor hesitancy.

- Analyst Reports: [Mention any recent analyst reports or ratings changes for D-Wave Quantum. Were there any downgrades or negative assessments that could have influenced investor behavior?]

- Financial Reporting Expectations: [Discuss if there were any anticipated financial reports or earnings announcements looming, which might have created uncertainty among investors leading to the dip.]

Investor Sentiment and Speculation

Investor psychology and speculation often significantly impact stock prices.

- Social Media Sentiment: An analysis of social media sentiment surrounding D-Wave Quantum on Monday could reveal whether negative narratives or rumors played a role in the stock dip. [Mention specific examples if available, while respecting responsible reporting].

- Short Selling Activity: Increased short selling activity could indicate a negative outlook on QBTS's short-term prospects and contribute to downward pressure on the stock price.

- Speculative Trading: The nature of the quantum computing market attracts speculative investors. Sudden shifts in speculative trading could amplify the impact of other factors.

Analyzing the Impact of the D-Wave Quantum (QBTS) Stock Dip

Understanding the implications of Monday's D-Wave Quantum (QBTS) stock dip is crucial for both short-term and long-term perspectives.

Short-Term Implications

The immediate impact of the dip was substantial for many investors.

- Percentage Change: The stock experienced a [Insert percentage] drop on Monday.

- Investor Portfolio Impact: Investors holding QBTS in their portfolio experienced a corresponding decrease in their overall portfolio value.

- Trading Opportunities: For some, the dip might have presented a buying opportunity, depending on their risk tolerance and long-term outlook on D-Wave Quantum's prospects.

Long-Term Implications

The long-term implications for D-Wave Quantum and the quantum computing sector are less clear but warrant careful consideration.

- Company Financial Health: The short-term stock price fluctuation might not significantly impact D-Wave Quantum's long-term financial health, especially if the company has sufficient cash reserves.

- Future Prospects: The dip doesn't necessarily reflect the long-term potential of D-Wave Quantum's technology. The company's ongoing research and development efforts will remain crucial.

- Quantum Computing Industry Impact: The overall impact on the quantum computing industry is likely minimal, as one company's stock fluctuation doesn't define the industry's trajectory.

Understanding D-Wave Quantum (QBTS) and its Position in the Market

A clearer understanding of D-Wave Quantum and its market position is vital for assessing the stock dip's significance.

Company Overview

D-Wave Quantum is a leading player in the quantum computing industry, focusing on [Explain their specific approach, e.g., quantum annealing].

- Technology: Their primary technology is [Explain the technology in detail, using keywords such as quantum annealing, adiabatic quantum computation].

- Target Market: D-Wave targets various industries, including [List the target market segments, such as optimization, machine learning, drug discovery].

- Market Position: D-Wave occupies a [Describe their position as a leader, niche player, or emerging competitor] position in the quantum computing market.

Competitive Landscape

D-Wave Quantum faces competition from various other companies in the quantum computing field.

- Key Competitors: Major competitors include [List key competitors such as IBM, Google, Rigetti].

- Competitive Advantages: D-Wave’s competitive advantage lies in [Highlight their unique strengths, such as its existing commercial quantum computers].

- Future Competition: The quantum computing field is rapidly evolving, so competition is likely to intensify in the coming years.

Conclusion

Monday's D-Wave Quantum (QBTS) stock dip was a complex event influenced by both market-wide factors and company-specific considerations. While the broader market downturn played a role, the absence of positive company news and the ever-present influence of investor sentiment and speculation likely contributed significantly. Understanding the nuances of the D-Wave Quantum (QBTS) stock dip is crucial for informed investment decisions in this rapidly evolving sector. The long-term prospects of D-Wave Quantum remain tied to its technological advancements and the overall growth of the quantum computing industry. Stay tuned for further updates and analysis on the future trajectory of D-Wave Quantum (QBTS) stock, and monitor the QBTS stock price closely. Careful analysis of D-Wave Quantum stock and the quantum computing market is essential for navigating the inherent volatility.

Featured Posts

-

Hmrc Savings Debt A Guide For Thousands Of Unknowing Taxpayers

May 20, 2025

Hmrc Savings Debt A Guide For Thousands Of Unknowing Taxpayers

May 20, 2025 -

Former Navy Number Two Convicted A Landmark Corruption Case

May 20, 2025

Former Navy Number Two Convicted A Landmark Corruption Case

May 20, 2025 -

Understanding The Significance Of Ftv Lives A Hell Of A Run

May 20, 2025

Understanding The Significance Of Ftv Lives A Hell Of A Run

May 20, 2025 -

Leclercs Outburst Understanding His Feelings Towards Hamilton After Ferraris Team Orders Controversy

May 20, 2025

Leclercs Outburst Understanding His Feelings Towards Hamilton After Ferraris Team Orders Controversy

May 20, 2025 -

Solve The Nyt Mini Crossword March 13 2025 Answers And Clues

May 20, 2025

Solve The Nyt Mini Crossword March 13 2025 Answers And Clues

May 20, 2025

Latest Posts

-

Aew Star Rey Fenix Debuts On Wwe Smack Down Next Week Name Change Announced

May 20, 2025

Aew Star Rey Fenix Debuts On Wwe Smack Down Next Week Name Change Announced

May 20, 2025 -

Tyler Bate Returns To Wwe Raw A Look At His Journey

May 20, 2025

Tyler Bate Returns To Wwe Raw A Look At His Journey

May 20, 2025 -

Rey Fenix Officially Joins Wwe Smack Down New Ring Name Revealed

May 20, 2025

Rey Fenix Officially Joins Wwe Smack Down New Ring Name Revealed

May 20, 2025 -

Wwe Raw Tyler Bates Highly Anticipated Return

May 20, 2025

Wwe Raw Tyler Bates Highly Anticipated Return

May 20, 2025 -

Rey Fenixs Wwe Smack Down Debut Ring Name And Next Weeks Appearance Confirmed

May 20, 2025

Rey Fenixs Wwe Smack Down Debut Ring Name And Next Weeks Appearance Confirmed

May 20, 2025