Monday's Market Sell-Off: Why D-Wave Quantum (QBTS) Shares Took A Hit

Table of Contents

The Broader Market Context: A Day of Red for Tech Stocks

Monday's market downturn wasn't isolated to D-Wave Quantum (QBTS). A general air of negativity swept across the financial landscape, impacting major market indices. The Dow Jones Industrial Average and the Nasdaq Composite both experienced significant declines, reflecting a broader trend of investor apprehension. This negative sentiment was particularly pronounced within the technology sector, a segment often considered more susceptible to shifts in investor confidence. Several news reports pointed to increasing concerns about inflation and rising interest rates as key drivers of this widespread sell-off. The tech sector, often valued based on future growth projections, is particularly vulnerable during periods of economic uncertainty.

- Decline in major tech indices: The Nasdaq, a bellwether for technology stocks, suffered a substantial drop, indicating widespread negative sentiment across the sector.

- Increased investor risk aversion: With economic headwinds intensifying, investors favored safer, more conservative investments, leading to a sell-off in riskier assets like many tech stocks.

- Impact of macroeconomic factors: Rising inflation and interest rate hikes contributed to a less optimistic outlook, impacting investor confidence in growth-oriented companies.

- Specific tech stocks also experienced drops: Companies similar to D-Wave Quantum (QBTS) in terms of growth stage and sector experienced comparable declines, underscoring the sector-wide nature of the downturn.

D-Wave Quantum (QBTS) Specific Factors Contributing to the Sell-Off

While the broader market downturn certainly played a role, several factors specific to D-Wave Quantum (QBTS) likely exacerbated its share price decline. The absence of recent positive news or major partnership announcements might have contributed to investor anxiety. Any perceived slowdown in progress or unmet expectations could easily amplify negative sentiment. While the company's financial reports would need to be examined thoroughly, concerns about future growth, especially relative to its competitors, may have also weighed heavily on investor decisions.

- Lack of recent positive announcements or partnerships: The absence of significant catalysts, such as strategic collaborations or technological breakthroughs, might have fueled investor uncertainty.

- Potential investor concerns regarding future growth: Investors are keenly focused on the long-term potential of quantum computing companies. Any doubt about future revenue streams and scalability could negatively influence investor confidence.

- Analysis of QBTS financial reports (if applicable): A careful review of D-Wave Quantum's financial performance would help identify any underlying weaknesses that contributed to the sell-off. Metrics like revenue growth, operating expenses, and cash flow will be crucial in understanding the current financial health of the company.

- Comparison to competitor performance in the quantum computing space: The performance of rival companies in the quantum computing sector is a significant factor influencing investor sentiment. A comparatively weaker performance by D-Wave Quantum (QBTS) might explain the more pronounced decline in its share price.

Investor Sentiment and Trading Activity Surrounding QBTS

Monday's trading volume for D-Wave Quantum (QBTS) likely reflected the heightened investor activity surrounding the sell-off. Analyzing price charts and applying technical indicators would provide a clearer picture of the price fluctuations. Social media sentiment and news coverage played a significant role, potentially contributing to the amplified decline. Any negative news or commentary might have further fueled the sell-off.

- High trading volume indicating significant investor activity: A high trading volume suggests a significant number of investors were either selling their shares or reacting to the market downturn.

- Analysis of price charts and technical indicators: Technical analysis tools can reveal patterns in the price movements and provide clues about the forces behind the price drop.

- Social media analysis – positive/negative sentiment towards QBTS: Monitoring social media platforms for comments and discussions related to D-Wave Quantum (QBTS) can provide valuable insights into investor sentiment.

- News articles and analyst reports impacting investor confidence: News reports and analyst commentary on D-Wave Quantum (QBTS) can significantly influence investor perceptions and contribute to price fluctuations.

Long-Term Outlook for D-Wave Quantum (QBTS)

Despite the short-term setback, the long-term potential of D-Wave Quantum (QBTS) and the quantum computing industry remains significant. While challenges persist, the potential for technological breakthroughs and market expansion in this innovative sector provides opportunities for recovery and growth. The company's ability to overcome current obstacles and capitalize on emerging market opportunities will ultimately determine its future success.

- Potential for future technological advancements: Ongoing advancements in quantum computing technology could significantly boost D-Wave Quantum's prospects.

- Expected market growth in the quantum computing sector: The quantum computing market is projected to expand substantially in the coming years, offering opportunities for significant growth for companies like QBTS.

- Opportunities for QBTS to regain market share: Strategic partnerships, technological breakthroughs, and effective marketing could help D-Wave Quantum regain its market position and investor confidence.

- Risks and challenges facing the company: D-Wave Quantum faces significant challenges, including competition, technological hurdles, and the need for further capital investment.

Conclusion:

The decline in D-Wave Quantum (QBTS) share price on Monday resulted from a confluence of factors, including the broader market downturn affecting technology stocks, and specific concerns related to the company's performance and prospects. While the short-term outlook might appear challenging, it's crucial to consider the long-term potential of the quantum computing sector. Understanding the factors that influence the price of D-Wave Quantum (QBTS) is crucial for informed investment decisions. Stay informed about the developments in D-Wave Quantum (QBTS) and the quantum computing market. Continue to monitor news and financial reports for a comprehensive understanding of future performance. Careful analysis of D-Wave Quantum (QBTS) and the broader quantum computing landscape is essential for navigating the complexities of this exciting, yet volatile, market.

Featured Posts

-

Benjamin Kaellman Potentiaalia Huuhkajien Hyoekkaeykseen

May 20, 2025

Benjamin Kaellman Potentiaalia Huuhkajien Hyoekkaeykseen

May 20, 2025 -

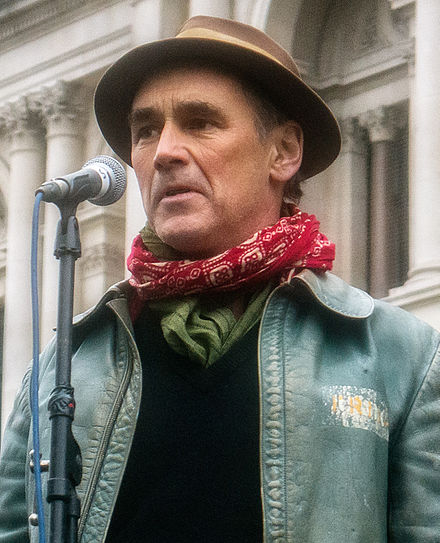

Music Festivals Turn London Parks Into Prison Camps Says Mark Rylance

May 20, 2025

Music Festivals Turn London Parks Into Prison Camps Says Mark Rylance

May 20, 2025 -

Joint Us Australia Missile Test Sparks Chinese Ire

May 20, 2025

Joint Us Australia Missile Test Sparks Chinese Ire

May 20, 2025 -

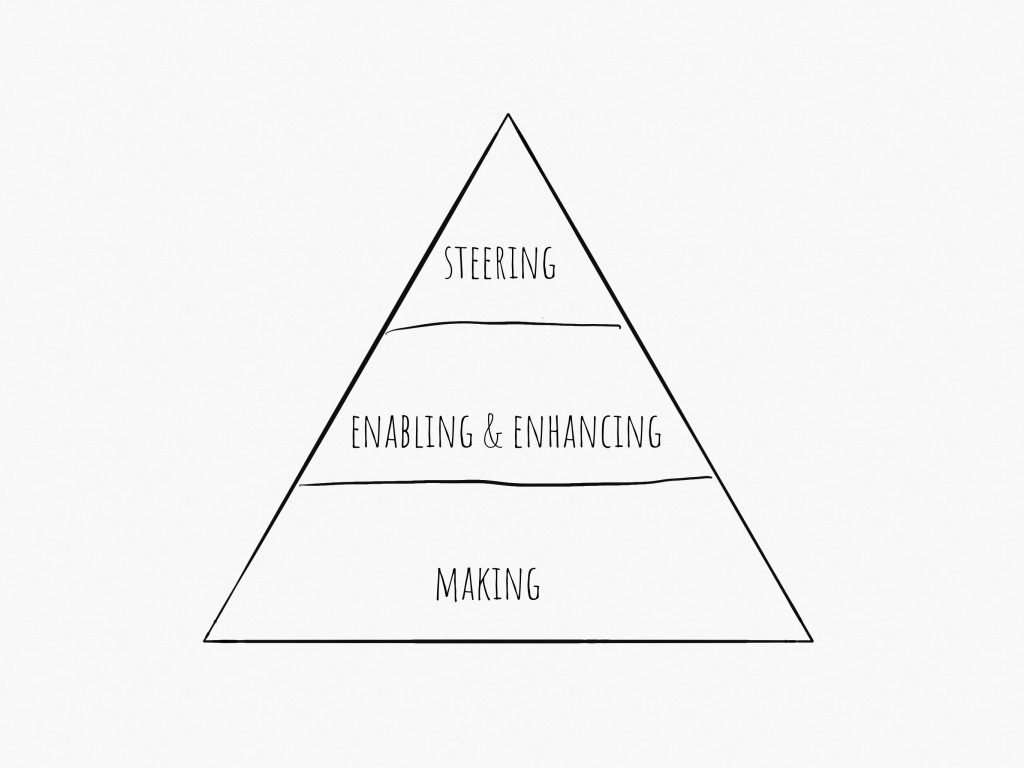

Rethinking Middle Management Their Contribution To Company Growth And Employee Satisfaction

May 20, 2025

Rethinking Middle Management Their Contribution To Company Growth And Employee Satisfaction

May 20, 2025 -

Haekkinen On Schumacher F1 Comeback Still Possible

May 20, 2025

Haekkinen On Schumacher F1 Comeback Still Possible

May 20, 2025

Latest Posts

-

Dimotiko Odeio Rodoy Synaylia Kathigiton Stin Dimokratiki

May 20, 2025

Dimotiko Odeio Rodoy Synaylia Kathigiton Stin Dimokratiki

May 20, 2025 -

Synaylia Kathigiton Dimotiko Odeio Rodoy Stin Dimokratiki

May 20, 2025

Synaylia Kathigiton Dimotiko Odeio Rodoy Stin Dimokratiki

May 20, 2025 -

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Mia Moysiki Bradia Stin Dimokratiki

May 20, 2025

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Mia Moysiki Bradia Stin Dimokratiki

May 20, 2025 -

Endiaferon Los Antzeles Gia Ton Giakoymaki

May 20, 2025

Endiaferon Los Antzeles Gia Ton Giakoymaki

May 20, 2025 -

Efimereyontes Giatroi Patra 10 Kai 11 Maioy Eyresi And Plirofories

May 20, 2025

Efimereyontes Giatroi Patra 10 Kai 11 Maioy Eyresi And Plirofories

May 20, 2025