Money Laundering Lapses: Paytm Payments Bank Faces ₹5.45 Crore Penalty From FIU-IND

Table of Contents

Details of the Money Laundering Lapses Identified by FIU-IND

The FIU-IND's penalty stems from a series of money laundering lapses uncovered during an investigation into Paytm Payments Bank's operations. While the exact details of the investigation remain partially undisclosed, reports suggest several critical failures in the bank's compliance framework. These failures, directly contributing to the penalty, appear to encompass both Know Your Customer (KYC) and AML compliance shortcomings.

The FIU-IND's findings, although not fully public, reportedly include:

- Insufficient KYC checks: Allegations point towards inadequate verification of customer identities, leaving loopholes for potentially illicit activities. This includes insufficient due diligence on high-risk customers and a failure to properly update customer information.

- Failure to report suspicious transactions promptly: A key component of AML compliance is the timely reporting of suspicious transactions. Reports indicate delays or omissions in reporting potentially suspicious activities to the relevant authorities, allowing suspicious transactions to potentially proceed unchecked.

- Weaknesses in the bank's anti-money laundering (AML) system: The overall AML system within Paytm Payments Bank appears to have been deficient, lacking the necessary robustness to detect and prevent money laundering activities effectively. This might include inadequate internal controls, insufficient staff training, or a lack of updated technology to detect suspicious patterns.

- Inadequate transaction monitoring: Failure to effectively monitor transactions for potentially suspicious patterns and activities. This could include large cash deposits, unusual transaction volumes, or transactions linked to known high-risk individuals or entities.

The ₹5.45 Crore Penalty: Implications and Responses

The ₹5.45 crore penalty represents a substantial financial blow to Paytm Payments Bank, though its impact on the bank’s overall financial health might be relatively limited. However, the reputational damage is arguably more significant. Investor confidence could be shaken, leading to potential challenges in securing future funding and expansion.

Paytm Payments Bank's official response to the penalty has not been fully detailed publicly. While an official statement acknowledging the penalty and expressing a commitment to enhanced compliance is anticipated, the specifics of the planned corrective actions remain to be seen. Beyond the financial penalty, the incident could expose the bank to further legal ramifications, including investigations by other regulatory bodies. This could potentially lead to more stringent penalties or operational restrictions.

Comparative Analysis with Other Financial Institutions

While the ₹5.45 crore penalty is substantial, it's crucial to compare it with penalties levied on other financial institutions in India for similar money laundering lapses. Some cases have involved significantly larger penalties, reflecting the severity of the violations. This comparative analysis provides crucial context, highlighting the need for consistent and robust AML compliance across the entire financial sector. Comparing the specifics of the violations and resulting penalties can highlight similarities and differences in approaches to enforcement and regulatory oversight.

Implications for the Fintech Sector and Regulatory Scrutiny

This case underscores the increasing regulatory scrutiny faced by the Indian fintech sector. The incident serves as a stark reminder of the critical importance of adhering to stringent KYC and AML norms. The consequences of failing to do so can be severe, impacting not only individual companies but also investor confidence and the overall growth of the sector.

The penalty imposed on Paytm Payments Bank might trigger stricter regulations and enhanced compliance requirements for fintech companies across India. This could involve increased monitoring, more frequent audits, and potentially harsher penalties for non-compliance. The incident could also lead to a reassessment of risk management strategies within the fintech industry, fostering a more proactive approach to preventing future money laundering lapses.

Conclusion: Preventing Future Money Laundering Lapses in the Fintech Industry

The ₹5.45 crore penalty imposed on Paytm Payments Bank for money laundering lapses highlights the critical need for robust KYC/AML compliance measures within the Indian fintech sector. The incident underscores the crucial role of regulatory bodies like the FIU-IND in maintaining financial integrity and preventing illicit activities. Preventing future instances of money laundering lapses requires proactive measures from all stakeholders, including financial institutions, regulatory bodies, and technology providers. Strengthening AML frameworks, enhancing employee training, and investing in advanced technologies for transaction monitoring are crucial steps to mitigate risks and ensure the long-term sustainability and credibility of the fintech industry. Learn more about AML compliance and best practices today!

Featured Posts

-

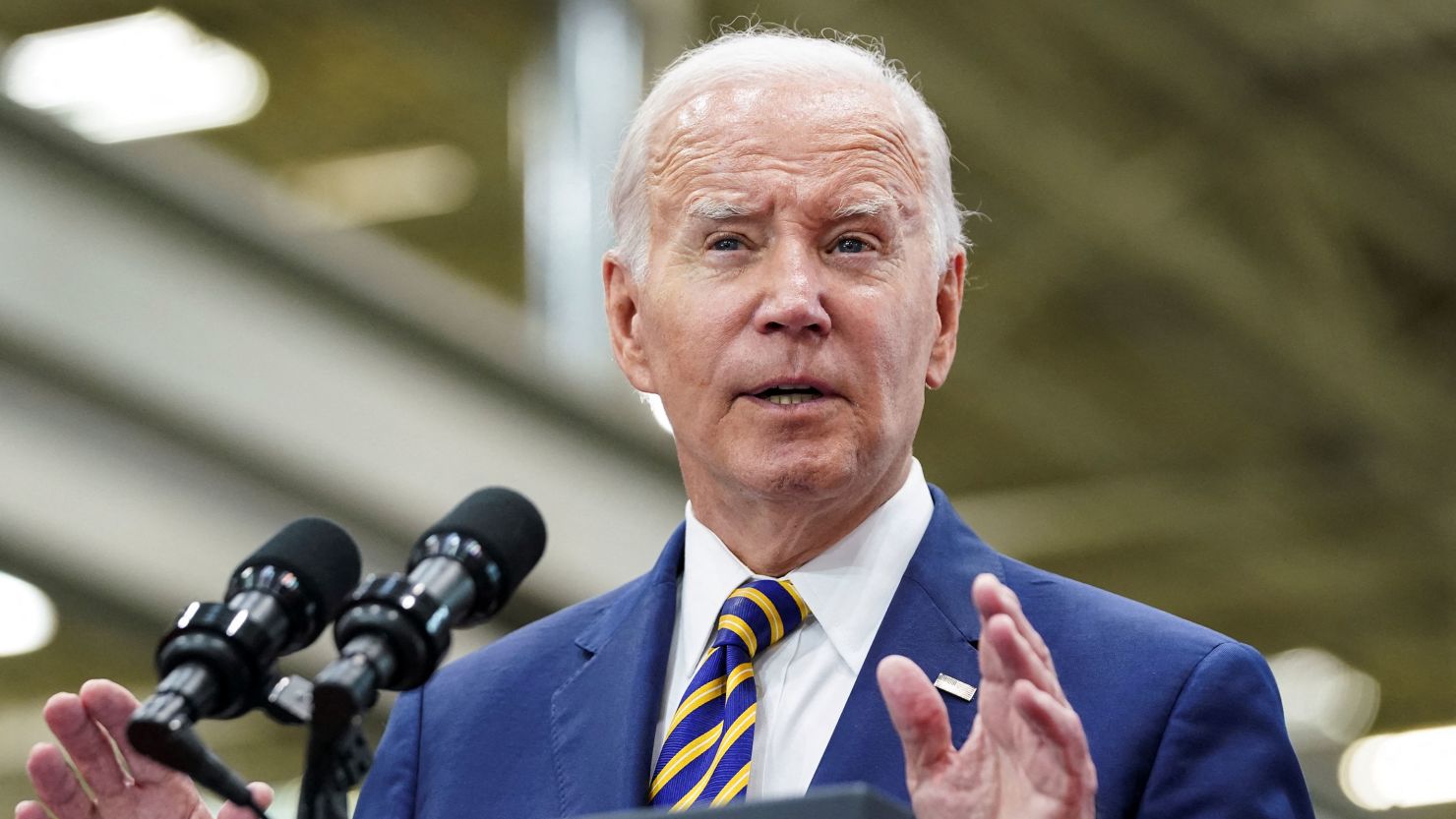

Joe Bidens Denials A Fact Check Of Recent Claims

May 15, 2025

Joe Bidens Denials A Fact Check Of Recent Claims

May 15, 2025 -

Tonights Nhl Playoffs Senators Vs Maple Leafs Game 2 Predictions And Betting Analysis

May 15, 2025

Tonights Nhl Playoffs Senators Vs Maple Leafs Game 2 Predictions And Betting Analysis

May 15, 2025 -

Malapitan Leads In Caloocan Mayoral Race Against Trillanes

May 15, 2025

Malapitan Leads In Caloocan Mayoral Race Against Trillanes

May 15, 2025 -

De Leeflang Kwestie Een Gesprek Tussen Hamer Bruins En De Npo Toezichthouder

May 15, 2025

De Leeflang Kwestie Een Gesprek Tussen Hamer Bruins En De Npo Toezichthouder

May 15, 2025 -

Jalen Brunson And The Knicks Injury Update And Playoff Implications

May 15, 2025

Jalen Brunson And The Knicks Injury Update And Playoff Implications

May 15, 2025