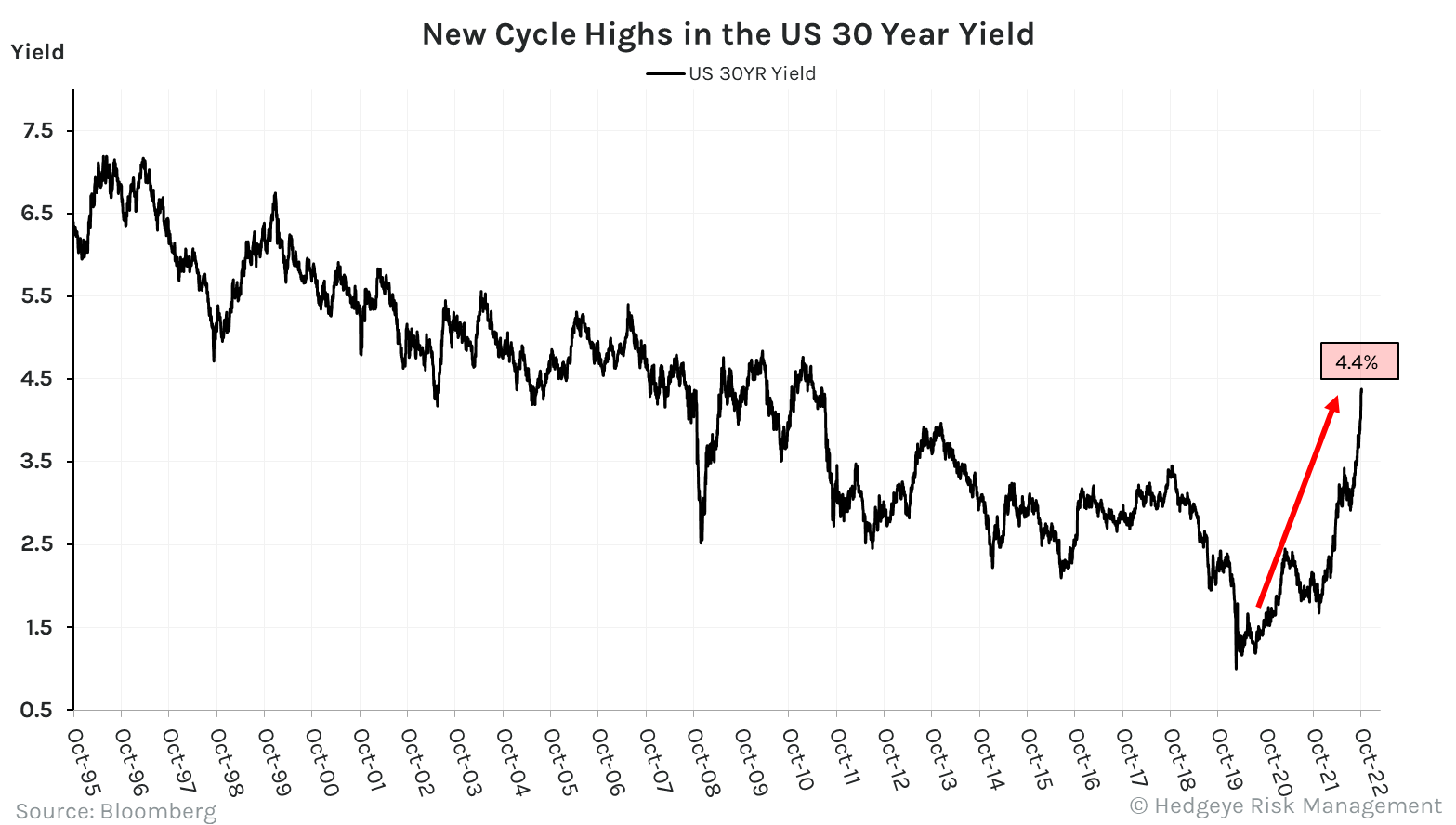

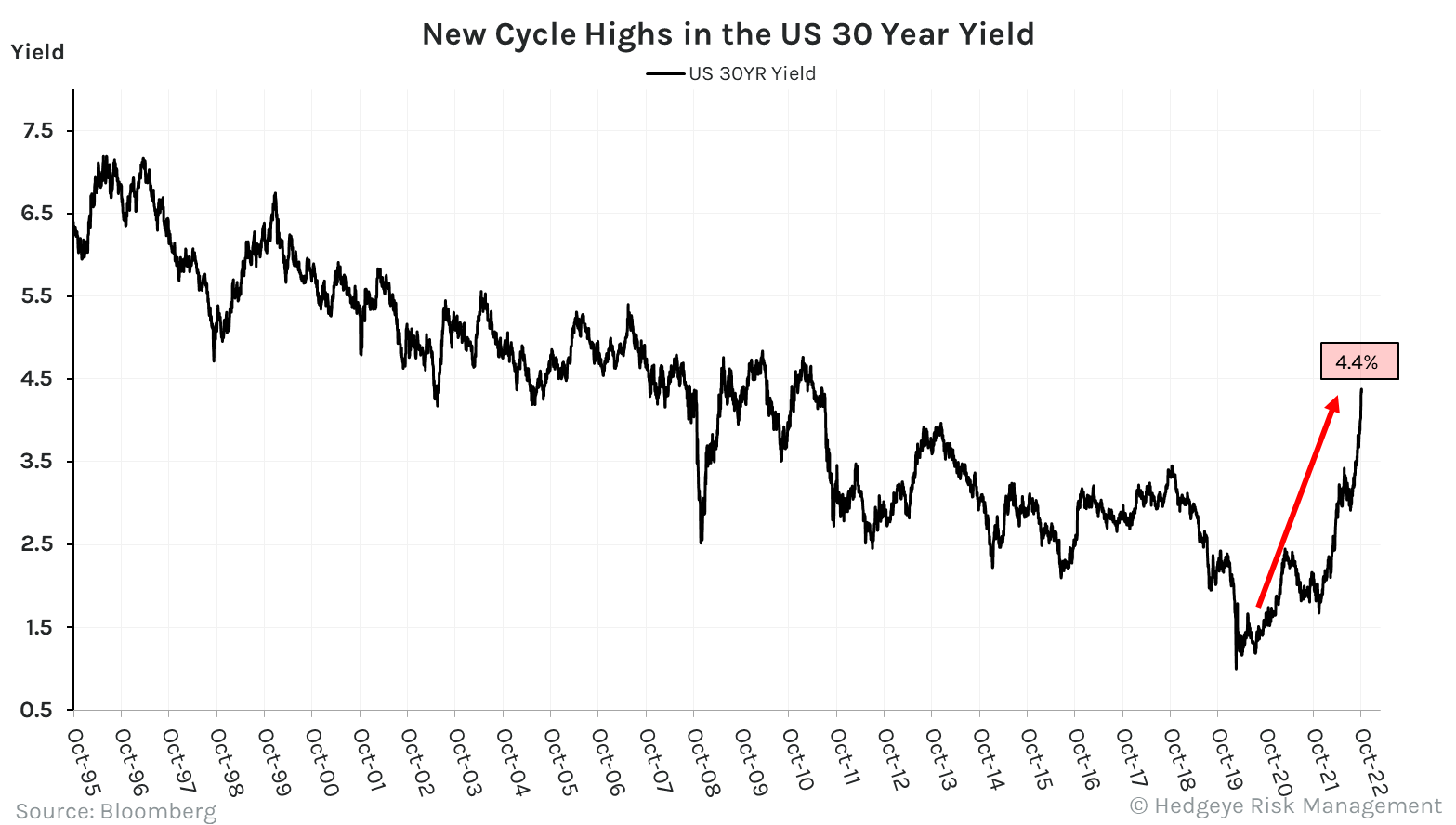

Moody's 30-Year Yield At 5%: Is The 'Sell America' Trade Back?

Table of Contents

Understanding the 5% 30-Year Treasury Yield

The 30-year Treasury yield is a crucial benchmark reflecting investor sentiment towards the long-term stability of the US economy. This yield represents the return an investor receives for lending money to the US government for three decades. A 5% yield is significant, particularly in the context of recent years of historically low interest rates. Several factors contribute to this rise:

- Inflation: Persistent inflation erodes the purchasing power of future returns, pushing investors to demand higher yields to compensate for the risk. High inflation directly impacts the real return on bonds.

- Federal Reserve Policy: The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, directly impact bond yields. Higher interest rates make existing bonds less attractive, driving down their prices and pushing yields upward. The Fed's actions significantly influence bond market dynamics.

- Global Economic Uncertainty: Geopolitical instability and global economic slowdowns can lead investors to seek the perceived safety of US Treasuries, increasing demand and potentially pushing yields higher. However, conversely, uncertainty can also drive investors away from the US market entirely.

Bullet Points:

- Impact on Mortgage Rates and Housing Market: Higher 30-year Treasury yields translate to higher mortgage rates, potentially cooling down the housing market.

- Effect on Corporate Borrowing Costs: Increased bond yields lead to higher borrowing costs for corporations, impacting investment and economic growth. This can stifle business expansion and hiring.

- Attractiveness to Foreign Investors: While higher yields can attract foreign investors seeking higher returns, the strength of the US dollar and the overall global economic climate will play a crucial role in this dynamic.

The 'Sell America' Trade: A Recap

The "Sell America" trade refers to a scenario where investors actively divest from US assets, moving capital to other markets they perceive as offering better returns or reduced risk. This can involve selling US stocks, bonds, and other investments.

Historically, "Sell America" periods have been triggered by various factors, including:

- Loss of Confidence: Political instability, policy uncertainty, or perceived economic weakness can erode investor confidence, leading to capital flight.

- Relative Returns: If returns in other markets are significantly higher than those in the US, investors may shift their investments accordingly. This can be influenced by factors like currency fluctuations and interest rate differentials.

Bullet Points:

- Historical Examples: The 1970s oil crisis, the 2008 financial crisis, and certain periods of high inflation have all witnessed instances of capital outflow from the US.

- Motivations: Higher potential returns in emerging markets, concerns about US debt levels, and geopolitical risks all contribute to the "Sell America" narrative.

- Economic Implications: A sustained "Sell America" trade can weaken the US dollar, increase borrowing costs, and potentially slow economic growth.

Connecting the Dots: Yield Rise and 'Sell America' Trade

The current 5% 30-year Treasury yield raises the question: is this solely a reflection of domestic factors, or does it indicate a resurgence of the "Sell America" sentiment? While the factors discussed above (inflation, Fed policy) are significant, analyzing capital flows is crucial.

Bullet Points:

- Analysis of Current Capital Flows: Examining the net flow of capital into and out of the US provides critical insights. Data from the US Treasury and other financial institutions is essential for this analysis.

- Comparison with Yields in Other Major Economies: Comparing US yields with those in other major economies like Germany, Japan, and the UK helps determine if the increase is unique to the US or part of a broader global trend.

- Expert Opinions: Consulting economic forecasts and analyses from reputable sources like the IMF, World Bank, and leading financial institutions offers valuable context and perspectives.

Potential Implications and Future Outlook

A sustained "Sell America" trade could have serious consequences:

Bullet Points:

- Impact on the US Dollar: Significant capital outflow could weaken the US dollar, impacting international trade and potentially fueling inflation further.

- Potential for Further Interest Rate Hikes: If the Fed interprets the yield rise as a sign of persistent inflation, it may continue to increase interest rates, potentially slowing economic growth.

- Long-Term Economic Growth Projections: Sustained capital flight could hinder long-term economic growth, impacting job creation and overall prosperity.

Conclusion: Moody's 30-Year Yield and the Future of the 'Sell America' Trade

The 5% Moody's 30-year yield is a significant development demanding close monitoring. While the rise can be partly attributed to domestic factors like inflation and Federal Reserve policy, the possibility of a renewed "Sell America" trade cannot be ignored. Further analysis of capital flows and global economic conditions is crucial to determine the extent to which this yield reflects a broader shift in investor sentiment. Staying informed about updates on Moody's 30-year yield and related economic indicators is crucial. We encourage further research into the complex interplay between global economic forces and the "Sell America" trade to gain a better understanding of the potential consequences for the US economy. [Link to relevant resources]

Featured Posts

-

Sostoyanie Zdorovya Shumakhera Drug Raskryl Pechalnuyu Pravdu

May 20, 2025

Sostoyanie Zdorovya Shumakhera Drug Raskryl Pechalnuyu Pravdu

May 20, 2025 -

The Reasons Behind D Wave Quantum Qbts Stocks Monday Drop

May 20, 2025

The Reasons Behind D Wave Quantum Qbts Stocks Monday Drop

May 20, 2025 -

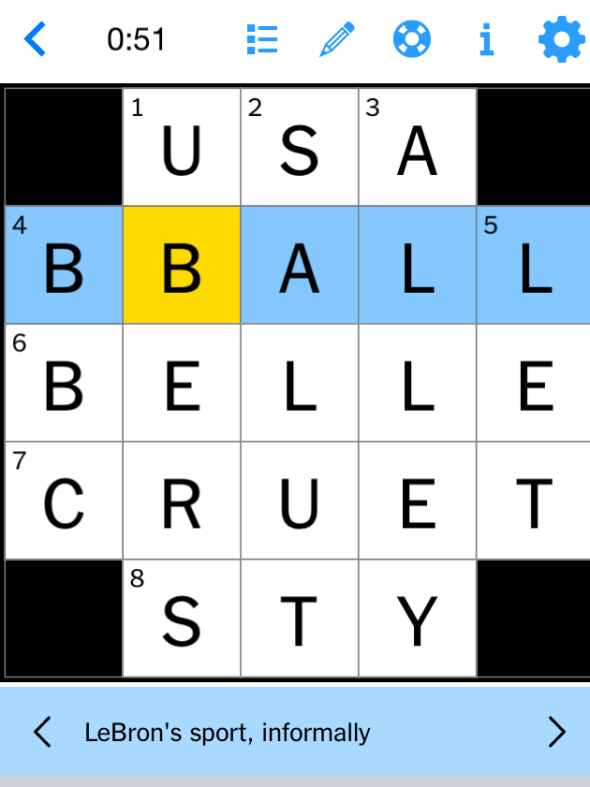

Nyt Mini Crossword Puzzle Answers For May 9th

May 20, 2025

Nyt Mini Crossword Puzzle Answers For May 9th

May 20, 2025 -

Engineers Union And Nj Transit Reach Tentative Agreement Preventing Strike

May 20, 2025

Engineers Union And Nj Transit Reach Tentative Agreement Preventing Strike

May 20, 2025 -

Hmrc Child Benefit Warning Urgent Messages You Shouldnt Ignore

May 20, 2025

Hmrc Child Benefit Warning Urgent Messages You Shouldnt Ignore

May 20, 2025

Latest Posts

-

Efimereyontes Giatroi Patra 10 Kai 11 Maioy Eyresi And Plirofories

May 20, 2025

Efimereyontes Giatroi Patra 10 Kai 11 Maioy Eyresi And Plirofories

May 20, 2025 -

I Los Antzeles Stoxeyei Ton Giakoymaki

May 20, 2025

I Los Antzeles Stoxeyei Ton Giakoymaki

May 20, 2025 -

Prokrisi Ston Teliko Champions League I Poreia Tis Kroyz Azoyl Me Ton Giakoymaki

May 20, 2025

Prokrisi Ston Teliko Champions League I Poreia Tis Kroyz Azoyl Me Ton Giakoymaki

May 20, 2025 -

Efimeries Giatron Patras 10 11 5 Pliris Lista

May 20, 2025

Efimeries Giatron Patras 10 11 5 Pliris Lista

May 20, 2025 -

Giakoymakis I Los Antzeles Kanei Kroysi

May 20, 2025

Giakoymakis I Los Antzeles Kanei Kroysi

May 20, 2025