Navan's US IPO: Exclusive Details On Banking Partners

Table of Contents

The Lead Underwriters: A Deep Dive into Navan's Chosen Banks

The success of any IPO hinges significantly on the selection of lead underwriters. These institutions play a pivotal role in managing the offering, marketing it to investors, and ensuring a smooth process. For Navan's US IPO, the lead underwriters will be instrumental in achieving a successful market debut. While specific names are often kept confidential until the official announcement, we can analyze the criteria Navan likely used in their selection process to anticipate potential partners.

- Bank Name (Placeholder): A leading global investment bank known for its expertise in technology IPOs. This bank likely boasts a strong track record in bringing technology companies to market, including experience in Software-as-a-Service (SaaS) offerings.

- Relevant Experience: Successful IPOs of comparable SaaS companies, demonstrating a deep understanding of the technology sector's valuation dynamics.

- Market Capitalization and Reputation: A large market cap suggests greater resources and a broader investor network. A strong reputation for execution and client satisfaction is essential.

- Specific Expertise: Demonstrated success with companies providing business travel and expense management solutions or in adjacent industries.

- Bank Name (Placeholder): A well-established investment bank with a strong presence in the US market. Their experience will be crucial for navigating the complexities of the US regulatory environment.

- Relevant Experience: A history of successful IPOs in the travel or financial technology sectors would be highly beneficial.

- Market Capitalization and Reputation: Similar to the first bank, a substantial market capitalization and an impeccable reputation for integrity and execution will be vital.

- Specific Expertise: Proven ability to manage large-scale IPOs and attract high-quality investors would be attractive for Navan.

Supporting Banks and Their Crucial Roles

Beyond the lead underwriters, several supporting banks contribute significantly to the success of an IPO. These banks typically play roles such as co-managers, bookrunners, and syndicate members, each contributing specialized expertise.

- List of Supporting Banks (Placeholder): We anticipate several well-regarded investment banks with expertise in the technology and/or financial services sectors to participate as supporting banks. These firms will aid in marketing the offering to a wide range of investors.

- Specific Roles and Responsibilities:

- Co-managers: Assist the lead underwriters in marketing and distribution of the offering.

- Bookrunners: Maintain the order book, ensuring efficient allocation of shares among investors.

- Syndicate Members: Contribute to the underwriting syndicate, helping manage risk and share the responsibility of the offering.

- Strengthening the IPO: The involvement of multiple reputable banks strengthens the credibility of the IPO, increasing investor confidence and potentially leading to a higher valuation.

The Strategic Rationale Behind Navan's Bank Selection

Navan's choice of banking partners is not arbitrary; it's a carefully considered strategic decision. The selection criteria likely prioritize several key factors:

- Market Presence and Reach: Banks with a substantial global presence provide access to a wider pool of potential investors.

- Access to Investor Networks: Connections with institutional investors, high-net-worth individuals, and other key players are vital for securing sufficient demand for the offering.

- Expertise in Navigating a US IPO: Understanding the regulatory landscape and the complexities of the US IPO process is crucial for a smooth and successful launch.

- Potential Long-Term Relationships: Establishing strong relationships with the banking partners beyond the IPO could be beneficial for Navan's future financial needs and growth strategies.

Implications for Investors and the Market

Navan's US IPO will have significant implications for investors and the broader travel and expense management market:

- Expected Valuation Range: Market analysts will have a wide range of predictions, and the final valuation will depend on numerous factors.

- Potential Market Share Gains: A successful IPO can provide Navan with the resources to expand its market share and accelerate its growth strategy.

- Influence on Competitors: The IPO will undoubtedly create a ripple effect throughout the competitive landscape, influencing competitors' strategies and potentially triggering a wave of consolidation.

- Overall Market Outlook: The success of Navan's IPO can provide a boost to investor confidence in the travel and expense management sector, attracting more investment and innovation.

Navan's US IPO: A Strategic Partnership for Success

Navan's US IPO represents a significant milestone, and the selection of its banking partners is a testament to its strategic vision. The lead underwriters, along with the supporting banks, bring a wealth of expertise and resources to the table, bolstering the IPO's prospects. The strategic partnerships chosen will undoubtedly influence the company's valuation, future growth trajectory, and the dynamics of the entire travel and expense management industry. Learn more about Navan's IPO and follow the progress of its banking partners to stay informed about this key development in the travel tech space.

Featured Posts

-

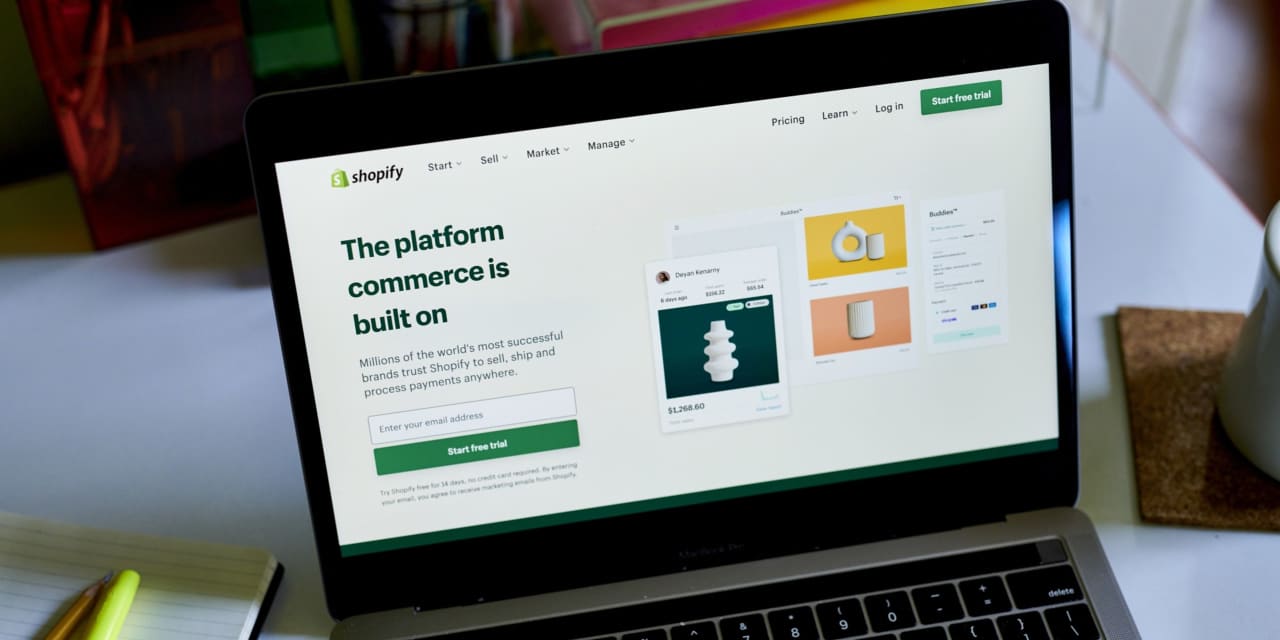

Nasdaq 100 Inclusion Sends Shopify Stock Up 14

May 14, 2025

Nasdaq 100 Inclusion Sends Shopify Stock Up 14

May 14, 2025 -

Rodzer Federer I Mirka Detaljan Pogled Na Njihove Cetiri Decice

May 14, 2025

Rodzer Federer I Mirka Detaljan Pogled Na Njihove Cetiri Decice

May 14, 2025 -

Concerned About Banned Candles Check Etsy Walmart And Amazon In Canada

May 14, 2025

Concerned About Banned Candles Check Etsy Walmart And Amazon In Canada

May 14, 2025 -

The Aaron Judge Intentional Walk Dilemma A Data Driven Approach

May 14, 2025

The Aaron Judge Intentional Walk Dilemma A Data Driven Approach

May 14, 2025 -

Que Visitar En Sevilla Este Miercoles 7 De Mayo De 2025

May 14, 2025

Que Visitar En Sevilla Este Miercoles 7 De Mayo De 2025

May 14, 2025

Latest Posts

-

Is Maya Jama Getting Serious With Ruben Dias A Look At Their Romance

May 14, 2025

Is Maya Jama Getting Serious With Ruben Dias A Look At Their Romance

May 14, 2025 -

Untold Family Stories The Judd Sisters New Docuseries

May 14, 2025

Untold Family Stories The Judd Sisters New Docuseries

May 14, 2025 -

Gold Plunge Dress Maya Jamas Breathtaking Grecian Inspired Ensemble

May 14, 2025

Gold Plunge Dress Maya Jamas Breathtaking Grecian Inspired Ensemble

May 14, 2025 -

Untold Stories Wynonna And Ashley Judd Open Up In New Documentary

May 14, 2025

Untold Stories Wynonna And Ashley Judd Open Up In New Documentary

May 14, 2025 -

Judd Family Docuseries Wynonna And Ashley Share Their Stories

May 14, 2025

Judd Family Docuseries Wynonna And Ashley Share Their Stories

May 14, 2025