Navigate The Private Credit Boom: 5 Do's And Don'ts To Land Your Dream Job

Table of Contents

Do's to Secure a Private Credit Job

Master the Fundamentals of Private Credit

To thrive in the private credit industry, you need a solid foundation in several key areas. This isn't just about possessing theoretical knowledge; it's about practical application and demonstrable skills.

- Deep understanding of credit analysis: This involves meticulously assessing the creditworthiness of borrowers, understanding their financial statements, and predicting their ability to repay debt. Proficiency in techniques like cash flow analysis and ratio analysis is paramount.

- Financial modeling: You'll need to build complex financial models to project future cash flows, assess the impact of various scenarios, and determine the appropriate pricing and terms for private credit investments. Software proficiency in Excel, including advanced functions like VBA, is essential.

- Risk assessment: Understanding and mitigating various risks associated with private credit investments—credit risk, market risk, liquidity risk, etc.—is crucial. Familiarity with risk management frameworks and techniques is highly valued.

- Legal frameworks related to private credit: A basic understanding of the legal and regulatory landscape surrounding private credit transactions, including loan agreements, covenants, and compliance requirements, is necessary.

- Portfolio management: The ability to manage a portfolio of private credit investments, monitor performance, and make adjustments based on market conditions and borrower performance, is a key skill for senior roles.

Developing these skills often requires specialized training. Consider pursuing relevant certifications, such as the Chartered Financial Analyst (CFA) charter, or taking online courses focused on private credit and alternative lending. Familiarity with Bloomberg Terminal is also extremely advantageous.

Network Strategically Within the Private Credit Industry

Networking isn't just about collecting business cards; it's about building genuine relationships. The private credit industry, like many others, is relationship-driven.

- Attend industry events: Conferences, seminars, and networking events offer invaluable opportunities to meet professionals, learn about new trends, and make connections.

- Leverage LinkedIn effectively: Optimize your LinkedIn profile to highlight your skills and experience, connect with individuals in the private credit sector, and engage with industry discussions.

- Connect with alumni: If you have attended a relevant university program, leverage your alumni network to explore potential opportunities and gain insights.

- Informational interviews: Reach out to professionals in the industry to schedule informational interviews. This is a great way to learn about different career paths, gain industry insights, and build your network.

- Join relevant professional organizations: Organizations like the American Private Equity & Venture Capital Council (AVPC) offer networking opportunities and access to industry information.

Building genuine relationships can lead to hidden job opportunities and provide valuable insights into company culture, giving you a significant advantage in the job search process.

Tailor Your Resume and Cover Letter for Private Credit Roles

Generic applications rarely succeed in a competitive market. Your resume and cover letter must clearly demonstrate your understanding of private credit and your suitability for the specific role.

- Highlight relevant experience: Focus on accomplishments that showcase your skills in credit analysis, financial modeling, risk assessment, and other relevant areas.

- Quantify achievements: Use numbers and data to illustrate your impact in previous roles. For example, instead of saying "improved efficiency," say "improved efficiency by 15%."

- Use keywords from job descriptions: Carefully review job descriptions and incorporate relevant keywords into your resume and cover letter to improve your chances of getting noticed by Applicant Tracking Systems (ATS).

- Showcase understanding of private credit principles: Demonstrate your knowledge of different private credit strategies, market trends, and regulatory considerations.

A well-crafted resume and cover letter tailored to each specific private credit job application significantly increases your chances of securing an interview.

Prepare for Behavioral and Technical Private Credit Interviews

Interviews for private credit roles often involve both behavioral and technical questions. Thorough preparation is essential.

- Practice the STAR method: Use the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral questions, providing concrete examples of your skills and experiences.

- Research common interview questions: Familiarize yourself with common interview questions and prepare thoughtful, concise answers.

- Prepare case studies: Practice analyzing case studies related to private credit investments, demonstrating your ability to assess risk, conduct due diligence, and make sound investment decisions.

- Understand the firm's investment strategy: Research the firm's investment focus, recent deals, and key personnel. Demonstrate genuine interest and alignment with their strategy.

- Demonstrate passion for private credit: Show enthusiasm for the industry and explain why you are interested in working for that particular firm.

Practicing your answers to common questions, preparing for case studies, and demonstrating genuine interest in the firm will greatly improve your performance in the interview process.

Don'ts to Avoid When Seeking Private Credit Employment

Neglecting to Research Specific Private Credit Firms

Sending generic applications shows a lack of interest and preparation. Each private credit firm has a unique investment strategy, culture, and team.

- Failure to research firm's investment strategy: Understanding a firm's investment thesis, target industries, and deal size is crucial.

- Failure to research the firm's culture: Understanding the firm’s culture helps you assess whether it's a good fit for your personality and working style.

- Failure to research the firm's recent deals: Knowing about their recent investments demonstrates your commitment and genuine interest.

- Failure to research key personnel: Familiarizing yourself with the team shows your willingness to learn more about the firm's leadership.

- Sending generic applications: Tailoring your application materials to each firm demonstrates your genuine interest and increases your chances of getting noticed.

Thorough research demonstrates your genuine interest and commitment to the firm, increasing your chances of success.

Underestimating the Importance of Networking

Relying solely on online applications limits your opportunities. Networking opens doors that online applications cannot.

- Failing to leverage professional connections: Use your existing network to explore opportunities and gain insights.

- Relying solely on online applications: Online applications are a crucial part of the job search, but networking significantly expands your reach.

- Ignoring industry events: Attending industry events provides unparalleled networking opportunities.

Networking significantly improves your chances of finding hidden job opportunities and gaining valuable insights.

Lacking a Comprehensive Understanding of Private Credit Markets

Staying updated on industry trends, regulations, and strategies is crucial for success in private credit.

- Lack of awareness of current market trends: Understanding current market conditions, interest rate environments, and economic forecasts is essential.

- Insufficient knowledge of different private credit strategies: Understanding various private credit strategies, such as direct lending, mezzanine financing, and distressed debt, is vital.

- Limited understanding of risk management techniques: Demonstrating a strong understanding of risk management techniques and best practices is crucial for success.

Keeping abreast of current events and understanding the nuances of private credit strategies is essential for success in this field.

Presenting a Poorly Prepared Application

A poorly prepared application can instantly disqualify you, regardless of your skills and experience.

- Generic resume and cover letter: Tailoring your application to each firm demonstrates your genuine interest and commitment.

- Grammatical errors: Grammatical errors show a lack of attention to detail and professionalism.

- Lack of specific accomplishments: Quantify your achievements with numbers and data to showcase your impact.

- Failure to demonstrate understanding of the role and company: Researching the firm and role thoroughly demonstrates your interest and commitment.

A well-crafted and error-free application is the first impression you make, and it's crucial to make it a good one.

Conclusion: Navigating the Private Credit Boom Successfully

Securing a dream job in the booming private credit industry requires a strategic approach. By mastering the fundamentals of private credit, networking effectively, tailoring your applications, and preparing thoroughly for interviews, you significantly increase your chances of success. Conversely, neglecting research, underestimating networking, lacking a comprehensive understanding of the market, or submitting a poorly prepared application can severely hinder your progress. The competitive landscape of the private credit boom demands strategic planning and execution. Start by researching firms whose investment strategies align with your goals and begin building your network. Implement the advice provided in this article to land your dream private credit job.

Featured Posts

-

Vive La Clase Nacional De Boxeo En El Zocalo A Traves De Estas Fotos

Apr 30, 2025

Vive La Clase Nacional De Boxeo En El Zocalo A Traves De Estas Fotos

Apr 30, 2025 -

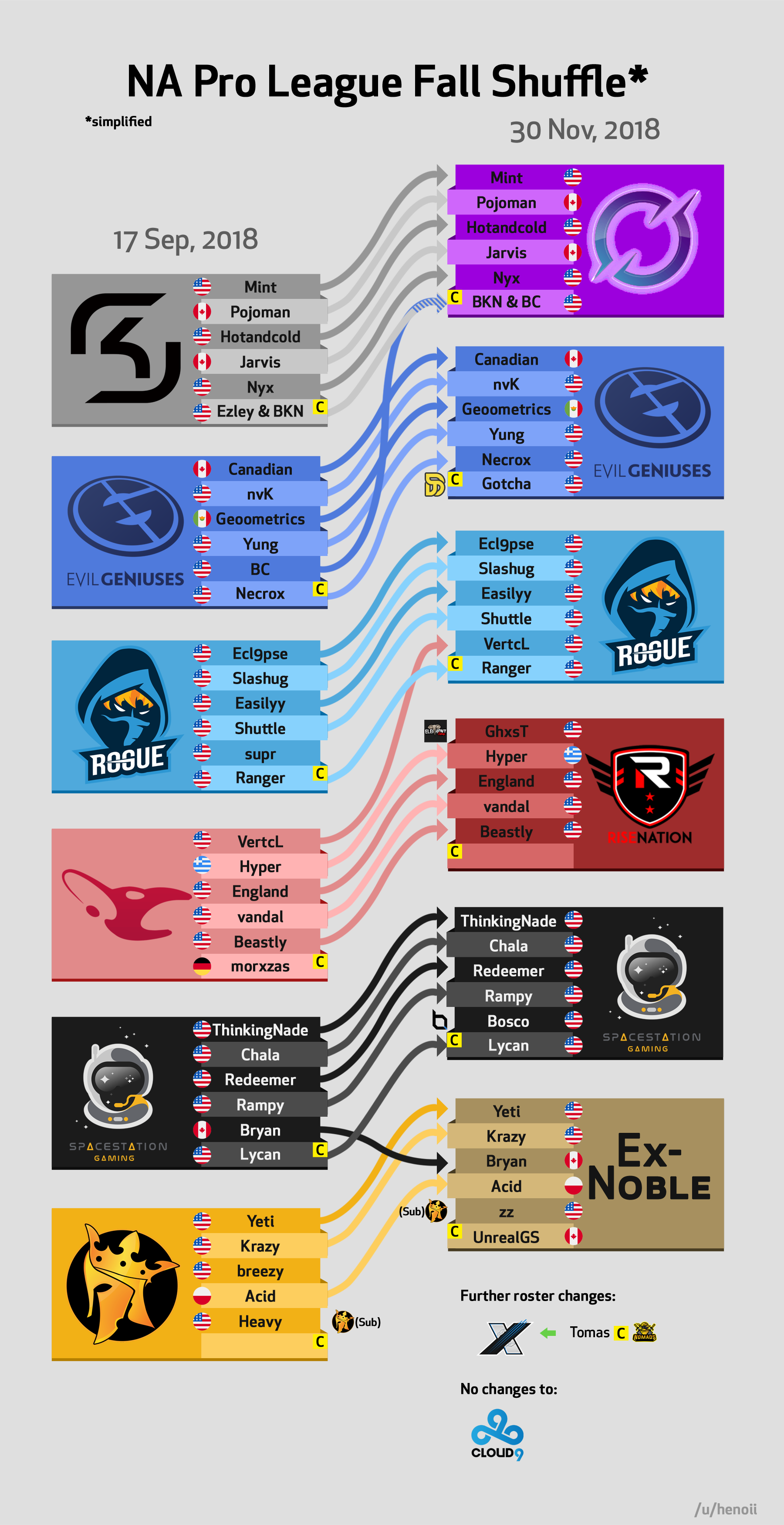

Dance Roster Changes A March 2024 Overview

Apr 30, 2025

Dance Roster Changes A March 2024 Overview

Apr 30, 2025 -

Pari Sen Zermen Epomeni Sezon Stin Euroleague

Apr 30, 2025

Pari Sen Zermen Epomeni Sezon Stin Euroleague

Apr 30, 2025 -

Ftc Vs Meta Examining The Future Of Instagram And Whats App

Apr 30, 2025

Ftc Vs Meta Examining The Future Of Instagram And Whats App

Apr 30, 2025 -

Churchill Downs Prepares For Severe Weather During Kentucky Derby Week

Apr 30, 2025

Churchill Downs Prepares For Severe Weather During Kentucky Derby Week

Apr 30, 2025

Latest Posts

-

Geweldsincident Van Mesdagkliniek Malek F In Hechtenis Na Steekpartij

May 01, 2025

Geweldsincident Van Mesdagkliniek Malek F In Hechtenis Na Steekpartij

May 01, 2025 -

Will Momo Watanabe Relinquish The Tbs Championship To Mercedes Mone

May 01, 2025

Will Momo Watanabe Relinquish The Tbs Championship To Mercedes Mone

May 01, 2025 -

Mones Desperate Attempt To Reclaim Tbs Championship From Watanabe

May 01, 2025

Mones Desperate Attempt To Reclaim Tbs Championship From Watanabe

May 01, 2025 -

Mercedes Mone Seeks Tbs Championship From Momo Watanabe

May 01, 2025

Mercedes Mone Seeks Tbs Championship From Momo Watanabe

May 01, 2025 -

Project Muse Building Shared Research Experiences In The Digital Age

May 01, 2025

Project Muse Building Shared Research Experiences In The Digital Age

May 01, 2025