Navigating The Aftermath: The Challenges Facing The Next Federal Reserve Chairman Under Trump's Presidency

Table of Contents

Inherited Economic Conditions and Policy Conflicts

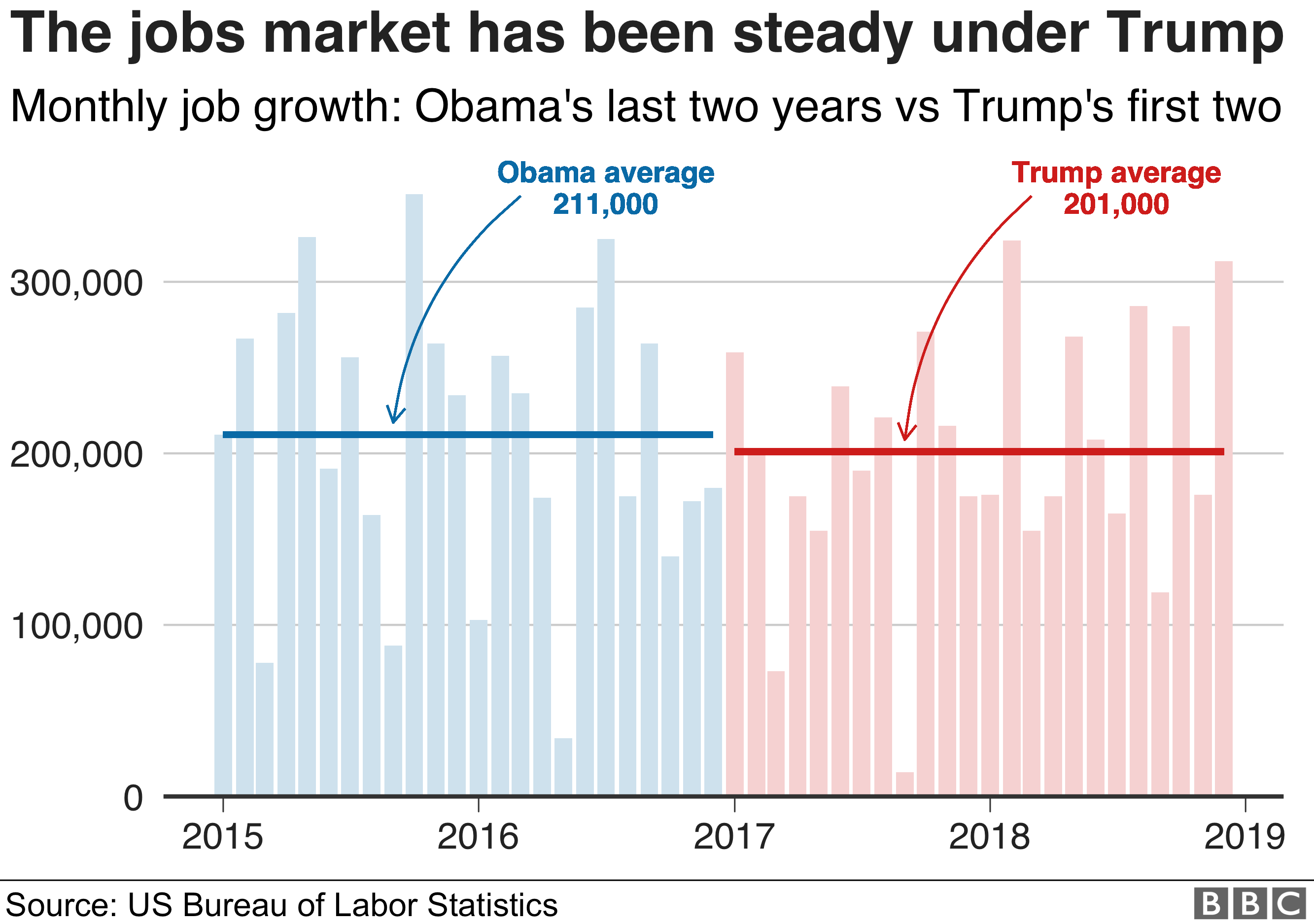

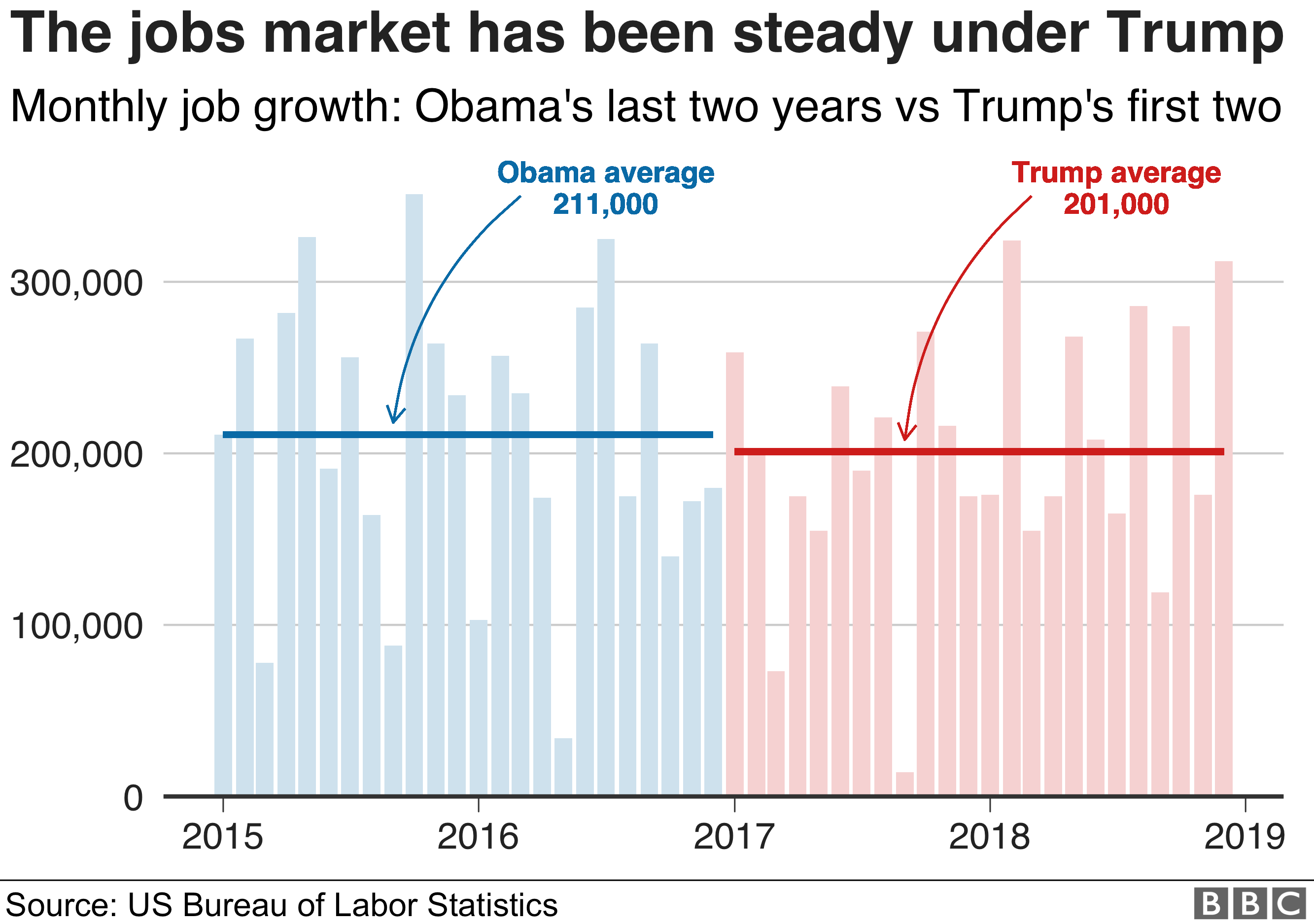

The Trump administration's economic legacy is a mixed bag, leaving the next Federal Reserve Chairman with a challenging inheritance. Key policies, including significant tax cuts, deregulation initiatives, and aggressive trade wars, have had profound and lasting impacts on inflation, unemployment, and the national debt. Understanding these impacts is crucial for navigating the economic terrain ahead.

-

High National Debt and its Implications for Interest Rate Policy: The national debt ballooned under the Trump administration, significantly impacting the Federal Reserve's ability to manage interest rates. High debt levels constrain the Fed's flexibility, potentially limiting its capacity to stimulate economic growth through interest rate cuts during future downturns. Managing this debt burden will be a major focus for the next Fed chair.

-

Lingering Effects of Trade Disputes on Global Markets and Domestic Growth: The Trump administration's trade wars, while aiming to protect domestic industries, disrupted global supply chains and increased uncertainty for businesses. These disruptions continue to impact domestic growth and inflation, requiring careful consideration by the Federal Reserve in its monetary policy decisions.

-

The Potential for Inflationary Pressures Due to Fiscal Policies: The combination of tax cuts and increased government spending under the Trump administration created a significant fiscal stimulus. This, coupled with the lingering effects of supply chain disruptions, increases the risk of inflationary pressures, demanding a proactive and nuanced approach from the Federal Reserve.

-

Differing Economic Philosophies Between the Fed and the Administration: The Trump administration often prioritized short-term economic gains over long-term stability, sometimes clashing with the Federal Reserve's focus on price stability and sustainable economic growth. This difference in philosophy will necessitate skillful navigation by the next Fed chair to maintain the institution's independence and credibility.

Maintaining Independence and Navigating Political Pressure

The Federal Reserve's independence is paramount to its effectiveness. However, the next chairman will face immense pressure from the executive branch and Congress to influence monetary policy for political gain. Maintaining this independence while fostering productive collaboration will be a crucial balancing act.

-

Examples of Past Instances of Political Interference in Fed Decisions: History provides numerous examples of attempts by presidents and Congress to influence the Federal Reserve's decisions. Understanding these historical precedents is essential for the next chairman in anticipating and mitigating potential political pressure.

-

The Role of Congressional Oversight and its Potential Impact: Congress holds significant oversight power over the Federal Reserve. Navigating this relationship while maintaining the Fed's autonomy requires careful communication and a clear articulation of the economic rationale behind policy decisions.

-

Strategies for Maintaining the Fed's Credibility and Autonomy: Transparency and clear communication are vital in maintaining the Federal Reserve's credibility and independence. The next chairman must articulate the Fed's goals and decisions transparently to both the public and political stakeholders.

-

The Importance of Transparent Communication to Manage Expectations: Open and honest communication with the public and Congress can help manage expectations and mitigate potential political pressure. By clearly explaining the rationale behind policy decisions, the next chairman can foster trust and understanding.

Addressing Emerging Economic Uncertainties

Beyond the inherited economic challenges, the next Federal Reserve Chairman will face a range of emerging economic uncertainties. These require a proactive and adaptable approach to monetary policy.

-

The Impact of Globalization and International Trade on the US Economy: The complexities of global trade and economic interdependence demand careful consideration. The Federal Reserve's actions must account for global economic conditions and the potential for international shocks.

-

The Rise of Automation and its Effects on Employment and Wage Growth: Technological advancements, particularly automation, are transforming the labor market. The Fed must consider the implications of automation on employment, wages, and overall economic growth when setting monetary policy.

-

The Growing Concerns About Climate Change and its Economic Consequences: The economic effects of climate change, such as extreme weather events and the transition to a low-carbon economy, represent significant challenges that require consideration within the context of monetary policy.

-

Potential for Unforeseen Economic Shocks and the Fed's Response Mechanisms: The global economy is subject to unexpected shocks, requiring the Federal Reserve to maintain robust response mechanisms and the flexibility to adapt to unforeseen circumstances.

Managing Inflation Expectations

Managing inflation expectations is a critical aspect of the Federal Reserve's mandate. The next chairman will face the challenge of navigating differing views within the Federal Reserve itself, as well as managing external pressures on inflation policy.

-

Different Approaches to Inflation Control (e.g., Hawkish vs. Dovish Policies): Different members of the Federal Open Market Committee (FOMC) may hold differing views on the appropriate response to inflationary pressures. The next chairman must effectively manage these internal debates while maintaining a cohesive approach.

-

The Importance of Clear Communication to Anchor Inflation Expectations: Clear and consistent communication about the Federal Reserve's inflation targets and policy strategies is vital in anchoring inflation expectations. This helps to prevent inflationary spirals and maintain price stability.

-

The Role of Data Analysis and Forecasting in Guiding Policy Decisions: Rigorous data analysis and accurate forecasting are crucial in guiding policy decisions. The next chairman must rely on the best available data and expertise to make informed decisions about monetary policy.

Conclusion

The next Federal Reserve Chairman faces an unprecedented set of challenges in navigating the economic aftermath of the Trump presidency. Maintaining the Fed's independence, managing inherited economic conditions, and addressing emerging uncertainties will require exceptional skill and judgment. The success of the next chairman in balancing political pressures with sound economic policy will have profound implications for the future of the US economy. Understanding these challenges is crucial for anyone following the future of the Federal Reserve and its impact on the US and global economies. Therefore, staying informed about the ongoing debates surrounding the Federal Reserve Chairman and their policies is vital.

Featured Posts

-

Neighbours 38 Years Later A Shocking Murder Unveiled

Apr 26, 2025

Neighbours 38 Years Later A Shocking Murder Unveiled

Apr 26, 2025 -

Portnoy Slams Newsom A Detailed Look At The Criticism

Apr 26, 2025

Portnoy Slams Newsom A Detailed Look At The Criticism

Apr 26, 2025 -

Analyzing Disinflation Ecbs Holzmann And The Trump Tariff Effect

Apr 26, 2025

Analyzing Disinflation Ecbs Holzmann And The Trump Tariff Effect

Apr 26, 2025 -

Los Angeles Wildfires And The Normalization Of Disaster Betting

Apr 26, 2025

Los Angeles Wildfires And The Normalization Of Disaster Betting

Apr 26, 2025 -

Benson Boone De Musica Viral A Show No Lollapalooza

Apr 26, 2025

Benson Boone De Musica Viral A Show No Lollapalooza

Apr 26, 2025

Latest Posts

-

The Significance Of Ariana Grandes New Hair And Tattoos

Apr 27, 2025

The Significance Of Ariana Grandes New Hair And Tattoos

Apr 27, 2025 -

A Professional Look At Ariana Grandes Latest Style Update

Apr 27, 2025

A Professional Look At Ariana Grandes Latest Style Update

Apr 27, 2025 -

Ariana Grandes Transformation Professional Styling And Body Art

Apr 27, 2025

Ariana Grandes Transformation Professional Styling And Body Art

Apr 27, 2025 -

Get Professional Help Understanding Ariana Grandes Style Choices

Apr 27, 2025

Get Professional Help Understanding Ariana Grandes Style Choices

Apr 27, 2025 -

Hair And Tattoo Transformations Ariana Grandes Bold New Image

Apr 27, 2025

Hair And Tattoo Transformations Ariana Grandes Bold New Image

Apr 27, 2025