Navigating The Belgian Energy Market: Financing A Large-Scale BESS

Table of Contents

Understanding the Belgian Regulatory Landscape for BESS

The Belgian regulatory framework for energy storage is evolving rapidly, reflecting the country's commitment to renewable energy integration. Understanding this framework is crucial for securing financing for your BESS project. Key aspects include:

-

Incentives and Support Schemes: The Belgian government offers various incentives to encourage BESS deployment, including subsidies, tax breaks, and feed-in tariffs. These schemes often prioritize projects that contribute to grid stability and renewable energy integration. The specific details of these programs are subject to change, so staying updated with the latest announcements from relevant ministries is essential.

-

Grid Connection Processes: Connecting a large-scale BESS to the Belgian grid involves navigating a multi-stage process, requiring interaction with Elia, the Belgian transmission system operator. This process includes technical assessments, grid impact studies, and obtaining the necessary permits. Careful planning and early engagement with Elia are crucial for a smooth and timely connection.

-

Permitting and Regulations: Obtaining the necessary permits for BESS installation can be complex, involving regional and local authorities. Navigating this process efficiently requires a thorough understanding of all applicable regulations and compliance requirements. Working with experienced legal and regulatory consultants can significantly streamline this process.

Bullet points:

- Recent legislative changes, such as those related to renewable energy targets and grid modernization, significantly impact BESS deployment.

- Key regulatory bodies involved include Elia (transmission system operator), CREG (energy regulator), and regional authorities.

- Streamlining the permitting process often involves proactive engagement with regulatory bodies and detailed documentation.

Exploring Financing Options for Large-Scale BESS Projects

Securing sufficient capital for a large-scale BESS project requires exploring diverse financing avenues. The optimal approach depends on project specifics, risk appetite, and available resources. Here are some key options:

Bank Loans

Traditional bank financing remains a viable option for BESS projects, particularly those with strong project sponsors and a robust financial model. However, securing competitive interest rates requires demonstrating the project’s financial viability and providing comprehensive collateral. Banks often conduct thorough due diligence before approving loans.

Advantages: Relatively straightforward process for established projects. Disadvantages: Requires strong creditworthiness, potentially higher interest rates compared to other options. Eligibility Criteria: Strong project financials, collateral, and a credible sponsor.

Equity Financing

Attracting investors and venture capital is another important avenue. This can provide substantial funding, but it typically involves relinquishing some ownership and control. A compelling investment proposition highlighting the project’s potential returns and contribution to the green energy transition is critical.

Advantages: Significant capital infusion, potential for long-term partnerships. Disadvantages: Dilution of ownership, potential conflicts of interest. Eligibility Criteria: Strong business plan, experienced management team, promising market outlook.

Government Grants and Subsidies

Belgian government programs offer grants and subsidies to support BESS projects that align with national energy policy objectives. These programs often require detailed applications and meet specific eligibility criteria. Staying informed about available funding opportunities is crucial.

Advantages: Reduced project costs, enhanced financial viability. Disadvantages: Competitive application process, specific eligibility requirements. Eligibility Criteria: Project alignment with national energy policy, environmental benefits, and feasibility.

Project Finance

Project finance structures are commonly used for large-scale infrastructure projects, including BESS. This involves financing the project based on its expected cash flows rather than the sponsor's creditworthiness. It often involves multiple lenders and equity investors.

Advantages: Reduced reliance on sponsor creditworthiness, risk allocation among multiple stakeholders. Disadvantages: Complex structuring, higher transaction costs. Eligibility Criteria: Robust financial model, strong offtake agreements, and experienced project management.

Green Bonds and Sustainable Finance

The growing market for green bonds and sustainable finance provides another avenue for attracting investment. Investors increasingly seek opportunities to support environmentally friendly projects, making BESS projects attractive.

Advantages: Access to a wider pool of investors, potential for lower interest rates. Disadvantages: Requires adherence to strict green finance standards. Eligibility Criteria: Demonstrated environmental benefits, adherence to recognized green bond standards.

Assessing the Financial Viability of a BESS Project in Belgium

Accurate financial modelling is paramount for securing financing. Key metrics include:

- Internal Rate of Return (IRR): Measures the profitability of the investment.

- Net Present Value (NPV): Calculates the difference between the present value of cash inflows and outflows.

- Payback Period: Determines the time it takes for the investment to recoup its initial cost.

Accurately forecasting energy prices, demand fluctuations, and operating costs is crucial for a realistic financial model. Robust risk mitigation strategies, addressing potential technical failures, regulatory changes, and market volatility, are essential.

Bullet points:

- Key factors influencing financial viability include energy prices, grid tariffs, government incentives, and operating costs.

- Potential risks include technology failure, regulatory changes, and fluctuations in energy markets.

- Risk mitigation strategies include insurance, hedging against price volatility, and robust project management.

Navigating the Due Diligence Process for BESS Financing

Thorough due diligence is critical for securing financing. This includes:

- Technical Due Diligence: Assessing the technical feasibility, performance, and reliability of the BESS technology.

- Commercial Due Diligence: Evaluating market demand, pricing strategies, and potential revenue streams.

- Legal and Regulatory Due Diligence: Ensuring compliance with all relevant laws, permits, and regulations.

- Financial Due Diligence: Verifying the accuracy of financial projections, assessing the creditworthiness of the project, and reviewing contracts.

Bullet points:

- A comprehensive due diligence checklist should cover all aspects of the project, from technical specifications to legal compliance.

- Engaging experienced consultants in each area of due diligence is highly recommended.

- Transparency and thorough documentation are crucial for a successful due diligence process.

Conclusion

Securing financing a large-scale BESS in Belgium requires a multifaceted approach. By thoroughly understanding the regulatory landscape, exploring diverse financing options, and developing a robust financial model supported by comprehensive due diligence, developers can successfully navigate the complexities of the Belgian energy market and unlock the significant potential of BESS. To learn more about the specific requirements and opportunities for financing large-scale BESS projects in Belgium, contact [Insert Contact Information/Link to relevant resources]. Start planning your large-scale BESS investment in Belgium today!

Featured Posts

-

Annual Donkey Roundup Rocks Southern California

May 03, 2025

Annual Donkey Roundup Rocks Southern California

May 03, 2025 -

Can Farmers Trust Reform Uk To Support The Agricultural Sector

May 03, 2025

Can Farmers Trust Reform Uk To Support The Agricultural Sector

May 03, 2025 -

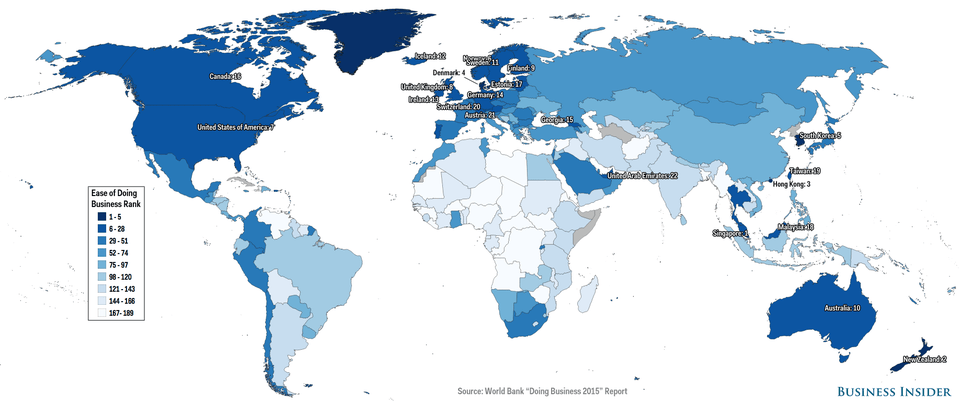

Discovering The Countrys Next Big Business Areas

May 03, 2025

Discovering The Countrys Next Big Business Areas

May 03, 2025 -

Gewinnzahlen Lotto 6aus49 Mittwoch 9 April 2025

May 03, 2025

Gewinnzahlen Lotto 6aus49 Mittwoch 9 April 2025

May 03, 2025 -

Reforming Mental Healthcare Towards A More Supportive System

May 03, 2025

Reforming Mental Healthcare Towards A More Supportive System

May 03, 2025

Latest Posts

-

Informacion I Fundit Sulm Me Thike Ne Qender Tregtare Ne Ceki Dy Te Vdekur

May 03, 2025

Informacion I Fundit Sulm Me Thike Ne Qender Tregtare Ne Ceki Dy Te Vdekur

May 03, 2025 -

Ceki Dy Te Vdekur Pas Sulmit Me Thike Ne Qender Tregtare

May 03, 2025

Ceki Dy Te Vdekur Pas Sulmit Me Thike Ne Qender Tregtare

May 03, 2025 -

Incidenti Tragjik Ne Ceki Sulm Me Arme Te Bardhe Ne Qender Tregtare

May 03, 2025

Incidenti Tragjik Ne Ceki Sulm Me Arme Te Bardhe Ne Qender Tregtare

May 03, 2025 -

Sulm Vdekjeprures Me Thike Ne Qender Tregtare Ne Republiken Ceke

May 03, 2025

Sulm Vdekjeprures Me Thike Ne Qender Tregtare Ne Republiken Ceke

May 03, 2025 -

Dy Te Vdekur Pas Sulmit Me Thike Ne Qender Tregtare Ne Ceki

May 03, 2025

Dy Te Vdekur Pas Sulmit Me Thike Ne Qender Tregtare Ne Ceki

May 03, 2025