Navigating The Chinese Market: The Struggles Of BMW, Porsche, And Other Auto Brands

Table of Contents

Intense Domestic Competition

The Chinese automotive industry is experiencing a remarkable surge in domestic brands, posing a significant challenge to established international players.

Rise of Domestic Brands

The rapid growth and technological advancements of Chinese automakers like Geely, BYD, and NIO are reshaping the competitive landscape. These brands are not only offering technologically advanced vehicles but are also increasingly competitive on price.

- BYD: With its innovative Blade Battery technology and a wide range of electric vehicles (EVs), BYD is a formidable competitor, capturing significant market share. Models like the Han and Tang EVs directly challenge luxury brands in terms of features and performance.

- Geely: Geely's strategic acquisitions and technological partnerships have propelled its growth, leading to the development of high-quality vehicles at competitive price points. The Geely Xingyue L and Lynk & Co models showcase their ambition in the premium segment.

- NIO: NIO's focus on premium EVs and its battery-swap technology positions it as a direct competitor to Tesla and other established luxury EV brands. Its innovative battery-as-a-service model also appeals to cost-conscious consumers.

Government subsidies and unwavering support for domestic brands further amplify their competitive advantage, creating a challenging environment for international luxury automakers. This support includes tax breaks, preferential access to resources, and initiatives to promote the adoption of domestically produced EVs.

The Price War Factor

The intense competition has ignited price wars, impacting the profitability and market strategies of luxury brands. Both domestic and international brands are vying for market share, often leading to aggressive pricing.

- BMW and Mercedes-Benz: These established brands have had to adjust their pricing strategies to remain competitive, sometimes sacrificing profit margins to maintain market share.

- Porsche: While maintaining a premium image, Porsche also faces pressure to offer competitive pricing, particularly in the rapidly expanding SUV segment.

These price wars necessitate careful market analysis and agile pricing strategies to balance profitability with market share, demanding a nuanced understanding of the Chinese market's dynamic pricing landscape.

Navigating Regulatory Hurdles

The Chinese government's stringent regulations present another layer of complexity for luxury automakers.

Emission Standards and Regulations

China has implemented increasingly stringent emission standards and environmental regulations, impacting vehicle development and production costs significantly. Compliance with these regulations requires substantial investment in research and development.

- Fuel Efficiency Standards: Meeting these standards necessitates the development of more fuel-efficient engines or a greater focus on electric and hybrid vehicles.

- NEV (New Energy Vehicle) Mandates: Regulations requiring a certain percentage of NEV sales put pressure on automakers to increase their EV offerings.

- Carbon Emission Targets: The government's ambitious carbon emission reduction targets further intensify the pressure on automakers to transition towards greener technologies.

These regulations significantly increase production costs and can impact the availability of certain models in the Chinese market.

Import Tariffs and Taxes

High import duties and taxes on imported luxury vehicles significantly impact pricing and profitability.

- Tariff Rates: High tariff rates increase the final price of imported vehicles, making them less competitive compared to domestically produced alternatives.

- Tax Implications: Understanding and managing the complexities of Chinese taxation is crucial for maintaining profitability.

Automakers employ various strategies to mitigate these costs, including local production and sourcing components within China.

Understanding Chinese Consumer Preferences

Adapting to the ever-evolving preferences of Chinese consumers is paramount for success.

Shifting Consumer Demands

Chinese consumers are increasingly discerning and demand cutting-edge technology, personalized experiences, and a commitment to sustainability.

- Electric Vehicle Adoption: The demand for electric vehicles is rapidly growing, driven by environmental concerns and government incentives.

- Technological Features: Consumers expect advanced technological features, such as autonomous driving capabilities, sophisticated infotainment systems, and connected car services.

- Brand Loyalty: While brand loyalty exists, it's not as entrenched as in some other markets. Consumers are more willing to explore different brands based on features and value.

- Social Media Influence: Social media plays a significant role in shaping consumer opinions and purchase decisions.

Understanding these shifting trends is crucial for developing and marketing products that resonate with the Chinese market.

Localized Marketing and Branding Strategies

Successfully navigating the Chinese market requires effective localization of marketing and branding strategies.

- Cultural Nuances: Marketing campaigns must be sensitive to Chinese cultural values and traditions.

- Communication Styles: Understanding the nuances of Chinese communication is crucial for effective brand messaging.

- Celebrity Endorsements: Using well-known Chinese celebrities in marketing campaigns can significantly enhance brand appeal.

Companies that successfully adapt their branding and marketing resonate strongly with Chinese consumers. Conversely, brands that fail to understand these nuances can experience significant setbacks.

Conclusion

The Chinese automotive market presents both tremendous potential and significant challenges for international luxury brands like BMW and Porsche. Successfully navigating this dynamic environment necessitates a profound understanding of intense domestic competition, stringent regulatory hurdles, and the evolving preferences of Chinese consumers. By adapting their strategies to address these key factors—prioritizing localization, technological innovation, and competitive pricing—luxury automakers can effectively position themselves for continued success in the world’s largest automotive market. Learn more about conquering the complexities of navigating the Chinese market and achieving sustainable growth in this dynamic environment.

Featured Posts

-

Angely I Restorany Biznes Plyuschenko Sikharulidze I Kuznetsovoy

May 20, 2025

Angely I Restorany Biznes Plyuschenko Sikharulidze I Kuznetsovoy

May 20, 2025 -

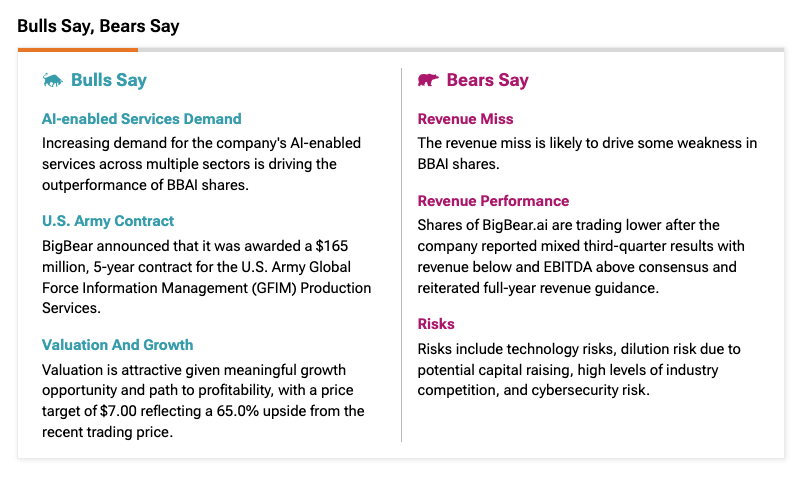

Big Bear Ai Bbai Investors Contact Gross Law Firm Before June 10 2025

May 20, 2025

Big Bear Ai Bbai Investors Contact Gross Law Firm Before June 10 2025

May 20, 2025 -

Pro D2 Valence Romans Su Agen Et La Course Au Maintien Decryptage Du Calendrier

May 20, 2025

Pro D2 Valence Romans Su Agen Et La Course Au Maintien Decryptage Du Calendrier

May 20, 2025 -

Pattinson Runs Lines For Upcoming Project With Girlfriend Waterhouse

May 20, 2025

Pattinson Runs Lines For Upcoming Project With Girlfriend Waterhouse

May 20, 2025 -

Tampoy Ston Gamo I Dynami Tis Deyteris Eykairias Martha

May 20, 2025

Tampoy Ston Gamo I Dynami Tis Deyteris Eykairias Martha

May 20, 2025

Latest Posts

-

Ap

May 20, 2025

Ap

May 20, 2025 -

Ai 82

May 20, 2025

Ai 82

May 20, 2025 -

Trump Era Ai Legislation A Triumph Yet Long Term Concerns Linger

May 20, 2025

Trump Era Ai Legislation A Triumph Yet Long Term Concerns Linger

May 20, 2025 -

Ap It

May 20, 2025

Ap It

May 20, 2025 -

Ai Industry Celebrates Legislative Victory But Uncertainty Persists

May 20, 2025

Ai Industry Celebrates Legislative Victory But Uncertainty Persists

May 20, 2025