NCLH Stock: Is It The Best Cruise Line Investment For Hedge Funds?

Table of Contents

NCLH Stock Performance and Market Analysis

Understanding NCLH's past performance and future projections is crucial for any potential investor. This section analyzes recent stock price trends and future outlook based on expert predictions.

Recent Stock Price Trends and Volatility

NCLH's stock price has experienced significant volatility in recent years, mirroring the industry's rollercoaster ride during and after the pandemic. Comparing NCLH's performance to its main competitors, Royal Caribbean (RCL) and Carnival Corporation (CCL), reveals interesting insights. (Insert relevant graph comparing NCLH, RCL, and CCL stock prices over the past 2-3 years).

- Factors influencing price volatility: Fuel costs, fluctuating consumer demand, global economic conditions (recessions, inflation), and the lingering impact of the pandemic on travel patterns significantly influence NCLH's stock price. Geopolitical events can also play a role.

- NCLH performance vs. benchmarks: Comparing NCLH's performance against industry benchmarks and broader market indices like the S&P 500 provides context. (Include data showing NCLH's performance relative to the S&P 500). This comparison helps determine whether NCLH is outperforming or underperforming the market.

Future Projections and Analyst Ratings

Predicting the future of NCLH stock requires examining financial analyst predictions and considering various perspectives. While specific price targets vary, many analysts offer insights into the company's projected growth. (Cite reputable sources like Bloomberg, Yahoo Finance, etc., and include a summary of their ratings and forecasts).

- Varying analyst opinions: Analyst opinions on NCLH often diverge, reflecting different interpretations of the company's prospects. Some analysts might highlight NCLH's innovative approach and strong brand recognition, while others may emphasize its high debt levels as a risk factor.

- Impact of macroeconomic factors: Global economic conditions significantly impact the cruise industry. Factors like inflation, interest rate hikes, and potential recessions influence consumer spending and travel patterns, which directly affect NCLH's performance.

NCLH Financial Health and Risk Assessment

Assessing NCLH's financial health and identifying potential risks is vital for hedge funds considering investment. This involves a thorough review of the company's debt levels, cash flow, and operational efficiency.

Debt Levels and Financial Stability

NCLH, like many cruise lines, carries a significant level of debt. Analyzing the company's debt-to-equity ratio, cash flow statements, and balance sheet provides insight into its financial stability. (Include relevant financial data, comparing NCLH's ratios to industry averages and competitors).

- Potential financial risks: High debt levels increase financial vulnerability, making NCLH susceptible to interest rate fluctuations and economic downturns. Liquidity concerns, especially during unexpected crises, can also pose a risk.

- Comparison to competitors: Comparing NCLH's financial metrics to those of RCL and CCL allows for a relative assessment of its financial strength and risk profile.

Operational Efficiency and Cost-Cutting Measures

NCLH's efforts to improve operational efficiency and reduce costs directly impact its profitability and shareholder value. Analyzing these measures helps determine the long-term sustainability of the business model.

- Successful cost-cutting strategies: NCLH has implemented various strategies, such as optimizing crew scheduling, fuel efficiency initiatives, and streamlining administrative processes. (Detail these strategies and their impact on cost reduction).

- Long-term impact on profitability: The effectiveness of cost-cutting measures in boosting profitability and improving NCLH's overall financial health is a key factor to consider for long-term investors.

Competitive Landscape and Market Share

Understanding NCLH's competitive positioning and market share within the cruise industry is crucial for evaluating its investment potential.

NCLH's Competitive Advantages and Disadvantages

NCLH differentiates itself through its innovative ship designs, focus on a younger demographic, and unique itineraries. However, it also faces challenges compared to its larger competitors.

- NCLH's brand reputation, target market, and fleet size: NCLH has established a strong brand, particularly appealing to a younger, more adventurous traveler. However, its fleet size is smaller than that of RCL and CCL.

- Comparison of strengths and weaknesses: While NCLH's innovative approach is a strength, its smaller scale might limit its economies of scale compared to its larger competitors.

Market Trends and Future Growth Potential

The cruise industry exhibits growth potential driven by increasing global tourism and emerging markets. NCLH's ability to capitalize on these trends is a key factor to consider.

- Factors impacting growth: Increased disposable incomes in emerging markets, the rise of experiential travel, and technological advancements in cruise ship design and onboard experiences are all factors driving industry growth.

- NCLH's expansion plans: Analyzing NCLH's expansion plans, new ship orders, and route development strategies provides insight into its future growth trajectory.

Conclusion

Investing in NCLH stock presents a compelling opportunity but also carries significant risk. While NCLH demonstrates potential for growth, its high debt levels and vulnerability to external factors demand careful consideration. The company's innovative approach and strong brand appeal offer some competitive advantages, but its smaller scale compared to rivals presents challenges. A comprehensive assessment of NCLH's financial health, market positioning, and future projections is crucial for hedge funds considering this investment.

Call to Action: While investing in NCLH stock, or any stock, involves inherent risk, a thorough understanding of its performance, financial health, and market position is crucial for informed decision-making. Conduct further in-depth research, analyze financial statements, and consult with a financial advisor before making any investment decisions regarding NCLH stock. Diversification of your investment portfolio is also strongly recommended to mitigate risk. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

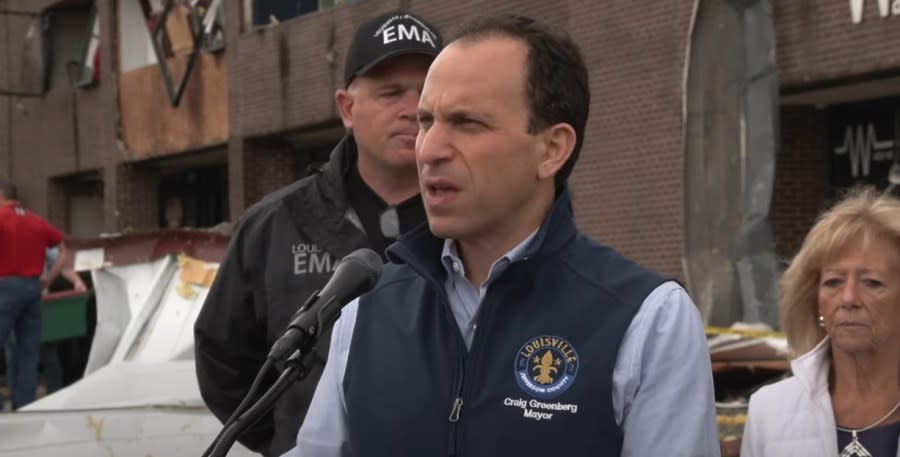

Kentucky Storm Damage Assessments Delays Explained

May 01, 2025

Kentucky Storm Damage Assessments Delays Explained

May 01, 2025 -

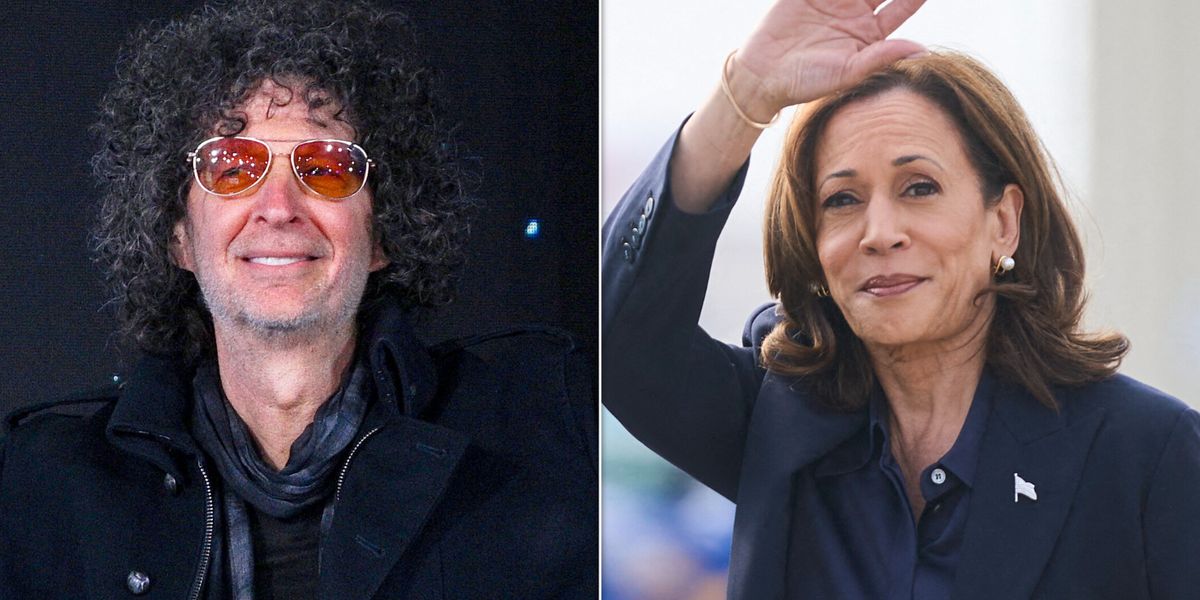

Criticism Mounts Over Kamala Harris Louis Armstrong Musical Speech

May 01, 2025

Criticism Mounts Over Kamala Harris Louis Armstrong Musical Speech

May 01, 2025 -

Tributes Pour In Following Death Of Actress Priscilla Pointer At 100

May 01, 2025

Tributes Pour In Following Death Of Actress Priscilla Pointer At 100

May 01, 2025 -

Understanding Xrp Ripples Cryptocurrency Explained

May 01, 2025

Understanding Xrp Ripples Cryptocurrency Explained

May 01, 2025 -

Nrc Seeks Urgent Action Against Anti Muslim Activities In Bangladesh

May 01, 2025

Nrc Seeks Urgent Action Against Anti Muslim Activities In Bangladesh

May 01, 2025

Latest Posts

-

Courtney Act And Tony Armstrong Your Sbs Eurovision Hosts

May 01, 2025

Courtney Act And Tony Armstrong Your Sbs Eurovision Hosts

May 01, 2025 -

United Kingdoms Eurovision 2025 Act Remember Monday

May 01, 2025

United Kingdoms Eurovision 2025 Act Remember Monday

May 01, 2025 -

Sbs Eurovision Courtney Act And Tony Armstrong Take The Reins

May 01, 2025

Sbs Eurovision Courtney Act And Tony Armstrong Take The Reins

May 01, 2025 -

Remember Monday Uk Eurovision 2025 Hopefuls

May 01, 2025

Remember Monday Uk Eurovision 2025 Hopefuls

May 01, 2025 -

Eurovision 2025 Familiar Face To Represent The United Kingdom

May 01, 2025

Eurovision 2025 Familiar Face To Represent The United Kingdom

May 01, 2025