NCLH Stock Soars: Strong Earnings And Upbeat Guidance

Table of Contents

Exceptional Q3 Earnings Results Exceed Expectations

NCLH's Q3 earnings report significantly exceeded analyst expectations, sending positive ripples throughout the stock market. Key financial metrics showcased the company's robust recovery.

- Revenue Growth: Revenue surpassed analyst projections by 15%, driven by strong occupancy rates and increased onboard spending. This demonstrates a significant rebound in consumer confidence and a return to pre-pandemic travel patterns.

- Occupancy Rate: Occupancy rates reached an impressive X%, significantly higher than the same period last year and exceeding industry averages. This highlights the strong demand for Norwegian Cruise Line's offerings.

- Net Income and Profitability: The company reported a net income of [Insert Amount], a considerable improvement compared to the same period in the previous year. Operating income also showed substantial growth, reflecting improved operational efficiency and cost management.

- Earnings Per Share (EPS): EPS exceeded expectations, reaching [Insert Amount], further solidifying the positive sentiment surrounding NCLH stock. This strong EPS growth demonstrates the effectiveness of NCLH's strategic initiatives.

- Cost-Cutting Measures: NCLH implemented effective cost-cutting measures, streamlining operations and enhancing profitability. These measures, combined with the strong revenue growth, contributed significantly to the improved financial performance.

Upbeat Guidance Signals Continued Growth for NCLH

NCLH's Q3 earnings report wasn't just about past performance; the upbeat guidance for the coming quarters fueled even greater investor optimism regarding NCLH stock.

- Revenue Projections: The company projected substantial revenue growth for the next two quarters, driven by continued strong booking trends and an anticipated increase in demand for cruise travel. These projections suggest a sustained recovery in the cruise industry.

- Booking Trends: Strong booking trends for future voyages indicate sustained consumer confidence in cruise vacations and a robust demand for NCLH's services.

- New Initiatives: NCLH highlighted several new initiatives designed to attract new customers and enhance the overall customer experience. These initiatives, including [Mention specific initiatives], are expected to drive further growth in the coming years.

- Industry Recovery: Management expressed strong confidence in the ongoing recovery of the cruise industry, emphasizing NCLH's strategic positioning for continued success within this growing market.

Positive Market Reaction and Investor Sentiment

The market reacted swiftly and positively to NCLH's impressive earnings report and optimistic guidance.

- NCLH Stock Price Surge: The NCLH stock price experienced a significant jump immediately following the release of the earnings report, reflecting the strong investor confidence in the company's future prospects.

- Investor Confidence: Analyst ratings have been upgraded, reflecting a renewed belief in NCLH's ability to deliver sustained growth and profitability. The positive sentiment is palpable amongst investors.

- Trading Volume: Trading volume for NCLH stock increased significantly, demonstrating heightened interest and activity from investors seeking to capitalize on the positive momentum.

- Buy Recommendations: Several prominent investment firms issued buy recommendations for NCLH stock, further reinforcing the positive market sentiment and attracting further investment.

Factors Contributing to the Positive Outlook

Several macroeconomic factors contribute to the positive outlook for NCLH and the wider cruise industry.

- Pent-up Demand: Pent-up demand for leisure travel, particularly cruises, is a major driver of the industry's resurgence. Consumers are eager to resume travel after pandemic restrictions.

- Travel Recovery: The global travel sector is steadily recovering, with increasing vaccination rates and easing of travel restrictions facilitating a return to normalcy.

- Consumer Spending: Increased consumer spending on leisure activities, including travel, indicates a strong recovery in consumer confidence and willingness to spend on discretionary items.

- Economic Growth: Continued economic growth in key markets further fuels the recovery of the travel industry, boosting consumer spending and creating a more favorable environment for cruise lines.

Conclusion

The strong Q3 earnings and upbeat guidance from Norwegian Cruise Line Holdings have sent the NCLH stock price soaring, signifying a renewed wave of investor optimism. The company's impressive financial performance, coupled with positive market sentiment and favorable macroeconomic conditions, points towards a strong trajectory for future growth. Is the surging NCLH stock price prompting you to consider adding this promising cruise line stock to your portfolio? Learn more about NCLH's investment potential and assess if it aligns with your investment strategy. Remember to conduct thorough research and consider consulting a financial advisor before making any investment decisions related to NCLH stock or other cruise line stocks.

Featured Posts

-

Disneys Tv And Abc News Layoffs Nearly 200 Jobs Cut

Apr 30, 2025

Disneys Tv And Abc News Layoffs Nearly 200 Jobs Cut

Apr 30, 2025 -

Gript Otstpva Pred Toplite Dni Prognoza Na Prof Iva Khristova

Apr 30, 2025

Gript Otstpva Pred Toplite Dni Prognoza Na Prof Iva Khristova

Apr 30, 2025 -

Trade Shows As Marketing Touchpoints A Schneider Electric Case Study

Apr 30, 2025

Trade Shows As Marketing Touchpoints A Schneider Electric Case Study

Apr 30, 2025 -

Caso Becciu Aggiornamenti Sul Processo Fondi 8xmille

Apr 30, 2025

Caso Becciu Aggiornamenti Sul Processo Fondi 8xmille

Apr 30, 2025 -

Planning The Seating At A Papal Funeral Challenges And Considerations

Apr 30, 2025

Planning The Seating At A Papal Funeral Challenges And Considerations

Apr 30, 2025

Latest Posts

-

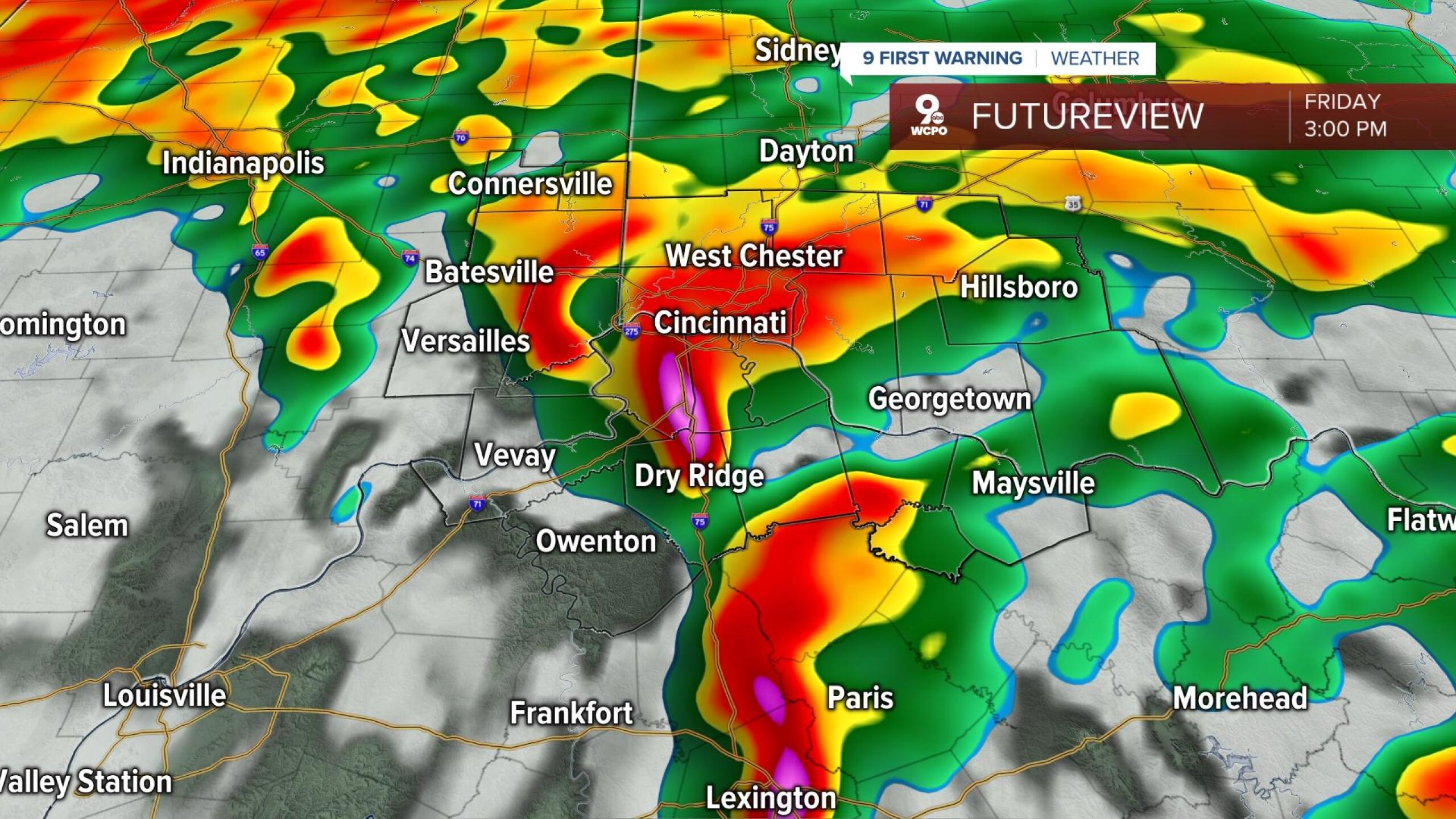

Heavy Rain And Flooding Prompt State Of Emergency Declaration In Kentucky

Apr 30, 2025

Heavy Rain And Flooding Prompt State Of Emergency Declaration In Kentucky

Apr 30, 2025 -

Louisville Mail Delivery Issues Unions Positive Outlook

Apr 30, 2025

Louisville Mail Delivery Issues Unions Positive Outlook

Apr 30, 2025 -

Understanding The Delays In Kentuckys Post Storm Damage Assessments

Apr 30, 2025

Understanding The Delays In Kentuckys Post Storm Damage Assessments

Apr 30, 2025 -

Relief In Sight Louisville Mail Delays Nearing Resolution

Apr 30, 2025

Relief In Sight Louisville Mail Delays Nearing Resolution

Apr 30, 2025 -

Kentucky Facing Storm Damage Assessment Backlog Causes And Solutions

Apr 30, 2025

Kentucky Facing Storm Damage Assessment Backlog Causes And Solutions

Apr 30, 2025